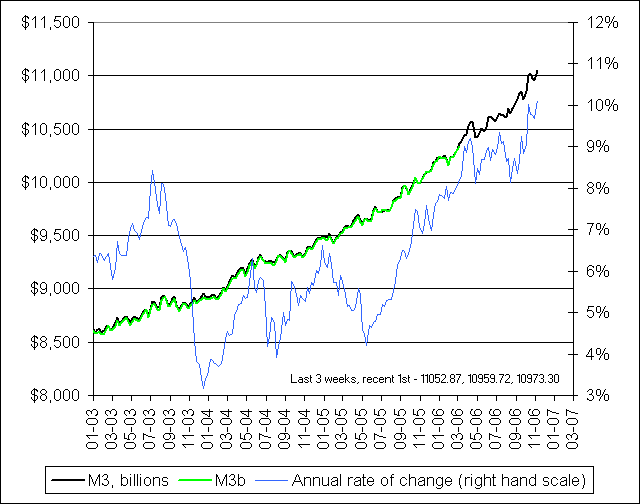

With the recent passing of Milton Friedman, it is indeed fortuitous that Barry Rithotlz over at the Big Picture Blog has found a new source for M3. And folks, the picture ain't pretty:

When the Federal Reserve announced they were discontinuing the M3 series there was a group of people who openly stated they were worried and/or concerned. I didn't buy into the concern, instead opting to believe the general statement from the Fed, which was "M3 isn't that important and we have other measures that are effective." (or something like that).

So, what is M3? According to my dusty and tattered copy of the Baron's Finance and Investment Handbook, 3rd edition M3 is M1 plus M2 plus time deposits over $100,000 and term repurchase agreements. Let's skip the deposits and focus on the repos.

So -- what is a repo? According to the same source, a Repo is an

"agreement between a seller and a buyer, usually of US Government Securities, whereby the seller agrees to repurchase the securities at an agreed upon price and, usually, at a stated time. Repos, also called called RPs or buybacks, are widely used both as a money market investment behicle and as in instrument of Federal Reserve Monetary Policy.

A repurchase agreement is like a short-term collateralized loan. Party A (the lender) loans party B (the borrower) money. In return, Party B gives Party A an asset (usually a short-term bond like a treasury bill). Party B has to repay the loan within a short period of time. Within the banking systems, this is usually done by the US Treasury with regional member banks.

Remember -- the US banking system is like a hub and spoke system with the Federal Reserve and US Treasury as the hub and all other banks like the spokes. According to the New York Post"

FOR the past few years the U.S. Treasury has been quietly involved in what the financial markets call "repo" agreements and this near-secret operation could explain why the nation's money supply seems to be confoundingly large.

It might also explain why Washington decided earlier this year to stop publishing M3 money supply figures, the broadest and most popular measure of money in circulation.

Repurchase agreements - or repos - have long been used by the Federal Reserve to get money quickly into the hands of financial institutions, which in turn can put the money into circulation in the form of loans.

Last Thursday [November 7, 2006], for example, the Fed executed $2.5 billion in overnight repos and $8 billion in 14-day repurchase agreements. These were reported on the financial wires.

The Treasury completed a $5.5 billion repo operation on the same day under what it calls the Term Investment Option. There was no mention of the Treasury operation on the wires. In the Fed's repo deals, the banks temporarily turn over securities to the central bank in exchange for cash.

Let's go back to the chart, especially the more wobbly line. This line shows the year-over-year change in M3. Starting in the spring of this year, the annual change in M3 has fluctuated between 8% and 10% -- the largest change in over 3 years. That's a huge change in money supply.

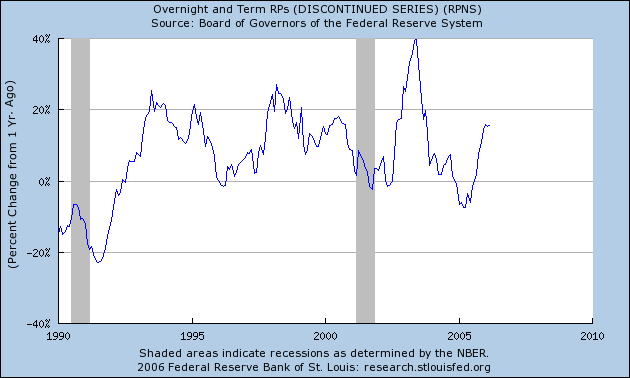

It is not a historically large number, however as this chart of the year over year percent change in M3 from the St. Louis Fed demonstrates.

So -- what is happening? I'll let Barry at the Big Picture sum it up:

This is a classic case of "ignore what they are saying, because what they are doing is speaking so loud:" While the Federal Reserve has been reporting rather flat money supply growth in M2 (blue line), in reality they have been dramatically increasing the cash (red and blue line) available for speculation.

Hence, that sloshing sound you heard. They have been providing the fuel for the rally, the huge M&A activity, the explosion in derivatives -- even the eye popping Art auctions are part of the shift from cash to hard assets. It is just supply and demand -- print lots of lots of anything, and that thing becomes increasingly devalued. It works the same for cash as it did for Beanie Babies.

Its not just the increase in Money Supply that should be concerning to investors -- its the misdirection about it. If Money Supply matters so little, as Fed Chair Bernanke has been out explaining to anyone who will listen, why pray tell has the Fed been working those printing presses overtime?

Given M3 increases, its no wonder the European Central Bankers laughed at the suggestion.