Below is a compilation of posts from my blog. It's been a crazy week with lots of news and confusion. While I don't know what is going to happen, I can explain what happened.

OK -- the week is over. Let's take a quick look at what happened.

Today, the main news was the Fed's announcement that they would add liquidity to the market if needed. This gave the market a floor. We opened lower and rallied twice.

Here's the 5-day chart. Remember that for Monday through Wednesday the subprime problems were behind us. Then came more news of serious issues in the debt/credit markets and the market tanked.

Here's where the rubber meets the road. Once again we're clinging to the 200-day SMA. This is a very important technical indicator. If prices close below the 200 day SMA for an extended period of time, we're looking at a bear market.

From a technical perspective, notice the 20 and 50 day SMAs are moving lower. Because the SPYs are below both of these numbers, these averages will continue to move lower. They will also provide upside resistance in a rally. The only good thing about these SMAs is they are about a point and a half below where they were when the market started first started dropping to the 200 day SMA. That means the market will have to move a smaller amount of points to test upward resistance.

Here are two more charts of the SPYs. These are year-long daily charts that use both Fibonacci fans and retracements. Notice the SPYs are near crucial levels for both the fans and retracements.

The bottom line is the markets are still in bad shape. They are are still clinging to support at areas where the psychology could change from bullish to bearish very quickly. While the Fed's move today will help ease some tension, the market really didn't rally that hard after the announcement and still closed down for the day. That means bulls are still on the sidelines. And the announcements from Countrywide and Washington Mutual and the negative reactions to these announcements indicates there are still a lot of people out there willing to pull the trigger at a moments notice.

According to S&P the largest market areas in order are: financials, technology, healthcare, industrials, and energy. These comprise about 65% of the average. Here are the charts in order of size.

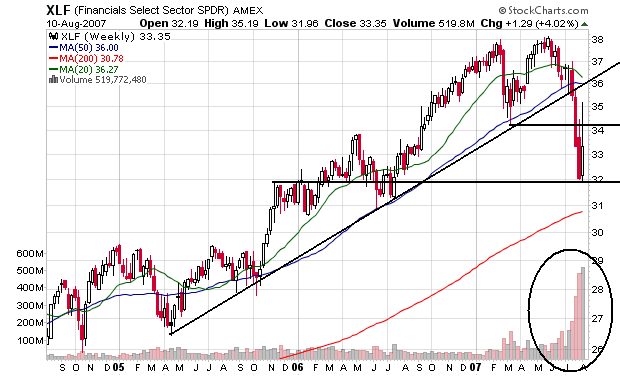

Financials:

This sector is technically in terrible shape. They broke a two and a half year uptrend in late June/early July. They have been droppinig on heavy volume ever since. The average is below the 20 and 50 day Simple Moving Average (SMA). They have another point to go before hitting the 200 day SMA (roughly 3%). In addition to the technical problems, this sector has some serious fundamental problems. In other words, this sector isn't going to recover anytime soon.

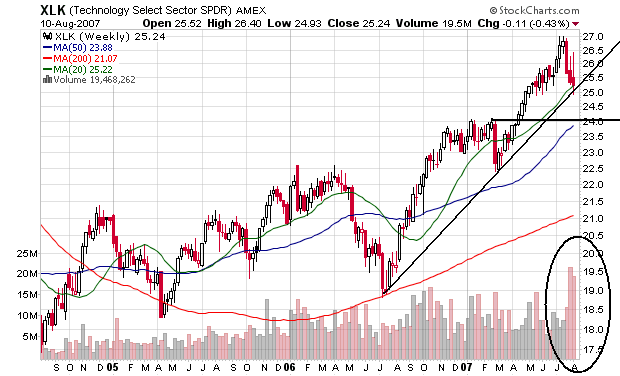

Technology

This is one of the favorite market areas of the blog Between the Hedges. This market is currently at the trendline of a year long rally. The average is also at the 20 day SMA, adding further support. Despite the volatility in the market, this sector has held up pretty well -- it dropped hard three weeks ago, but the drop has lessened over the last two weeks. All three moving averages are still moving up. Despite the heavy volume, the average is still holding to the trend line. The average has support right around 24.

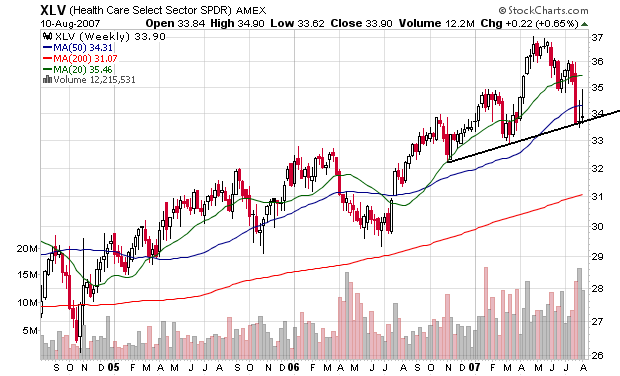

Health Care

Health care is in a mini-rally that started late last year. The average took a big hit earlier this month but is now hugging the trend line. All three moving averages are still trending up, although the average is below the 20 and 50 SMA which will pull the SMAs down a bit. The sector has support at $33 and a little below.

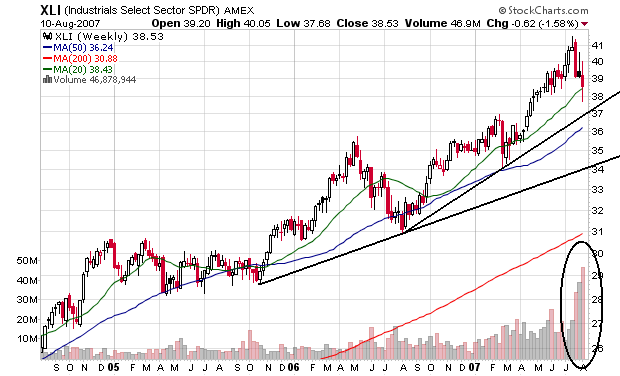

Industrials

Industrials are the beneficiaries of global infrastructure investment and a weak US dollar. We have two upward slanting trend lines: one that started in late 2005 and a steeper one that started in mid-2006. All three moving averages are still moving up and prices are trading right at the 20 day SMA. Despite heavy volume on the sell-off of the last three weeks, prices are still at the trend line. The average has support at the 20 day SMA and right around the $37 level.

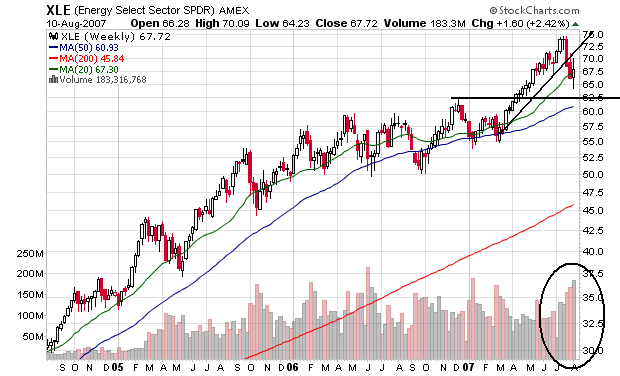

Energy

Energy had a mini-rally that started in March 2007. It has broken the trend but is now at the 20 day SMA. The sell-off over the last three weeks has occurred on heavy volume, but the average is still right at the 20 SMA. While there is about 3%-5% downside, there is a ton of support in the $57 to $62 area.

OK -- the week is over and it's time to

1.) Look back on what happened,

2.) Try and figure out what might happen.

What happened

Bottom line: there are a ton of problems in the credit market that aren't going away anytime soon. The main reason for that comment comes from Countrywide Financial's report on Thursday. Countrywide is the largest mortgage lender by volume. That means they have a ton of stature and clout in the market. The problem is simple: they can't find liquidity for their mortgages right now. They had to place $1.8 billion of loans into their investment portfolio and devalue both investments by between 14% and 20% when the transferred those assets. The devaluation tells me that buyers are pretty scared about the whole mortgage mess right now.

Add to this the news that BNP stopped withdrawals from some of its funds a Goldman Sachs fund lost over 20% since the beginning of the year, Washington Mutual agreeing with Countrywide's assessment of the credit markets, and the central banks pumping liquidity into the market, and you have a recipe for increased volatility and concern.

And in case you thought that wasn't enough:

But, he adds, the full weight of resets on adjustable-rate mortgages have yet to been felt. From the beginning of 2007 through the middle of 2008, over $1 trillion ARMs will reset, many from low "teaser" rates. Then the extent of the declines in home prices and the financial fallout will be apparent, Magnus observes.

The news has continued to come out in a very negative vein. And it's the big players who are making the announcements. That is all the more concerning. When the mortgage mess first started in last 2006/early 2007 it was the smaller players making the announcements. While this was disconcerting, it wasn't earth shattering. Now the big boys are saying, "boy is it rough out there". That should concern everybody.

What's going to happen

Expect more of last week for the foreseeable future, especially with this news:

From the AP:

Mortgage finance giants Fannie Mae and Freddie Mac will not be allowed to take on more debt, the government said Friday, denying requests to relax the companies' investment caps as a way to pump cash into the struggling mortgage market.

The decision by the Office of Federal Housing Enterprise Oversight capped a week of speculation that buoyed the stock prices of the government-sponsored companies. Investors drove Fannie's share price 17 percent above last Friday's close, and pushed up Freddie's stock by 11 percent.

Volatility will be around for some time. More funds are going to announce problems, deals will get shuttered, and blow-ups are possible. It's going to get nasty.