From the Wall Street Journal:

For months, Dale Albright, a 30-year-old Tampa, Fla., bankruptcy lawyer, has watched as his clients buckle under mortgage and credit-card debts. After an expensive recent hospital stay, he's worried that a run of bad luck could leave him in financial straits, too.

"I care about bringing our troops home...and for the most part, I believe as far as domestic terrorism goes, I think we've got that pretty much under control," Mr. Albright says. "But the economy really scares me." A longtime Republican, this election he says he's voting Democrat.

With the parties just weeks away from the first presidential nominating contests, economic concerns are seizing a top spot in many voters' minds. Falling housing prices, rising gasoline prices and health-insurance worries are supplanting the war in Iraq and concern over terrorism.

I realize the war in Iraq and the terrible foreign policy of the Bush presidency has caught everyone's attention for the last four years. But during the same amount of time some huge economic fundamentals have started to come home to roost in a really negative way. Right now the economy is bleeding pretty pretty badly and its highly likely the economy will be a top issue in the 2008 election.

Consider the following.

We all know that housing is in the toilet. This is an issue that won't solve itself anytime soon. The basic problem is supply and demand -- as in, there's a ton of supply and dropping demand.

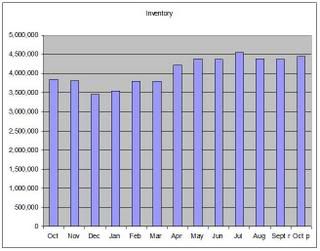

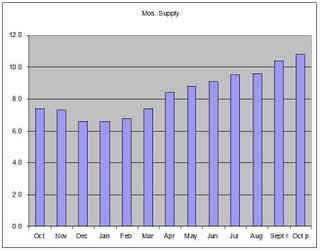

The total inventory of existing homes available for sale is huge:

And the months of supply at the current sales is increasing, indicating demand is plummeting.

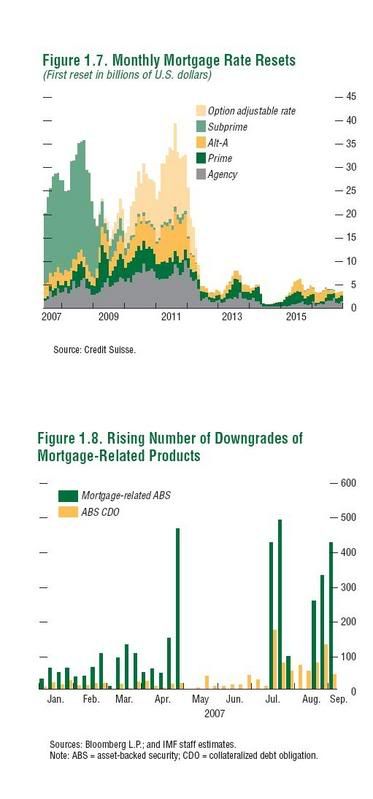

And this problem is just getting started. Consider this chart which shows the total amount of resets out there in the economy at large. We've got a few more years of real estate trouble out there.

The US manufacturing sector is also experiencing problems. Consider:

Overall industrial production started to drop in 2006. But notice the gray lines which represent the monthly change in the number. That number's increases have been slowing for the last few months at consistently smaller rates, indicating production is slowing down.

Durable goods orders have been dropping consistently or a year. And notice especially the year-over-year line, which has been in negative territory for most of the last year.

Overall employment growth is declining as well. Total job growth -- which was never that strong to begin with -- has been slowing declining for the last year.

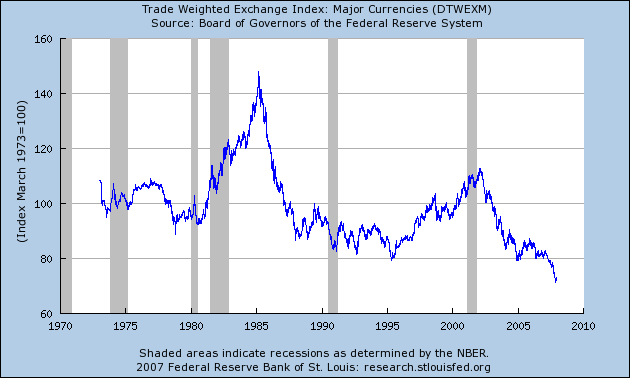

The financial markets have noticed all of these problems. As a result, they have been selling the dollar, which currently stands at its lowest level in 30+ years:

Simply put, a lot of very negative factors are lining up right now. Job growth is weak, manufacturing is slowing and housing is tanking. The dollar -- despite the oft-repeated "strong dollar policy" of the administration -- is tanking. By the summer of 2008 when the presidential race is in full swing it's possible we'll be in a recession. At minimum, I'd give that 30% chance of occurring.

In short, it could be the economy, stupid, in 2008.