"When the going gets weird, the weird turn pro."

- Hunter S. Thompson

When you live in interesting times it is sometimes hard to distinguish the real news from the fake news. For instance, I read this today.

WASHINGTON—A new report has revealed that when it comes to the important matter of owing large sums of money, Americans display a level of expertise and proficiency unrivaled throughout the world.

The same day I also read this.

The Treasury Department said Thursday that it will sell a record total of $115 billion in new notes next week, more than market participants had expected.

Both articles look like they could be real news, don't they?

The first article was from The Onion, and therefore should be considered "fake". The second article was from the Wall Street Journal, so it should be considered "real"...at least that's the way it should be.

But remember the wise words of Mr. Thompson.

Only The Onion article was telling the whole story.

The WSJ mentioned the new debt that was being issued by the Treasury, but failed to mention the enormous mountain of existing debt that was scheduled to be rolled over just next week. Let's see if I can count this up....

70 day CMBs, $30 billion (tomorrow)

13 week Bills, $32 billion (July 27th)

26 week Bills, $31 billion (July 27th)

52 week Bills, $27 billion (July 28th)

2 year Notes, $42 billion (July 28th)

5 year Notes, $39 billion (July 29th)

7 year Notes, $28 billion (July 30th)

19 year, 6 month TIPS (reopened), $6 billion (July 27th)

Almost one quarter of a trillion in a single week.

We've been bombarded with lots of gigantic numbers over the past year, so maybe this number doesn't impress you. It needs to be put into perspective.

For example, this was your wage last year: $42,270

This is the average bonus that Goldman Sachs is giving their employees this year: $700,000

And this is the amount of money the Treasury needs in just one week: $235,000,000,000

Or to put this is another way:

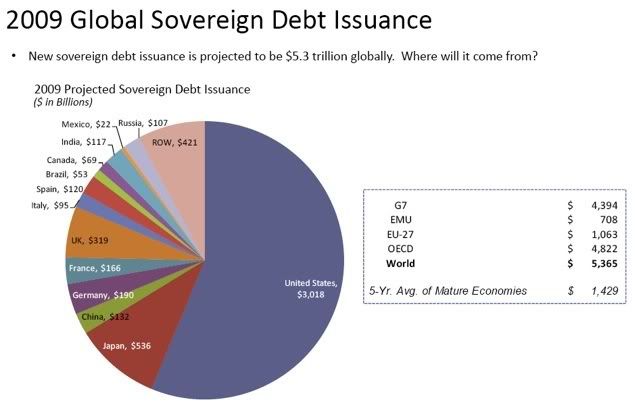

Notice how America is borrowing far more money than the entire rest of the world combined. These aren't normal times. The weird have turned pro.

Here There Be Monsters

"The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists."

- Ernest Hemingway, "Notes on the Next War: A Serious Topical Letter" , 1935

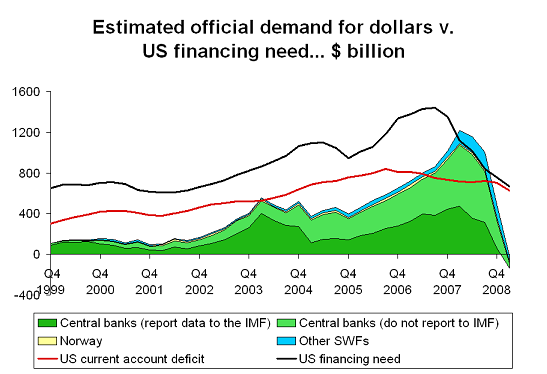

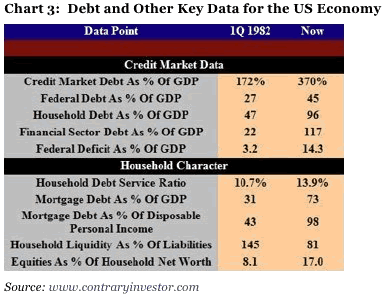

There are many dangers from borrowing so much money from foreign lenders. The first and most obvious danger is with interest rates.

In a 2003 paper, Thomas Laubach, the US Federal Reserve’s senior economist, calculated the impact on long-term interest rates of rising fiscal deficits and soaring national debt. Applying his assumptions to the recent spike in the US fiscal deficit and national debt, long-term interests rates will double from their current 3.5pc.

Considering that this is the Federal Reserve's own prediction, this should be taken seriously. Consider what will happen to the already weak housing market if mortgage rates were to double in the next few years?

Even a single percentage point increase could cost the Treasury an additional $50 Billion a year, and with most of the nation's debt being short-term, it would be felt almost immediately.

It's simply a matter of supply and demand. The more debt that nations issue, without an increase in demand, means the price of that debt falls. In the bond market, price and interest rates are directly inversely related.

The governments of America, Britain, Japan, and elsewhere have tried to compensate for that dearth in demand by monetizing the debt. However, that caused the other supply and demand problem - more money printing without more goods means the value of the currency drops.

In 2009 and 2010, Washington will sell more than $5 trillion in new debt, according to Citigroup. A decade from now, according to the Congressional Budget office, Washington’s outstanding debt could equal 82 percent of G.D.P., or just over $17 trillion.

...

"It’s an exaggeration of course, but it’s a little like what happened to the subprime borrowers," Mr. Rogoff said. "People are just assuming the funding will always be there."

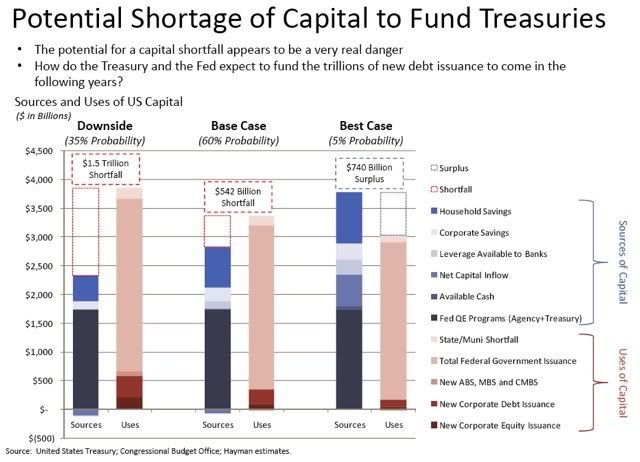

On the demand side of this issue is the simple lack of enough capital in the world. Bill Gross of Pimco had this to say on the matter.

The immediate question is who is going to buy all of this debt? Estimates suggest gross Treasury issuance of up to $3 trillion this calendar year and net offerings close to $2 trillion – almost four times last year’s supply. Prior to 2009, it was enough to count on the recycling of the U.S. trade/current account deficit to fund Treasury borrowing requirements. Now, however, with that amount approximating only $500 billion, it is obvious that the Chinese and other surplus nations cannot fund the deficit even if they were fully on board – which they are not. Someone else has got to write checks for up to $1.5 trillion additional Treasury notes and bonds.

Gross goes onto say that if the governments continue to try and spend our way out of the recession there are only two possible outcomes: 1) an immediate and enormous rise in interest rates, or 2) massive debt monetization by the central banks.

It appears that, because of a lack of clear vision and plan, we are seeing a combination of those two things. No one wants to make the tough choices, thus we will get a little bit of all the possible problems.

The country was more than 200 years old before America's public debt hit $1 Trillion. It hit $6 Trillion in early 2002, and then $10 Trillion in 2008.

By the end of this year it will climb over $13 Trillion. The CBO estimates nearly $10 Trillion in new debt by 2019. In economics this trend is considered "parabolic", and all things that go parabolic are unsustainable.

It begs the question - where will the money come from?

Sometimes people ask that question, which is a very good question, but stop there.

An even better question to ask is - is there enough money?

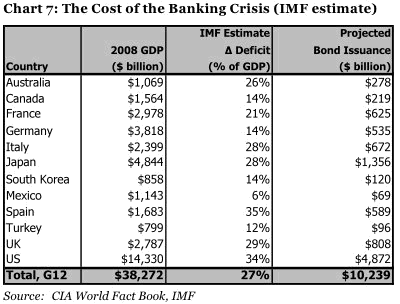

The IMF, which has repeatedly underestimated the economic crisis, has produced some numbers which are scary in and of themselves.

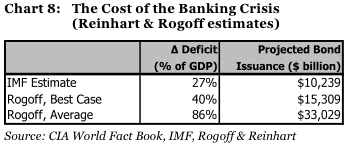

Fortunately, Carmen M. Reinhart and Kenneth S. Rogoff have studied dozens of historical examples since 1800 and tried to answer that question by basing it what that history teaches us.

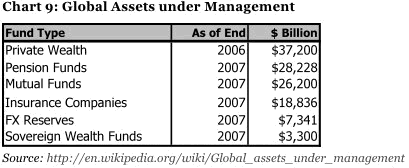

If you are like me, $33 Trillion is so far above my ability to imagine that they may as well be using another language. That's why it is important to put things into perspective by comparing this number to other asset classes.

If you understand the significance of these numbers you have arrived at the "Oh, shit" moment. The amount of money required to bail the world out of the current economic crisis, if this crisis plays out at a historical average, is nearly equal to all the private wealth currently in the world.

To repeat the obvious, this doesn't add up. What about the capital needed to fund the businesses of the world? What about the capital needed for private consumption?

Britain is trying to bail out their economy. The Euro nations are bailing out their economies. So is China and Japan. There isn't enough capital in the world for all these bailouts.

Kyle Bass from the US fund Hayman Advisors said the markets were choking on debt.

"There isn't enough capital in the world to buy the new sovereign issuance required to finance the giant fiscal deficits that countries are so intent on running. There is simply not enough money out there," he said. "If the US loses control of long rates, they will not be able to arrest asset price declines. If they print too much money, they will debase the dollar and cause stagflation.

"The bottom line is that there is no global 'get out of jail free' card for anyone", he said.

The numbers simply don't add up. Everyone can't borrow at the same time. Someone has to lend.

To argue otherwise is to tilt at windmills.

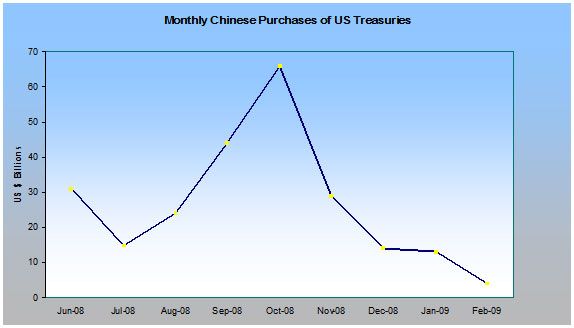

So then the assumption is that China will lend us the money, right?

China isn't happy with our management of their dollar-based assets. Because of that they are cutting back on their lending.

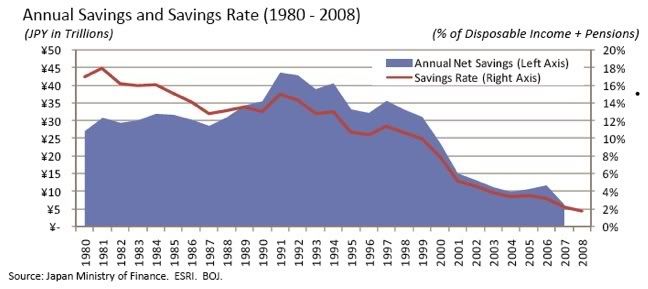

What about Japan, our second-largest creditor? They've been some of the world's greatest savers for over a generation.

Japan is no longer in a position to bail out America's overspending because Japan is getting old. Unlike young people who save, old people retire to live off their savings.

There is no "what if". The odds of all this deficit spending getting financed at an affordable rate is zero. It's simply not going to happen.

To put it another way, I will refer back to The Onion article.

"Their ability to consume well beyond their means, disregard all signs of approaching financial ruin, and then sit there like a fat duck waiting for solutions to appear is truly remarkable. Few nations achieve such excellence in one singular aspect of life. Bravo, America."

The report concluded that Americans are also second to none when it comes to defaulting on long-overdue loans, be they from individuals, banks, or great and powerful nations that have absolutely no qualms about making others regret their foolish mistakes for generations to come.