Even if, as its seems to be the case, the global economy doesn't depend on the US growth to start to recover, it is clear that the evolution of the US economy in the decade to come will have a major impact on the future of the global economy and the place of the United States in the global economic and geopolitical balance of power. The fact that consumer spending represented more than 75% of the US GDP growth in the years 2000 to 2007 means its evolution will play a critical role in shaping the future of the Us economy. So, it's worth having a look at an interesting paper on Zero Hedge:

A Detailed Look At The Stratified U.S. Consumer

When analyzing the recovery prospects before the U.S. economy, no analysis is complete without a detailed look at the capacity of the U.S. consumer, that dynamo that has always managed to pull the economy out of whatever hole it managed to find itself over the past 80 years.

The whole article is worth reading. However, Its most interesting part focuses on the deleveraging problem and the dire economic situation of the US middle-class regarding the said deleveraging:

The Deleveraging consumer

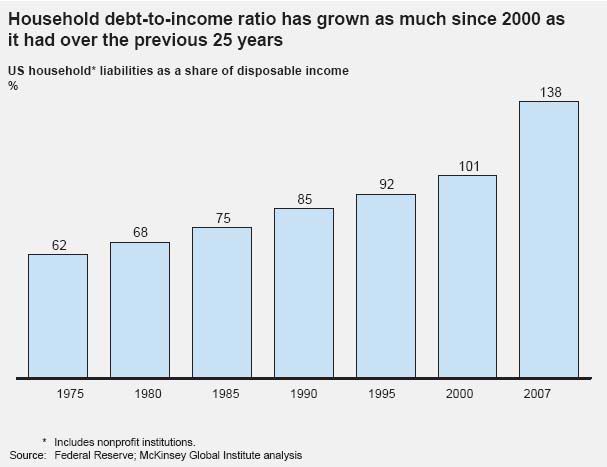

"Between 2000 and 2007, US households led a national borrowing binge, nearly doubling their outstanding debt to $13.8 trillion. The pace was faster than the growth of their incomes, their spending, or the nation's GDP.

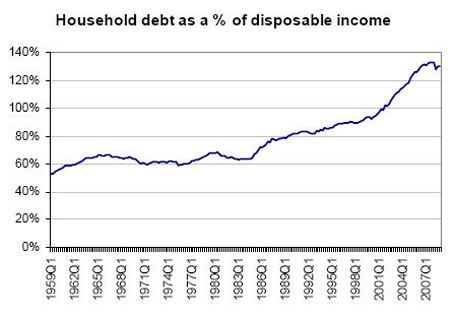

The sharp recent upswing in the chart below indicates that consumers on average are commencing a paradigm shift to frugality as the "wealth effect" evaporates: the increase in consumer wealth lead to an increase in consumption financed by rising asset values. [...] The double whammy of a collapse in both the equity market and housing values will ultimately result in an increase in savings rates to long-term averages in the 9-10% range. And, as pointed out above, the adverse economic impact of this transformation in the consumer psyche will likely be in the $2-3 trillion range.

Furthermore, to the impact of the collapse of equity and housing values, we must add the rising unemployment and the decrease in wages as factors pushing to a strong and sustained increase in savings. According to theWall Street Journal:

Major retailers reported that American consumers are continuing to hunker down, casting a cloud over the durability of the U.S. recovery and underscoring the importance of overseas demand in restoring the world economy to health.

...

American consumers appear so shaken by the worst recession since the Great Depression -- and so pinched by unemployment, stagnant wages and stingier lenders -- that they are reining in spending on all but basics. Economists also see an upturn in U.S. household saving as the beginning of a prolonged period of thrift.....

So how deep will this deleveraging process will go and how long will it last? According to Zero Hedge:

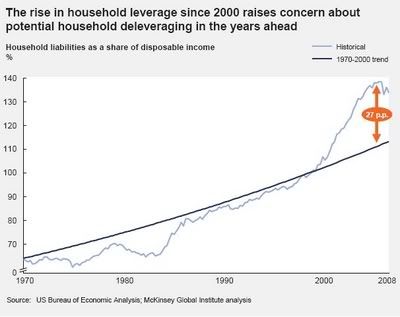

The biggest concern from a reversion to the mean perspective is that if the ongoing deleveraging trend were to follow its full course, household debt-to-income would have to decline by 27 bps to its long-term trendline, in effect extracting $2.8 trillion from the economy.

Here I think Zero Hedge's figure is very conservative: these 27 bps refer to what they call the "long-term trend line". If you look at the graph, that would mean returning to a "normal"(!) ratio of around 115% of disposable income in 2009 (and more in the future). However, this long-term trend line is strongly influenced by the debt growth that started in the mid-80s. Maybe it would make more sense to look at what was the long-term trend line before Reagan policies led to substitute debt for wage growth:

Going back to a debt to disposable income ratio situated between 60% and 70% means a decline of 68 to 78 bps from the 2007 peak level of 138%. I am not sure it has necessary to go back to 60%, but I think there should be, at least a reflection about what constitutes a sustainable debt to income ratio.

The dire situation of the American middle-class

But, facing debt and deleveraging, not all US citizens are equal:

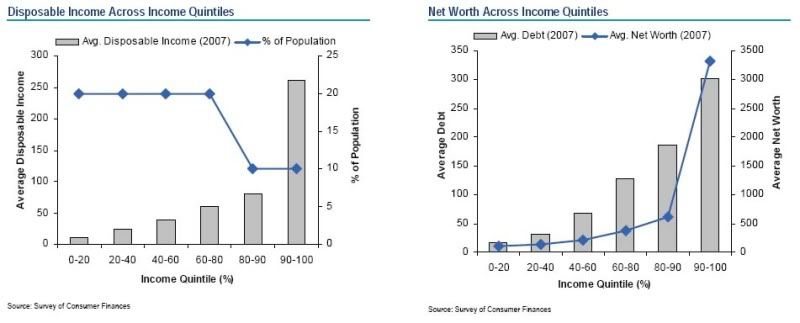

A drill down of disposable net income (after tax) and net worth, demonstrates why any discussion of "generic" consumers should be much more properly phrased as an observation of the "Wealthy" and "Everyone else".

The disposable income difference between the richest 10% and even the next richest decile is staggering: a 3x order of magnitude. And a fact that Taleb fans would likely appreciate most, the pretax income difference between the median and mean for the top decile is shocking: $206,900 versus $397,700. This is skewed by a statistically low number of outliers earning an abnormally large amount of disposable income.

...

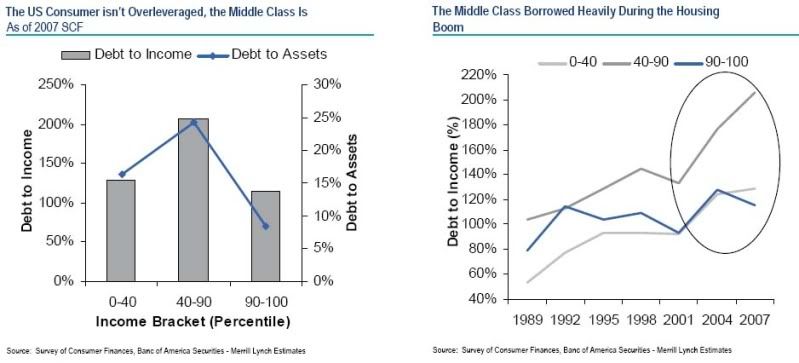

Probably the most dramatic observation appears when evaluating relative leverage of the various consumer classes.

It is apparent that the problem of consumer (de)leveraging is actually one of a Middle class burdened with excess debt. The debt-to-income ratio for the middle class is on average more than 200%, almost double that of the highest decile, "Upper Class."

The divergence among the classes is even more obvious when comparing aggregate net worths:

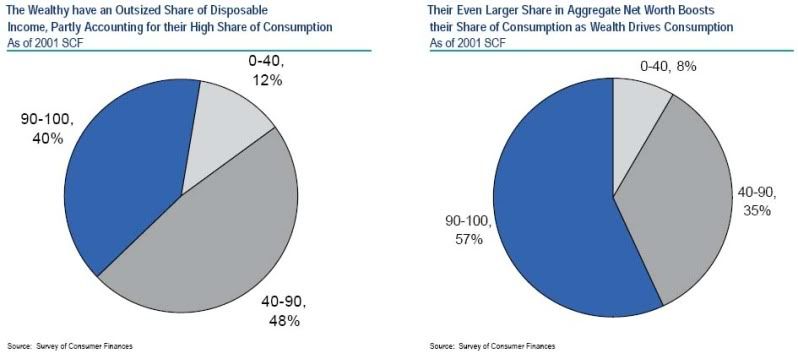

While 10% of the population collects 40% of disposable income, it represents 57% of net worth! This is an impressive conclusion: on a lowest common denominator, the Net Worth variance between the 10% of the population that make up the wealthy and the 50% that comprise the middle class is over 8x!

...

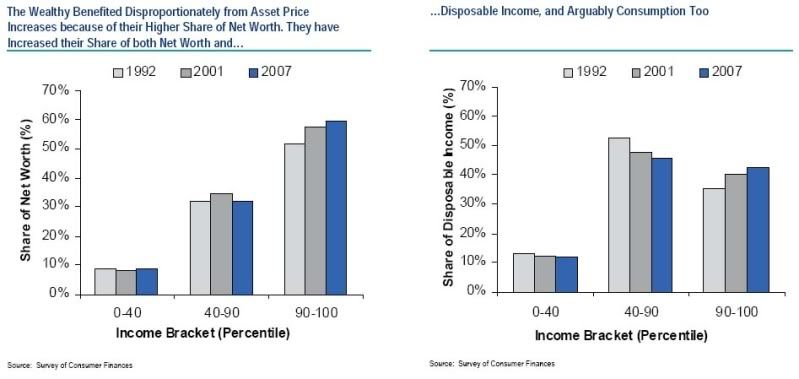

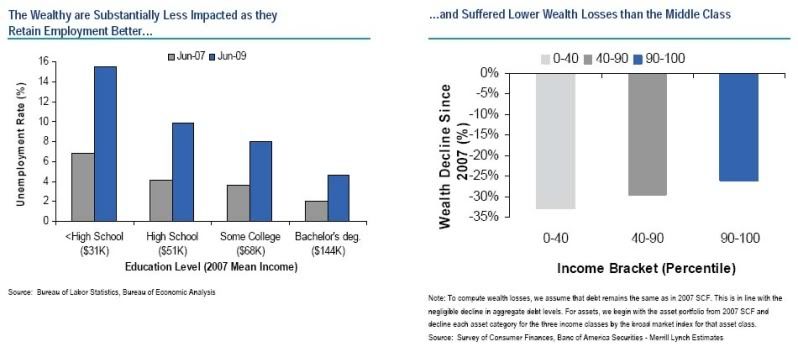

when looking at data historically, it is once again the top decile, or the "Upper" Class the benefitted consistently over the the past 15 years, to the detriment of both the low-income and the middle-classes, which represent 90% of the population.

...

Yet estimates demonstrate that even though on an absolute basis the wealthy are losing overall consumption power, the relative impact has hit the lower and middle classes the strongest yet again.

...

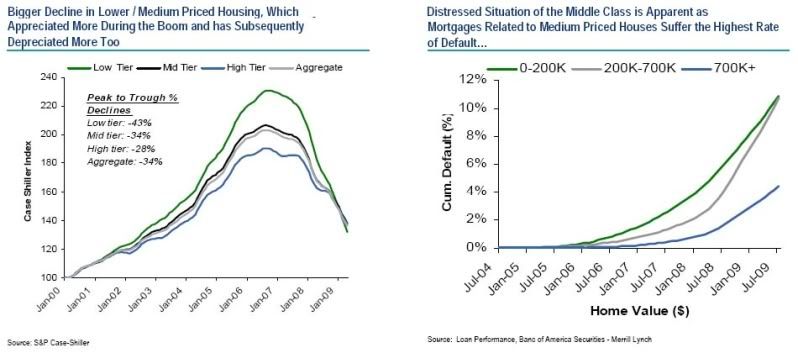

And to add insult to injury, the segment of housing that has been impacted most adversely in the current downturn, is lower and middle-priced housing: that traditionally occupied by the lower and middle classes.

I certainly do not share the opinion of the author, who, after having made a very articulate analysis of the situation, argues that, given that the richest 10% represent 40% of the US consumption, they should be cajoled into consuming again and not taxed more, and says nothing about what policies/measures should be adopted to tackle the situation in which tha middle-class is mired (Vae Victis!).

Given the size of the problem facing the vast majority of the American households and particularly the middle-class, only a massive redistribution from the uber-wealthy to the middle and lower income categories will provide a sustainable solution. This means:

- ending the current system that allows the financial sector to grab the biggest part of the wealth created

- a major overhaul of the wage system towards a better sharing of the created wealth

- a bold reform introducing a strong redistributive tax policy.

Will the Obama administration be able (let alone willing) to implement a bold enough reform to help the middle and lower income classes to get out of their economic situation? Unless they do so, the US will most probably be facing many years of very slow growth and high unemployment until these categories have gotten rid of their debt.