This whole tax debate has eclipsed a central progressive tenet. Hey Democrats, if you want to win the white vote back, why don't you help poor people for God's sake, instead of glossing over their existence, patronizing them and lying to their faces? How about some integrity and some compassion? But hey, it could only give you landslides, so don't treat this seriously.

But... you know what really lacks seriousness? The poverty level defined by the government. Talk about a joke. At least the Soviets let themselves laugh about the propaganda.

US poverty level by number of persons in household:

1 $10,830

2 14,570

3 18,310

4 22,050

The same people that believe a family of 4 can survive on 22,000 in near any state probably also believe that the reason the unemployed can't get work is because they're just too lazy.

And you know the problem with giving these poor people belated tax refunds or tax credits? It's too damn complicated. More than a few of these people can barely even read--somehow we're still highly productive as a national workforce, yet still humbled and frightened enough to be, in the words of the polemicist blogger Joe Bageant, "America's invisible and non represented people, the ones who shovel the shit and seldom complain." But you expect them to comprehend the tax code? Why, when most Americans can't? A heartland lawyer chimes in:

If you wonder why I sometimes have a bewildered look when you ask a tax question, here is a clue: In her 2008 Annual Report to Congress, the National Taxpayer Advocate, Nina Olson, complained about the Tax Code’s complexity including (among many other examples) “at least 16 separate incentives to encourage taxpayers to save for retirement. These incentives are subject to different sets of rules governing eligibility, contribution limits, taxation of contributions and distributions.” She also criticized the constant changes, pointing out that amendments to the Tax Code were made at the rate of more than one per day in the five years from 2003–2008. Read her report: http://www.irs.gov/... [Vol. 11, No. 1 Choate’s Notes Spring 2009]

I don't have very much good to say about the Reagan Administration. If you want to see where our federal debt trouble began look there. However, one of the things it got right was the Internal Revenue Code of 1986. It closed a lot of loopholes and greatly simplified our income tax. It was far from perfect, but it was a great leap forward. Since then, we have lost a lot of ground.

Basically, a lot of poor people get screwed while the rich more than manipulate the system. There are two kinds of tax payers: those who play the game and those who don't. Those who don't must think it's for serious. And hey, this system's great for employing accountants if not so great for the people in vests at Wal-Mart, the people who fix your cars, your johns and serve your fries. You know, the meek and the lowly? Those who shall inherit the earth?

This country's so far rightward that ideas Nixon once entertained with some consideration, like a guaranteed national income, seem an attempt at humor. But we are in changing times. The world of the 20th century is finally dying an ugly death a decade too late, every day around us. Thank God, for it was a classist and divided world.

At this point, with decades of stagnation, decline, and inaction on wage inequality, the poor are not in any position to be paying federal taxes. The minimum wage was only raised in the most bare-bones manner, and the $7.25 level, at the time, did not "bring the minimum wage to its level of 1968." Grossly disproportionate health insurance cost continues to put the lie to that family-of-four poverty level. The economy had its worst decade since the 1930s. Wages either stagnated or, according to Kevin Drum, grew so poorly that debt overtook wages for the poor.

Eliminating taxes for the poor to a higher level is a political win-win for Democrats, who can garner more than enough revenue from the rich. Pullitzer-prize winner David Cay Johnston:

And at the top? Now, that’s a different story. The average income for the top 400 taxpayers rose over the 45 years from $13.7 million to $263.3 million. That is 19.3 times more.

The income tax bill went up too, but only 7.8 times as much because tax rates plunged. Income tax rates at the top fell 60 percent, three times the percentage rate drop for the vast majority. And at the top, the savings were not offset by higher payroll taxes, which are insignificant to top taxpayers. ...

What is the social utility of creating a society whose rules generate a doubling of output per person but provide those at the top with 37 times the gain of the vast majority? ...

Is a ratio of gain of 37 to 1 from the top to the vast majority beneficial? Is it optimal? Does it provide the development, support, and initiative to maximize the nation’s gain? Are we to think that the gains of the top 398 or 400 taxpayers are proportionate to their economic contributions? Does anyone really think that heavily leveraged, offshore hedge fund investments are creating wealth, rather than just exploiting rules to concentrate wealth, while shifting risks to everyone else?

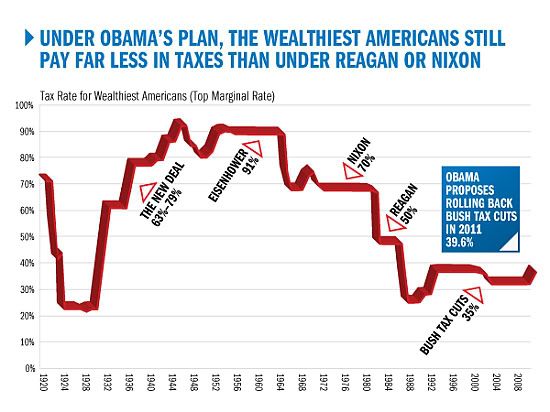

[edited] If you re-instituted the tax rates of the Eisenhower Administration and adjusted them to inflation, guess what--there's no evidence that it would destroy jobs! We would love the unemployment rates of the 1950s and 1960s. With real money coming in, the feds would have more than enough in the coffers to hire 1 million workers and lower the unemployment rate, and fuel a cycle of increased spending that would improve the wider economy. We have no shortage of ideas except when it comes to ideas specifically, explicitly for the poor. This is a rich country; the salt-of-the-earth have offered enough blood, sweat and tears at the altar of Baal.

[edited] If you re-instituted the tax rates of the Eisenhower Administration and adjusted them to inflation, guess what--there's no evidence that it would destroy jobs! We would love the unemployment rates of the 1950s and 1960s. With real money coming in, the feds would have more than enough in the coffers to hire 1 million workers and lower the unemployment rate, and fuel a cycle of increased spending that would improve the wider economy. We have no shortage of ideas except when it comes to ideas specifically, explicitly for the poor. This is a rich country; the salt-of-the-earth have offered enough blood, sweat and tears at the altar of Baal.

Raising taxes on the rich is necessary to address income inequality, the debt and the deficit. But it is only half the equation, and unfortunately, it does not provide near the political benefits that actually being the party of the working people in a both deeper and more vocal sense would be. Why not? For years we've heard every politician throw around the phrase "middle class" like they actually meant it. For the white poor, the middle class don't seem to care much about them, and unfortunately are most often experienced as rude customers and people who lay them off. And we have heard of the need for change, even Republicans have latched on. But for the white poor, change is historically an omen of bad a'coming:

Maybe if the Democratic Party (4+ / 0-)

Recommended by:

Meteor Blades, badger, Litvak36, ban nock

was really a people's party and was willing to show face enough to stop groveling at the extinct "middle class," but instead started talking about how much the boss sucks... it could get somewhere. Maybe if it related to how a lot of change has screwed the poor over, either directly or implicitly, and pressed things specifically about them, in their terms, instead of things for those who have college loan payments and nice parking spots... with crumbs on the side...

Maybe if the Democratic Party's advocates clearly saw working people as brothers and sisters instead of obstacles, white trash, hicks, and stopped addressing them with patronizing cliches about "voting against their self-interests," working class people might be surprised enough to listen. It's not that they believe Republican professional assholes like [John] Boehner are on their side, it's that they find his message clearer and less insulting.

by Nulwee on Sun Nov 21, 2010 at 10:04:40 PM PST

[ Parent ]

"The rich pay their fair share, but if you're poor, you won't pay income tax" gets somewhere. The Republicans can't lie that it's going to promote laziness, because those who don't work aren't getting any direct benefit. Democrats are so afraid on tax issues that they always let a crumb for the poor equal a feast for the rich, but there's no reason why that need be. On its own this won't prove enough, but it does serve as the critical beginning of a new relationship between the Democratic Party and the working class.

More government data on poverty, health insurance, et cet. at: http://www.census.gov/...

Update:

Following the logic of the diary, you have to revise upward the poverty level and tax accordingly. The idea that the poor "pay no tax" already is, to me, what's disingenuous. There's also the value of time, and many people, rather than risk trouble with the IRS, put off their income into tax refunds. Government doesn't give interest.

Marginal Tax Rate[4] Single

10% $0 – $8,375

Married Filing Jointly

$0 – $16,750

Married Filing Seperate

$0 – $8,375

Head of Household

$0 – $11,950

http://www.dailykos.com/...

Obviously ideas like taxing more fairly on social security and lowering payments from the poor are also valuable. These are not exclusive suggestions.

UPDATE: Chart I saved is somewhat old, originally from the Washington Monthly.