No matter how many times it's said, lowering tax rates for the highest income Americans does not create jobs or stimulate the economy. In fact, a detailed look reveals that the overall economy does slightly better when taxes at the top are significantly higher. This also holds true on the state level, as states with higher top personal tax rates have growth rates and median incomes that average greater than those with low (or even no) taxes. No matter how many times the experiment is repeated, or how long you extend the results, cutting taxes for the wealthy does not stimulate growth.

The idea that cutting taxes for the wealthy will generate jobs is as much a myth as bigfoot, and I don't mean the truck. It's demand that stimulates economic growth and drives down unemployment. Demand isn't generated by giving even more money to those who already have more than enough. It doesn't come from a handful of people ordering up yachts. It's certainly not created by rewarding those who engage in speculative investment. Demand grows when the much broader base of middle and working class have money available to meet needs ranging from feeding their families, to buying cars, to putting their kids through school.

Cutting the top tax rate will not stimulate demand. However, cutting the top tax rate can still wreck the economy. Here's how it happens.

This chart reflects Census data on income over the last sixty years. Folks at the 2oth percentile serve as a view of the working poor. Those at the 60th percentile represent the middle class. The 95th percentile serves as a marker for the wealthy. All the numbers have been adjusted to account for inflation so that doesn't cloud the issue.

From this you can see that folks at the 95th percentile were bringing home the equivalent of around $65,000 in 1947 and are nearer to $200,000 today. With a gain over over 300% after inflation, they've done pretty well over this period.

The middle class has also improved their lot, though not by as much. In 1947, the 60th percentile was pulling in the equivalent of just over $28,000. Compare that to $75,000 today and it's still a gain of over 260%. Yes, the gap in income spreads out a lot more than you would think from those numbers, but then the income of the 95th percentile was a lot more than that of the 60th percentile to begin with.

Finally, the poor. Those at the 20th percentile were earning less than $13,000 in 1947. Remember that these are adjusted values, so this is no "yeah, but in my day you could buy a loaf of bread for a nickel" number. Today the poor have doubled their relative income, coming in around $28,000.

That's the overall picture. Everyone gains over time, but the wealthy not only grow faster than the others, they have more money to start with, so the income gap constantly expands. It's pretty much what you'd expect.

Only there's a little more hiding in the data.

This is the year-over-year income growth for those at the 95th percentile. I've split the data into two regimes: a higher top tax rate from 1947 to 1981 (top rate ranging between 69% and 94%) and a lower top tax rate between 1982 and 2008 (where taxes ran from 28% to 50%). Broken down like this, you can see that there were good years and bad years in both time periods. The income growth of the wealthy isn't immune to a bad overall economy, and in recession years their income came down. Strangely enough, the income of the wealthy actually grew better under the high tax regime, but then as we'll see, so did other incomes.

Let's jump next to the poor. Split out in the same way, you can see that while tax rates were higher on the wealthy, the income of the poor actually grew at an annual rate that was roughly equal to that of the rich. Yes, the rich were still edging them out, and because of the big difference in starting point, the gap between rich and poor was still expanding each year, but it sure beats out conditions under the low top taxes. Since taxes on the wealthy fell, income for those at the bottom has stagnated.

Finally, the middle class. Like both the 95th percentile and the 20th percentile, growth for the middle class cruised along at around 2% for the period when the taxes on the wealthiest Americans was higher. However, when those rates were cut, middle class income growth was abruptly cut in half. For the last twenty five years, the middle class has not even averaged 1% growth a year.

Here are those numbers again.

Income

Percentile |

Higher top tax rate

1947-1981 |

Lower top tax rate

1982-2007 |

| 95th |

2.11% |

1.62% |

| 60th |

2.22% |

0.97% |

| 20th |

1.96% |

0.58% |

When top tax rates were higher, the middle class was actually holding its own against the folks at the top, and the poor were moving up at roughly the same rate as the rest of the nation. When tax rates were cut at the top, there was a radical change. Under the low taxes on the wealthy regime, middle class growth was cut in half. Growth of income for the poor was cut to less than a third of the previous pace.

Why? Because cutting taxes at the top does exactly what the conservatives have always advertised—it encourages the wealthy to make more money. However, personal taxes aren't paid on the revenues of a company. They're paid on how much you take home. Cutting taxes at the top encouraged the wealthy to put more cash into their own pockets and hold back pay that otherwise would have gone to middle class employees and the working poor.

Cutting top tax rates doesn't benefit the wealthy by growing the economy, or even by growing their own income in terms of actual dollars. It benefits them by suppressing the income of the middle class and the poor. After all, what makes someone rich isn't just making more dollars, it's making more dollars than everyone else.

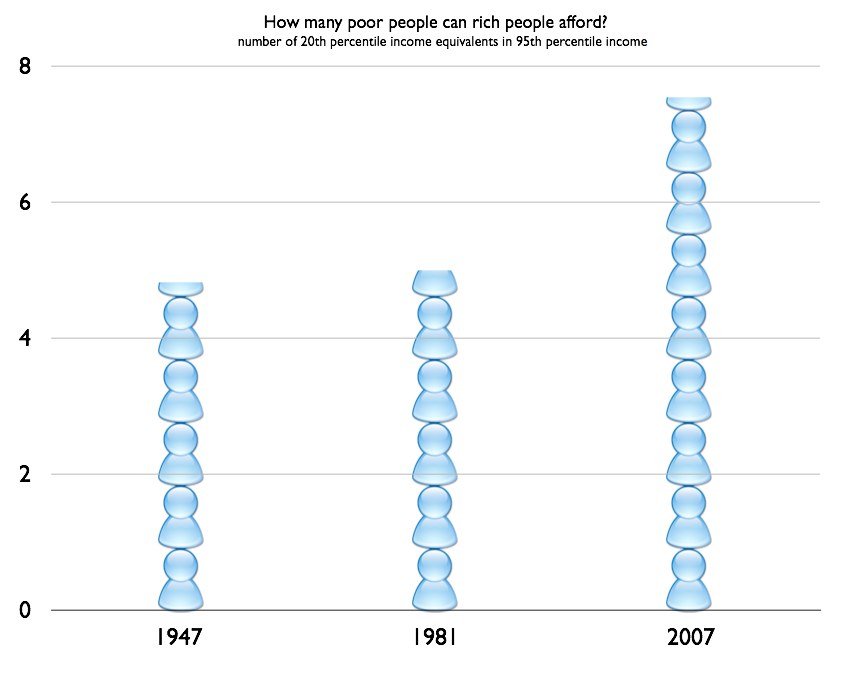

Here's one more way of looking at it. In 1947, the income of one wealthy person at the 95th percentile was enough to purchase the annual labor of just over five people living at the 20th percentile. For the next 34 years, that relationship stayed almost the same. However, in the 25 years that followed the relationship altered much more radically. Now the income of one person at the 95th percentile is enough to buy the work of more than seven people at the 20th percentile. Relative to the poor, the wealthy are far more wealthy. And relative to those at the top, both the poor and the middle class are far worse off than they were 25 years ago.

For the wealthy, when taxes were relatively high they could see that their interests were best served by making more investments in their business and providing the kind of benefits and training that gave them a long term edge. The only way to do well was by participating successfully in the market, and often doing well also required doing good. There's no doubt about it, capitalism is driven by enlightened self interest, but the form of enlightenment varies wildly with the limits that society imposes. In a well governed economy, regulations and taxes exist that place responsibilities to community, employees, and the environment on par with those of shareholders and executives. In this kind of system, corporate officers and owners will see that they can build more value for themselves by building for the long term, by placing value in their employees, by sharing benefits and knowledge. An educated, competent workforce is the only way to create the broadly based, durable company needed for those at the top to enjoy the benefits.

However, enlightened self interest can also come in the form of realizing that no one is minding the shop. In such circumstances, it pays to ignore the community, ignore the workers, ignore the rules. When short term gain offers a better return than virtuous participation in the marketplace, enlightenment says "screw it, I'll take mine now, thank you." That's what happened when deregulation of the savings and loans generated a crisis in the 1980s. It's what built the unsustainable bubble that popped in 2008. And it's what we've been doing to the broader economy since 1982. We've deregulated wealth; removed the incentives that made it reasonable for those who had much to invest in those who had little. We screwed up. When taxes drop so far that they cease to be a consideration, the best move is to simply grab all the money while it's available. Why tempt fate in the marketplace, why risk unforeseen circumstances, why do all that boring old work if you can simply pocket the profits and run?

The current system provides no incentive to build companies and systems that can stand the test of time, companies built around valuable and educated workers who have a stake in the success of the company, community, and society. We've built a system that's tottering on the edge of terminal instability, and those calling for still lower taxes are likely to knock out the last supports holding up the floor.

As it turns out, Ronald Reagan really did stage a second American revolution; a revolution that reversed the original. Because removing any pressure on income at the very top removed the only obstacle to what we have today—a system that inches ever closer to feudalism.

note: all the data this week came from census data available here, but calculations of annual growth and relative growth are my own. Any error is sure to be on my end.