For months, Republican born-again deficit hawks have been warning Americans that "we're becoming Greece." Of course, as FactCheck.org and Paul Krugman among others rightly concluded, "Greece -- with a long history of fiscal irresponsibility, very high public debt, and a country without a currency -- doesn't bear much resemblance even to the other peripheral Europeans, let alone the United States." But in one aspect, America would do well to follow the Greek example. With tax fraud now costing the U.S. Treasury an estimated $400 billion in revenue a year, Washington like Athens should launch a campaign to publicly shame the tax cheats.

As GlobalPost reported this week, those Greek business and individuals evading their tax bills are about to get the same treatment as prostitutes' clients in some U.S. municipalities. A list of 6,000 business cheats who owe Athens $41 billion has already been published. Now, Greece's legendary upper-class tax fraudsters are about to see their names in bold print:

As Greece's colossal debt problems weigh on the global economy, its wealthy have become famous for their brazen unwillingness to pay taxes.

By some estimates, a third of Greek taxes go unpaid, amounting to $20 billion or more. At least half of the country's budget shortfall could be eliminated if only the government could collect these revenues.

So, in addition to enacting the harsh budget cuts that are triggering unrest among the working class, Greek authorities are deploying novel methods to smoke out tax dodgers...now, a public-shaming campaign is underway to collect overdue taxes and rebuild trust with ordinary Greeks resentful of sweeping austerity measures.

As it turns out, there are a host of reasons the United States and Greece bear so little resemblance to each other. One of them, as Michael Lewis explained last fall, is the sheer scope of Greek tax cheating:

But beyond a $1.2 trillion debt (roughly a quarter-million dollars for each working adult), there is a more frightening deficit. After systematically looting their own treasury, in a breathtaking binge of tax evasion, bribery, and creative accounting spurred on by Goldman Sachs, Greeks are sure of one thing: they can't trust their fellow Greeks.

That rot starts with the epidemic of tax cheating which has crippled Athens. As the New York Times reported last year in "Greek Wealth is Everyhere But Tax Forms," the "wholesale lying about assets" in that nation of 11 million people is symptomatic of the "staggering breadth of tax dodging that has long been a way of life here." With a GDP of $341 billion and a budget of $108 billion, the impact on Greece's fiscal health is grave:

Various studies, including one by the Federation of Greek Industries last year, have estimated that the government may be losing as much as $30 billion a year to tax evasion - a figure that would have gone a long way to solving its debt problems.

To put that number in perspective, U.S. GDP reached $14.25 trillion GDP in 2009, while President Obama's proposed federal budget for the next year was $3.8 trillion. So the tax cheating epidemic in Greece is roughly three to four times worse than in the United States:

Various studies have concluded that Greece's shadow economy represented 20 to 30 percent of its gross domestic product. Friedrich Schneider, the chairman of the economics department at Johannes Kepler University of Linz, studies Europe's shadow economies; he said that Greece's was at 25 percent last year and estimated that it would rise to 25.2 percent in 2010. For comparison, the United States' was put at 7.8 percent.

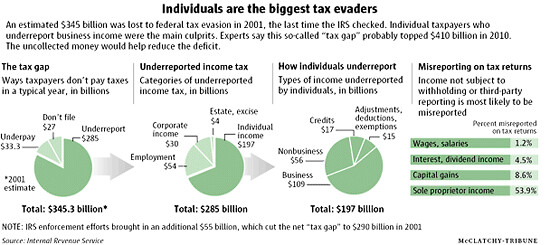

Sadly, Americans seem to be closing the gap (and at a time when the overall federal tax burden is at its lowest since 1950.) The Brookings Institution recently estimated that the U.S. Treasury is losing up to $500 billion a year to tax fraud and evasion, up substantially from the IRS estimate of $345 billion in 2001. Helping fuel that hemorrhage of red ink was the 1990's Republican jihad against the IRS, a campaign which substantially reduced the agency's enforcement capabilities - and its audits. Only now, with the Obama administration's efforts to crack down on wealthy cheats and their offshore accounts, is the tide slowly turning.

Unsurprisingly, this spring Republicans voted to cut $600 million funding for IRS enforcement despite its almost 10 to 1 return on investment, prompting Ezra Klein to remark, "Converting dollar bills into $10 bills is an excellent way to pay off your credit card. Except, it seems, if you're a House Republican."

Of course, those same Republicans for whom the IRS is a four-letter word won't be so keen on having American tax cheaters publicly shamed and disgraced like a hooker's "john." Then again, as David Vitter shows, the Johns of the GOP instead represent their party in the United States Senate.

* Crossposted at Perrspectives *