Credit rating declines due to home foreclosures or short sales are not as dramatic as commonly reported. More important, consumers' damaged credit ratings are rebounding most of the way to their original levels in far less than seven years.

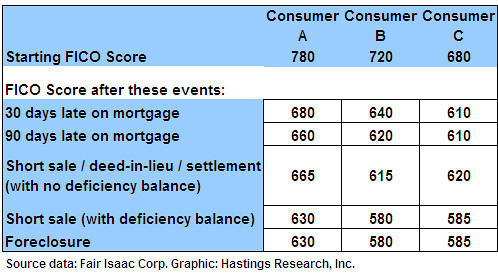

According to data from Fair Issac, FICO scores are dropping no more than 150 points due to a foreclosure or short sale, as reflected in the first chart. My own research turns up similar numbers (though I've seen a foreclosure knock as little as 80 points off a FICO score).

That first chart is entirely FICO data. The second chart is where the numbers get interesting – because rumors of people's credit being completely dead are greatly exaggerated. The next three charts include data collected by me and researchers I hire, highlighted in yellow. FICO's version of "time to recover your credit score" is true up to a point, but the trick word is "fully" [italics in the second chart are mine]. The ~ stands for "approximately."

That first group, with 780 FICO scores, are the "A" grade borrowers. They take the hardest hit to their scores – fair or unfair – but notice the startling difference in recovery times when you substitute "recover 80 percent" for "recover fully."

In hard numbers, this means that someone with a 780 FICO score who drops 150 points to a 630 score might not have the 780 score back for seven years, but they'll up to 750 in as little as two years. And they'll have that "A minus" for a couple of years after that. It's not the end of the world.

(This is not urban legend. The most dramatic example I've seen firsthand was a man who did a short sale with a deficiency in mid-2011. His ultra-high 820 FICO score plummeted 200 points to 620 ... and six months later was back to 780, an "A" grade borrower again.)

Credit scores recover just a little more quickly for a 720 FICO consumer (720 was the average American score before the Great Recession hit.)

In a not-unusual example, one of my readers showed me this sequence of credit scores reported:

1. She started with a 720 FICO score, and suffered a home foreclosure in late 2009. No short sale, no deed-in-lieu, just a straight foreclosure leaving a deficiency behind.

2. She checked her credit in April 2011, and it had rebounded to a 694 FICO score.

3. About that time she was unable to make credit card payments, and defaulted on three credit cards, which created another black mark.

4. Today in March 2012 she's back up to 679 ... only 41 points lower than her starting score, 2 1/2 years after the foreclosure. Over the next couple of years that will rise to 720 again.

By the time we look at people who start with a 680 score – which is actually not too shabby in the Great Recession – they've recovered 80 or even 100 percent of the lost score in no more than three years. This is more like a bump in the road than long-term financial trauma.

The bottom line is that in the current economy most people see their credit restored to near-former levels in about three years – if they don't have any further payment problems. So you'll pay 1 percent more on a new mortgage or 4 percent more on a car loan ... and life gets back to normal. (Assuming you have a job and no medical bills, of course – otherwise you have bigger problems than a bad credit score.)

Conversely, if you do have any more black marks on the way – you think you may not be able to continue with credit card payments, for example – then consider defaulting on those other debts now. That way your credit score will take the hit sooner, and will start the climb back towards normal that much sooner.

###

Research:

1. FICO estimates from http://bankinganalyticsblog.fico.com/... (Bankruptcy scores were deleted to keep the focus on home walkaways. "A" and C" consumer labels were reversed from FICO's chart for more logical presentation.)

2. Hastings Research independent results are from hundreds of interviews with homeowners, realtors, and mortgage brokers. They are supported by online reports from individual homeowners. Anyone wanting to confirm them can use a search engine to search for phrases such as 'fico score recover' or 'fico score rebound'. A lot of the bulletin board posts will be gibberish, but there are plenty where visitors describe their situation clearly, and give exact numbers and dates as they tell their story. (Ignore the web articles written by and for the banking industry; the true story is found in reader posts on smaller websites.)

Nicholas Carroll is the author of Walk Away From Debt for a Better Future.