This week, Rex Nutting of the MarketWatch caused a stir with his analysis correctly showing that federal spending has hardly budged under President Obama, rising at the slowest pace since Dwight Eisenhower was in the White House. Predictably, James Pethokoukis of the conservative American Enterprise Institute cited the jump in Washington's spending as a percentage of the U.S. economy to comically "prove" that "actually, the Obama spending binge really did happen." Comically, that is, because Pethokoukis conveniently ignores the staggering economic contraction resulting from the Bush recession, with GDP only last year having returned to 2008 levels. Even less surprising, the perpetual tax-cutters of the right neglected to mention that thanks to the steep recession and the Treasury-draining Bush tax cuts, total federal tax revenues as a percentage of GDP hit their lowest level since 1950.

On January 7, 2009, Reuters reported that President Bush was bequeathing a $1.2 trillion budget deficit to his successor. That record gap was fueled by Bush's $700 billion TARP program and plummeting tax revenue due to the shrinking American economy. As Reuters noted, President-Elect Obama "said he expects deficits around $1 trillion for years, forcing tough budget choices."

Which is exactly what came to pass. But even with the 2009 stimulus program and the necessarily growing outlays for Medicaid, unemployment insurance, food stamps and other safety net programs, those trillion deficits had less to do with Barack Obama boosting spending than the dramatic loss of tax revenue. As former Reagan administration official Bruce Bartlett explained in October 2009:

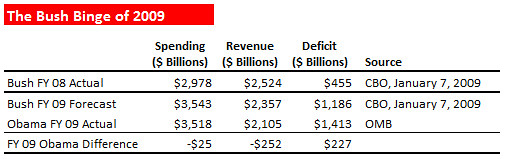

According to the Congressional Budget Office's January 2009 estimate for fiscal year 2009, outlays were projected to be $3,543 billion and revenues were projected to be $2,357 billion, leaving a deficit of $1,186 billion. Keep in mind that these estimates were made before Obama took office, based on existing law and policy, and did not take into account any actions that Obama might implement...

Now let's fast forward to the end of fiscal year 2009, which ended on September 30. According to CBO, it ended with spending at $3,515 billion and revenues of $2,106 billion for a deficit of $1,409 billion.

To recap, the deficit came in $223 billion higher than projected [in January], but spending was $28 billion and revenues were $251 billion less than expected. Thus we can conclude that more than 100 percent of the increase in the deficit since January is accounted for by lower revenues. Not one penny is due to higher spending.

Obama's own tax cuts, the ones contained in the February 2009 stimulus bill, "reduced revenues in FY2009 by $98 billion over what would otherwise have been the case."

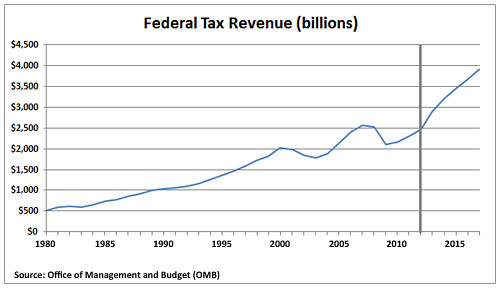

This chart shows just how dire the tax revenue drought has become. For those Republicans who claim "tax cuts pay themselves," it's worth noting that federal revenue did not return to its pre-Bush tax cut level until 2006. (While this graph shows current dollars, the dynamic is unchanged measured in inflation-adjusted, constant 2005 dollars.)

But that picture tells only part of the story. Measuring taxes and spending as a percentage of the total U.S. economy reveals revenue at historical lows. Meanwhile, the temporary jump in outlays as a percentage of recession-reduced GDP, literally the lowest common denominator, is ignored by Pethokoukis.

Of course, that the American tax burden hasn't been this low in generations has long been apparent to honest observers. Thanks to the combination of the Bush Recession and the latest Obama tax cuts, the AP reported last year, "as a share of the nation's economy, Uncle Sam's take this year will be the lowest since 1950, when the Korean War was just getting under way." In January, the Congressional Budget Office (CBO) explained that "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." That finding echoed an earlier analysis from the Bureau of Economic Analysis. Last April, the Center on Budget and Policy Priorities concluded, "Middle-income Americans are now paying federal taxes at or near historically low levels, according to the latest available data." As USA Todayreported in May 2010, the BEA data debunked yet another right-wing myth:

Federal, state and local taxes -- including income, property, sales and other taxes -- consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress.

Or as one-time Reaganite official

Bruce Bartlett explained it in the New York Times a year ago:

In short, by the broadest measure of the tax rate, the current level is unusually low and has been for some time. Revenues were 14.9 percent of G.D.P. in both 2009 and 2010. Yet if one listens to Republicans, one would think that taxes have never been higher, that an excessive tax burden is the most important constraint holding back economic growth and that a big tax cut is exactly what the economy needs to get growing again.

It's no wonder Reuters global editor

Chrystia Freeland concluded today, "Like an Anorexic, U.S. Sees Itself Fat with Taxes."

Largely overlooked in the discussion of whether Barack Obama has or has not gorged on a federal spending binge is that state and local governments are on a starvation diet.

In the states, public sector revenue and spending has yet to return to pre-recession levels, with devastating results. Last week, that Republican bastion the Wall Street Journal concluded that the 600,000 state and local government jobs already lost since December 2008 represented an "anti-stimulus" which has added a full point to America's unemployment rate. Last month, the Economic Policy Institute noted that the private sector had gained 2.8 million jobs while federal, state and local governments shed 584,000 just since June 2009. EPI concluded that the public sector job losses constituted "an unprecedented drag on the recovery":

"The current recovery is the only one that has seen public-sector losses over its first 31 months."

Back in March, Paul Krugman expressed the same point, but with some inconvenient historical context for the Party of Reagan. "In fact, if it weren't for this destructive fiscal austerity," Krugman explained, "Our unemployment rate would almost certainly be lower now than it was at a comparable stage of the 'Morning in America' recovery during the Reagan era."

We're talking big numbers here. If government employment under Mr. Obama had grown at Reagan-era rates, 1.3 million more Americans would be working as schoolteachers, firefighters, police officers, etc., than are currently employed in such jobs.

And once you take the effects of public spending on private employment into account, a rough estimate is that the unemployment rate would be 1.5 percentage points lower than it is, or below 7 percent -- significantly better than the Reagan economy at this stage.

Earlier this month,

Krugman's New York Times colleague Floyd Norris offered more detail on "

the Incredible Shrinking U.S. Government."

For the first time in 40 years, the government sector of the American economy has shrunk during the first three years of a presidential administration.

Spending by the federal government, adjusted for inflation, has risen at a slow rate under President Obama. But that increase has been more than offset by a fall in spending by state and local governments, which have been squeezed by weak tax receipts.

In the first quarter of this year, the real gross domestic product for the government -- including state and local governments as well as federal -- was 2 percent lower than it was three years earlier, when Barack Obama took office in early 2009.

On Wednesday, President Obama weighed in on Nutting's finding that "government spending under Obama, including his signature stimulus bill, is rising at a 1.4 percent annualized pace - slower than at any time in nearly 60 years." Casually reminding Americans of the Republican debt orgy of the Bush years, Obama pointed out:

"This other side, I don't know how they've been bamboozling folks into thinking that they are the responsible, fiscally-disciplined party. They run up these wild debts and then when we take over, we've got to clean it up."

Or as

Vice President Dick Cheney famously put it during George W. Bush tax cut and spending binge, "Reagan proved deficits don't matter." Unless, that is, a Democrat is in the White House.

UPDATE: Politifact ("mostly true") and the Washington Post (three Pinocchios") looked at Nutting's assertion on Obama's spending and came to opposite conclusions. But neither seems to mention that the Congressional Budget Office forecast FY 2009 spending at $3.54 trillion (that is, more than Obama actually spent) two weeks before his inauguration.

* Crossposted at Perrspectives *