Cross posted at our new beta site Voices on the Square and The Starz Hollowz Gazette

Yes, this is true. It's not a popular saying, but I'm not here to make everyone feel good for 2012 electioneering while people are suffering to feel a sense of belonging among the Washington elite prognosticating over poll numbers instead of real issues. As we have this debate over 4 percentage points in the tax code, the overall omission of most Americans suffering from the fallout of the housing bubble is insulting.

That's right. This debate ignores the big elephant in the room; the millions of people underwater defrauded into mortgage debt and other private debt chaining them to their deflating assets with no sufficient income prospects added up and compounded in a usurious fashion sucking demand out of the economy. For those that do not "got theirs jack" and can't afford cable news to cheer along with this partisan war syndrome dynamic, this actually matters.

It matters because as I have chronicled here, here, here, and here, the Foreclosure Fraud Settlement was an insult to the millions injured from the fallout of this bubble once NY AG was bought off to prop it up with stilts. Banks were given credit for the HAMP mods in addition to being propped up by the other failed HARP program. Basically those that defended that settlement or any of these programs anymore have to admit now they knew nothing.

For want or need of a nice election tune, many are tuning in to this election while too many are tuning out these debilitating economic problems because the absolute failure to deal with them at all. I partially understand, it is daunting and demoralizing, but whether one wants to tune in to these problems or not, the song remains the same.

It's the song of the decade and it goes well beyond this election.

Now there are other solutions besides debt forgiveness, but none theoretically as quick and feasible. Also I'm beginning to tire myself out talking about the President and everyone in Congress being stuck on stupid when it comes to deficits and the federal budget they write while knowing nothing at all about national accounting. Nope, we do need Modern Monetary Theory, deficits, and a job guarantee, but Post Keynesians are right too; we need a private debt jubilee.

Those are the few solutions that would work and no one in the beltway, even the progressive beltway, is talking about them at all. So I was rather surprised and delighted to see Steve Clemons and Richard Vague pick this up and articulate it rather well despite some small nitpicks I have.

Want Economic Growth? Forgive and Restructure Debt for American Working Families

It's private debt that matters most.

There is about $24 trillion in consumer and business debt held in the United States today and this dwarfs the federal debt, money supply, and the nation's GDP.

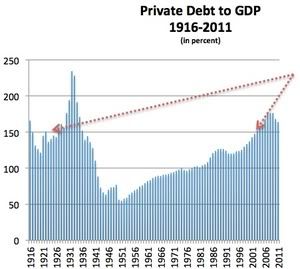

In a short report (pdf) we are releasing today that explores the behavior of private debt before and after economic crises -- not only in the U.S., but in Japan as well as a number of European nations -- we have noted that (1) a fast run-up of private debt combined with (2) a level of private debt more than 150% of GDP were evident in both the Great Recession of 2008-2009 as well as in America's Great Depression.

In a short report (pdf) we are releasing today that explores the behavior of private debt before and after economic crises -- not only in the U.S., but in Japan as well as a number of European nations -- we have noted that (1) a fast run-up of private debt combined with (2) a level of private debt more than 150% of GDP were evident in both the Great Recession of 2008-2009 as well as in America's Great Depression.

Federal debt was inconsequential to these crises. Charts in the report (pdf) we are posting today make clear that Spain, economically beleaguered today, was in excellent federal balance sheet health before the recent Eurozone financial quakes started.

[............]

In ancient times and as recorded in the old Testament of the Bible, the Land of Israel forgave all debts periodically, and the economic basis point for lands and slaves was reset in what was called "Jubilee."

Yes, I love the point about Spain having their budget balanced and still falling into recession because of the massive global housing bubble that hit them that we and the U.K exported across the world. I love it because it stops deficit terrorists in their tracks because they have no answer to it like they have no answer to how Japan has never defaulted even though it was downgraded by S&P and had a debt to GDP ratio of over 200%. The biblical reference to Israel's jubilee is prescient and kind of makes us look bad in modern times when we are supposed to be more evolved.

I think it's time we at least live up to some of the worthy economic standards of ancient biblical tribes. Even Kings forgave debt about every 7 years or so. Can we live up to that and at least talk about this? Or will I be crucified for bringing it up and having lack of faith that an election will solve this problem even though the lack of mention signals it won't even come close?

It basically goes down to economist Michael Hudson's accurate prescient adage:

"Debts that can't be paid won't be paid."

Here's one of Hudsons' colleagues at the UMKC talking about the head of FHFA Edward Demarco's continuing opposition to principal write downs.

The Black Financial and Fraud Report: Agency Says No to Mortgage Relief

JAY: And what alternative does the Obama administration have? Some people have suggested perhaps the Fed could do something like this in terms of pressuring the big banks. I guess that wouldn't affect Fannie and Freddie mortgages so much, but a lot of these mortgages are also held by big banks. Is there some policy alternative there?

BLACK: There's probably no effective alternative. Obama, of course, could use the bully pulpit and urge the largest banks to do this, urge them to come together and create a plan. If they were to do that, that would pressure Fannie and Freddie to do the same thing. But I really can't see the big banks answering the call of the Obama administration in helping to get it reelected.

No, their chance to do something about this was in the massive foreclosure litigation. Remember when the largest banks engaged in massive foreclosure fraud to the tune of 10,000 times a month, you know, more than 100,000 times a year, and they were sued by many of the state attorney generals? And, unfortunately, the Obama administration pressured the states to enter into a very weak settlement. This is when the Obama administration was completely in bed with the big banks. And so they didn't get as part of that settlement anything really significant in reducing the principal amount of the debt. There are some programs, but they're trivial compared to the scope of the problem.

I like how Bill Black delves into the fake stress tests many delusional Democrats touted as being serious(during Geithner's PPIP proposal run-up which still tells us nothing about bank solvency), even though Black lines up the multiple banks that failed right after being shown solvent by their fraudulent pseudo accounting methods. Economic history is hard to deny even though many will try.

I also agree with Black that there were options during the proceedings of the Foreclosure Fraud sellout, but they were pissed away. FHFA is an independent agency so DeMarco can't be fired. However that is also a poor excuse I have heard more than once. Yves Smith lays out why rather well why that is the case as she always does.

Why “Firing Ed DeMarco” is No Solution to FHFA Refusal to Engage in Principal Modifications (Updated)

As much as this blogger is firmly of the view that this is a poor economic decision (deep principal mods are a sound idea, as long as you have a decent approach for vetting borrower income and other debt payments to see if they are viable with a mod), I have to hand it to DeMarco as a bureaucratic infighter. He is effectively throwing the abortion of HAMP results in Treasury’s face. Recall that HAMP did not require borrowers to default in order to qualify for mods, yet many did out of misdirection by servicers. Now in fact, servicers are unlikely to play that game this time, since a principal mod reduces their servicing income. But the fact, as detailed by Neil Barofsky in his book Bailout, that Treasury was indifferent to how homeowners fared under HAMP, and merely saw this as a vehicle for “foaming the runway,” meaning spreading out the number of foreclosures over time, rather than saving borrowers, led to irresponsible actions (like ordering servicers to sign up people for trial mods initially without even qualifying them), numerous changes in program design (disastrous for highly routinized servicers) and lack of concern with the fact that many people lost their homes by virtue of HAMP who might have kept them, has produced some data (in particular, informed estimates of the number of people who defaulted to qualify for HAMP) against the Administration.

[...............]

The way to beat this is not via taking out a contract on DeMarco, it’s in doing a better job of promoting the merits of principal mods and debunking the “deadbeat borrower” meme.

[............]

Update 7:00 PM: Adam Levitin points out, per Ezra Klein, that Obama could get rid of DeMarco via simply making a permanent appointment on a recess. Technically true, but Obama had that option to him long ago, in fact back in 2010 when the Senate let his appointee Joseph Smith hang in the breeze and Smith withdrew. And he also could have done it earlier this year, when DeMarco first made his opposition to principal mods clear (he deferred taking a stand as long as possible).

To replace DeMarco at this juncture would be waving a red flag in front of Fannie and Freddie hating Republicans, and would bolster Romney’s campaign by giving them a solid anti-Obama talking point. And the reality, as we indicated above, is that Obama has never been serious about helping homeowners. He’s never crossed swords with the folks who demonize borrowers in distress, never had any of his minions get tough with recalcitrant servicers. He has plenty of latitude to make an impact, and the only thing he threw his weight behind was the cosmetic, bank-serving mortgage settlement. He’s clearly made the calculation, and he has determined he is well served with DeMarco in place as a scapegoat.

There's always a scapegoat too many partisans point to to keep Democrats from doing their jobs. This involves this president doing recess appointments whenever he can make to stop Republican obstruction, just like George W. Bush used to do when Democrats didn't like his appointments. But president Obama didn't even want to appoint Elizabeth Warren that way even though he had to appoint Richard Cordray that way. He could have gotten rid of DeMarco through a recess appointment of his nominee from NC, but the absence of such a move speaks volumes, especially since Demarco has become a convenient scapegoat.

This recess appointment to get rid of DeMarco was not on the agenda even though FHFA own or guarantee roughly half of all underwater mortgages. Doesn't sound like it was thought of as a pressing problem by this administration and everyone who makes this excuse since we didn't hear anything back in 2010. Principal write downs would benefit the agency as well as the economy.

Adding that fact onto the Foreclosure Fraud sellout in general is just uninspiring. This is a big enough problem to make these points and they need to be made even during an election. To want them to go away is to want people and their concerns and well being to go away. There's never going to be more leverage than right now to advocate for those enslaved by private debt.

So basically, to sum up, there are no excuses even about Ed Demarco that excuse the President from drastically mishandling this. SIGTARP Neil Barofsky lays these indisputable facts out in this new book. He knows better than you or I because he was actually there. Maybe you don't care, but you should.

I'm sorry this real world problem ignored by the beltway in this diary doesn't inspire hope, but it really shouldn't. We can only hope this issue even gets a mention much less any real solution to it that is not a giveaway to the banks. I hope that changes for the good of the people and not the SCOTUS definition of people; real people who need real help.