The GOP has frozen progress in Congress over a measely 4.6% tax increase on NET INCOME over $250,000. All agree to leave the Bush Tax Cuts in place on all NET INCOME for $250,000 and less. Not 46%, no. 4.6%. The Republican Party in both the House and Senate has blocked so many bills in order to protect their wealthiest consitutents from having to pay a measely increase of 4.6% only on income that EXCEEDS $250,000.

Why isn't the Democratic Party clearly broadcasting this FACT?

For an example, let's look at Constituent A, who earns a salary that produces a NET INCOME, after all the allowable deductions and tax code complexities are factored in, of $500,000.

Currently, Constituant A pays the Bush Tax cuts on his/her entire NET income.

If President Obama's plan passed, Constituent A would only be taxed an additional 4.6% on NET Income over $250,000. In short, Constituent A would pay 39.6% instead of 35% on the second $250,000. Let's do the ARITHMETIC:

The tax on Constituent A's NET Income would remain the same for first $250,000.

Under the Bush Tax rate of 35%, Constituent A would pay 35% on $251,000 - $500,000.

The Arithmetic for Bush Tax Cut:

35% x $249,000 = $87,500

Under the Democratic Plan, the tax would increase by a measely 4.6% to 39.6% on the amount in excess of $250,000 or, in this case, on $249,000.

The Arithmetic for Democratic Tax Increase on Net income over $250,000:

39.6% x $249,000 = $98,604

The tax increase for Constituent A with the measely 4.6% tax increase would be:

$98,604 - $87,500 = $11,104

If you divide the tax increase, $11,104 by NET Income of $500,000 you will find that this increase is only a 2.2% of income increase paid to the USA. In short, how can anyone argue that a 2.2% of income increase of tax, in this case, is burdonsome? Don't all Americans have to chip in to reduce the debt? To do their fair share?

Granted, there are lots of tax details in this simplified presentation, most of which address income under $250,000; however, the majority of the grid lock in Congress stems from this measely 4.6% increase on income over $250,000. Period.

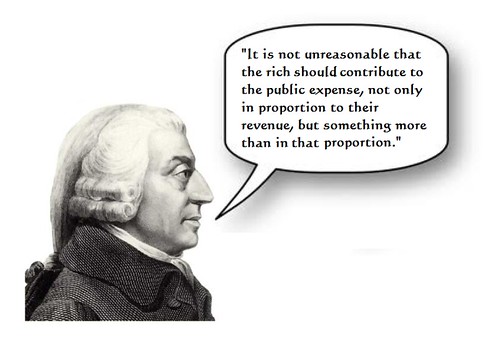

Even Adam Smith agreed that "to whom much is given, more is required" to paraphrase

MY DREAM would be a return to truly progressive tax rates with many more levels like we had until Reagan took office.

The rates were progressive, even for different levels of wealth. Simplifyng the tx code by reducing the income divisions makes the tax code less progressive, imo.

Here's a simplified chart depicting the high earner tax rates over the years:

DO WE ALSO FORGET TO EMPHASIZE THAT, when taxes are cut, deficits rise? Here's a chart showing the tax rate history on the highest earners:

Here's a deficit chart where you can see the deficits rising when tax rates, shown above, decrease:

We can improve our framing of this important issue.

There is a lot of misinformation being circulated, primarily to make sure the public remains confused. The GOP are so much more diligent and unified in their messaging. Granted most of their messaging is false, but they have the Hitler thing down very well. A big lie repeated can become a truth perceived (paraphrased).

Here'e are some examples of misinformation:

TAXES: CLINTON VS BUSH from Snopes

Ezra Klein on Clinton-Era Tax Rates from National Review

Here's an article that does a pretty good job summarizing the years of this debate:

I think this article from the NYTimes is helpful: Bush-Era Tax Cuts

At the NYTimes link, you will find a 2010 chart link that demonstrates how much the Bush Tax Cuts saved each income level.

Can Democrats let their independent or undecided voter friends know that the big debate about ending the Bush Tax Cuts for the top income earners is really only about a measely 4.6% increase?

I hope so.

How is it that the GOP gets away with their head-spinning, lie spinning anti-tax debate about a measely 4.6% increase on the wealthy message?

GOTV