First a little Medicare pay-for history ...

The History of Medicare Payroll Deductions

by W D Adkins, eHow Contributor

The first Medicare payroll deductions were implemented in 1966. Originally, the Medicare tax rate was 0.35 percent of all earned income, with employee contributions matched dollar for dollar by employers.

In the 1960s, the number of retirees and the cost of health care rose rapidly. Congress raised the Medicare payroll tax to 0.5 percent in 1967 and to 0.6 percent in 1968 to keep up with increasing costs.

In 1973, Medicare payroll deductions rose to 1.0 percent of total earnings. The rate dropped to 0.9 percent in 1974. Medicare tax was raised again to 1.0 percent in 1978.

Congress once more increased payroll deductions in 1979, this time to 1.05 percent.

The Medicare payroll tax reached 1.3 percent in 1981. Another change was introduced in 1984.

[...]

Congress raised the Medicare payroll tax to 1.35 percent in 1985 and to 1.45 percent in 1986.

After 1986, Congress made no more changes in Medicare payroll deductions. As of 2011, the tax rate remained at 1.45 percent of earned income.

[...]

Obvious Solution 1) Raise the Medicare Payroll Tax to keep pace with the rising costs of health care.

2012 Social Security and Medicare Tax Withholding Limits

[...]

There is still no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax. The Medicare Tax Rate applies to all taxable wages and remains at 1.45 percent. The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, increases to 7.65 percent for 2012.

The information in the following table shows the changes in Social Security and Medicare withholding limits from 2011 to 2012. The new limits are effective January 1, 2012.

Tax 2011 Limit 2012 Limit

Social Security Gross $106,800.00 $110,100.00

Social Security Liability $4,485.60 $6,826.20

Medicare Gross No Limit No Limit

Medicare Liability No Limit No Limit

Obvious Solution 2) Raise the FICA Withholding Limit (ie the Ceiling). Use the excess Trust funds to supplement Medicare.

Obvious Solution 2.b) Apply the Medicare Tax Rate to the "deferred" fortunes made everyday on Wall Street.

Health Spending Growth Projected To Average 5.7 Percent Annually Through 2021

by Chris Fleming, healthaffairs.org -- June 12, 2012

New estimates released today from the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS) project that aggregate health care spending in the United States will grow at an average annual rate of 5.7 percent for 2011 through 2021, or 0.9 percentage point faster than the expected growth in the gross domestic product (GDP). The health care share of GDP by 2021 is projected to rise to 19.6 percent, from its 2010 level of 17.9 percent.

[...]

The major effects of the Affordable Care Act on overall spending levels are expected to be felt most acutely in 2014. The coverage expansions associated with the Affordable Care Act for Medicaid and private health insurance are expected to increase the growth rate for health spending to 7.4 percent in 2014, with notable increases in spending on physician services and prescription drugs by the newly insured. Throughout the latter half of the projection period, incomes are expected to be higher, and a large number of baby boomers are anticipated to be receiving coverage under Medicare. Among others, these factors are expected to drive health spending up around 2 percentage points faster than overall economic growth by 2020, consistent with trends in the United States for about the past thirty years.

[...]

A measly "2 percentage points faster than overall economic growth" (ie GDP)

-- that's some Austere problem.

Obvious Solution 3) Focus on Economic Growth, Increase the GDP. Focus on putting People back to work, to increase the Tax base.

A Healthy Economy = A Healthy Population.

Medicare -- ourfuture.org

[...]

Conservatives are wrong about the challenges facing Medicare. Conservatives argue that rising enrollment in Medicare is driving up costs. However, the Congressional Budget Office has reported that “the aging of the population…accounts for only a modest fraction of the growth” in Medicare costs. The main factor is the growth of health care costs -- the extent to which the increase in health care costs has exceeded the growth of the economy.

Conservative attempts to privatize Medicare have been disastrous. President Bush’s Medicare prescription drug plan forced seniors to deal with hundreds of private insurers and prohibited the government from negotiating lower drug prices. The plan’s “doughnut hole” saddled 3.4 million Medicare beneficiaries with high drug costs. [ Kaiser Family Foundation] [...]

"The main factor is the growth of health care costs" and one of the main cost factors there is "prohibition against the government from negotiating lower drug prices"

ie. Pharmaceutical profit margins are a built-in rising cost.

Obvious Solution 4) Let the Medicare recipients bargain as a government program group -- to lower the ever increasing Drug rate cost, using economies of scale. Like the rest of the "free market" is allowed to do.

ie. WE NEED to change the national mindset: Without health-challenged Seniors -- Drug Companies are out of a job. No must-pay customers, means No gang-busters Business.

The War On Entitlements

by Thomas B. Edsall, nytimes.com -- March 6, 2013

[...]

These facts include the following: Two-thirds of Americans who are over the age of 65 depend on an average annual Social Security benefit of $15,168.36 for at least half of their income.

Currently, earned income in excess of $113,700 is entirely exempt from the 6.2 percent payroll tax that funds Social Security benefits (employers pay a matching 6.2 percent). 5.2 percent of working Americans make more than $113,700 a year. Simply by eliminating the payroll tax earnings cap -- and thus ending this regressive exemption for the top 5.2 percent of earners -- would, according to the Congressional Budget Office, solve the financial crisis facing the Social Security system.

So why don’t we talk about raising or eliminating the cap -- a measure that has strong popular, though not elite, support?

[...]

Elite anxiety over entitlement-driven budget deficits and accumulating national debt has created a powerful class in the nation’s capital. The agenda of this class is in many respects on a collision course with mounting demands for action by those lower down the ladder to address the threat to government social insurance programs. Intransigent opposition by the better off and their representatives to raising the necessary revenue means that not only Social Security and Medicare face a budgetary ax.

[...]

Obvious Solution 5) Give the

Progressive Caucus a "seat at the Austerity table."

This Time. Common sense needs some representation.

Obvious Solution 6) Give the People the choice of a Public Option -- one the that puts a premium on Health -- and NOT its 20% profit margin.

And Obvious Solution 7) ...

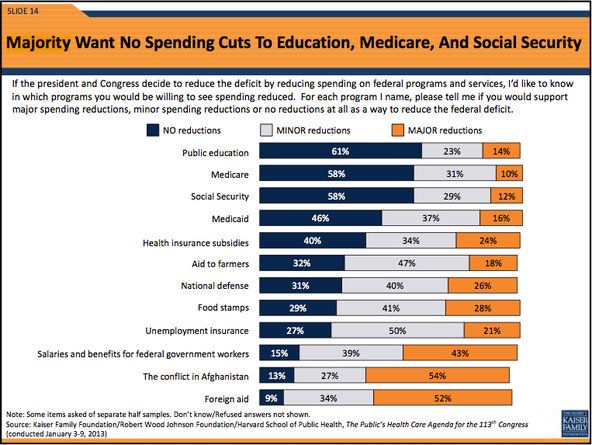

larger image -- Source: NYTimes

And Obvious Solution 7) Actually LISTEN to the People -- and give us what we want.