The media is filled with people chanting, "peak oil is dead, peak oil is dead." It is particularly popular among conservatives, egged on by the oil industry and Wall Street. The reasons are not complicated. The shale oil "boom" seems to validate the "drill, baby, drill" meme. Investment firms are always looking for over-hyped areas to inflate a bubble or two. It also serves the "free market" mythology, our hero flexing its glorious muscles to "solve" the energy needs of the nation while "freeing" us from our dependence on foreign markets, particularly those nations with an affinity for Islam or run by dictators not to our liking. And who can resist a little flag-waving nationalism as America proudly emerges as a new force on the energy market? Finally, there is the satisfaction of shouting down the "doom-sayers" that dared question the fossil emperor's elegant robes.

On the one hand, it is an impressive propaganda campaign, with articles timed to appear almost simultaneously in media outlets, each spouting the same talking points, and drawing from the same sources. Before long, heads are bobbling everywhere.

Of course, there is one small problem with the narrative. It is all bullshit.

What is peak oil?

Peak oil is the idea that the production of conventional oil, light crude, will peak and decline in coming years across the globe. The prediction came originally from M. King Hubbert in a 1956 presentation to the American Petroleum Institute. (See also this 1971 Scientific American publication.) At that time, he was chief of geology for Shell. Hubbert had been studying oil production and well depletion rates, observations that led him to predict that conventional oil production would peak around 1970 in the U.S. and around 2005 globally. Those predictions have held up.

Hubbert used an island metaphor to explain his ideas. Oil exploration is a search for new islands of oil. The big islands, continent-sized giant fields, have largely been found and exploited. To maintain production, the industry has to find an many more smaller islands, which increase costs because you are drilling more wells.

He did not consider shale oil, tar sands, and deep ocean deposits as conventional oil because the productions costs were much higher and energy return on investment much lower. These were sources you turn to when conventional supplies are depleted and crude oils prices rise to the point that exploiting these unconventional sources is profitable. In other words, Hubbert accurately predicted the end of cheap oil.

His ideas were controversial at the time because the oil industry wanted to count unconventional sources of oil as part of their stated reserves even though they were not profitable to develop when oil prices were low. This 1982 discussion with an Exxon executive lays out Hubbert's reasoning (emphasis added).

DR. HUBBERT (in response to remarks by David Nissen - Exxon): Your kind remarks with regard to my previous studies of the evolution of the U.S. petroleum industry are greatly appreciated. However, you suggest that my estimates of the ultimate amounts of oil to be recovered is questionable for reasons of classification and because I have not taken into account the effect of the price of oil on ultimate recovery. You mention oil shale, coal, and the Orinoco heavy oils of Venezoela.

With regard to classification, if unintelligibility is to be avoided it is essential that one define his terms and then adhere rigorously to those definitions. In the present study I have been concerned with the techniques of estimation as applied to conventional crude oil and natural gas in the U.S. Lower-48 states. This excludes consideration of shale oil, coal, Orinoco heavy oils, natural gas from unconventional sources, and also oil and gas from Alaska.

My analyses are based upon the simple fundamental geologic fact that initially there was only a fixed and finite amount of oil in the ground, and that, as exploitation proceeds, the amount of oil remaining diminishes monotonically. We do not know how much oil was present originally or what fraction of this will ultimately be recovered. These are among the quantities that we are trying to estimate.

Your statement that the fraction of the original oil-in-place that will be recovered is correct, but the effect may easily be exaggerated. For example, we know how to get oil out of a reservoir sand, but at what cost? If oil had the price of pharmaceuticals and could be sold in unlimited quantity, we probably would get it all out except the smell. However there is a different and more fundamental cost that is independent of the monetary price. That is the energy cost of exploration and production. So long as oil is used as a source of energy, when the energy cost of recovering a barrel of oil becomes greater than the energy content of the oil, production will cease no matter what the monetary price may be. During the last decade we have very large increases in the monetary price of oil. This has stimulated an accelerated program of exploratory drilling and a slightly increased rate of discovery, but the discoveries per foot of exploratory drilling have continuously declined from an initial rate of about 200 barrels per foot to a present rate of only 8 barrels per foot.

In other words, when the price of oil is high enough to justify going after shale oil, tar sands, and deep ocean wells, conventional oil is in terminal decline. Hubbert did not predict an end to hydrocarbons you can refine into oil, but rather the decline of cheap conventional oil.

The spin machine in action

Meet Daniel Yergin. He is an economist, founder of Cambridge Energy Research Associates (CERA), and the oil industry's favorite supply-sider. Whenever the media is talking about oil supply, almost invariably you will find quotes from Yergin or some lackey from CERA (now part of the IHS family of consultants) gushing about oil production and minimizing the growth in global demand. The same is also true when Congress wants to push "drill, baby, drill" energy policies. For example, Yergin was the star witness in recent hearings held by the House Energy and Commerce Committee in their drive to dramatically increase oil and gas leases on federal land. Here is a taste of his hyperbole.

The United States is in the midst of the “unconventional revolution in oil and gas” that, it becomes increasingly apparent, goes beyond energy itself. Today, the industry supports 1.7m jobs – a considerable accomplishment given the relative newness of the technology. That number could rise to 3 million by 2020. In 2012, this revolution added $62 billion to federal and state government revenues, a number that we project could rise to about $113 billion by 2020.2 It is helping to stimulate a manufacturing renaissance in the United States, improving the competitive position of the United States in the global economy, and beginning to affect global geopolitics. This revolution has also engendered two debates -- about the environmental impact of shale gas development and about the role of U.S. energy exports. All this sets the framework for the Subcommittee’s hearings.

Yergin is a clever and effective propagandist in his attempts to discredit peak oil predictions. By 2005, peak oil discussions were becoming more common. Asia was beginning to drive global oil demand and oil production was not keeping pace, which would force oil prices to record levels. At the time, oil prices were hovering around $60 a barrel and many analysts were predicting prices would soon hit the $100 mark.

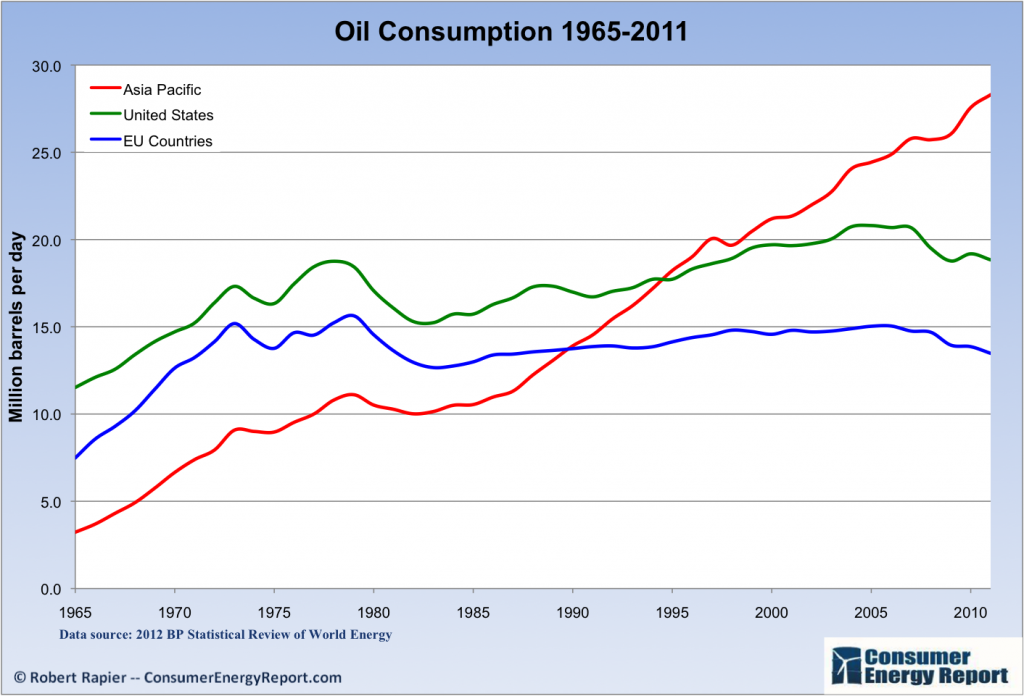

The past 46 years has seen oil consumption grow by 63% in the U.S., 60% in the EU, and 777% in Asia Pacific. Oil consumption in the U.S. and the EU has been trending downward since about 2005. But the reason there has been little relief from high oil prices — despite the drop in demand in the West — is that global oil consumption continues to climb on the back of very strong Asian demand.

Robert Rapier, Energy Trends Insider

Yergin

countered with a forecast of a 30-year plateau in supplies with declining demand that would eventually bring oil prices down to $40 a barrel. At the time,

he was also chairman of the Energy Department's Task Force on Strategic Energy Research and Development. The Bush administration was pushing shale oil drilling and Congress was creating the "Halliburton loophole" to protect drillers using hydraulic fracturing. He even took to the pages of the

Washington Post to mock the idea of peak oil.

When oil prices broke into the $100 a barrel range in 2008 as many analysts had been predicting, Yergin again went on the offensive for the oil industry. He blamed high prices on analysts talking about peak oil.

One of the parting gifts of the Bush administration to the oil industry was a dramatic revision of what the Securities and Exchange Commission (SEC) allowed oil companies to count as reserves for investment disclosure documents. The SEC previously only allowed reserves to be counted as "proven" if drilling had begun, a practice Yergin resoundingly criticized in his 2005 editorial in the Washington Post. The new rules expanded the proven designation to undeveloped sites if the company promised to drill within 5 years. Suddenly, oil company reserves were growing rapidly on the strength of hand-waving over leases. (Remember all of those leases the oil industry has held in its pocket while clamoring for more? Those are useful for the industry to inflate its reserve estimates for the purpose of inflating its stock prices.)

Yergin used the burgeoning estimates of oil company reserves as the basis for his 2011 book ("The Quest: Energy, Security, and the Remaking of the Modern World”), in which he again attacks the notion of peak oil, much to the delight of the gullible media.

He considers the notion of “peak oil” — the idea that the world’s supply is rapidly running out — and mostly dismisses it. Thanks to new technologies, estimates of the world’s total stock keep growing.

Yergin is working hard to spin fracking for

shale oil as our economic savior, cheered on by the "drill, baby, drill" crowd. Conservative pundits are echoing the "peak oil is dead" mantra and regurgitating Yergin's talking points on shale oil. Recent examples include David Frum in

CNN and Tracy Mehan in

American Spectator, both of which appeared on March 5.

The oil industry needs the American people filled with the false beliefs that shale oil, tar sands, and other expensive hydrocarbons will create economic prosperity and lower transportation energy costs. It keeps down opposition to covering the country with shale wells and tar sands pipelines. Yergin and others have been very successful in convincing many that happy days and cheap oil are here again.

The shale oil rush is proof of peak oil

The oil industry wants you to focus on the amount of oil being produced from shale wells and not look closely at how individual wells perform. The devil is in the details. Geologist David Hughes examined production data for more than 65,000 shale oil and gas wells. The moral of the story is simple. These wells have rapid depletion rates. Here is a summary of the data for the Bakken formation in North Dakota.

Why does the depletion rate matter? Simple. In order to maintain current heavily-hyped rates of production, new wells have to be drilled at the same ridiculous pace, if not even faster. Using Hubbert's island metaphor, these shale wells are itty-bitty islands. It takes a great many of them to match the production of only a few large strikes during the golden age of American oil between 1930 and 1960.

Why should you care? Because the shale oil and gas frenzy will be one of the most environmentally destructive initiatives in our history. Millions of acres will be cleared for well pads, drilling roads, and a mind-boggling web of pipelines, much of it on federal lands. Much of this acreage will include those carbon sinks known as trees. This industrial wasteland will likely never be reclaimed, certainly not by the oil industry. When a well becomes unprofitable to produce, the industry will close it in and move on to greener pastures to destroy. Let's also not forget the enormous consumption of water, often in arid regions, toxic emissions from drilling equipment and rolling stock, methane released or flared, and the uncertain effect of hundreds of thousands of wells and fractured shale formations on groundwater supplies.

All of this destruction will never bring broad-based prosperity or cheap prices at the pump. Wells are quickly drilled and crews move on to the next hole. Industry employment numbers are a shell game. Pump prices are set on the global commodity market, not by how much oil is produced in America. Because of the high production costs associated with fracturing shale formations to squeeze out a few barrels of oil, the industry is only going to produce when oil prices are high enough to guarantee a decent profit margin. There is nothing revolutionary, evolutionary, innovative, or even sane about the shale binge. It is peak silliness aimed at a poorly-informed populace so the oil industry can plunder public lands.

The drill, baby, drill propagandists have even discovered a cute trick to promote shale drilling as environmentally responsible. Shale gas will save us from climate change.

Here is David Frum:

One of the technologies developed by the oil industry -- fracking -- has made available vast new supplies of cheap natural gas. Gas has become so cheap that it can be substituted for coal as an electricity-generating fuel. In just eight years, coal's share of the U.S. electricity market has tumbled from one-half to one third -- and still falling. Gas emits only half the carbon per unit of energy of coal.

Here is the

President’s Council of Advisors on Science and Technology:

Support continuing expansion of shale-gas production, ensuring that environmental impacts of production and transport do not curtail the potential of this approach. Continuing substitution of gas for coal (and in some instances for oil) will remain an effective short- and middle-term decarbonization measure and an economic boon only insofar as methane leakage from production and transport is held to low levels and drinking water is not adversely impacted. The Federal Government has an important role to play in both of these respects, through collecting and distributing reliable data and through strengthened regulation where the data indicate this is required.

Shale gas is better than coal if you ignore all the negative impacts of extraction.

As Hubbert predicted, cheap oil is gone for good. Peak silliness, however, is here to stay.

|

Help Us Spread the Word About Climate Change

For those of you on Facebook and Twitter: Please help to spread the word by hitting the FB and Tweet links at the top of this diary and if you have time, join the discussion with comments. Share such postings with friends, family, co-workers, and acquaintances.

Thanks, as all of this helps build the Climate Change movement as well as introducing critically important ideas about renewable sources of energy.

Please use hashtags #climate, #eco, and #climatechange to tweet all diaries about the environment.

"Green Diary Rescue" is Back!

After a hiatus of over 1 1/2 years, Meteor Blades has revived his excellent series. As MB explained, this weekly diary is a "round-up with excerpts and links... of the hard work so many Kossacks put into bringing matters of environmental concern to the community... I'll be starting out with some commentary of my own on an issue related to the environment, a word I take in its broadest meaning."

"Green Diary Rescue" will be posted every Saturday at 1:00 pm Pacific Time on the Daily Kos front page. Be sure to recommend and comment in the diary.

|