Ajai Chopra (left) of the IMF and an unidentified colleague pass a beggar as they make their way to the Central Bank in Dublin in November 2010. Photograph: AP

It's easy to be Snarky about Ireland exiting the Troika Bail-out on the 15th. December, but it really is a big deal for the Austerity Hawks: It proves (to them) that they were right all along, and that austerity "works". Ireland is the shining poster child to be waved in front of Greece, Spain, Portugal and every other prodigal state should they waver from the approved path of austerity. Some in Ireland are attributing historic significance to the bail-out exit, whilst others see it as merely escaping the tyranny of the Troika for the tender mercies of the international sovereign debt markets.

But it also does no good to deny that a significant economic recovery is now underway in Ireland (from a very low base), so does this prove all the Keynesians wrong? I would argue that neither proposition is correct: Ireland has succeeded (insofar as it has) for neither the standard Austerity or Keynesian reasons and has done so due to factors that are mostly non-generalizable to other economies. To understand the Irish recovery, you have to understand an almost unique combination of factors that is making it possible.

Given that the scope and sustainability of Ireland's economy is still under debate, I will begin by offering some evidence for and against the recovery hypothesis and then suggest some reasons as to why it might be happening.

1. Evidence against recovery

First the evidence that Ireland is not recovering substantially:

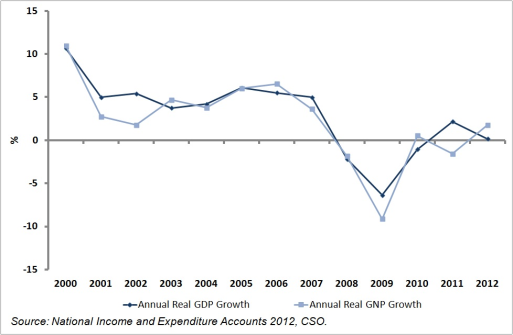

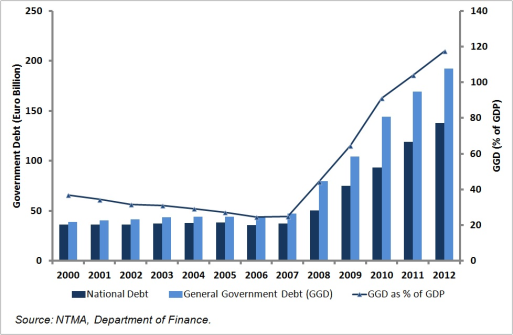

Between 2008 and 2011 real GDP declined by 5.4 per cent, while real GNP declined by 10.1 per cent. Since then it has effectively flat-lined. Property prices halved and unemployment rose to 15.1%. Ireland went from having the highest net immigration level in Europe in 2006 to the highest net emigration level in 2012. In the meantime, Irish Government finances where devastated by a combination of the bank bail-outs, world recession, and a collapse in revenues arising from the property crash and domestic recession.

So we need to be clear: Insofar as Ireland is experiencing a recovery now, it if off a very low base indeed relative to previous performance. As Krugman has rightly noted, any policy which achieves a modicum of growth having first devastated the economy is setting the bar for success very low indeed.

2. Evidence for recovery

So what is the evidence for a recovery since 2012? First it must be noted that Irish GDP figures are distorted by the huge foreign owned multinational sector which routes much of their global revenues through Ireland for corporate tax avoidance reasons. This has the effect of inflating the real GDP figures. However the extent of those financial flow has been reducing due to the "Patent Cliff"which has seen several block busting drugs like Viagra and Lipitor come off patent, dramatically reducing exports (and GDP) whilst not necessarily reducing real economic activity within Ireland.

Evidence that this is the case is provided by the unemployment figures which show unemployment falling from a peak of 15.1% in 2009 to 12.8% at the end of September 2013, and 12.5% at end November. This includes a fall in unemployment of 42,000 over the past year including a reduction in the rate of Long-term unemployment from 8.9 to 7.6 per cent.

Lest anyone think this was caused entirely by net emigration, it should be noted that there was also an annual increase in total employment of 3.2 per cent or 58,000 in the year to the end of September, bringing total employment to 1,899,300 whilst the total labour force increased by 16,300 to 2,182,100 over the year.

Whilst the the recovery in employment initially included many part time and low paid jobs, the evidence now is that the number of full time and better paid jobs is also increasing with income and spending tax takes increasing ahead of target:

Increased tax take adds weight to recovery claims

Overall, the total amount of income tax paid in the 11 months to the end of November was €35.2 billion, 4.2 per cent ahead of the €33.8 billion collected during the same period in 2012. The total was also ahead of the budget target, which was €34.97 billion.

Total revenues, tax and non-tax, for the 11-month period, came to €51.5 billion, 8.3 per cent more than the €47.6 billion collected during the same period last year 5 per cent ahead of the Government's €49 billion budget target.

The Government spent €60.08 billion during the first 11 months of the year, 0.8 per cent less than during the same period in 2012. The figure was 4.4 per cent less than its budget target of €62.85 billion.

ConalMac Coille, economist with stockbroking firm, Davy, said that the Government is on track to "comfortably beat" its deficit target for the year of 7.5 per cent of gross domestic product.

Property prices have also begun to rise again after declining 50% from peak - by 15% in Dublin and by 8% outside Dublinin the past year, whilst Dublin rental prices are up 7% due to shortages in supply. The once dormant building industry is beginning to respond. The Irish tourism industry has also experienced aspectacular rebound thanks partly due to Government initiatives like the Gathering.

As indicated in the above quote, however, whatever is driving the recovery in jobs, it most definitely is not Government Keynesian stimulus spending. Neither is the continued recession in large parts of the Eurozone helping to drive Irish export growth, nor, as so eloquently noted by Krugman, is Germany's trade surplus. So what is driving the recovery?

3. Political Stability

The catastrophic banking collapse followed by more widespread economic collapse resulted in an historic defeat at the polls for Fianna fail - for so long the natural party of Government, and for it's close links with crony capitalism and the building industry. It gave the current Fine Gael/Labour coalition government an unprecedented majority and mandate to manage the crisis and lead a recovery process. All blame could conveniently be placed on the preceding Fianna Fail/Green coalition and the political system was effectively purged. Little matter that the policies ultimately pursued were not all that much different from previous Governments for all the bluff and bluster that the new Government would govern "Labour's way, not Frankfurt's way".

I have written elsewhere on the reasons why there wasn't an open rebellion by the Irish people against the bank-bail-outs in particular, and the harsh austerity measures in general. Suffice to say here that Ireland is an extremely stable and cohesive political entity, for all the Troubles in the North, and difficulties in disentangling the state from the Catholic Church. But perhaps the single most important factor was the 30 year tradition of national collective bargaining whereby the Government, Trade Unions, Employers, and the Voluntary and Community sectorsit down and negotiate a National Plan which includes agreements on pay rises, taxation measures, social programmes and legislative proposals which takes a lot of the tensions and conflict out of the industrial relations and political process.

That process has become increasingly fraught as austerity bit harder and harder, but the political and social capital which had been built up over the decades enabled it to engineer a mostly consensual way forward. Nothing could be further from the Thatcherite and Reaganomic dreams of current neo-liberal economic Austerity theorists, and that it was able to survive the catastrophic impact of the banking and economic collapse is truly remarkable.

You won't read about it in neo-liberal economic textbooks or political tracts, however. In fact you hardly hear about much it outside Ireland at all.

4. Corporate Taxation rates

One of the main reasons Ireland's economic recovery is not generalizable to all other countries is because a key component of it is based on corporate tax competition and maintaining a differential with respect to its main competitors. While Ireland's standard 12.5% corporate tax rate is not especially low for smaller or less developed countries worldwide, it is significantly lower than the headline rates charged by Ireland's main competitors for foreign direct investment within the EU. However headline rates can be misleading, and the effective rates (after deductions for allowable expenditure like R&D) are not all that different:

Cantillon: A very different tale about corporate tax

The latest Paying Taxes report from PricewaterhouseCoopers/theWorld Bank at first glance tells a very different tale to the reports carried in this newspaper and elsewhere about Dublin-based multinationals paying very little tax on whopping great turnovers and profits.

According to the PwC/World Bank report, Irish corporates pay an average effective tax rate of 12.3 per cent, almost exactly the 12.5 per cent statutory rate that applies to non-passive corporate profits.

This compares with an EU average effective tax rate of 12.9 per cent, and a global effective rate of 16.1 per cent. Germany has a corporation tax rate of between 30 per cent and 33 per cent, but an effective tax rate of only 8.1 per cent, while for France the comparative figures are 33.3 per cent and 8.7 per cent.

A far more legitimate complaint about the Irish corporate tax system has been the way it has allowed foreign owned multinationals like Google, Apple, and Microsoft to set up non-tax resident companies in Ireland through which they can route their world-wide revenues and, via further loopholes in Dutch, Bermudian and US tax law, avoid paying tax on it altogether: The infamous Double Irish and Dutch Sandwich. Irish Finance Minister, MIchael Noonan, announced the abolition of the Irish part of this loophole in his recent budget, and it will be interesting to see what impact this has on Irish corporate tax revenues and foreign direct investment in the future

My view, which I have not seen articulated anywhere else, is that it may not have very much impact on Ireland one way or the other. Companies which effectively used Ireland as a tax shelter will find other shelters through which to route their global revenues. Thus no increase in the Irish corporate tax take. However there is also no reason why they shouldn't continue to locate their European headquarters and much of their operations in Ireland, because those activities where always taxed in Ireland in the first place. It is only the nameplate non-resident part of their tax engineering activities which will move elsewhere, and these never generated any tax revenue or much employment in Ireland in the first place. We shall see, but Ireland and the multinationals locating here have always claimed that the relative benign corporate taxation regime was only ever one of many reasons for locating in Ireland.

5. Industrial Development Authority

Of perhaps more importance to the Irish recovery than any perceived tax advantage has been one of the few institutions in Ireland which can genuinely be called world class: The Industrial Development Authority. Over the years it has attracted and persuaded to locate in Ireland a veritable who's who of leading technology and pharmaceutical global corporates often while these companies and their technologies were still in their early stages of development. These are not minor nameplate operations, but production, R&D, and service operations employing thousands. The result has been an increasing cadre of well educated, trained, experienced and confident managerial and technical personnel some of who have gone on to establish their own indigenous companies.

This is also part of the reason why the renewed experience of emigration from Ireland has not been as traumatic as for previous generations: Many of those emigrating are well educated, trained, qualified and experienced and have been able to pick up good jobs in England, Australia, Germany, Canada and the USA and for some, at least, it has been a positive career move. True, they represent a huge loss to Ireland's economic potential, but some are now returning with much enhanced professional and entrepreneurial capabilities.

6. Conclusion

It is not my intention here to present an comprehensive analysis of just why Ireland may be recovering despite the considerable headwinds of a huge public and private debt load, continuing Government austerity policies, anaemic recoveries in our major trading partners, and an unhelpful, to say the least, policy stance from our EU partners: Merely to issue a cautionary note that the standard Austerity and Keynesian narratives don't necessarily tell the whole truth. No doubt the debate below will include many contrary contributions.

Despite German denials, Ireland has chosen to exit the bail-out without a precautionary credit line from the ESM because German and EU political debate on the issue couldn't have been more unhelpful. It must be galling to Ireland's leaders to see the Austerians claim all the credit for "Ireland's Success"(tm) when nothing could be further to the truth. I have written as long ago as July 2011 that Ireland could be on the brink of recoveryand it has been a long time coming thanks largely to an unhelpful international economic and political climate. Ireland may have been largely the author of it's own downfall through an unsustainable economic boom and subsequent bank bail-out, but it is now also having to build it's own recovery largely without outside assistance.