Rick Warren, who's Saddleback Church enjoys tax-exempt status, went on a bit of Twitter rant last night, tweeting that low-income Americans pay no taxes, and by inference, are a burden on those that do.

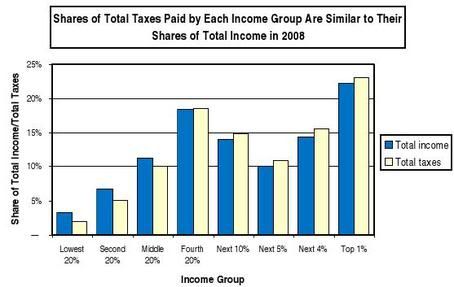

One can argue whether or not the Pastor's tweet was the Christian thing to do, but what's not up for debate is this: low-income Americans certainly do pay taxes, and at a far higher rate than Americans in the upper income brackets.

In 2009, nearly 47% of American taxpayers paid no Federal Income tax, either because they didn't make enough to qualify, or because of deductions like child care credits that eliminate their liability.

However, those individuals, if they work, pay Social Security and Medicare taxes. If they don't, they still have to pay sales taxes, one of the most regressive taxes there are. For instance, in Washington State, a 2003 study by the Institute on Taxation and Economic Policy found that the poorest 20 percent of Washingtonians pay 17.5 percent of their income in taxes each year, while the top 1 percent pay just 3.3 percent.

Washington State has no income tax, relying instead on a 6.5 percent sales tax for funding.

In addition, depending on their state and circumstances, many lower-income Americans also pay car taxes, gas taxes, utility users taxes, telephone excise taxes, as well as so-called "sin taxes" for tobacco and alcohol. If they own property, they pay sales taxes, if they rent, chances are their rent probably covers their landlord's property tax - who receives a mortgage interest tax deduction--a deduction which the renter does not benefit from. And, as states tighten their belts, lower-income Americans wishing to seek higher education end up paying higher taxes in the form of increased student fees at state colleges.

Here's a handy graph that shows how lower-income Americans really do pay more than their fare share of taxes.

Rick Warren's deleted his tweet sometime in the middle of night after it went viral, complaining that detractors were "just looking for a fight, not clarity."

Well, Pastor Warren, here's some clarity for you.

In a 2009 article for The Nation, John Weiner detailed how Rick Warren used his considerable political clout to get out from under an 1996 IRS investigation for illegal exemptions.

The IRS permits members of the clergy to claim exemptions for their housing. At the time of Warren's audit the amount claimed had to be "reasonable"--it shouldn't exceed the fair market value for the rental of the home. That 1996 audit concluded that Warren was deducting more than that--the IRS said he owed it $55,300. Warren challenged the IRS in tax court, arguing that his housing exemption should be unlimited.

In 1993 Warren deducted $77,663, his entire Saddleback Church salary that year, as a housing expense--and paid no taxes at all on that salary. In addition, he claimed a deduction for his mortgage expenses--even though they had been covered by the salary. He made similar claims in subsequent tax returns.

When the IRS tried to collect back taxes on the exemptions, Warren took them to court. In May 2000, the court struck down the IRS's "reasonable" clergy-housing cap, accepting Warren's argument that a clergy's housing claim could be unlimited. The IRS appealed, and the case went to the Ninth Circuit.

That court declared that it wanted to consider not only whether the IRS had been right in trying to limit Warren's tax deduction for housing but also whether the tax break for clergy housing violated the establishment clause in the Bill of Rights, which requires separation of church and state.

Then things got interesting. The Ninth Circuit never got to make the determination.

Congress stepped in--and acted with "almost miraculous" speed, as Richard Hammar, editor of the Church Law & Tax Report newsletter, explained to the New York Times. The new law granted Warren his deductions... Congress also put into law, from that time forward, the IRS's "fair rental value" rule.

The Clergy Housing Allowance Clarification Act of 2002 was approved unanimously by Congress, then signed into law by George W. Bush on May 20, 2002, rendering the IRS case against Warren moot. "I have filed hundreds of briefs in federal courts," Chemerinsky told me, "and this is the only time that Congress passed a law to make a specific pending case moot." He added, "It is very rare for Congress to pass a law to make a pending case moot before there was a decision."

Who would Jesus tax? Well, according to Rick Warren and his friends in Congress, not him.