This is a joint article from New Deal Democrat and Bonddad. On Saturday May 9, Meteor Blades wrote a front page diary titled, "One Month of Slightly Less Terrible Jobless News Does Not Make a Trend." As New Deal Democrat will demonstrate , there are plenty of reasons for economists to be saying the worst is behind us. As I will demonstrate, Meteor Blades article was poorly informed regarding what we really wrote about the employment report. More importantly, it was an attempt to silence any opinions that do not fit in with a particular political agenda.

A few of us have pointed out that things are getting better -- and for that, we have been called out as allies of Faux news or corporate interests, or told by front-pagers that we're not interested in economic justice for Americans, with a false assumption that we're only looking at one little piece of information. Apparently, good news isn't welcome here.

I. First, let's look at the economic numbers -- as in facts and data.

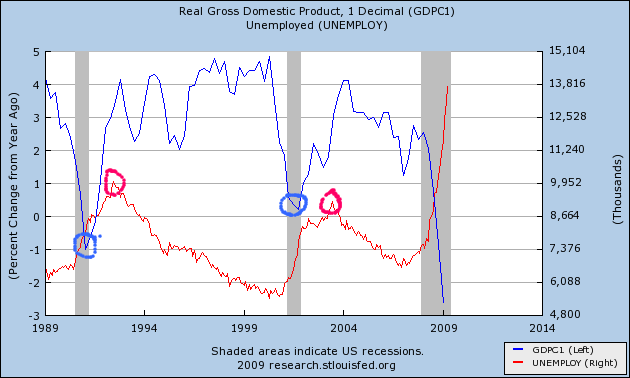

Economic cycles typically run in an order. First, things like manufacturing layoffs peak. Employers see their order book get a little better. A few more people than before order new houses. As that happens, they increase the hours of their existing employees. If the increases continue for awhile, those employers start to add new emloyees.

So, A (leading indicators)--> B (return to positive GDP)--> C (job increases). In the last recovery in particular, C took a long time coming. But you need A and B first, before you get C, as shown in this graph, where the turning point for GDP is circle in blue, and the subsequent turn in unemployment is circled in red:

Most economic pundits get it wrong and in particular, they miss turning points because they just project past trends into the future. The best way to look into the economic future is usually just to look at the Conference Board's Index of Leading Economic Indicators, which I've listed below, with the weights given each indicator by the Board:

real money supply (35%)

average weekly manufacturing hours (25%)

interest rate spread (10%)

manufacturers' new orders for consumer goods (8%)

supplier deliveries (7%)

stock prices (4%)

consumer expectations (3%)

building permits (3%)

average weekly initial claims for unemployment insurance (inverted) (3%)

manufactureres' new orders for durable goods (2%)

So are we, as a front-pager implied, grasping at a straw? -- at one slightly less bad piece of economic news? Far from it! 8 out of 10 of these leading economic indicators have now turned positive or at least neutral. Let's look at them in turn:

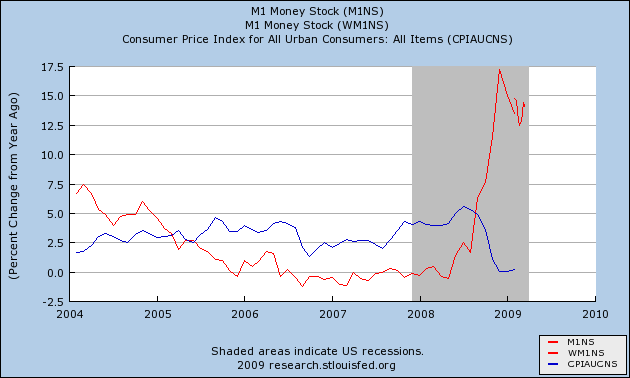

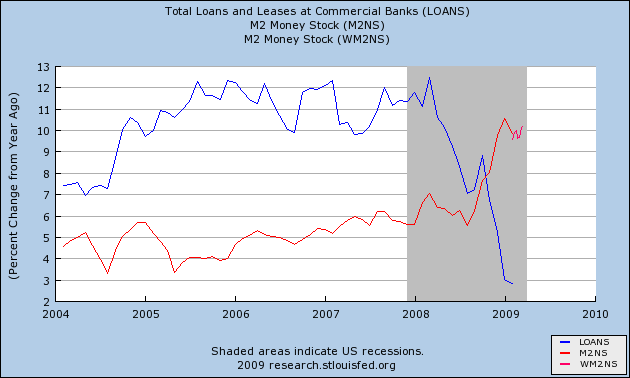

Real money supply (35%)

These have been strongly positive since the Fed started flooding the system with money late last year.

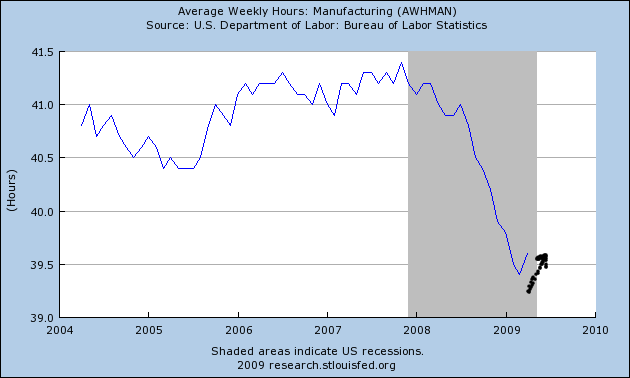

Average weekly manufacturing hours (25%)

This has been the biggest cause of the indicators' recent decline. It has now turned positive.

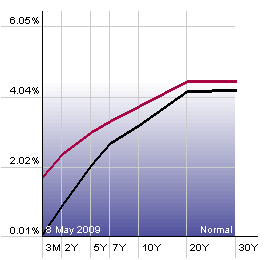

Interest rate spread (10%)

This is positive when short term rates, on the left, are lower than long term rates, on the right. It has been positive for over a year.

Manufacturers' new orders for consumer goods (8%)

This is one of the two series that is still heading down.

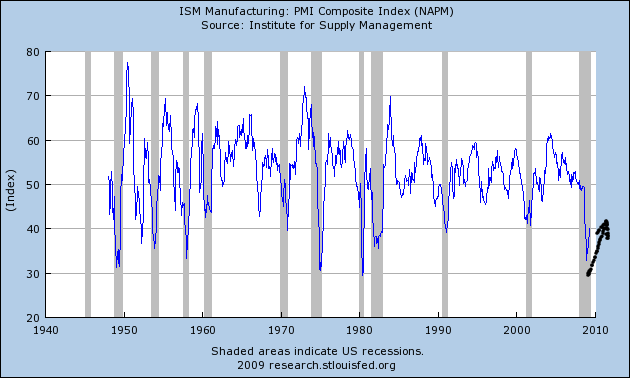

Supplier deliveries (7%)

This turned positive several months ago, and is now typically at a reading immediately proceeding the end of a recession.

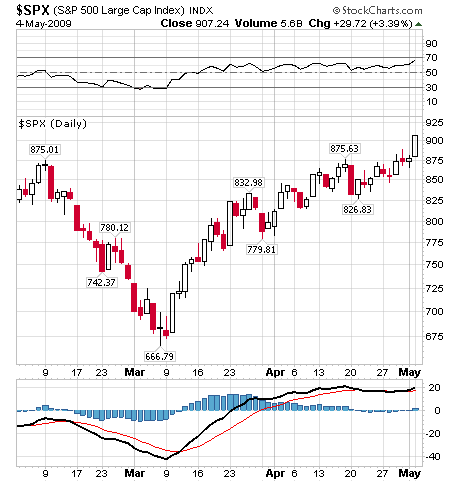

Stock prices (4%)

These are measured over a 3 month period, and have rebounded 30% since their early March low.

Consumer expectations (3%)

These have been meandering sideways, but in the most recent month has also turned up.

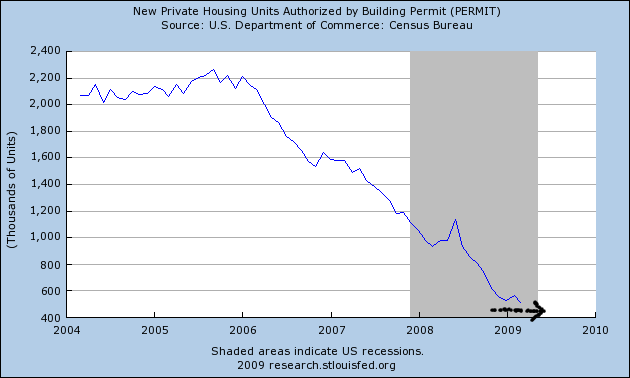

Building permits (3%)

This is one of the two items that was still headed down as of its last report, although it has generally moved sideways in the last few months.

Average weekly initial claims for unemployment insurance (inverted) (3%)

This is an inverted series, so down = good. According to research conducted by Prof. James Hamilton of UC San Diego, whose graph is shown above, the end of a recession typically happens about 2 months after the turn in this indicator. Per the blue dotted line in the graph above, he believes it is substantially more likely than not that we have seen that turn.

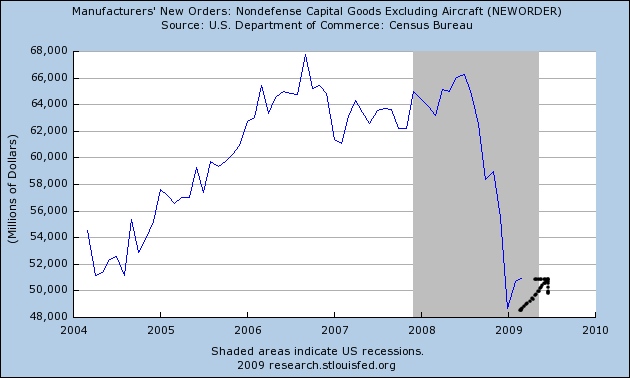

Manufacturers' new orders for nondefense capital goods (2%)

These also have just turned up, after being strongly down for months.

Of course leading economic indicators will point up, while the economy is still going down. If they didn't, they would be leading! D'uh!

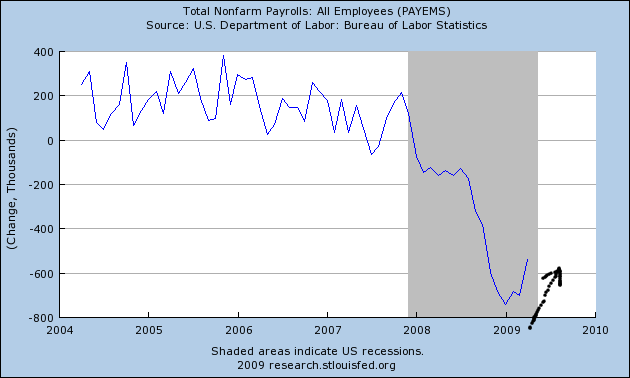

And in addition to all that, contrary to the front-pager's assertion, the latest jobless news -- especially taken in conjunction with the payroll information dissected by Prof. Hamilton -- does indeed break the awful trend of late 2008 and appear to establish a new, more hopeful, trend:

In Summary, there are plenty of reasons, those listed above not being in any way exhaustive, that people like us are saying that the economic situation looks like it is getting ready to improve. We are relying on far more than just one "not-quite-so-awful" piece of data.

II. Now, let's turn to the specific article in question. First, MB makes the following point:

Is the intent of the happy-talkers to use fact that unemployment is getting worse at a better rate to chill the widespread rage over what has - during the past three decades - brought us to the economic precipice? You know: deregulation, deunionization, privatization, unfettered globalization, wage stagnation for the lower- and lower-middle-income groups, and an unprecedented transfer of wealth to the upper 20%, especially the top 1%? Is it to undermine any pressure for additional government action to improve matters? Beats me.

First, in pointing out that things are not actually as bad as previously thought we are simply pointing to the data. We are not trying to do anything aside from that. To argue we are trying to "undermine any pressure for additional government actions to improve matters" is, well, wrong.

Next MB writes:

The facts are simple: the short-term outlook may have improved ever so slightly in April if you’re one of the people who didn't get laid off or who hasn’t been out of work for more than six months. But neither the medium nor long term presents any great cause for elation.

However, a careful reading of what I and NewDealDemocrat wrote would indicate MB did not read what either of us wrote.

I wrote: "While initial claims are topping, continuing claims are still setting records. That indicates that while the immediate lay-off situation is improving the continuing situation is still poor at best." In other words, the data indicates the short-term situation is getting better while there is no improvement in the long-term situation. Read the whole article.

New Deal wrote: "I hasten to point out that the economic situation for average Americans will continue to stink. But it will stink more like April 1933 than Febraury 1933 -- in other words, the trend will be up not down. I also suspect this will be another "jobless recovery" where the unemployment rate continues to climb over 10% and stays there for several years. And I am also very worried that the fundamental problems in the American economy have been elided and that a "W" shaped recession a la 1979-82 may be in store, where a brief recovery gives way to an even deeper Recession Act II in a year or two." Elsewhere he has written: " The Bailout/Stimulus Fed packages all have failed to address the underlying problem in the American economy, of strapped consumers and an obese financial sector. Until that is addressed, I do not expect the secular bear market - and the economic problems that underlay it - that started in 2000 to end. We are just coming to the bottom of the second in a series of at least 3 stairstep declines that probably won't end for another 5 or even 10 years .... 'We have a structurally deficient economy and nothing has been fixed.' For that reason although I expect +GDP growth later this year, it will be anemic and fragile. Should for example the price of Oil go back up over $80/barrel, we could be knocked right back into recession. More generally, should inflation raise it's ugly head again, the Fed will be in a hell of a spot."

In other words, neither of us were blowing "happy smoke" in an attempt to manipulate opinion. Both of our opinions were extremely guarded and came with several important caveats. This last fact was overlooked.

MD relies on several pieces of information, all of which are true.

A record for the length of a recession unmatched since the 1930s. A record high for the number of people collecting unemployment benefits. A record unmatched since the 1930s for the percentage of the unemployed who have been out of work for more than six months. A record high for the number of people collecting food stamps. A record low since 1964 for the number of hours production workers put in weekly: 33.2 hours. A record high for foreclosure filings. And on and on.

A careful reading of what I wrote about the unemployment numbers would have revealed that I dealt with the total number of unemployed for 15+ weeks, 27+ weeks and the median duration of unemployment. I (as usual) provided graphs.

In other words, both of us realize that, even if US Gross Domestic Product turns up in the second half of this year (so, by usual standards, the economy is in recovery), that won't matter to the 10%+ unemployed who will still be in terrible economic pain and will need relief. The entire middle class needs a return to economic fairness and justice. Those issues have barely been addressed by the political classes.

Most importantly, the overall tone of MB's article was one of censorship -- either make sure all the information is slanted towards a negative bent until we get our agenda or go somewhere else. This is reminiscent of "bending the facts around the policy" attitude of the previous administration. If the objective of this site is to now tell people what to write and how to write it, then this site has become what it fought against.

It is neither necessary nor productive to base the appeal of progressive economic solutions on the idea that the four horsemen of the economic Apocalypse -- insolvency due to national debt, or hyper-inflation, or peak oil, or Great Depression 2 -- are just around the corner. Relying on the idea that an economic Apocalypse is imminent makes us look like tin-hatters if the economy starts to turn around. It costs us precious credibility. And it isn't the case we need to make. To the contrary, the 29 years since Ronald Reagan's election have resulted in the middle class suffering, and suffering more acutely as time has gone on. Telling the truth about the slow, decades long assault on average Americans, and the inequitable increasing concentration of wealth and privilege in a very small minority should suffice. We should focus our energies on pressing for permanent changes in economic policy to renew and sustain middle and working class growth.

In the meantime, Daily Kos ought to welcome news on the economy that is a necessary step in the direction of average Americans' situation getting better.