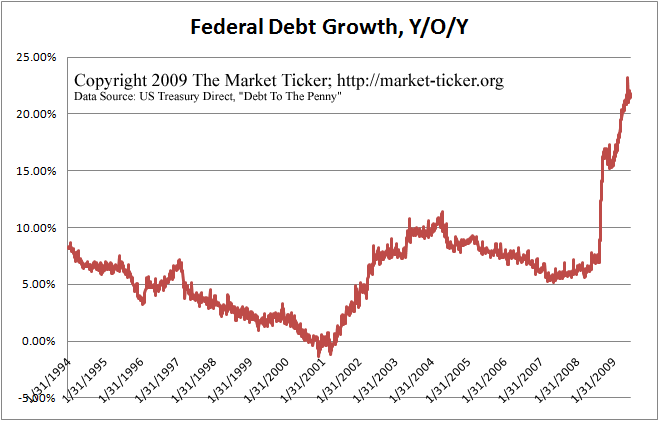

Disturbing news for the future of the US, the government, and its people. Our ability to fund new debt is rapidly approaching its limit. Massively cutting deficit spending and a return to pay-go may be our only way out. If we do not do this, we may be forced to do it by the market.

Such an event would be very, very unpleasant.

Karl Denninger cites a report by Zero Hedge and by Chris Martinson in his most recent post reporting blatant Ponzi-style monetization with the government essentially buying its own bonds to keep the price up.

Mad props to both Zerohedge and Chris Martenson for noticing this; I missed the facts buried in the CUSIP list.

The upshot: The Fed bought nearly half of LAST WEEK'S 7 year Treasury Issuance TODAY.

Huh? Remember, after the 5 year auction that went badly (and which I wrote about) the 7yr auction went "well." Rick Santelli (and a lot of other people) agreed - demand was strong. That made no sense to me at the time, coming one day after a near-failure in the 5 year.

Well now we know what happened: The Fed pretty clearly pre-arranged, either explicitly or by "suggestion", that the Primary Dealers take up the auction with the promise that The Fed would immediately monetize half the issue!

The Fed, THE FED, apparently bought half of the issued T-bills at today's treasury auction. Denninger points out why:

When it sinks in to the market's consciousness - we had two failed Treasury Auctions last week, both 5 and 7 year, yet we intend to try to borrow ANOTHER $400 billion next quarter and nearly $100 billion this coming week - the consequences could be extremely severe.

What is "severe"? "Severe" might be:

- Massive, immediate increases in T-bill yields and a crash in T-bill prices. Say hello to the 15% mortgage.

- A concurrent complete crash in all asset prices as interest rates go to the moon

- Massive government layoffs in all sectors

- Massive cuts in entitlement programs like Medicare and Social Security. It won't take an act of Congress or Republicans to destroy these programs, there simply will not be the money to pay for them and they will fail

- Massive unemployment in all states (won't predict a rate, but I wouldn't be surprised if U3 hit 20%).

- The immediate end of all stimulus plans and any hope for any in the future, ever again

The absolute worst possible economic event for the US would be foreign buyers refusing to purchase US debt. Those who argue that deflation is the enemy here ignore this risk at their peril. An immediate forcible end to US government deficits would be an absolute catastrophe that would make the last meltdown look like a walk in the park.

The US must get its deficits under control. Doing so will be very painful: the addict always is pained by the removal of his drugs, which is why no President since Reagan had ever managed to do it (even Clinton's "budget balance" was based on a fraudulent stock bubble), and Obama's solution to Bush's mess was again to give more heroin to the junky rather than tell him sternly that this time he was going to have to take his medicine.

The rehabilitation process will be long, slow, and ugly, which is why no politician, including Bush or Obama, wants it to happen on their watch. But our options now are pain, or more pain.

Some commenters here are going to call me right wing, or a tool of the Republicans, or a corporatist, or what have you. I consider myself reality based, and we simply cannot maintain this level of spending. I'd love to cut spending by getting out of Iraq and Afghanistan, in fact, that would be my preferred method. Also, lets stop all bailouts, and raise taxes on the rich (though this will help less than some here hope that it will).

I believe that we either get our spending under control or some day very soon, perhaps in weeks, these Fed/T-bill auction shenanigans are going to end very, very badly.