So much has been made of the subprime mortgage implosion that you would think it was almost totally responsible for the economic collapse, and that once the subprime problem was fixed then the worst would be over.

Unfortunately nothing could be further from the truth, despite hitting new highs in foreclosure listing. Instead it was the first round of a three part collapse, and we are on the edge of the second round.

I will demonstrate with a fantastic series of charts below, most of them were created by the T2 Partners.

Round One

First, let's take a look at the subprime and overall housing market.

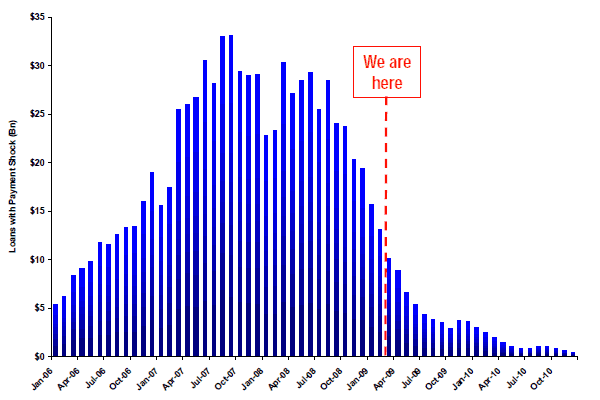

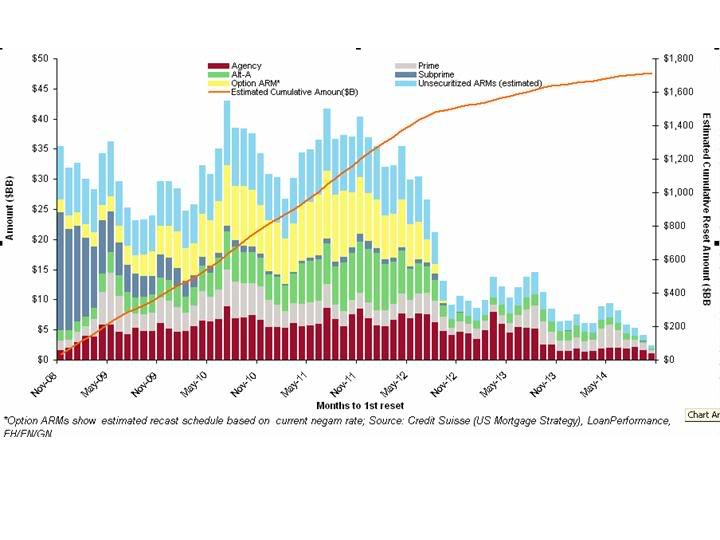

As you can see, the huge wave of subprime mortgages resettings from "teaser" rates to market rates has virtually ended.

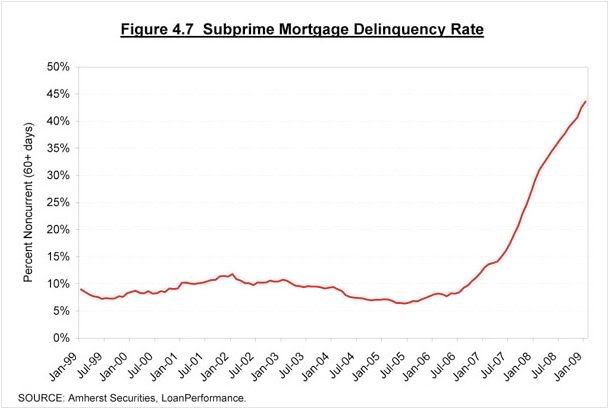

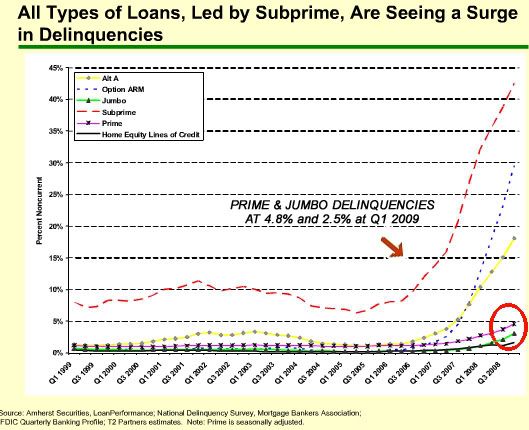

In its wake we've seen a massive spike in subprime mortgages going into default and foreclosure.

The damage inflicted has been severe.

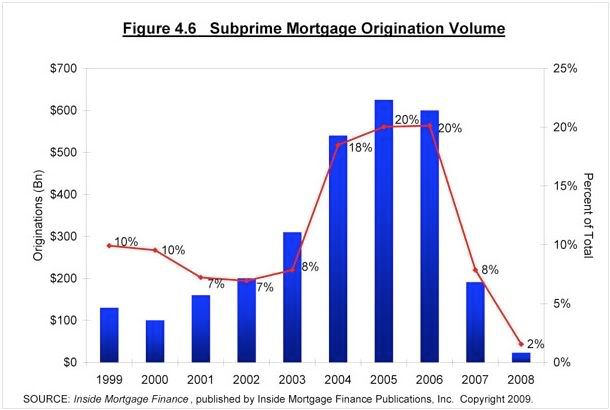

The problem is that subprime mortgages were never a significant part of the mortgage industry.

The resetting of "teaser" rate mortgages into market rate mortgages has only just begun.

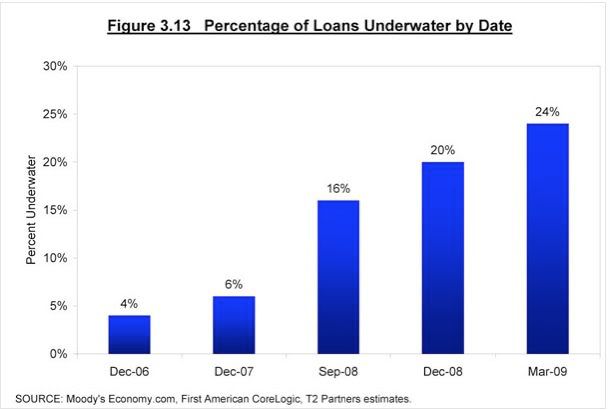

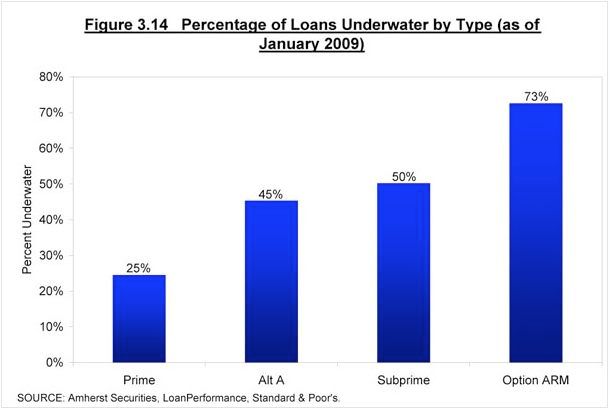

The problem of negative equity has already leaked out into other mortgage classes even before the teaser rates have expired. The percentage of homes going into negative equity has increased by 50% in just 6 months.

The Boston Federal Reserve has documented that negative equity is the leading cause of foreclosures.

As you can see, subprime isn't the mortgage class in the most danger - Option-ARM is.

Round Two

Most subprime mortgages had teaser rates lasting 2 or 3 years. Alt-A and Option-ARM mortgages usually had teaser rates of 5 to 7 years.

That's why you saw the subprime market implode first.

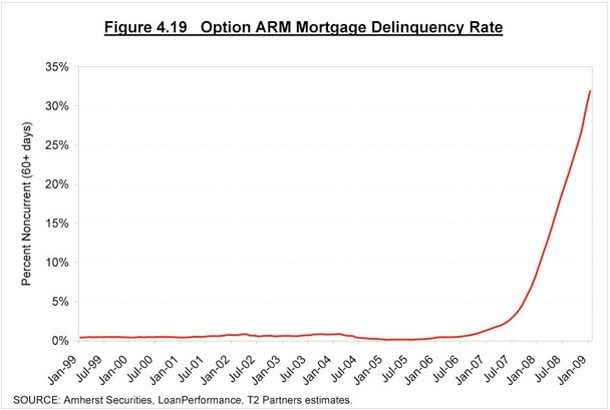

However, most Option-ARM mortgages had "triggers" in their contracts so that they would automatically amortize once they've reached a certain level of negative equity, usually around 110%. (see this link for a detailed explanation)

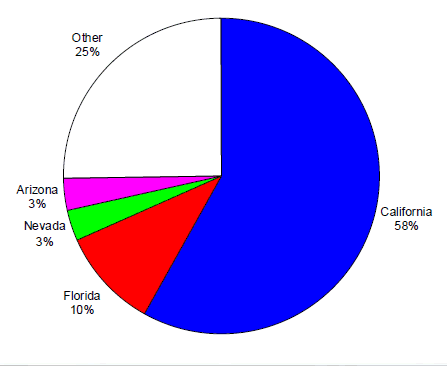

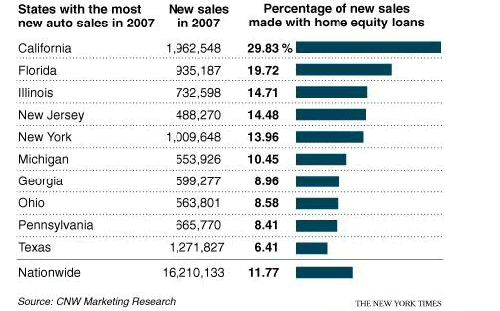

The Option-ARM market was overwhelmingly concentrated in the state of California.

Round Three

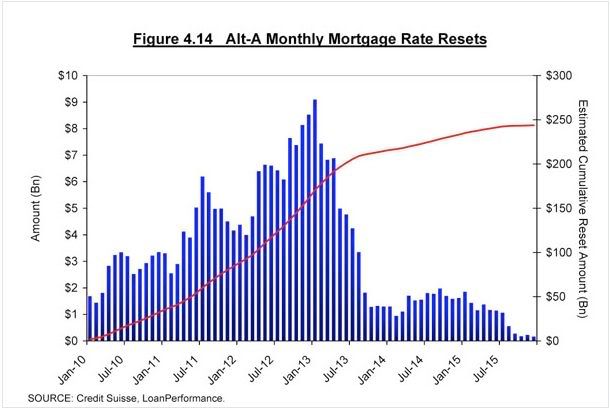

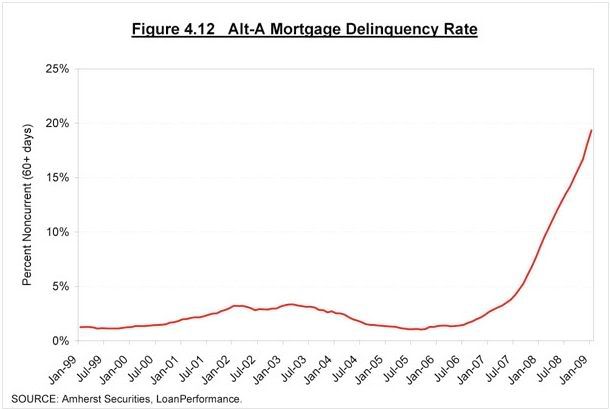

The Alt-A market is the other ticking timebomb about to explode.

Years before the resetting of Alt-A mortgages has peaked defaults are already skyrocketing. If this trend continues it would easily be the worst mortgage class of them all.

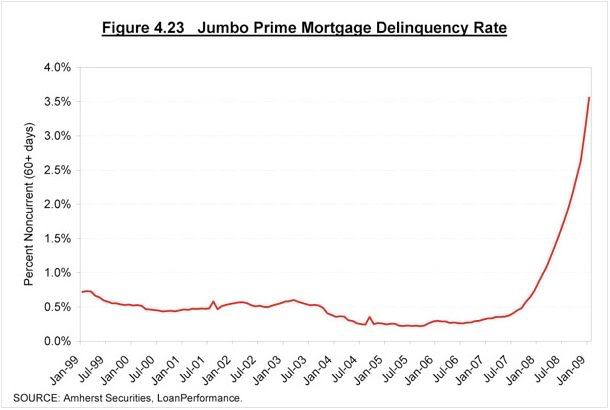

Finally, we need to mention one of the safer of the mortgage classes - jumbo.

Putting this into perspective

The housing market is so large that it effects all other asset classes. It's meltdown comes at a terrible price.

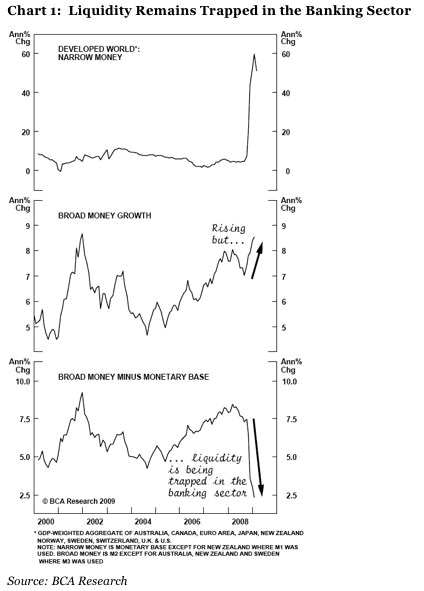

It's effect on the banking industry can be seen in the monetary base and credit markets.

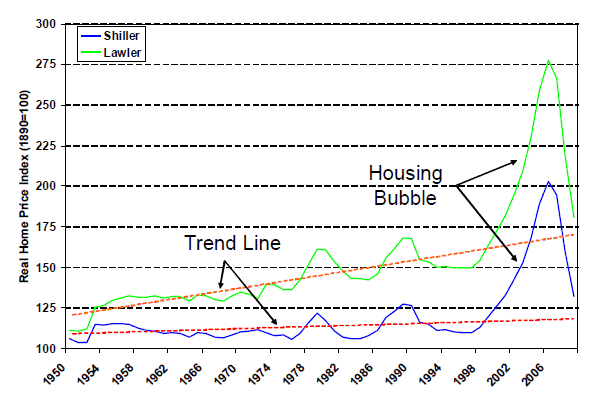

If you judge where the housing market will bottom by historical averages, then we still have a ways to go.

Notice how historically housing recessions have overshot to the downside of the trend. Since no housing bubble has ever reached the insane levels of the recent one, you can expect the overshoot to be particularly deep.

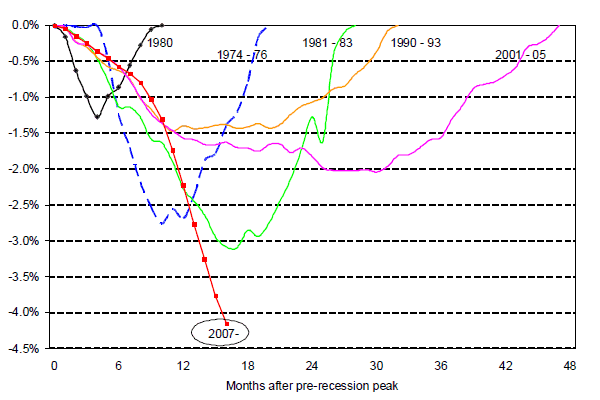

Making the depth of the housing recession look increasingly scary is the depths of the jobs recession we are still sinking into.

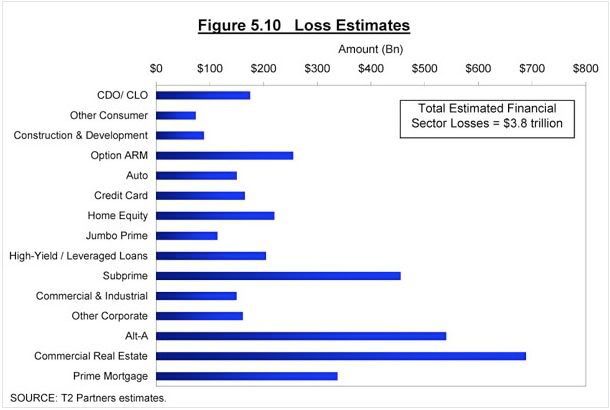

To put this economic crisis into perspective, check out the other asset classes in the economy, and their expected losses.

Notice the expected losses in commercial real estate. These loans were typically written to reset after 5 to 7 years. The writedowns in these loans are just about to strike.

[Update: Someone in the comments turned me on to this Times article. Here's a quote from it.

Richard Parkus, an analyst at Deutsche Bank, said he thought two-thirds of all commercial real estate loans due in the next few years — hundreds of billions of dollars' worth — could go bust.

...

What is clear from the hearing is that commercial real estate could turn out to be a much bigger problem for banks and the economy than the Treasury Department, the Federal Reserve and other bank regulators seem to believe. "The question is, What percentage of commercial real estate loans will have trouble refinancing?" Parkus said at the COP hearing. "It is likely to be a big problem."

How big? In the government's recent bank stress test, examiners predicted that commercial real estate loan losses for the 19 largest banks in the nation would be far less than the value of home loans that go unpaid in the next two years — $53 billion vs. $185 billion. But Warren said she thought the two-year horizon of the government stress test may have understated the size of the banks' commercial real estate problem.