The White House sent a bill to Congress today that would finally require that hedge funds are regulated - to an extent. And now Reuters reports that hedge funds, which have forever resisted any form of meaningful regulation, really want to be regulated.

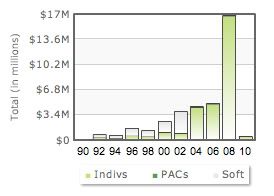

Now we know why the industry contributed nearly four times as much money to federal candidates as they did last cycle, according to the Center for Responsive Politics:

'Cause that's what industries do when they want more oversight....

Even better, Reuters tells us that "Famed" hedge fund manager James Chanos wants more regulation of the industry than President Obama is willing to give. Well, except that the proposals made by the Obama administration and Chanos don't look that different. And that's not terribly encouraging.

The hedge fund industry, which may have caused the financial crisis by heavily shorting Lehman Brothers as it collapsed, knew it would face new regulations soon, so the fact that Chanos says the industry should be regulated isn't exactly laudible.

The chairman of the Coalition of Private Investment Funds, a hedge fund lobby that refuses to disclose its members, and founder of Kynikos Associates, Chanos is under SEC investigation for conspiring with fellow hedgies and a research analyst to drive down the stock price of Fairfax Financial Holding.

A lawsuit filed by Fairfax alleges that Chanos received a negative report about Fairfax written by an analyst at Morgan Keegan before it was published and then forwarded the document to other hedge funds before shorting the stock, which, if true, would amount to stock manipulation and is certainly illegal.

Over the past few years, Chanos has been accused by Overstock CEO Patrick Byrne and his team of journalists at Deep Capture of "naked" short selling - an abusive form of stock manipulation in which an individual sells shares without ever borrowing them, creating Fails to Deliver and "counterfeit" or "phantom" stock and driving a stock’s price way down.

Initially, Chanos and our useless media said naked short selling doesn't exist and that Byrne is a crackpot. More recently, he's admitted that naked short selling does exist but isn't a problem even though it's illegal.

Dow Jones Financial News wrote that, after the SEC placed a temporary ban on short selling last year, Chanos sent a letter to the agency on behalf of the Coalition of Private Investment Funds "requesting that the emergency order on naked short selling not be extended, a sharp contrast to how other market participants have reacted."

The letter reads:

"We recognize that the financial sector is undergoing an extremely stressful period as a result of extraordinarily difficult fundamental economic conditions. We do not believe that current market prices are a result of a mysterious conspiracy or, more to the point, the inadequacy of current rules related to short selling. For the reasons set forth in this letter, we urge the Commission not extend the Emergency Order beyond the announced expiration date of 11:59 pm on July 29th, 2008, or beyond the current list of Designated Securities."

James Chanos has been accused of naked short selling and conspiring with other hedge funds to drive down stock prices, and we should be heeding his esteemed advice as to how to regulate the industry for which he currently lobbies the government? We're fucked.

Cross-posted at The New Argument.