It’s basic logic, for starters, that anyone who was skeptical about this foreclosure fraud “settlement” automatically has more credibility than those celebrating this settlement when the full terms have yet to be released. Why? Extraordinary claims require extraordinary evidence.

After all it’s quite late in the game, a game of no accountability for Wall St, to have any reason to think that responsibly doubting the merit of this so called “settlement” is an extraordinary claim. Therefore, while using the scientific method as an example, the burden of proof for this untested hypothesis does not actually fall on the skeptics. It falls on everyone else.

Let's talk about commercial real estate robosigning/document abuses. They are important because they show just how widespread this fraud is and will continue to be. This stresses the point that the foreclosure fraud settlement, the one we cannot see, should not fill anyone with glee.

For a long time, the damage of the commercial real estate bubble – although not completely blowing up everything like the residential real estate bubble – was pared off as if it didn’t exist by some bloggers. They acted like as if it was just something those “nattering nabobs of negativity” said, but the damage is going to be significant after all. Oops!

Knee jerk commentators blaming borrowers when any bad news involving this foreclosure fraud sellout comes up, (like the RW did with Bush except now to protect the Obama administration) have something to think about; something involving actual reality and data.

Banks face Crisis in Bungled Commercial Mortgages.

Research by Harbinger Analytics Group shows the widespread use of inaccurate, fraudulent documents for land title underwriting of commercial real estate financing. According to the report:

This fraud is accomplished through inaccurate and incomplete filings of statutorily required records (commercial land title surveys detailing physical boundaries, encumbrances, encroachments, etc.) on commercial properties in California, many other western states and possibly throughout most of the United States.

Analysts expect 2012 to be a record-setting year for commercial real estate defaults. Last week delinquencies for office and retail loans hit their highest-ever levels, according to Fitch Ratings. The value of all delinquent commercial loans is now $57.7 billion, according to Trepp, LLC. Also, while the national office vacancy rate has come down it is still very high: It hit 17.6 percent in the fourth quarter, down from 18.5 percent a year earlier, according to Jones Lang LaSalle.

This gives even greater weight to the widespread problems of foreclosure fraud since they are not limited to just residential mortgages. That makes them harder to deny or to blame borrowers like many are doing, even on this site to deflect blame away from this administration and this shitty deal. I'm sure that takes "real heart."

Fortunately, this piece by Yves Smith referencing Georgetown law professor Adam Levitin’s analysis set the record straight on these denials and excuses people are giving involving the SF foreclosure audit.

San Francisco Foreclosure Audit Elicits Predictable Responses from Securitization Mess Deniers

Jackson’s predictable attack stirred a rise from Georgetown law professor Adam Levitin, arguably the top US legal expert on securitization. He has written several law journal articles on the topic, was special counsel to the Congressional Oversight Panel, and has testified before several Congressional hearings on securitization. His latest post is a takedown of the efforts to discredit the San Francisco audit, using Jackson’s piece to illustrate some of strategies used.

Levitin addresses disputes about the audit’s accuracy and methodology:

Whatever quibbles one might have with the audit’s methodology, it’s pretty hard to deny that there aren’t serious paper work problems.

If you want a “neutral” audit of the paperwork screw ups, take a look at MBS trustee exceptions reports (you can get them from servicer bankruptcies, when the trustee files a proof of claim). For the ones I’ve looked at, the number of exceptions (meaning paperwork problems found by the trustee) outpace the number of loans. This is on the front-end, before foreclosure, and while many of the problems are minor or don’t implicate foreclosures, the trustees also weren’t looking for a whole bunch of potential problems. (I would also not assume that most of the problems noted in exceptions reports were ever fixed–the expense would be prohibitive to the servicer. Query whether trustees then insisted on putbacks….)

Of course those that have an interest to protect the banks like Peter Jackson freaked out while attacking Adam Levitin on twitter. This is similar to what goes on at this site and other places in the blogosphere in order to protect everything this administration does. Those motivations are transparent and are to serve and protect the interests of a politician instead of the victims of foreclosure fraud.

We can play the game of denial regarding what Law Professor Adam Levitin laid out above involving the SF audit and the foreclosure fraud involving the commercial real estate bubble if you want, but Adam Levitin is also a top US legal expert on securitization. The facts he lays out are going to take a whole lot more effort to deny than just a few snide ignorant comments from Peter Jackson or anyone else.

The Commercial RE Bubble

This academic study is one of the only ones performed on the Commercial Real Estate bubble showing the similarities, but also stressing the differences like the fact that there is no government involvement in the Commercial Real Estate Bubble like Fannie and Freddie with the Residential bubble.

From this you learn how the securitization process corrupted both markets commercial and residential (more significantly corrupt). You also learn how traditional buyers in subordinated Commercial Real Estate market were outbid by investors who wanted Commercial Real Estate to securitize and package into CDOs. This of course led to a huge loss in underwriting standards we see today and will continue to see in the future.

CDOs are also what connect the Commercial and Residential bubbles and this is well defined. So well defined, in fact, that it’s actually pretty embarrassing to doubt Professor Levikin here at all with any claim that he hasn’t vetted this audit or overall problem with both real estate bubbles. The securitization process is a complete mess in general with no defined standards and none of this is being addressed at all in either markets.

Until it is, we must not pretend we are making any valid steps towards fixing these problems. I know that many have tried just to relegate this to just quirky CA and their crazy laws, but reality strikes again reported by David Dayen.

New Study From Consumer Advocates Shows Mass Servicer Abuse

Well, here’s an interesting report that might have been good to have in hand a few weeks ago. The National Association of Consumer Advocates, the National Association of Consumer Bankruptcy Attorneys and the National Consumer Law Center have released the results of a survey showing that “mortgage servicers continue to initiate foreclosure proceedings improperly, either while a homeowner is awaiting a loan modification or due to improper fees or payment processing.” This is a key element of the servicing standards in the (as-yet unseen) foreclosure fraud settlement, but it was also part of the consent order last year from the Office of the Comptroller of the Currency. In other words, the banks are under an order to stop doing these types of things, and they have simply not complied. That’s the state of things heading into the settlement, when the banks will be asked to comply again.

The study from NACA, NACBA and NCLC surveyed attorneys representing homeowners in foreclosure cases in 45 states and the District of Columbia. The results are really staggering. Here’s a sample:

Over 90% of the respondents report representing a homeowner placed in foreclosure while awaiting a loan modification in the last year.

Homeowners were improperly foreclosed on while awaiting both HAMP and GSE loan modifications: of the survey respondents that represent homeowners placed in foreclosure while awaiting a loan modification in the last year, 85% represent homeowners awaiting a HAMP loan modification; 66% represent homeowners with a loan owned by Fannie Mae or Freddie Mac.

We still don’t know that much about the real terms of this settlement besides the trial balloons released, but we do have the executive summary from Assistant Attorney General Philip A. Lehman which no doubt was vetted by the banks, administration, and state AGs. As Yves Smith notes, those that are jumping up and down celebrating a limited release of liability for these servicers have reason to believe they are living in a fantasy world. I base that off of the executive summary of this foreclosure fraud “settlement.”

Quelle Surprise! Administration and State Attorneys General Lied, Mortgage Settlement Release Described as “Broad”

This is the critical part:

The proposed Release contains a broad release of the banks’ conduct related to mortgage loan servicing, foreclosure preparation, and mortgage loan origination services. Claims based on these areas of past conduct by the banks cannot be brought by state attorneys general or banking regulators.

The Release applies only to the named bank parties. It does not extend to third parties who may have provided default or foreclosure services for the banks. Notably, claims against MERSCORP, Inc. or Mortgage Electronic Registration Systems, Inc. (MERS) are not released.

This is sufficiently general so that it is hard to be certain, but It certainly reads as if it waives chain of title issues and liability related to the use of MERS. That seems to be confirmed by the fact that made by local recorders for fees are explicitly preserved (one would not think they would need to be preserved unless they might otherwise be assumed to be waived). This is exactly the sort of release we feared would be given in a worst case scenario. The banks have gotten a huge “get out of jail free” card of bupkis.

It’s also doubtful if Eric Schneiderman really received the MERS carve out that was supposed to make this deal worth signing onto among other things. It’s very disappointing that he signed on anyway.

We know banks get credit for using HAMP in this settlement which they could use even without it anyway (though it’s largely acknowledged as a failure on the aggregate level which is the one that matters), like many of these principal modifications which could be handled even without this settlement from what we are told, and they’re also using other people’s money to pay for a ton of this. Pension funds, 401(k)s and mutual funds will be used to pay for this as well as taxpayer money.

Mortgage Settlement Plan is More Bank Bailout

So not only is the settlement designed to shift the costs of the banks’ misdeeds onto already victimized investors, but taxpayers will also be picking up some of the widely touted $25 billion tab. Shahien Nasiripour tells us in the Financial Times that banks will be able to count future mods made under HAMP towards the total:

However, a clause in the provisional agreement – which has not been made public – allows the banks to count future loan modifications made under a 2009 foreclosure-prevention initiative towards their restructuring obligations for the new settlement, according to people familiar with the matter. The existing $30bn initiative, the Home Affordable Modification Programme (Hamp), provides taxpayer funds as an incentive to banks, third party investors and troubled borrowers to arrange loan modifications.

Neil Barofsky, a Democrat and the former special inspector-general of the troubled asset relief programme, described this clause as “scandalous”.

“It turns the notion that this is about justice and accountability on its head,” Mr Barofsky said.

BofA, for instance, will be able to use future modifications made under Hamp towards the $7.6bn in borrower assistance it is committed to provide under the settlement. Under Hamp, the bank will receive payments for averting borrower default and reimbursement from taxpayers for principal written down..

HUD wasn't happy about Shahien Nasiripour's reporting and attempted to debunk it unsuccessfully. David Dayen has the scoop here too. Former special inspector general for TARP Neil Barofsky, has the best response to HUD on the HAMP situation.

HUD Continues Defense of Allowing HAMP Modifications as Part of the Foreclosure Fraud Settlement

UPDATE: I asked Neil Barofsky, the former special inspector general for TARP and NYU professor, who was quoted in the Financial Times story that HUD goes after here, for his comments. Here they are:

If (HUD) had included in the settlement agreement a provision making HAMP’s Principal Reduction Alternative mandatory when NPV+ (a long-standing recommendation for all servicers made by SIGTARP), and then exempted these HAMP subsidized modifications from receiving credit under the settlement, they would have reached far more homeowners.

And why is HUD bragging that its settlement terms lack the obviously inadequate compliance requirements and borrower protections that are part of HAMP? You would hope that they would want to exceed that failed standard, not celebrate that they will be far under it.

Just to parse this, NPV+ is a test required for principal reductions in many pooling and servicing agreements with investors. Basically, Barofsky is saying that Treasury could have made principal reductions mandatory through HAMP when that equation comes out as beneficial, and then forced the settlement’s principal reductions separately. That’s how you could reach the maximum borrowers. The rest speaks for itself.

We can go ahead and add this to what is missing like any accountability to end this game of fraud and moral hazard. You see, it only matters to an individual when they say “HAMP worked out for me and people I know so there” when overall the data shows it hasn’t worked out as well as a whole, it isn’t fair, and this deal doesn't even live up to HAMP's poor standards.

This is the type of RW garbage we hear when people excuse all of this fraud for election season.

“I got mine. I know personally know someone who has been helped by HAMP. It’s not Obama’s fault people took mortgages they couldn’t afford even if they were defrauded.”

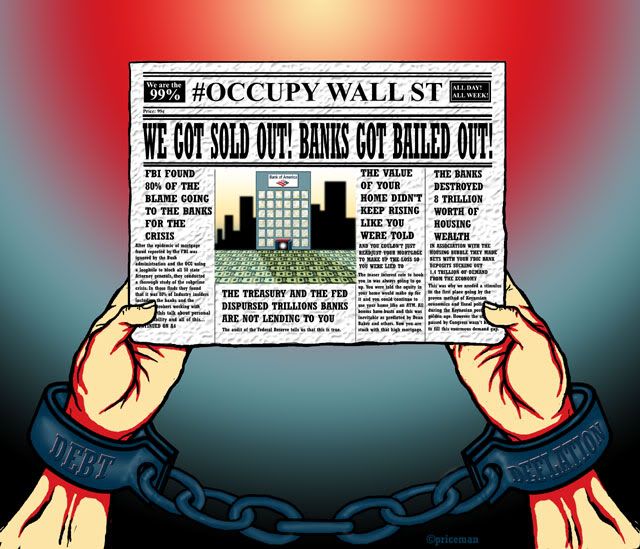

I don't expect this on a Democratic site even if the President is technically a Democrat; a third way neoliberal Democrat, but I’ve actually heard these kinds of defenses of him and they really say a lot. None of which amounts to saying one cares about the people being defrauded as acknowledged by the FBI that pointed 80% of the blame towards the banks and the mortgage industry in the subprime mortgage crisis and foreclosure crisis.

Instead, much has been made about the rumor about private parties being free to pursue further damages to make up for the $1800-2000 each borrower receives under this settlement(which does define a poor standard that will make all judgments awarded much less as Yves Smith said). One can only assume that those parading the private lawsuit excuse game haven’t paid any attention, whatsoever.

For instance, let’s look at NY. The prospects are not promising.

New York’s largest foreclosure firm, which once handled thousands of cases in the Lower Hudson Valley, will officially close Monday, but it has left a trail of questions and frustrated property owners caught in legal limbo.

The Steven J. Baum PC law firm, based in Amherst, N.Y., originally was retained for more than 600 foreclosure cases that remain active in Westchester, Rockland and Putnam. In all, Baum’s firm has handled more than 4,000 cases in the three-county region since 1999, court records show.

But last year, the firm announced its official closing, scheduled for Feb. 20, after it came under scrutiny from state and federal agencies for “robo-signing,” or mass producing foreclosure documents without verifying whether they were accurate.

“The problems Baum’s firm left this state with are just beginning,” said Susan Chana Lask, a Manhattan attorney. “The new firms taking over his files need to take time to figure out and correct what he did.”

That means homeowners face longer delays and could owe more money in accrued interest, penalties or fines while their cases drag through an already overburdened state and federal court system.

And even less so in FL.

Sen. Jack Latvala, a Clearwater Republican, said foreclosure was a "dark cloud" hanging over the Sunshine State. He mentioned a backlog of 368,000 foreclosure cases in the state's courts.

Snip

The collapsed real estate market resulted in millions of foreclosures across the country that hit courts like a rogue wave. One recent survey showed Florida has about a quarter of the nation's foreclosures.

snip

Other civil and criminal investigations have resulted in the collapse of two major foreclosure law firms and the temporary stoppage of many lenders' foreclosure filings.

snip

"There are law firms handling tens of thousands, if not hundreds of thousands of (foreclosure) cases, and they don't have their documents in a row," said Drysdale, who also chairs the Florida Bar's Consumer Protection Law Committee.

So no, it’s not easy. Why do some choose to live in a dream world of massive successful private litigation? It’s very costly, and the damages awarded for foreclosure fraud abuses by the banks are anything but a given. That’s why it is usually state AGs that have more of the resources to pursue these cases with more favorable results for consumers, financially or otherwise on a whole.

The prospects for those successes are now weakened since 49 state AGs were pressured and signed onto this travesty. Only those with poor knowledge about the cold harsh realities of the legal system could claim otherwise. And yet these claims are continually made. And all to protect a flawed settlement in which the full terms, a couple of weeks out, still have not been released because the President said it was awesome in the SOTU.

But if it was so awesome, the full details would come out in a hurry, but they have not. One would think that a development this important would mandate a demand for the exact terminology related to this deal before celebrating. After all, not everyone is only worried about how this makes Democrats look.

That is always the prism in which these excuses are made and by people who say they are Democrats because they care about working people and the middle class. And yet that doesn't stop them from embracing the RW prism of so called "personal responsibility while being defrauded" suddenly to protect the image of their favorite politician.

With “settlements” or secret non settlements like this we’ll be lucky if enough people will ever be able to escape this kind of debt bondage. Hell, we'll be lucky is strapped state budgets don't soak up some of this purported 25 billion up to try to escape that same bondage and that is a sad state of affairs for this "settlement." The national accounting sin of Obama's inept federal deficit reduction rhetoric strikes again as states need more aid perverting this deal even further with a misappropriation of funds from the proposed settlement they didn't get from the stimulus.

National Foreclosure Settlement: Several States Using Funds From Deal To Close Budget Gaps

We should demand something better so there is more demand in the economy and overall justice for what happened.

DEBT DEFLATION