Sometimes a person or organization becomes so powerful and Evil that they appear cartoonish.

It might seem impossible to find a similar character outside of a James Bond movie or a cartoon about a mouse with an oversized brain. After all, who really wants to take over the world and has a plan to do it, right?

And yet, Goldman Sachs is on the verge of doing what Julius Caesar, Charlemagne, Hitler and Napoleon tried and failed to do.

Carney, a former Goldman Sachs investment banker who successfully helped to steer the Canadian economy through the global crisis, will succeed Mervyn King next year, Chancellor George Osborne told parliament.

"He is quite simply the best, most experienced and most qualified person in the world to be the next Governor of the Bank of England," Osborne said.

The announcement sounds unthreatening until you put it into perspective.

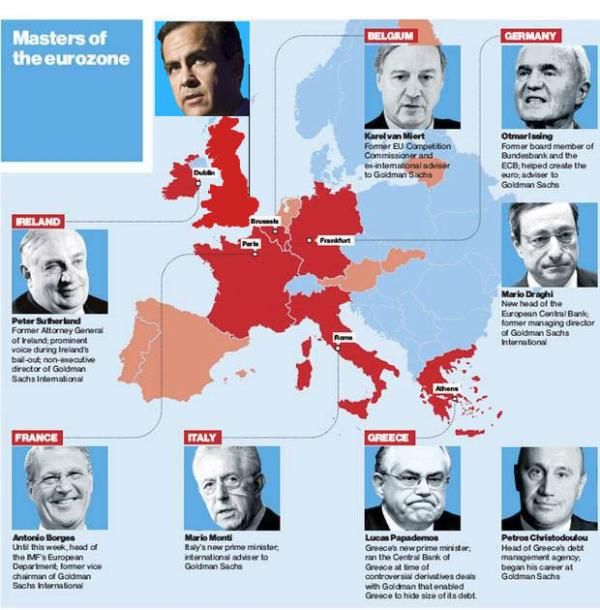

For example, in July the Independent had a great graphic that displayed the New Reality in Europe.

Well now that graphic needs to be updated to this.

Everywhere that a nation has gotten into economic trouble, Goldman Sachs has moved into a position of power.

Most companies are usually content to pump-and-dump a stock to the public.

Goldman Sachs does it with nations.

The normal scenario usually involves helping a nation hide a problem and sell its debt until the problem blow up into a bubble that bursts in a spectacular way. Goldman Sachs makes money selling the overpriced debt, and by betting against the nation.

Goldman Sachs then puts their "man" into a position of power to direct the bailouts so that Goldman gets all its money back and more, while the nation's economy gets gutted.

3rd world nations have seen this before, but Goldman Sachs have been sparing no one.

It was a Goldman Sachs man, Mark Carney, now head of the Bank of England, that helped tank Russia's economy in the 1990's.

These policies ended in a severe economic collapse, which just happened to profit Goldman Sachs tens of millions of dollars. In spite of their involvement in a 1.25 billion dollar bail-out of the Russian government, Goldman Sachs appears to have been betting against success.

The fact that Goldman Sachs has felt it necessary to put one of their own in the Bank of England should raise alarm bells about what the future holds for Britain.

A history of evil

In England, Goldman Sachs was able to manage a sweetheart deal with the taxman, who decided they didn't need to consult a single lawyer before letting Goldman walk on a failed tax avoidance scheme.

The IMF strategy chief in charge of working with Europe's bailouts over the past year was a former Vice Chairman at Goldman Sachs International.

While a conflict of interest exists, that doesn't make Goldman Sachs Evil.

What makes them Evil is that Goldman Sachs helped create the crisis.

Goldman Sachs helped the Greek government to mask the true extent of its deficit with the help of a derivatives deal that legally circumvented the EU Maastricht deficit rules. At some point the so-called cross currency swaps will mature, and swell the country's already bloated deficit.

OK, so that's underhanded. But does that qualify as Evil? Not exactly. What makes it Evil is what Goldman Sachs was doing

behind the scenes.

While it arranged the swaps, Goldman also sought to buy insurance on Greek debt and engage in other trades to protect itself against the risk of a default on those swaps. Eventually, Goldman sold the swaps to the national bank of Greece.

So they helped hide the Greek debt problem until it blew up, while betting against Greece, and when Greece finally imploded they put one of their guys in charge of "cleaning it up".

If that doesn't sound shady, what does?

What it really sounds like is very familiar.

Life imitating art

A couple years ago Andy Borowitz published a short news spoof titled Goldman Sachs in Talks to Acquire Treasury Department. Like most humor, it was funny because it was true.

The Goldman spokesman said that the merger would create efficiencies for both entities: "We already have so many employees and so much money flowing back and forth, this would just streamline things."

Mr. Hestron said the only challenge facing Goldman in completing the merger "is trying to figure out which parts of the Treasury Dept. we don't already own."

By the time Borowitz published the article, the connections between Goldman Sachs and the Treasury Department were already

well known to any member of the public that was paying attention.

THIS summer, when the Treasury secretary, Henry M. Paulson Jr., sought help navigating the Wall Street meltdown, he turned to his old firm, Goldman Sachs, snagging a handful of former bankers and other experts in corporate restructuring.

In September, after the government bailed out the American International Group, the faltering insurance giant, for $85 billion, Mr. Paulson helped select a director from Goldman’s own board to lead A.I.G.

And earlier this month, when Mr. Paulson needed someone to oversee the government’s proposed $700 billion bailout fund, he again recruited someone with a Goldman pedigree, giving the post to a 35-year-old former investment banker who, before coming to the Treasury Department, had little background in housing finance.

All those connections come with benefits. Well-paying benefits.

While Goldman Sachs was getting bailed out by the Federal Reserve in 2008, Stephen Friedman was sitting on the New York Federal Reserve board AND was

purchasing stock in Goldman Sachs.

When the Treasury Department was considering bailing out AIG, who was making "two dozen" personal calls to the Treasury Secretary? Why the CEO of Goldman Sachs, of course. And who benefited the most from the AIG bailout? Why Goldman Sachs, of course.

The biggest beneficiary of the AIG money was Goldman, which received $12.9 billion.

That makes Goldman Sachs unethical, but not necessarily Evil. What makes them Evil is that they

bet against the debt that they sold AIG.

Goldman Sachs underwrote $17.2 billion of CDOs for AIG, more than any other firm

Knowing precisely the garbage it had underwritten (our assertion), Goldman bought billions in credit default swaps that would rise in value as AIG stumbled (fact)

AIG ultimately paid Goldman – with taxpayer dollars confiscated by many former Goldmanites in the Treasury – the full value of their default contracts: $14 billion.

$2.9 Billion of the bailout money Goldman Sachs kept for themselves.

After these tax-payer funded bailouts filled their coffers, Goldman Sachs then handed out

enormous bonuses to the thieves they employed, bonuses even larger than the bailout money they received,

Goldman Sachs made money on both ends of a bad trade.

A bit of Goldman Sachs news that fell through the cracks during the AIG bailout was Goldman being forced to pay Enron creditors $7 million for selling bad debt weeks before Enron's collapse in 2001.

The year following the AIG bailout, a Goldman Sachs director was linked to insider trading.

Florida just ordered Goldman Sachs to pay $20 million for lying to investors.

Goldman is currently charged with securities fraud and it is linked to the company president.

Goldman Sachs is also being sued by pension funds for misleading statements (i.e. fraud) in regards to the bankrupt MFGlobal.

MFGlobal, run by former Goldman Sachs co-CEO and former New Jersey Governor Jon Corzine, declared bankruptcy Oct. 31, having sunk the majority of its investments into toxic European sovereign debt.

Of course Goldman Sachs didn't just knowingly sell bad debt to AIG. They did it to their

own clients without disclosing that they would profits from their client's losses.

When does a non-Evil company conspire to profit from the demise of its clients?

In a rare display of justice, the former director of Goldman Sachs just got sentenced to 2 years in prison for insider trading.

With so many criminal acts from one company, when does the world stop putting them into positions of power and start calling them what they are: a criminal organization?

There is nothing unusual about a company having too much power over local governments. It leads to a lot of abuse, but it can be dealt with easily. Having too much power over a federal government is a whole different animal, especially when the country is the major military power in the world.

Having too much power over multiple major governments of the world is unprecedented. The only comparisons are the East Indies Companies, and that historical lesson involved man-made famines that killed tens of millions in order to enrich stockholders.

They are transitioning away from their main business - fraud - and moving to something bigger, something new, something troubling that can only be compared to the Robber Barons of the middle ages.

In those days the Robber Barons stole gold and silver. One wonders what they will be stealing today, when people carry pieces of paper backed by nothing more than a promise to pay?

Goldman Sachs now operates as a global destabilizing force that is a danger to democracy. Their actions bring social unrest across continents, and they are getting worse.