Why do the financial “experts” make decisions that are so removed from human values? Part of the reason may be that they spend too much of their time thinking about money.

Filthy Lucre

The process of thinking too much about money causes impairment of mental and emotional functions. This proven effect, known as Lucraphrenia, is relatively weak in any given instance and can be overcome by awareness and prevention, but when it is untreated over years or decades, the effects can accumulate into a serious syndrome.

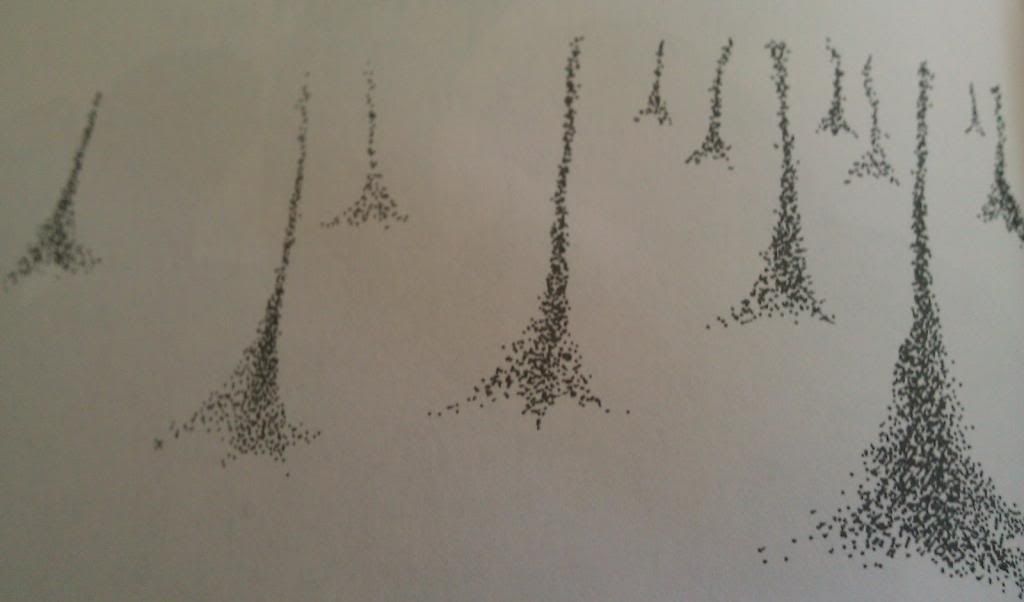

Since many of those who rise to the top of the caterpillar pillar of finance do so by dint of endless study of money, by the time they arrive at their exalted station, they have lost much of their capacity to understand the real purpose of the numbers they know in so much detail.

Let’s start with the experimental evidence – it’s clear. A series of experiments conducted by Dr. Kathleen D. Vohs at University of Minnesota showed that exposure to images of money caused people to be less helpful to others:

First we exposed the subjects to concepts of money in very subtle ways. For example, we would have some Monopoly money on the table on which they were working, or we would have them do a word task that involved unscrambling words that made up logical phrases, and sometimes those phrases related to money. Then we gave subjects the opportunity to help someone else … Subjects who were reminded of money were less helpful than subjects not reminded of money.

In addition, people exposed to images of money were less likely to ask for help, less likely to be concerned when socially isolated, and even less sensitive to physical pain.

It’s intuitively obvious why. Money often represents a callous accounting of a person’s worth, and if your (assets + credit) at any given moment doesn’t match even momentary needs, you’re sunk. The growing abstractness of money, as numbers stored on a computer, and the explosive growth of zero-sum transactions, reinforces this.

The Cost

.

If such effects can be measured based only on short term exposure to images of money (and sometimes not even real money), then imagine the effect of spending a working lifetime focused on the topic.

There are exceptions, of course. Take for example Nobel prize winning economist Paul Krugman. But in this case the exception may even help prove the rule. Krugman’s greatness is not defined by his adroitness with numbers (although he’s got that), but rather by his ability to see past the numbers to the greater purpose of money, and of an economy.

Many people do manage to work daily with money and escape mostly unscathed. The harmful effects are partly mitigated by observing good results that you can create for actual fellow humans. And, there are some wonderful companies who, perhaps recognizing their duty to offset the health effects of dealing with money, base their success of creating a positive community for workers and customers alike.

The negative effect is strongest when the financial environment is abstract, not connected directly with any actual useful thing, and it is magnified when the transactions are zero sum: for you to win, somebody else has to lose.

For every Paul Krugman, there are thousands of financial wizards who have succumbed to the Incestuous Amplification of numbers-and-greed economics. These people, sadly, drive much of the activity in our contemporary economy.

There are many reasons why people in the finance industry lose their compass. Company culture, the competing pressures to get “ahead”. But another factor may simply be simply the subject matter itself: If you work with money all day and don’t connect it with useful acts or goods, then its inherent coldness will seep into your soul.

Climbing to Success

.

This suggests some measures that we should take as a country to improve national-level financial decisions. Key boards, such as the federal reserve, should include members of non-financial professions, such as philosophy and art. If the “experienced” financial people need to take a bit of time to “explain“ to the new board members why a given financial maneuver serves the national interest, that time could be one of the best investments that we ever make.

When evaluating consumer protection measures, our government should consider not only the potential for overt fraud, but also the soul-destroying effect on consumers of having to navigate a maze of terms and conditions at every turn to determine whether they are being taken to the cleaners. Every time you have to decipher the terms of a purchase or loan agreement, it creates an incremental hardening in the arteries of your soul.

The effect is not limited to those with a lot of money. In fact, I suspect that the ill effect may be magnified for people who have little money, but are caught in complex transactions or severe financial pressure. At the very moment when they need community the most, the need to focus on money could cause such people to become less able to reach out.

At an individual level, there are important measures you can take to lessen your exposure to monetary complexity and thus protect your mental health. This one is tough. In shark-infested waters, you can’t just blissfully swim. Financial literacy, and related numeracy, are critically important life skills.

Limit exposure as much as you can

So, while still protecting yourself in a world where money is ubiquitous, the useful thing is to identify where you can simplify your transactions. If you are able to have investments, you can buy a broad fund instead of tracking individual stocks. To align your goals with good results in the world, you can invest in a socially responsible fund that is

divested of fossil fuels. If you are tempted to buy some kind of timeshare or other complex deal – just don’t (and beware the related condition of affluenza).

After you engage in a particularly complex financial transaction, wash your hands thoroughly, find a loved one nearby, and give them a hug. If no loved ones are handy, take a moment for another type of life-affirming act, preferably of kindness. It is important to counteract the corrosive effect before it seeps too deeply into you.

Regular detox is helpful, several times a week if possible. Plan for blocks of several waking hours where you have no interaction with money. If, with some advance planning, you can go for a full day or more (camping, anyone?), that’s very special.

So, if you have read this far, you may be wondering …. Thinking about, the process of thinking about, money, is that harmful?

If so, I am sorry. But perhaps it could work as a vaccine - if reading this helps you to decide to spend a finance-free afternoon, or even a whole day, then reading this will provide a good return on investment. Oops.

As with most chronically harmful effects, the most important thing is awareness. Know that the effect is happening, and that as a conscious and caring person, you can overcome Lucraphrenia, in yourself, your friends, and loved ones.

UPDATE Oct 5, 2013: Edited from the original "Lucrazema" to "Lucraphrenia"