This has been revised to remove references to I.O.U.'s and add a bit of explanation. You can browse the revision history at my blog. This diary is being linked to from There Is No Crisis. There are efforts to create pdfs and flash presentations from it. Contact me if you have more ideas on how to help. Thanks to everyone for the helpful comments. --Tunesmith

I have been creating some "Social Security For Dummies" graphs that anyone is welcome to use. Cross-posted from

my blog.

Social Security For Dummies

Social Security is funded by a payroll tax. When we make wages, 6.2% is taken out of our paychecks to go to Social Security. An additional 6.2% is matched by our employers. This stops after the first 90k of income for each person.

In a perfect year, the Social Security beneficiaries would need exactly as much money as we pay in taxes. However, most of the time, the amounts are unequal. When the baby boomers retire, they will require more money than the payroll tax generates.

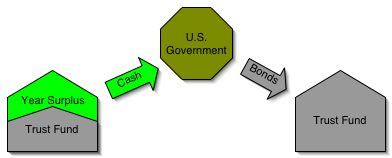

To make up for this, we have years where we generate more in payroll taxes than we need to spend on beneficiaries. This excess goes into a Trust Fund. The Trust Fund grows each time there is a yearly surplus.

Later, when there are years where the beneficiaries require more money than the payroll taxes provide, we can take money from the Trust Fund to make up the difference.

Since 1970, there have been 11 different years where we have had to do that, and it's worked fine.

How does the Trust Fund work? When excess money is generated, Social Security is required by law to invest the money in U.S. Treasury Bonds, considered the safest investment on the planet. They are issued by the U.S. Government, who has never defaulted on them. These bonds are supposed to be cashed in later when extra money is needed.

So, Social Security's Trust Fund is a big collection of bonds, and the U.S. Government gets the cash.

What does the Government do with this money? It spends it. That is theoretically okay if the intention is to pay it back later, but that is not Bush's intention.

In 2003, the Bush Administration ran a deficit of $536 billion. Social Security ran a surplus of $156 billion. (The Postal Service also ran a surplus of $5 billion.) So, the Bush Administration reported a deficit of $380 billion instead of $536 billion, ignoring the fact that that money is supposed to be earmarked for future bond redemptions.

Now the Bush Administration is saying that when beneficiaries require more money than payroll taxes generate - 2018 or 2028, depending on who's talking - that we will not be able to afford it.

This basically means that the Bush Administration is following a policy of ignoring the Trust Fund entirely. Rather than viewing excess money as going to the Trust Fund, they view it as going to the government:

And then when the time comes, they will see the extra money that the Beneficiaries needing as coming from the government, from cashing in bonds:

They will then paint this as a problem - even though this is exactly how it is supposed to work - because in their mind, it would require higher government spending. And the GOP can't have that. So instead of paying us back, they say that benefits would instead need to be cut.

It is important to recognize what they are doing here. The payroll tax is a regressive tax designed for Social Security. Normal tax is a progressive tax designed for normal government spending. They are two separate systems. Revenue and Spending need to balance out in each system, and they should not intermingle:

But the Bush administration applies payroll tax to the normal deficit, claims that the trust fund does not exist, says Social Security needs to be cut, and implies that the government isn't good for their U.S. Treasury Bonds anymore:

To summarize, the Bush Administration takes the extra payroll taxes intended for Social Security and spends it on war and tax cuts:

Then, Bush declares there isn't money for when the Social Security beneficiaries require more money than the payroll taxes supply, and says the only solution is to cut Social Security benefits:

When actually, the truth is that the surplus is supposed to be applied to social security in later years:

While the following shows what the real problem is, in red, white and blue: