By happy happenstance, today's "quote of the day" from PNHP's always must read Don McCanne listserv and feed discussing the subtle Federal push for the high out-of-pocket cost Bronze Plans under PPACA, and today's eAlert from The Commonwealth Fund pointing out that "to control health care costs, focusing only on Federal budget outlays won't solve the problem", have the same message from different approaches:

The real problem with health care costs is the total system costs and the total cost to individuals and families. It is NOT about just the costs to the Federal budget.

- As my colleague Dr. McCanne points out today:

HHS is comparing family plans that will be offered in the state insurance exchanges with family plans that are currently offered in the individual insurance market. The current plans are terrible, which is the main point that HHS should have made. To keep premiums down to a level that families can barely afford, the existing plans provide very limited benefits, potentially exposing families to very high out-of-pocket expenses.

So that the savings can be calculated on an apples to apples comparison, HHS has selected the most austere plan to be offered in the exchanges - the bronze plan, which has an actuarial value of 60 percent - a plan that's about as lousy as those on the individual market today. This leaves the family exposed to 40 percent of their health care costs (though admittedly with inadequate income-indexed subsidies, which is important but not covered here further).

The family has the option to buy up to a silver plan, but then the touted savings goes away. Furthermore, the silver plan is also an under-insurance product since its actuarial value is still only 70 percent, leaving the family responsible for 30 percent of the costs. Although still a lousy plan, as HHS says, "this benefit enhancement is a choice, not a requirement." What a choice.

Gold and platinum plans with actuarial values of 80 percent and 90 percent will be offered in the exchanges, but very few families will move up to those plans since they must pay the full additional premium. Only the wealthiest families will be able to afford the difference.

The title of HHS's release says "lower insurance premiums" and "more choices." But what they bury in their report is that you get lower premiums only if you choose a crappy plan similar to those currently available in the individual market.

We can do far better than that. We can enact an improved Medicare for all. Then you wouldn't have to worry about unaffordable premiums and out-of-pocket expenses since they would be replaced with equitable taxes which would be affordable for all.

- A parallel theme also arrived in my inbox today from the Commonwealth Fund, which put out a report commenting on the Deficit Commission's (and Beltway-wide conventional groupthink) false emphasis on just saving tbe Federal Government money. As they point out in order "to bend the health care cost curve, focusing only on Federal budget outlays won't solve the problem":

However, our concern is that the focus of many of the other recommendations is mostly on reducing federal spending without consideration of the impact on beneficiaries, state governments, or businesses, rather than controlling health care spending overall. Achieving reductions in federal spending merely by increasing out-of-pocket costs to older, disabled, and chronically ill Americans through higher deductibles and coinsurance may save the federal government money, but it does not address the underlying causes of the rapid growth of health care costs—nor, for that matter, does it begin to address the problems faced by state and local governments, businesses, and families.

In many cases, these policies would create new financial barriers for the people who most need good health care, and thereby make the most appropriate care less accessible to them. As a result, people might avoid needed care or skip medications to manage their chronic conditions—and then end up in more expensive emergency departments or hospital rooms when they become too sick to avoid care any longer. Such policies do not control health care spending—they merely shift the costs to someone else's budget, including vulnerable retirees and the disabled.

The Bipartisan Policy Center suggests several options for controlling long-term growth in federal health outlays, including proposals to convert Medicare to a fixed-dollar voucher for the purchase of private insurance and turn Medicaid into a fixed-dollar block grant to the states. However, doing so would effectively abdicate the role of the federal government in controlling health care costs, and rely on private insurers or state governments to develop an effective cost-control strategy. This runs the risk that failure to control costs will result in fewer benefits and higher costs for Medicare and Medicaid beneficiaries who are least prepared to bear this burden.

So far, neither private insurers nor states have found a way to control health care costs. During the health care reform debate, private insurers effectively acknowledged that they could not control costs enough to compete against a public health insurance plan. Even large insurers often feel that they have to comply with demands for higher payment rates from major hospitals, physicians, and other providers, contributing to high and variable payment rates across providers.

Which would seem to suggest that promoting ever more so-called private market competition can only result in increased costs.

Only Medicare, as the largest purchaser of health care, has sufficient clout to set payment rates while still engaging the participation of nearly all providers.

Gee, maybe the improved Medicare for All advantages of monospony and system planning would be a good idea. Since "Medicare for Some" is already the best, and the private insurers have both proven and admitted that they can't do it, how about we put them out of our misery and go with Improved Medicare for All.

Likewise, state governments already have wide discretion to control Medicaid spending by setting provider payment rates, contracting with private managed care plans, and establishing limits on the amount, scope, and duration of benefits. Yet, Medicaid is a comparatively small payer that is, in many states, chronically underfunded, and its beneficiaries are concentrated in low-income communities with a shortage of health care providers. As a result, low Medicaid payment rates have mostly had the effect of limiting an already sparse supply of participating providers. Converting Medicaid to a block grant would not increase the number of effective tools in states' cost-control toolkits.

Yup. Just expanding Medicaid, and/or dumping it to the individual states so they can engage in a race to the bottom, is not a great solution.

The federal government is most capable of taking the lead in resetting incentives for providers and consumers by rewarding quality and high-value care and harmonizing public and private payment for medical services so that payment rates are more consistent across providers and patients and the incentives they present effectively reward better and more efficient care. Instead of focusing almost exclusively on reducing federal spending, the United States must reform its fragmented and misaligned financing system to get at the roots of rapidly growing health care costs in both the public and private sectors. Indeed, with public oversight and accountability, Medicare could act in concert or partnership with private insurers to address factors contributing to rising costs, leveraging the combined purchasing power of all payers to achieve value for money spent and slow the growth in health care costs.

Hmmm... the best defragmenting would be Improved Medicare for All. The tag-on of partnering with private insurance is belied by everything else they have said. Let's tell congress what we really want.

We can certainly afford to take the time to design sensible and effective solutions that achieve savings without sacrificing access to care for our nation's most vulnerable populations or undermining innovation and quality of care. Nor can we forget the need to restore federal tax revenues to work toward balancing the federal budget.

In other words, Improved Medicare for All, paid for by progressive taxation.

- For those wishing to see the analysis that compares the best health care reform that the mainstream Democrats ever proposed (mandate and strong public options called Building Blocks) with actually proposed Republican Plans (Enzi, Burr, Cantor) and a version of single payer (Stark), the report by the Commonwealth Fund (with analysis by the Lewin Group) from two years ago remains the most recent (only) full comparison avialable:

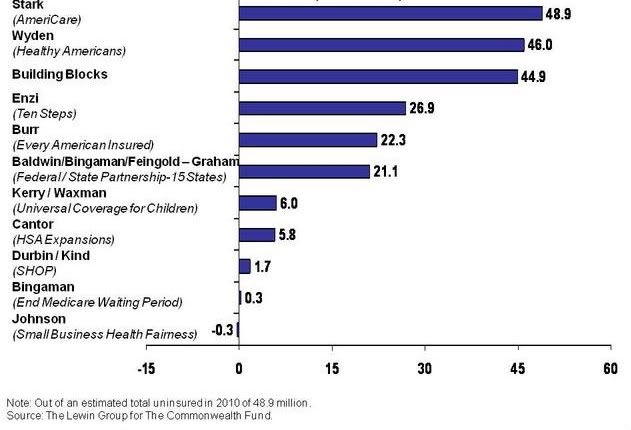

a. Number of the Uninsured Who Would Become Newly Covered:

Only single payer (Stark) gets everybody covered. The strong pubic option Building Blocks plan that we did not get does pretty good, and the Republikcan plans do not come close and mostly don't really even try.

So, what about costs?

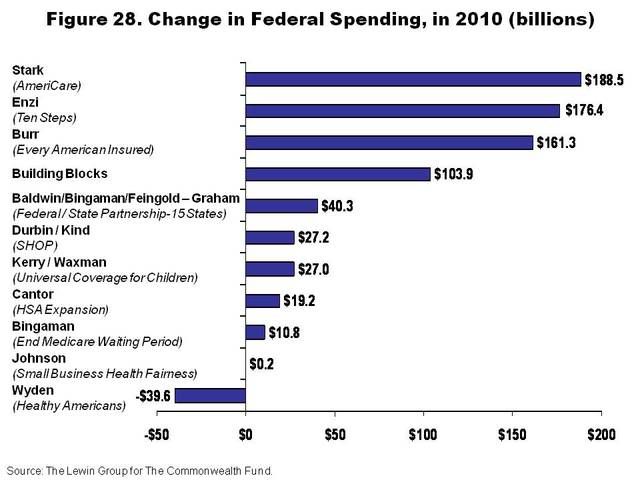

b. Just the irect costs to the Federal government, not the total cost.

In other words, not the additional costs by individual and families such as premiums, deductibles co-pays, out-of-pocket due to refusals of insurance company to pay. It does not include additional costs by employers. It does not include the additional costs by state or local government. Not surprisingly, the Wyden Plan, which like the McCain plan from the campaign, takes away the tax corporate deduction for providing insurance and does little to offer pay directly for coverage, saves the Federal Government the most. While the proposals from Single Payer (Stark), and the more comprehensive Republican plans Enzi, Burr) and the Building Blocks plan (what we got but with strong public option as well) cost the Federal Government the most.

But you can see from the graph and table below, this is a very incomplete and essentially dishonest view.

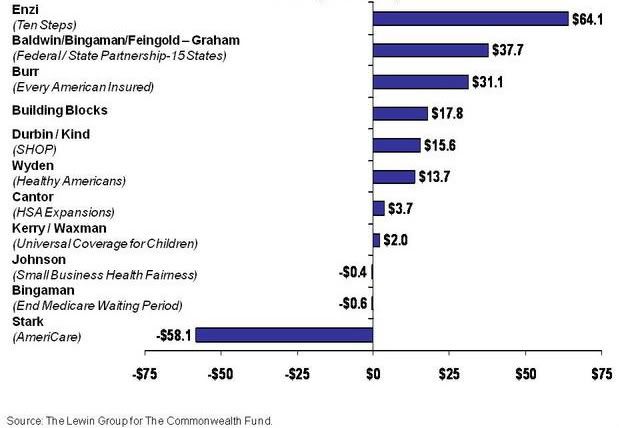

c. What really matters is the total Change in National Expenditures on Health Care:

This table shows the change in total costs, the total national expenditure on health care. This is the one that corresponds with Percent of GNP spent on health care, that infamous statistic that shows that U.S. spends twice as much as other developed industrialized nations, but is the only one not covering everybody and the only one bankrupting families if they get sick... and the only one dependent on for-profit private insurance companies.

Notice the complete turn-around compared, to the JUST federal government view in the prior table. While some plans saved the Federal Government money, what they really do is increase total costs and dumps those cost onto others.

Indeed most of the other plans... Enzi, Baldwin, Burr and alas even Building Blocks (including Obama-Baucus that we got) amount to huge giveaways and supports for the private for-profit insurance companies. And do not control total costs, nor costs to individuals, families, state government, or employers.

Only Single Payer (here represented by the Stark plan) actually saves money for the overall system, the country as a whole.

Only Single-Payer like plans can actually control overall total costs.

And this from Commonwealth Fund and Lewin Group, two entities that that do not support single payer.

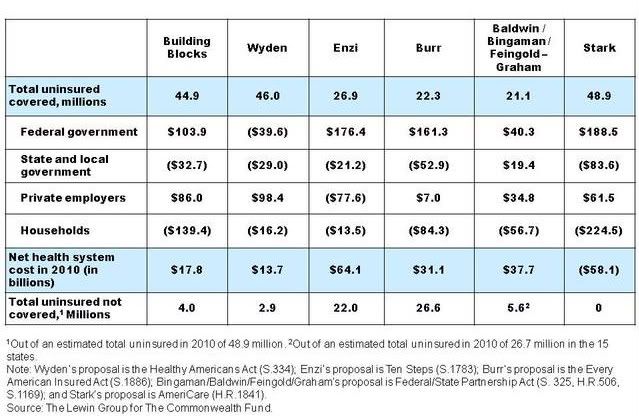

c. Who Pays by Stakeholder Under the Different Plans:

This is the real story, typically ignored by proponents of the other plans including the various variations of mandate plans (Obama, Baucus, Clinton, Edwards, Building Blocks, etc.) and the Republican proposals (Enzi, Burr, Cantor).

The Building Blocks plan, like the Obama-Baucus plan we got, would increase costs overall, and to the federal government and for employers.

Regardless of what the CBO or beltway mainstream may say, being "revenue neutral" and saving the Federal government money is not the most important goal of health care reform.

We do need to control costs, but it is overall total costs that are what really count.

And, we also need to provide coverage that is truly Universal for all people, Comprehensive in covering all health needs, and does not bankrupt you if you get sick.

Single payer takes on access to health care coverage as a national responsibility, paid for by federal taxes, but reducing direct and total costs to states, local governments and for individuals and families. And as noted, they are the only plans that make a significant overall cost reduction and control. And they are the only plans that actually result in coverage for everybody!

Of course, worst of all, essentially fraudulent nonsense, are the Republican plans (Enzi and Burr and Cantor) that provided minimal addition coverage, while giving tax payer money away to line the pockets of the for-profit private insurance companies even more than now.