crossposted from Voices on the Square

I have talked about the broader economic/historic and political/ethical dimensions of Consol Bonds, but this diary is simply about how a certain type of Consol Bonds can be used to avoid default.

I have talked about the broader economic/historic and political/ethical dimensions of Consol Bonds, but this diary is simply about how a certain type of Consol Bonds can be used to avoid default.

What do I mean by "Fixed Interest Payment" Consol Bonds? I mean a bond without a maturity date, that specifies the dollar amount to be paid as interest twice a year. These would be sold on the open market, just as we sell ordinary 10yr bonds. Since the dollar value of the interest payment is specified, and there is no maturity date, no Face Value is required, and so no Face Value is specified.

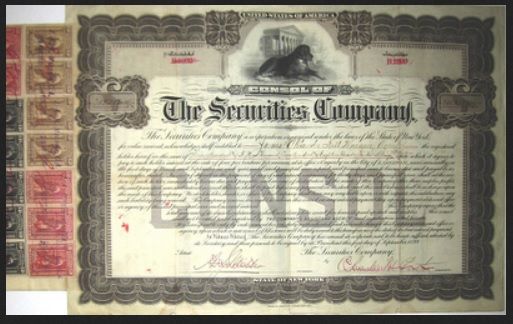

Consol Bonds are actually a quite old-fashioned type of bond, widely covered in elementary financial mathematics because of their simplicity.

The point of a Consol Bond was that there is no maturity date. Instead, the government just pays the interest, and if they want to retire the debt, they buy the Consol Bond back from the open market. "Consol" stands for "Consolidated", since they were originally used by the British, starting in Colonial Days before the French and Indian war to "consolidate" a number of different bonds with different maturity dates.

Crafting A Security To Avoid The Debt Ceiling

Why "Fixed Interest Payment"? Formally, the original Consol Bonds had a face value and an interest rate, but since they have no maturity date, the Face Value is only used to compute the interest payment. So if a Consol Bond cuts to the chase and specifies a Dollar Value Interest Payment, then there is no need for a Face Value at all.

The thing to understand here is that the "debt ceiling" is legally defined based on:

(1) The face value of bonds sold at a discount and redeemable on demand. (section [a] of the relevant legislation)

(2) The purchase price paid by the general public on original issue, plus interest earning since issue, for bonds sold at a discount and not redeemable on demand (section [c] of the relevant legislation)

(3) For all other bonds with interest and face value guaranteed by the government, the face value of the bonds (section [b] of the relevant legislation).

"Selling at a discount" means that the government sells a bond below its face value, and then part of the actual interest earnings on the bond is the difference between original purchase price and face value.

Fixed Interest Payment Consol bonds would have a Face Value of Nothing, so they would always sell at a premium basis, and never sell at a discount basis, so they would clearly always be counted at Face Value.

And since they have no Face Value they would not add to the amount limited by the debt ceiling law.

Fixed Interest Payment Consol Bonds Are Not Cost-Free

Yes, this is a loophole. And the reason that the loophole exists is that the market interest rate for the Consol Bond will clearly be higher than the market interest rate for 10yr bonds. Reliance on Consol Bonds means a higher interest expense, and a larger deficit. That's why we were not using Consol Bonds when the Debt Ceiling legislation was written, and why nothing was included in the legislation to take them into account.

Now, it would be better to raise the debt ceiling. That would save on total interest payments.

But there is no need to default.

Any claim that the debt ceiling requires the government to default is simply false. It requires ignoring the fact that issue of Fixed Interest Payment Consol Bonds is not restricted by the Debt Ceiling legislation as it currently stands.