Housing has been deteriorating for the last two years. News from yesterday indicates the market stands a very good chance of getting worse.

From the WSJ:

Among the latest trouble signals, the number of American homes entering foreclosure rose to the highest level on record in the fourth quarter of 2007. Meanwhile, homeowners' share of the equity in their homes fell to a post-World War II low.

Let's think about those facts for a minute.

1.) Foreclosures are at a record high. More Americans are defaulting on their loans at the highest rate ever recorded. That is not a good sign. And that number stands a good possibility of getting worse.

Economy.com estimates 8.8 million homeowners, or about 10 percent of homes, will have zero or negative equity by the end of the month. Even more disturbing, about 13.8 million households will be "upside down" if prices fall 20 percent from their peak. The latest Standard & Poor's/Case-Shiller index showed U.S. home prices plunging 8.9 percent in the final quarter of 2007 compared with a year earlier.

Currently, the situation is already terrible:

According to the Mortgage Bankers Association, more than 2% of the nation's about 46 million mortgage loans were in the foreclosure process in the fourth quarter, and 0.83% of loans entered the process. Both figures are the highest since the industry group started keeping track in 1972.

2.) Homeowners equity is at the lowest level in the post-WWII era. That means banks and financing companies now own more of the US housing market than private individuals.

And this has led to a decline in individual net worth:

The total wealth of American households slipped about $533 billion to $57.7 trillion in the fourth quarter, the first drop since 2002, the Fed said. Central to the decline: The value of housing-related assets -- including those that are mortgaged -- fell by $170 billion to $20.2 trillion while the value of other financial assets, such as stocks, dropped by $254 billion to $45.3 trillion.

The Fed uses a home-price index compiled by the Office of Federal Housing Enterprise Oversight that some critics say understates the drop in home values. Using the popular S&P/Case-Shiller index of home prices, total household wealth would have dropped by $1.4 trillion during the quarter, said J.P. Morgan's Mr. Feroli.

According to the Mortgage Bankers Association, more than 2% of the nation's about 46 million mortgage loans were in the foreclosure process in the fourth quarter, and 0.83% of loans entered the process. Both figures are the highest since the industry group started keeping track in 1972.

This is what happens when you base your economy on record low interest rates leading to speculative excesses. As the asset's increase in price everybody is fat and happy. But when prices fall, you have problems. Big problems.

And the problems are starting to spread into other areas to the economy.

Officials in Vallejo, California hammered out a financial agreement late on Thursday with police and fire-fighters that may allow the cash-strapped former Navy town to avoid becoming the first sizeable city in the state to file for bankruptcy.

Why was this California city on the verge of bankruptcy? Like many municipalities, they rely on property taxes for their financing.

Blue-collar Vallejo's economy long relied on the U.S. Navy's neighboring Mare Island shipyard. When the Navy closed the base in the mid-1990s, Vallejo became a bedroom community.

Property taxes were healthy when California's housing market was running hot earlier this decade, but recently those revenues have been on the slide along with demand for housing.

Vallejo, with a population of roughly 130,000, now is in one of the region's hardest hit housing markets. Like other markets where home purchases were financed with risky mortgages in recent years, foreclosures are on the rise.

This Vallejo is alone? Think again.

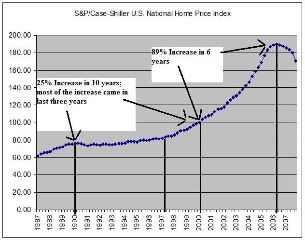

So -- will this problem end soon? Very doubtful. Here is a chart of home prices according to the Case Shiller home price index.

\

\

Notice that in the 1990s -- which was a healthy economic expansion -- home prices increased about 10-20%. This occurred primarily in the last three years of the expansion. During this expansion, prices increased 80% nationally. Also note that aside from record low interest rates, there was nothing different about this expansion that would warrant a price increase of that magnitude. Now, prices are just starting to fall.

This won't end soon.

Update [2008-3-7 7:42:39 by bonddad]:: From IBD:

The share of delinquent mortgages rose to 5.82%, the most since 1985. Payments at least 30 days overdue are deemed delinquent.