Doom sells. When someone says "the sky is falling" it's easy to say "yes it is -- and we're all just plain going to hell." However, the data points of the last 3-4 months indicate the economy is bottoming. In addition, the leading economic indicators tell us the possibility of recovery is very high. Let's look at what the data says.

Let's start with the index of leading economic indicators:

The Conference Board LEI for the U.S. increased sharply for the second consecutive month in May. In addition, the strengths among its components continued to exceed the weaknesses this month. Vendor performance, the interest rate spread, real money supply, stock prices, consumer expectations, and building permits contributed positively to the index, more than offsetting the negative contributions from weekly hours and initial unemployment claims. The index rose 1.2 percent (a 2.4 percent annual rate) between November 2008 and May 2009, the first time the index has increased over a six-month period since July 2007, and the strengths among the leading indicators have become balanced with the weaknesses during this period.

Two months in a row of extremely strong readings is extremely important as it indicates there are strong currents of recovery in the making.

UPDATE: New Deal democrat here. Bonddad has allowed me to add to the content of his diary with more information about the Leading Economic Indicators.

Here is how the LEI look on a year-over-year basis:

The LEI, in blue, show a definitive upturn in the last two months, while the coincident indicators, in yellow, show that we are currently still declining.

The confirming turn up of LEI in May has moved both the 3 and 6 month trend of the LEI to positive territory. This is a Big Deal. Here is a graph, showing that since WW2, every time there has been a significant (~2%) turn up in the 3 month average of the LEI, a recovery (in the sense of +GDP growth) has started immediately. On a 3 month basis, LEI are now up exactly 2%.

Another way of measuring is to look at a "diffusion index" of the LEI (as in, how many of the 10 are positive, and how many are negative). Every time 9 of the 10 indicators have been positive as measured over 6 months, a recovery has begun.

With the last two months, already 5 of 10 of the indicators have moved into the positive category. Another couple of months of positive LEI readings will meet the 9 in 10 standard.

{N.B. Both of the above graphs are slightly dated and so don't show the recent upturn -- NDD}

The improvement has been such that the Economic Cycle Research Institute reported this past week that

A gauge of future U.S. economic growth rose, and its yearly growth rate turned positive, raising hopes that the end of the recession is in sight, .... [EFRI's] Weekly Leading Index rose to a 37-week high of 117.6 for the week ending June 19, from a downwardly revised 117.0 the previous week.

The index's annualized growth rate spiked to a 97-week high of 2.1 percent from minus 0.6 percent a week ago.

It was ECRI's highest yearly growth reading since the week ended August 10, 2007, when it stood at 3.4 percent.

"Following a 28-week upturn, WLI growth has broken into positive territory for the first time in over 22 months -- an affirmation that an end to the recession is at hand," said Lakshman Achuthan, managing director at ECRI

The ECRI weekly leading index is over 100 years old -- meaning its data covers the Great Depression. Whenever the weekly leading index and the long leading index are both improving, over that entire history, an improvement in GDP has always followed shortly.

I remain concerned about working hours, which will be reported Thursday July 2. If they stabilize or improve, that will be enough for me to go on record predicting that the Recession will have bottomed out by Labor Day, give or take 2 months.

OK, back to Bonddad ...

-------

Then there was the news from the Census Bureau regarding durable goods:

New orders for manufactured durable goods in May increased $2.8 billion or 1.8 percent to $163.9 billion, the U.S. Census Bureau announced today. This was the third increase in the last four months and followed a 1.8 percent April increase. Excluding transportation, new orders increased 1.1 percent. Excluding defense, new orders also increased 1.4 percent.

This jibes with the news from several Federal Reserve districts regarding manufacturing. The New York Index has rebounded:

The general business conditions index fell several points from last month’s level, dropping to (-9.4), but remained well above the string of deeply negative readings observed in the October-March period. This month, 28 percent of respondents reported that conditions had improved, compared with 23 percent last month, while 38 percent of respondents reported that conditions had worsened, up from 28 percent. After rising above zero last month, the shipments index retreated to )-4.8). The unfilled orders index, at (-10.3), was little changed. The delivery time index rose a few points to (-10.3), and the inventories index fell to -25.3.

As has the Philadelphia Index:

Declines in the region's manufacturing sector were much less in evidence in June, according to results for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments showed notable improvement, suggesting recent declines have lessened dramatically. Indicative of ongoing weakness, however, firms reported sustained declines in employment and work hours this month. Most of the survey's broad indicators of future activity showed continued improvement, suggesting that the region's manufacturing executives are becoming more optimistic that a recovery in business will occur over the next six months.

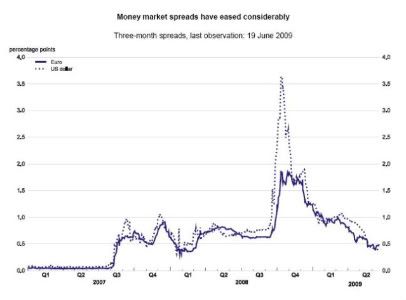

And credit spreads have dropped to low levels, indicating the problems associated with the credit markets are easing:

And the ISM manufacturing index is clearly rebounding:

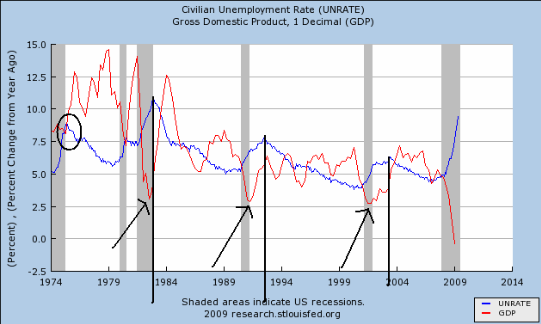

Now -- a word about employment. The unemployment rate is a lagging indicator. This means it drops after GDP starts to increase. Here is a graph from the St. Louis Federal Reserve that shows the relationship.

This graph plots the year over year percentage change in GDP with the unemployment rate. Notice that in each of the last three expansions the year over year percentage change in GDP started to increase before the unemployment rate went down. In other words, we have to have an increasing year over year percentage change in GDP before we can even think about talking about an improving unemployment picture. Put another way, using the unemployment rate before looking at the percentage change in GDP is putting the cart before the economic horse.

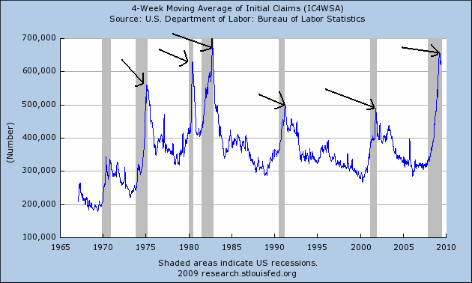

And speaking of employment, notice the the 4-week moving average of initial unemployment claims continues to drop:

The continuing improvement in this picture is incredibly important. As I have previously pointed out, the 4-week moving average of initial unemployment claims tops out right at or before the end of a recession:

Now -- let me add some caveats.

1.) I am NOT saying "isn't it wonderful that people are unemployed at high rates". I am also NOT SAYING "we shouldn't care about people who are unemployed." I am saying that the signs are there in more then a cursory fashion that the economy is bottoming and we will start to see positive GDP growth soon.

2.) Positive GDP growth is a prerequisite to employment growth. For those of you who disagree, please show me a time when a country had negative GDP growth and positive employment growth.

3.) Recovery comes in stages. There is no way we are going to wake up tomorrow and say "gee, isn't it wonderful having 4% GDP growth!" It is going to take considerable time for the economy to heal. A good analogy is it is impossible to turn around a battleship on a moments notice.

4.) However, the cumulative total of all the indicators says the economy is clearly bottoming. Combine that with a massive fiscal and monetary stimulus and the possibility of positive GDP growth is incredibly high.

5.) I have repeatedly stated I do not think the recovery will be robust. In fact, I think we'll be stuck in a 1%-2% growth rate with high unemployment for at least another year and a half or longer.