Gloom and doom is the way of blogs lately. Nothing is good; everything is bad. Unfortunately, lost in this translation is a set of monthly trends that shows the worse is over. Now -- this does not mean everything is roses. Far from it. As I have mentioned in the past the recovery will be weak with slow growth and high (7%-8% minimum) unemployment for the better part of a year. But the data indicates the worst is behind us.

Before I begin, let me make a few observations.

1.) There are two predominant ways to present economic data: year over year and month over month. Year over year removes seasonality. Here's an illustration. Suppose you are looking at the retail sector's employment trends starting in September and you see in increase in hiring. A logical conclusion is things are looking up because companies are hiring more. However, this excludes the possibility of a seasonal effect; namely that retail typically hires more people as the holiday season approaches. As a result, it's better to compare this September to last September -- this removes "seasonality" from the equation.

However, month over month has value as well -- especially when the economy is at a turning point. While the current year over year data is terrible, the current month to month data shows an extended (as in more than a few months) period of stabilization. This tells us the worst is over.

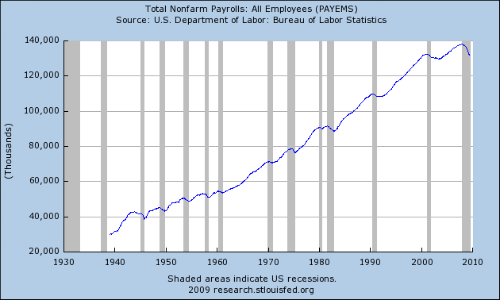

2.) There's been a great deal of debate about employment centered on whether or not the unemployment rate a leading or coincident indicator. As I demonstrate in this article in all expansions save one since WWII the year over year percentage change in GDP has increased before the unemployment rate has dropped. While the past is not a guarantee of future performance, that's one heck of a track record for an economic indicator. In short, the unemployment rate lags GDP growth over 80% of the time. The rate of establishment job growth is thought of as a coincident indicator -- that is the number of people on payrolls increases and decreases with overall economic growth. However, this number has developed a lagging quality over the last few expansions meaning the recession could technically end and we could still experience job losses. Take a look at this chart which shows the increasing lag time for establishment job growth:

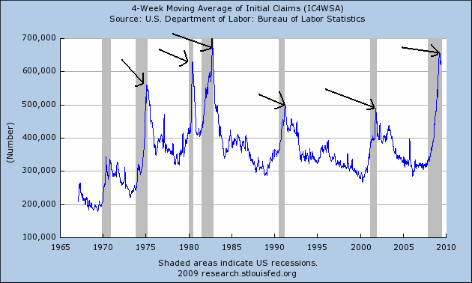

If you want a reliable series of employment indicators, look at the 4-week moving average of initial unemployment claims which typically peaks right at or slightly before the end of a recession:

(This is another reason I believe the recession is technically nearing the end; the 4-week moving average of initial unemployment claims has been dropping for several months)

What appears to be happening overall is the following: companies are still letting people go at the "traditional" time in the cycle. However, they are waiting longer before they start to rehire people.

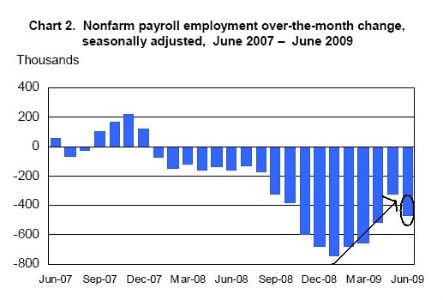

While we're on the topic of employment, let's take a look at the latest jobs report because an important fact was overlooked:

We'd had four straight months of better and better employment reports -- reports that showed the rate of job loss was decreasing. That makes the latest jobs report an outlier in the series. Combine that fact with the following points:

The Challenger Job Cut Survey is clearly improving and

The seasonally-adjusted number of mass lay-offs spiked, fell and moved a bit higher but is still far lower than before

you get an improving jobs situation.

Let me add one more point: I am not saying it's wonderful that people are out of work, or that we shouldn't increase the length of time people are on unemployment insurance or anything remotely or even non-remotely related to that. What I am saying is the statistical series are improving.

Now, let's look at some other important numbers.

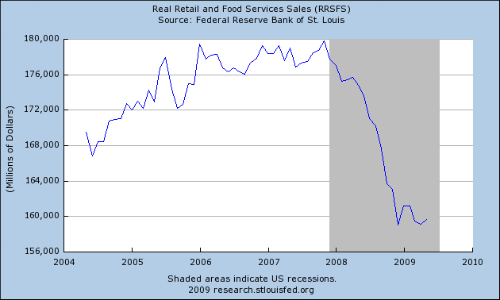

Real (inflation adjusted) retail sales have bottomed as have

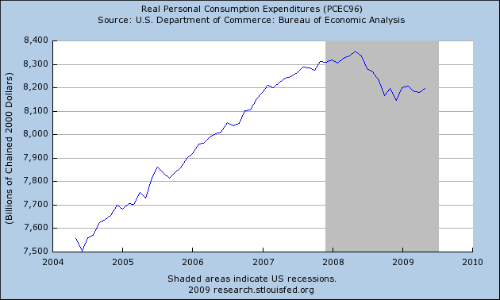

Real (inflation-adjusted) personal consumption expenditures. In addition

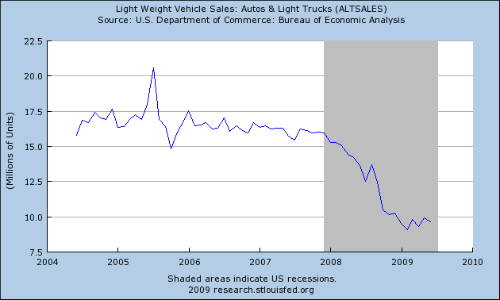

auto sales have bottomed.

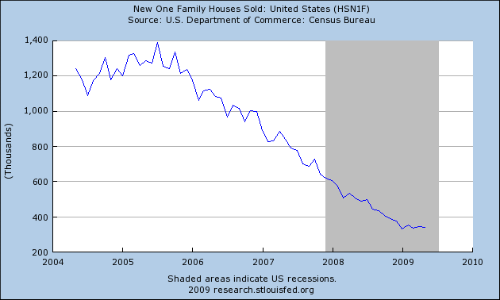

And maybe new home sales have as well.

But that's not all.

The ISM manufacturing index has been increasing in clear upward trend as has the

ISM non-manufacturing index. In addition

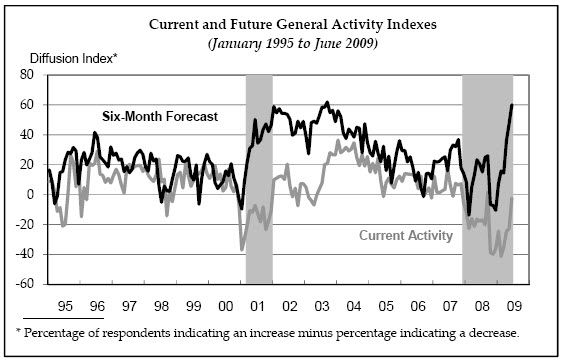

The Philly Fed and

New York Federal Reserve index of regional manufacturing has improved.

The bottom line is there are a ton of indicators saying the worst is over. Now -- this does not mean we have clear skies ahead because nothing could be farther from the truth. There are huge challenges. But, all signs are the worst is over.