I don't believe there is any investment, outside of a mania, that elicits more emotion, both positive and negative, than gold. People love it or hate it, there isn't much in between. It's because of these strong emotions that there is so many misconceptions about the yellow metal. Emotions tend to cloud normally reasonable minds to the point that they miss either opportunities or dangers.

Which brings us the current bull market in gold. What does gold hitting all-time record highs mean? To answer that you must brush away the myths and misunderstandings of what gold is and why someone would purchase it.

I am going to attempt to do that.

Gold is a Bubble?

You hear that a lot these days. People, nearly all of whom failed to anticipate gold's rise, say things like this.

"Pick a number, [Gold] will continue to go up until it stops... It is a bubble. To say otherwise would be naive, that's really what it is."

Accusations that gold is in a bubble don't make it so. For example, I found this prediction of the gold bubble bursting from December 2005. The price of gold has more than doubled since then. A simple Google search will turn up multiple declarations of correctly predicting the bursting of the gold bubble every time the gold price temporarily corrects.

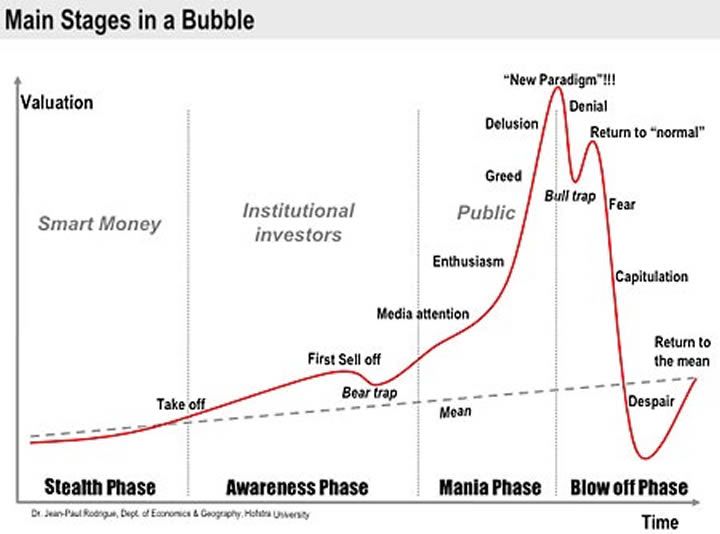

So you have to ask yourself, what is a bubble? After two economic bubbles in a decade, people should be able to identify them by now. The most obvious condition of a bubble is that everyone is participating that can participate. Remember how everyone you knew that could afford a home in 2006 was already a homeowner? Sometimes they were flipping houses. It seemed like everyone was talking about rising home prices, and how the price never seemed to go down.

Now ask yourself, do you know anyone that owns gold bullion? The answer to that probably is "no".

Gold, a silly artifact to many investors in the 1990s, has become the great "if only" investment: "If only I'd bought it nine years ago, or four years ago, or six months ago."

But even now there are plenty of people who can't bring themselves to consider gold as an investment.

Can you honestly say that an investment that "plenty of people can't bring themselves to consider" is some sort of speculative mania? There is no mania here. The general public has sat this one out. Most people don't even know how to buy gold.

Some point towards all the cash4gold commercials you see on TV as an indication of a gold bubble. In fact it shows the opposite. If gold was in a mania then the commercials would be gold4cash - they would want to be selling you gold, not buying it from you. The idea of a bubble is to find the bigger fool to sell an overpriced asset to, not to accumulate the asset.

What is gold?

"In truth, the gold standard is already a barbarous relic."

- John Maynard Keynes

So why buy gold at all? What is its purpose? It is this question that is the most controversial and causes the most misunderstandings. Here is the simple answer:

Gold is money.

This statement always brings out outraged gold-haters. "You can't buy groceries with it," they shout. This point, while seemingly obvious, isn't as correct as they would lend you to believe.

For starters, I have to ask when is the last time they went to a grocery store? If they did they would notice very few people paying for groceries with paper money. Instead you see them using little pieces of plastic to pay. Are those little pieces of plastic money? No. The credit and debit cards represent money. The actual money is sitting in the bank vaults.

Are bank vaults brimming with paper money? No. They are filled with mortgage-backed securities, treasury bills, and gold.

That's right, gold. The largest hoarders of gold in the world are the many central banks. They don't own the gold because it is pretty to look at. The only things they put in their vaults is money.

Where people get confused is the difference between currency and money. Currency is only one element of what is considered the money supply. If you asked 10 different economists what is money, you would probably get 10 different definitions. That's why every nation has multiple official ways to measure how much money is in the economy.

"If anything had or could have a value equal to gold and silver, it would require no tender law; and if it had not that value it ought not to have such a law; and, therefore, all tender laws are tyrannical and unjust and calculated to support fraud and oppression."

- Thomas Paine, 1786

If you check up on gold in the financial pages you will most likely see it included in commodity prices. It is, after all a metal you mine from the earth like zinc and copper, and is subject to the laws of supply and demand like oil and wheat.

But that's where the comparisons to other commodities end. Gold has almost no uses as a commodity.

gold has no intrinsic value as a consumption good or a producer good, it is an example of what I call a fiat (physical) commodity...

Since gold is a fiat commodity currency, its value will be determined largely by its attractiveness relative to other fiat currencies - the fiat paper currencies issued by central banks. Gold should not be analysed as one of a set of intrinsically valuable commodities (silver, iron, lead, zinc, platinum, aluminium, titanium etc. etc.) but as part of a set of intrinsically useless and valueless fiat currencies - the US dollar, the yen, the yuan, the euro, sterling, the rupee, the rouble etc. etc.). It is therefore in times that market participants are nervous about the future value of most other fiat currencies, that gold will be at its most attractive.

The quote above makes several basic mistakes in its attempt to denounce gold. For instance, it confuses what the word "fiat" means. It also calls gold a "6,000 year bubble", which defies common sense in regards to what a mania is. However, the article does correctly identify gold's role in the world and why it is.

Unlike other commodities that get consumed, almost all the gold ever mined is still in existence. Unlike oil, gold doesn't get used up in production. Unlike copper, gold doesn't rust. Unlike wheat, gold isn't eaten. Gold just sits there retaining its value.

The only realistic purpose for gold is to be used as money, just like it has been for 6,000 years. It's value being determined by the laws of supply and demand, just like fiat currencies.

Unlike paper currencies, the supply of gold can only be expanded by about 2% a year. Thus the same amount of gold it took to buy a loaf of bread during Babylonian days is about the same amount of gold is takes to buy a loaf of bread today. The price of gold may vary a great deal depending on the supply of paper money out there, but the supply of gold is constant (with the loan exception of the conquest of the New World in the 16th Century).

One other thing I should mention. As for using gold to buy groceries, it turns out that you can do it. With Goldmoney.com you can get a debit card issued to you and use it at the grocery store to buy your weekly groceries just like everyone else. The difference is that instead of debt instruments representing your money, you would have your own gold and silver sitting in a vault.

I personally don't do this, nor am I incline to for personal reasons, but I thought I should mention it.

So why buy gold?

Imagine for a moment that there is an asset that has gone up in dollar value every single year for eight straight years, is about to have one of its best years in 2009, and is the best performing asset class of the decade.

Imagine that this asset has been going up in value in every currency in the world over the last five years.

Imagine that worldwide demand for it is hitting all-time records while outstripping supply. At the same time worldwide production of it has fallen 10% over the same period.

Imagine that worldwide government selling of this asset has turned into worldwide government buying of this asset for the first time in over 40 years.

Imagine that all the major commercial producers of this asset are positioning themselves for years of rising prices.

If I told you that this asset was widgets, or oil, or even pet rocks, you would probably be rushing out to buy some in order to ride this bull market. That's what everyone did with dot-com stocks and real estate.

Now imagine that professional investment advisers on Wall Street, who wouldn't hesitate to sell you black-market kidneys and weapons of mass destruction, if it were legal and they could make a profit on it, have universal disdain for this asset.

Imagine that if you mentioned buying this asset at a neighborhood party someone would be sure to think you are a kook.

Doesn't it make you wonder what is wrong with this picture? Why would people, who bought houses in the middle of the desert that they never intended to live in, or dot-com stocks from companies without a business plan, frown on any investment that is making money?

The common refrain by Wall Street is that gold's only use is as a hedge against inflation. Since inflation expectations are currently low, it doesn't make much sense at the moment to buy gold. They like to point out how gold peaked in 1980 at $850 an ounce, when inflation was high, and has been an incredibly poor investment since then...if you ignore the last decade.

What Wall Street never does is explain the reasoning for this link between gold and inflation. If you examined the statement you would find it is without foundation.

Gold isn't an inflation hedge. Gold is a currency hedge. The reason why Wall Street gets this wrong is because they still think of gold as a commodity, not as money.

Inflation is a common symptom of a weak currency, but it isn't the only symptom, nor is it a required symptom.

The most important reason why gold prices are at a lifetime high today (gold has already sailed past its previous all-time high of $1,030/ounce hit in March 2008) has to do with the sliding value of the US dollar against other leading currencies...

For many years now, surplus liquidity from all over the world has flowed into dollar-denominated assets — the currency itself, US government bonds and American money market funds. However, the steadily sliding value of the US dollar in recent times, coupled with the country’s economic troubles, has stoked fears that the dollar could be in a terminal decline.

Those fears have prompted a whole host of global investors, the central banks of many nations included, to look for alternative "safe havens" to park their funds in.

Gold, once the standard on which all paper money was based, currently appears to be the haven of choice.

While the People’s Bank of China admitted to progressively adding to its gold reserves in April this year, India’s own Reserve Bank of India has recently bought a whopping 200 tonnes of gold from the International Monetary Fund to buttress its gold reserves.

It isn't just central banks recently looking to diversify their money reserves. Private investors have been doing this for years.

Another myth that Wall Street tries to imply is that the people who own gold all bought it at the top in 1980. The chart above shows how an increasing percentage of gold investors bought gold recently, and thus are sitting on healthy profits.

What's more, the price of gold was only above $800 for all of three trading days in 1980, so hardly anyone even had the opportunity to buy at the top. It was a parabolic spike that saw its price go up nearly four-fold in the space of just 13 months.

Now compare that to today's gold market, where it hasn't gone up by more than 23% in any one year. Based on that, does today's gold market look more like a bubble or a bull market?

Has too much money already gone into the gold sector? Why is gold going up now?

Gold is going up now for a very simple reason: governments all over the world are printing massive amounts of it in order to fight the global recession. It's really not very hard to figure out. When you create a massive supply of something out of thin air you cheapen the value of it.

So what does record high prices in gold mean? It means that faith in paper currencies, the dollar in particular, are at record lows. Gold's function in today's world is to be the canary in the coal mine. It is simply doing what it is supposed to be doing. Nothing more.

Is now a good time to buy gold? Not if you are looking to make a quick killing like the house flippers were in 2006. This is a bull market, not a bubble market. Vicious price corrections could happen at any time without notice.

Will gold go down one day? Yes, when interest rates and government deficits return to historic norms. When it finally does happen the price of gold will probably drop a great deal, but that isn't going to happen any time soon.

Will gold ever be considered a bubble? Yes, if the public starts to participate. Any bull market, once it goes on long enough, can become a bubble. When your neighbors and coworkers start recommending gold mining stock to you, or start bragging about how much their bullion has appreciated in value, then you should start selling.

Could the gold bull market top already be in, and it will do nothing but fall from here? Anything is possible. Our paper dollars could become the most valuable assets on the face of the Earth tomorrow. But I prefer to look at what is likely to happen.

One last point worth addressing is the opinion that people only buy gold in the case of the apocalypse. In that scenario it makes more sense to buy canned food and shotguns instead of gold.

This idea has no basis in history. When the currencies melted down in Argentina, Zimbabwe, and Weimar Germany it wasn't the apocalypse, but people that owned gold retained their savings. You can still buy canned food and shotguns if you want, but they aren't a good investment for any likely scenario to come.