In a recent article in the New Yorker, economist James Surowiecki argued that

it doesn’t matter if blame for a poor economy might plausibly be laid on a previous Administration: it’s the party in charge that voters hold responsible. In other words, if the economy is bad on Election Day, blaming George Bush probably won’t work. "The old party gets credit or blame for the first year, and then it’s the new party’s economy," Larry Bartels, a political scientist at Princeton, says. "By November, it will be the Democrats’ economy."

It's a commonplace that elections are referendums on the state of the economy. In fact, research has shown that the saying that "people vote their wallets" is very close to the truth. Although it appears that the economic recovery has hit a rough patch, I will show that measured in both jobs and more importantly income -- with an unlikely backhand assist from the price of gasoline at the pump -- people "voting their wallets" are more likely to vote for Democrats this November than generally expected.

From the New York Times to Democratic pollster Tom Schaller to Open Left's Paul Rosenberg, the inevitability of a GOP "wave" election destroying the Democratic majority in Congress in November has come into serious doubt. In this diary I am going to show you how jobs and, even more importantly, income growth, support their skepticism.

With the election less than 6 months away, we can begin to see the outlines of how the economy might look by that time. Strong job growth in the coming 4-6 months still looks very likely. Income growth is likely to happen too. The price of gasoline looks likely to be lower than it has been in the last few months, thus giving average Americans more money to spend on other things. These three things will improve the outlook for most Americans, and so in turn Democrats may indeed receive a boost from the economic recovery come November.

The James Surowiecki article cited above argues:

[T]he high unemployment rate may be less important politically than you’d think. Seth Masket, a political scientist at the University of Denver, has found that, in midterm elections since 1950, there’s been no correlation between the unemployment rate and election outcomes. The key economic variable for voters, other studies show, has been income growth, or, more specifically, how fast per-capita G.D.P. is rising. In other words, if income growth is brisk enough, Democrats should benefit at the polls

...

Bartels, in his book "Unequal Democracy," points out a strong correlation between voting in Presidential elections and income growth during election years, rather than income growth over the full length of a Presidency. Indeed, he narrows it down further: the second and third quarters of the election year seem to matter most. Since the second quarter started just last week, there’s time for moods to brighten substantially by Election Day. Some have argued that an economic rebound won’t matter this year, because things have been so awful that normal growth won’t feel like progress. But, as Sides says, "it doesn’t seem that economic growth matters less when you’re digging out of a crisis. What voters look at is whether things are getting better or worse."

Let's start with Jobs.

Although Surowiecki tells us that income, rather than unemployment, is the crucial metric, let's start with jobs, to reiterate the proven record of real retail sales as a leading indicator.

As I have discussed in a number of previous diaries, real retail sales (that is, retail sales adjusted for inflation) are the "Holy Grail" of Leading Indicators for job growth. Based on that , a little over a month ago, I wrote that Strong Job Growth Looks Likely for the Rest of 2010. This was based on the fact that 70% of the economy is consumers, and consumers were buying things at a better rate than they had since well before the Recession.

I'll spare you reposting all the graphs, but if you click through on either of the two links above you will see that I showed this very consistent relationship going back 65 years through every recession, recovery, and expansion. Real retail sales have consistently turned at both tops and bottoms, an average of 3-5 months before job growth or losses turned. In the case of the "Great Recession", real retail sales, smoothed on a 3 month basis, bottomed 8 months before jobs bottomed, longer than usual but not nearly with so much a lag as in the 2002-03 "jobless recovery."

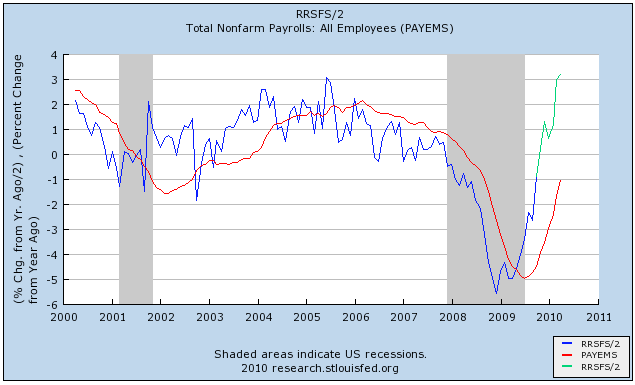

Another way of looking at the same statistics is that, in percentage terms, real retail sales had their worst YoY decline in December 2008. Payrolls had their worst YoY percentage decline 6 months later, in June 2009. In the months since June, the YoY percentage of job losses/gains has continued to lag the YoY percentage losses/gains of retail sales by a median 6 months. Here's a graph showing YoY percentage change in jobs (red, through April 2010), and real retail sales (blue, up until October 2009), showing that both are at the same YoY percentage change. The last six months of real retail sales are shown in green:

If job growth was to continue for the next six months at the same rate as real retail sales have in the last six months, there would be at least 2% YoY job growth in October, which translates into 2 million new jobs in the the 6 months before the November election! But let's be conservative, and figure that, while this consumer recovery will be more muted than that. Real retail sales imply that we will see Job growth of at least 165,000 a month, but even 250,000+ a month average job growth for the rest of this year looks doable.

In short, there is every reason to believe that job growth will be an issue favorable to Democrats rather than the GOP by election day.

Now Let's turn to Income

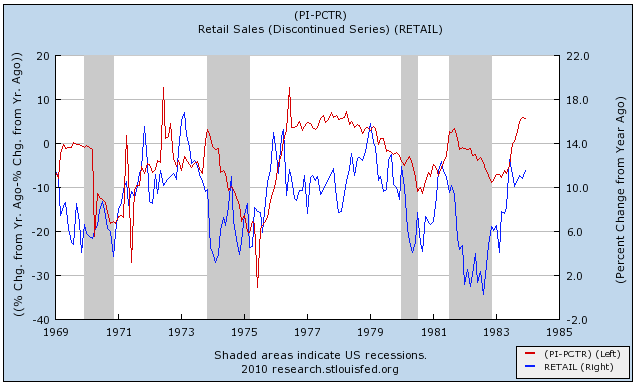

While we won't know anything about 2nd quarter GDP for another two months, and of course the third quarter hasn't even started, we can make an informed estimate about what will happen with personal income. As it turns out, while not so perfect a correlation, real retail sales also lead personal income by several months. To show you, I've graphed YoY real retail sales (in blue) and compared them with YoY personal income (red) going back to 1970. The data is much more noisy but it is still true that real retail sales (blue) tend to lead personal income (red):

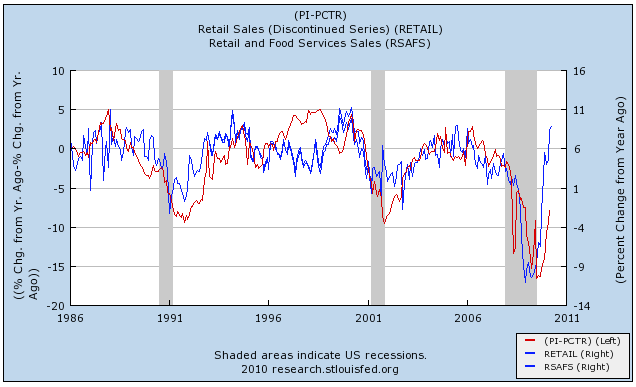

Now, here is the same graph for the last 25 years up until the present, showing that the relationship still holds:

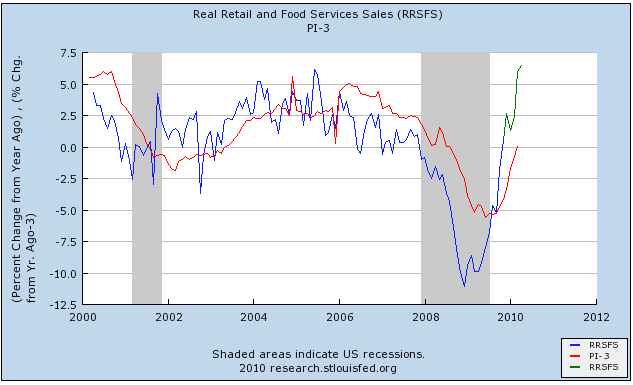

Here is a close-up, showing the last ten years, and the last 5 months of real retail sales in green:

Once again, it looks quite likely that income is going to follow consumer spending upward in the next few months - just when it will give Democrats the biggest boost.

How the price of Oil - the 'Joker in the Deck' may wind up helping Democrats

But there are significant threats to the recovery going forward. Before we give any sigh of relief for Democrats (and Americans), we need to take a look at them.

To begin with, for the first time in over a year, the index of Leading Economic Indicators went down slightly in April. Given the stock market swoon since then, it is very likely that there will be another, stronger down move in the LEI for May. The primary reason most have given for the downturn in the stock market has been the woes of the Euro zone. There is no doubt, as I wrote about at length last week, that a big downdraft in Europe could have repercussions here. Beyond that, more basically, the truth is that Income Stagnation is the greatest threat to the Recovery.

The American middle/working classes have been relentlessly squeezed by stagnating incomes since the 1970s. When consumers have been unable to do either finance debt at lower rates, or cash in appreciating assets, they cut back on spending, triggering recessions.

Last year, because we actually underwent a significant deflation, especially in Oil prices, the 85%-90% of Americans who were employed (depending on how you count unemployment), had more disposable income to spend. And they had also saved up nearly $500 billion at the same time., both of which gave a real boost to the economy at the bottom of the recession.

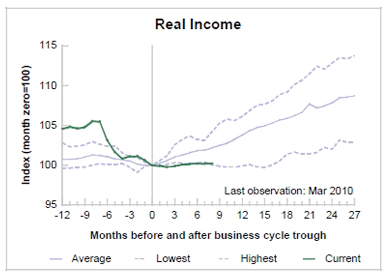

But while all the other indicators of recovery have turned positive -- including, in the last few months, jobs -- real income is still limping along the bottom:

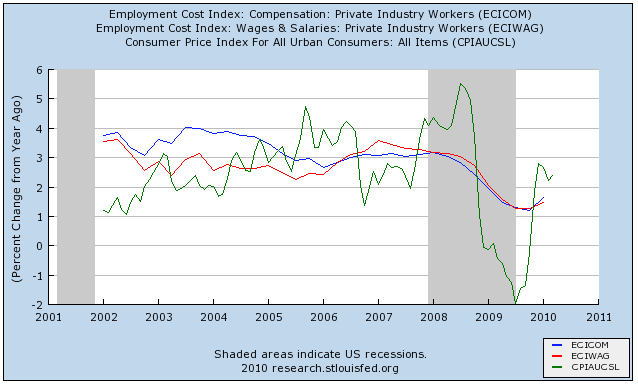

Because of this, the economic recovery is in a very tight spot -- precisely because average American consumers also remain in a very tight spot, as this graph, showing median wage and benefit growth (blue and red) compared with inflation (green) shows:

With wage growth of about 1.5% for the last year. even 2% inflation is too much for them to withstand -- without the ability to refinance debt, their disposable income simply isn't keeping up.

And that is where Oil comes in.

Prof. James Hamilton recently updated his forecast of Oil's impact on the economy.

Prof. Hamilton has previously noted that past Oil shocks (pdf) reached the point of maximum statistical impact on consumer behavior 12 months after the shock. Secondly, "eventually [consumers] ... reduce[d] spending by 2.2%, ... much more than the shock itself."

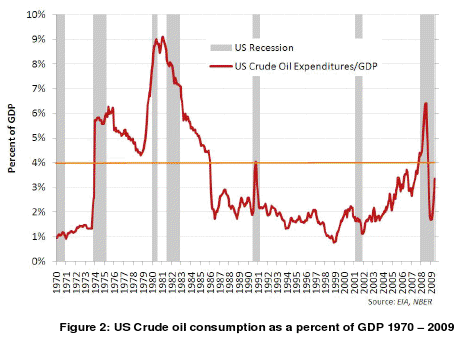

The same idea, that it is the shock of sudden price changes, as well as some threshold figure of consumer spending, has been posited by Oil analyst Steven Kopits, who in summary says that in the past, when the cost of Oil consumption has risen to 4% of GDP, which has also coincided with a spike in the price of Oil, there has always been a recession. Here are graph showing the two critical points. The first shows the corollation between Oil prices as a share of GDP and recession (through the end of last year):

Since then, Oil prices briefly grazed the 4% of GDP mark a couple of months ago.

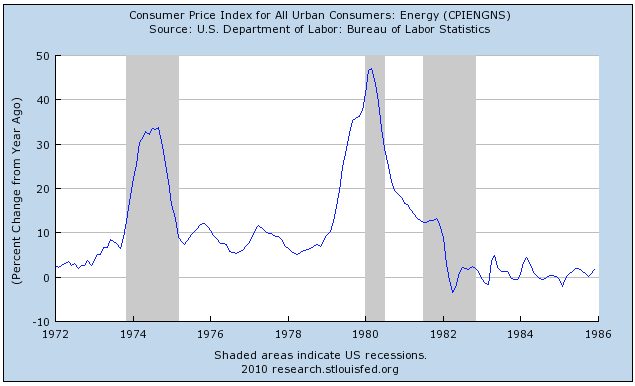

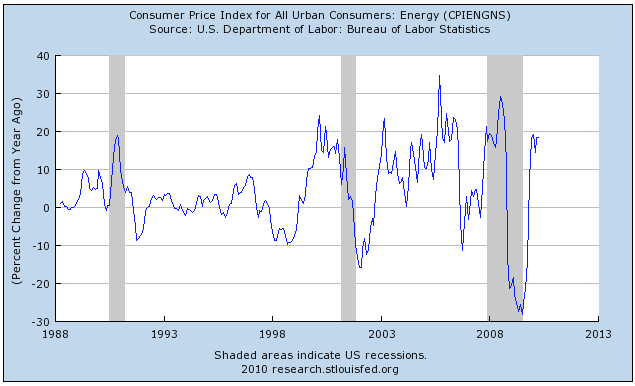

The second two graphs show inflation in energy costs, showing that recessions have typically required an spike in energy prices of at least 20% as an antecedant condition. First, here are the 1970s energy price shocks:

And here is YoY energy price inflation since the early 1980s:

Note that late last year energy inflation neared the 20% mark.

That brings us back to Prof. Hamilton's recent update. in which he said that:

With gas prices now about a dollar per gallon higher than they were a year ago, that leaves consumers with $12 billion less to spend each month on other things than they had in January of 2009. On the other hand, the U.S. average gas price is still more than a dollar below its peak in July of 2008. Changes of this size can certainly provide a measurable drag or boost to consumer spending, but are not enough by themselves to cause a recession.

....

[W]ith retail gasoline prices still a dollar a gallon below what consumers have recently seen, I'm doubtful that gasoline prices have the ability to induce as much consumer anxiety as we observed two years ago.

The Euro Crisis means lower gasoline prices, and lower interest rates, for Americans

The crisis in the Euro zone has had two direct, immediate, and beneficial impacts on that equation: first, the price of Oil has fallen from almost $90 to below $70, which will be reflected shortly in decreases in the price of gasoline at the pump:

Secondly, the crisis in the European currency has driven large institutional investors to purchase US Treasury Bonds, driving the interest rate on a 10 year Treasury from 4% a couple of months ago, all the way down to 3.10% at one point last week. According to the Mortgage Bankers Association, that had a direct impact on mortgage rates, and refinancings:

The refinance share of mortgage activity increased to 68.1 percent of total applications from 57.7 percent the previous week. The adjustable-rate mortgage (ARM) share of activity remained constant at 6.3 percent of total applications from the previous week.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.96 percent, with points increasing to 1.08 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.19 percent from 4.32 percent, with points increasing to 1.36 from 0.81 (including the origination fee) for 80 percent LTV loans. This is the lowest 15-year contract interest rate ever recorded in the survey.

Finally, if the price of Oil continues to stabilize somewhere around $70, or falls even lower, within two months the YoY inflation rate will fall to about only 1%. That is because there was a big, +0.9% increase in inflation in June 2009 due to a surge in Oil prices then. Take that away, and replace it with a decline in the price of Oil, and suddenly the paltry 1.5%+ YoY wage growth discussed above is nevertheless significantly higher than the inflation rate. More specifically, the decline in the price of Oil will cause energy inflation to retreat far from the threshold 20% mark - and could hit 0% YoY in the next few months.

Thus,because of lower interest rates, and lower prices at the pump, the real, inflation adjusted disposable incomes of average Americans look likely to turn up exactly at the time when, according to Surowiecki's analysis, they will have the most beneficial consequences for Democrats.

In summary, Schaller and Rosenberg are onto something. Although there are certainly problems that could derail this analysis -- particularly if the Euro crisis gives rise to another September 2008 style "credit event" -- there are excellent reasons to believe that people who "vote their wallets" this November will be voting for Democrats more than the conventional wisdom believes.