400 Richest Americans Pay Only 18% Tax Rate

by Mark Berman, OpposingViews.com -- Jul 26, 2011

If politicians really want to dig their way out of this debt ceiling mess, they should look to the ridiculously low tax rate paid by the 400 richest Americans. On average their tax rate is 18%, Wall Street financier Steve Rattner said on MSNBC on Monday.

Forbes reports that the reason is because of the Bush tax cuts, which reduced the tax rate on capital gains and dividends to 15%.

Another expert said if those tax breaks and other loopholes were closed, the country would be fine. "If there is political will, the political parties can very easily find a Trillion dollars just in the tax code," said Ron Weiner, resident of RDM Financial Group.

Easy Money! Millions in fortunes -- Taxed at only 15% ...

larger {snicker, as if}

How large is your Effective Tax Rate, after your long days of toil?

Hint: It's a LOT more than 15% -- try nearly doubling that default Wall Street Welfare rate.

All About the Rich People

The top earners are willing to blow up the house rather than have Obama touch their golden goose, the capital gains tax.

by Brian Morton, CityPaper.com -- July 20, 2011

[...]

The dirty secret is that capital gains taxes -- taxes on “unearned wealth” -- are what allow people like Donald Trump to pay a lower tax rate than his maid or secretary. Right now the long-term rate on capital gains -- investments or assets that are held for more than a year -- are taxed at 15 percent, compared to the top income tax rate of 35 percent. And rather than accept everything that the president offered, which would be far more than they could ever get under a Republican president, the top earners are willing to blow up the house so he can’t touch their golden goose, the capital gains tax.

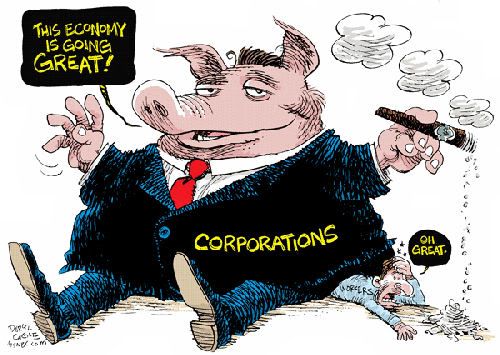

Who says the Wealthy don't benefit from Welfare? Wall Street Welfare.

Just try bumping their Tax Rate up to that of their Secretaries (around 30%)-- and see how quickly they jump on their Corporate Jets, and fly to Washington to read their Congressperson the Riot Act!

They won't have it -- anyone messing around with their Golden Goose.

NO WAY! No How! NO New Taxes!

The Secret Issue At The Heart Of the Budget Fight

by Jonathan Chait, tnr.com -- July 14, 2011

[...]

Obama's deal on taxes was that he proposed to start with the revenue levels we'd have if the Bush tax cuts only on income over $250,000 phased out. But, to assuage Republican concerns about higher tax rates, he agreed to tax reform that would drop the rates back down to Bush-era levels, and make up the lost revenue by closing tax preferences.

Now, here is where things broke down. To do that in a way that means the progressivity of the tax code, you'd almost be required to reduce or eliminate the tax preference for capital gains. That's how the Reagan administration and Democrats did it when they reformed taxes in 1986 -- they dropped the top tax rate from 50% to 28%, but the rich wound up paying more because they ended the preference for capital gains.

This, however, is a a huge bugaboo to the right. Since 1986, the GOP has obsessively and successfully crusaded to re-open the capital gains tax preference. Most of the very, very rich get the bulk of their money from capital gains. There's nothing they'd like less than ending that preference.

IF ... we could somehow how put Capital Gains Tax back on that "equal footing" of the Reagan era -- How much extra Revenue should it bring in to the U.S. coffers?

(Assuming the Tea Party crowd, gets replaced by real Representatives, progressive Representatives, in 2012, ... that's the BIG-IF.)

(Assuming the Tea Party crowd, gets replaced by real Representatives, progressive Representatives, in 2012, ... that's the BIG-IF.)

"The Peoples Budget" -- The Alternative Solution We Can All Support Now

by BPC, blackpolitics.com -- April 24, 2011

Tax Capital Gains and Qualified Dividends as Ordinary Income

The People’s Budget would eliminate the preferentially low rates on long-term capital gains and qualified dividends, and it would tax all capital income as ordinary income under the marginal tax rate structure. The Tax Policy Center (TPC) estimated that taxing capital gains and qualified dividends as ordinary income would generate $989.8 Billion over the 2007-17 period, relative to then-current law (the Bush-era tax cuts would have expired for all years in the 2012-21 budget window).

Extrapolating from this score, taxing capital income as ordinary income is projected to generate $1.0 Trillion in savings over the 2012-21 period.

What a Capital Idea -- $1.0 Trillion Dollars -- either to be gambled away on the Wall Street Casino, or captured and Re-invest in the Nation's Future.

Who's to decide? The IRS or the Bankers? The Tea Party Pledgers, or the Party of the People ?

.

.

.

Capital Gains are Taxing the Economy ...

And the Wall Streeters are benefiting from it, day in and day out. They are secretly addicted to that Welfare spigot for the Wealthy. Whatever you do -- Don't Turn Off the Tap! ...

Capital Gains are Taxing the Economy ... when instead,

The Economy should really be Taxing Capital Gains!

Shouldn't the Wall Streeters be paying back, just a small percentage, of their low-tax "unearned" Billions, that they've been raking in for all these years?

It may be their Money Tree, it may be their boundless Spigot, it may be their Golden Goose -- but it really should be OUR Economy. That should really belong to the Nation. Including some of those untapped Eazy Money sources.

And while were at it -- we need to start Taxing the Job Exporters too. But that's a story for another day. It really should be OUR Economic Workplace too. Shouldn't that Golden Goose really belong to everyone?

It's only Fair. Why is it, only OUR Goose -- those of the working stiffs -- that gets cooked, day in and day out? To feed the Economy ... To fuel the Nation?

Why are those Capital Gains Taxes, so hoggishly low, anyhow? Why are they so easily ignored ... by those who say the want to jump start the Economy?