What Buffet more-or-less said, charts version:

(Updated with click-able charts)

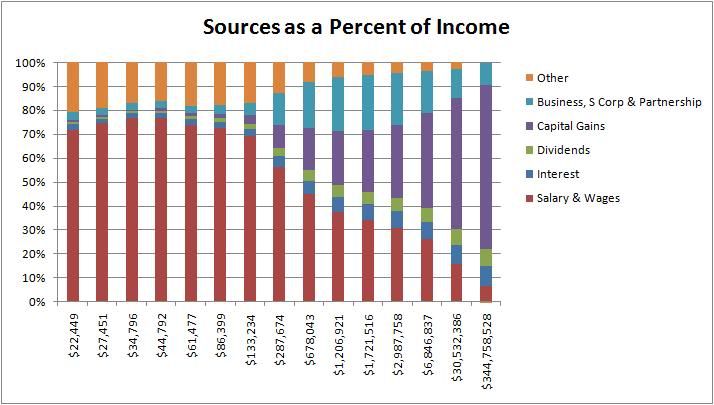

First, let’s look at how people actually make their money. This chart divvies up each income range by where the money comes from. The IRS provides more detail, but for simplicity I clumped the smaller bins together.

Salary provides the bulk of income for ranges up to $135k or so, and then it drops off to be replaced by S Corp & Partnership income, as well as capital gains. This transition to gains is pretty important, as capital gains get a preferential tax treatment.

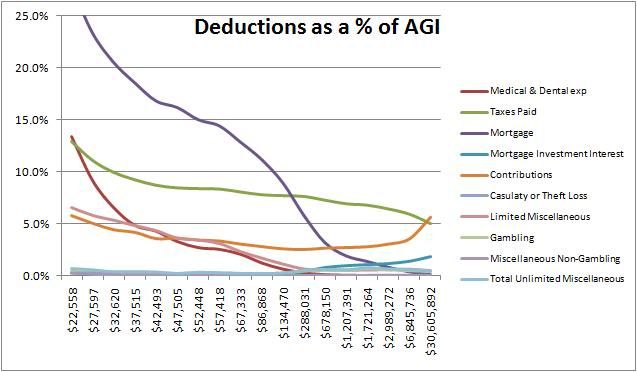

After you've made your money, you get to declare deductions. Deductions allow you to reduce the amount of income you need to pay taxes on. The government offers deductions on items it is trying to promote (such as efficiency improvements), things it values (such as home ownership via a mortgage deduction) and a whole bunch more sensical or nonsensical items (often depending on viewpoint). The major deductions, when plotted out, kindof look like this:

Notice the mortgage deduction trend line. It is very high as a percentage for low wage earners and drops off. Don’t let jealously over that million dollar mortgage deduction cause you to shoot yourself in the foot.

Besides, this is chump-change compared to the hidden bonus deduction. What is the bonus deduction? It is my term for income is not treated as income (a portion of interest earned, social security, and pensions) plus the preferential tax rates on dividends and capital gains. Check this out:

Think of the bonus deduction as the equivalent itemized deduction someone like Buffet would need to get his tax bill down to what he actually pays if it weren't for preferential rates on capital gains. The preferential treatment of capital gains allows someone like Buffet to file as-if he were deducting over 1/2 of his income!

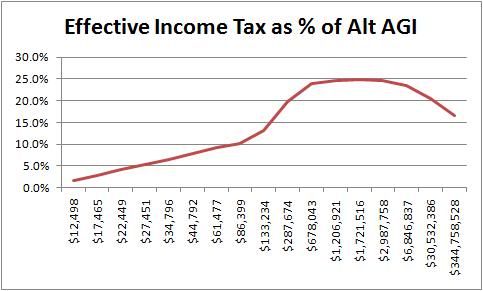

The net result is an income tax chart that looks something like this:

To create the Alt AGI, I added back in items excluded from AGI: untaxed interest earned, untaxed pensions, and untaxed social security.

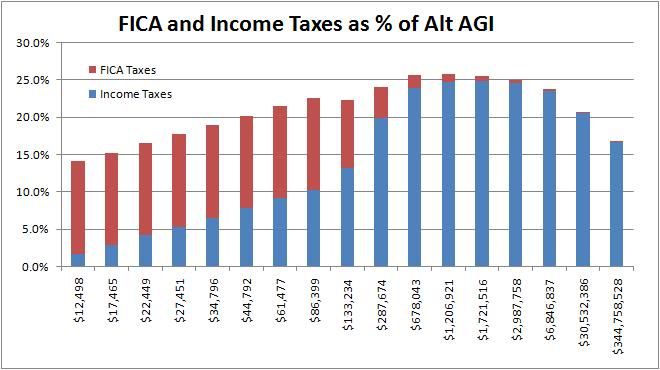

Of course, the story doesn't end here. And, unfortunately, this is also proof that people don't look at their W2s before they put on their pointy hats and protest in the streets. If they did, they would realize that tax rates really look like this:

Buffet probably pays a lower tax rate than most janitors.

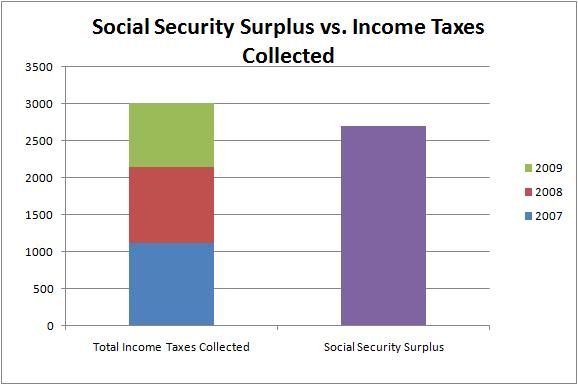

And, just because you get the FICA taxes back when you retire (as Social Security payments) doesn't mean you should disregard them. First of all, that $2.6 trillion dollars is earning a crappy interest rate. Oh, and did I mention that there is a $2.6 TRILLION dollar surplus? That is $2.6 trillion dollars stash, as-in excess of payouts, as in excess FICA taxes for low wage earners and lower income taxes for high earners. How much is $2.6 trillion dollars...? Check this out:

The Social Security surplus is almost equal to ALL of the income taxes collected in 2007-2009. Of course, as I mentioned, running a Social Security surplus allows income taxes to be lowered, thus benefitting the wealthy. Personally, I think people like Rand Paul understand this and seek to play tax-payers for chumps with their phoney solvency crisis. It is almost impossible to study tax revenues and not figure this out.

PS - i just couldn't leave this one out: Look who still has their pensions (and it isn't the janitors...):

Spreadsheets are here and here if anyone wants to check my math (or make a student homework assignment out of it :) )

PPS: What Buffet really said in case you missed it.