Brilliant segment from Stephen Colbert last night that just laid waste to all the Republican cries of "class warfare" with Obama's plan to raise taxes on millionaires, with Stephen providing his own unique solution to the problem.

And demonizing the wealthy is not what our economy needs. Just ask GOP economist guru Paul Ryan.

REP. PAUL RYAN, R-WI (9/18/2011): If you tax something more, Chris, you get less of it. If you tax job creators more, you get less job creation.

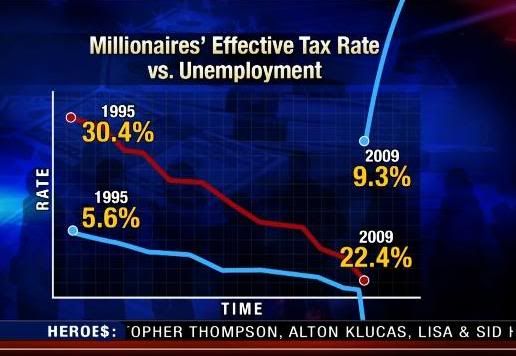

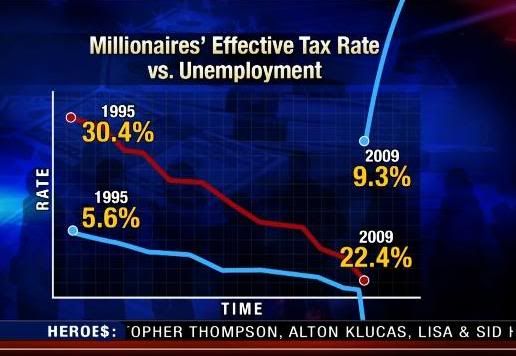

Yes, job creators like me need low taxes so we can continue to create jobs. Just look at history. In 1995, the effective tax rate paid by millionaires was 30.4%. By 2009, it had dropped to 22.4%. And over that same period, unemployment plummeted from 5.6% all the way down to 9.3%.

But folks, I promise, there is more jobs coming. Just be patient. We job creators are like a slot machine. If you just keep pumping in tax cuts, eventually we're gonna pay off. You can't quit now, you've got us all warmed up.

But the most frightening aspect of Obama's plan is that it might be popular. A recent CNN poll shows that 63% of people think taxes should be raised on high-income Americans and corporations. That is ridiculous! If we raise taxes on corporations, what incentive will they have to make money, other than the fact that it's the sole reason they exist?

....

Folks, if we don't find someone to pay the government's tab soon, Congress may get desperate enough to do the unthinkable: what the majority wants. (Bacon On Everything!) Fortunately, the Republicans have another way.

JOHN BOEHNER (7/11/2011): ... let's grow the economy and create jobs, broaden the tax base ...

REP. PAUL RYAN, R-WI (4/3/2011): We need to lower tax rates for corporations and individuals, and broaden the tax base.

JON HUNTSMAN (9/8/2011): ... we've got to broaden the base ...

MICHELE BACHMANN (7/19/2011): We need to broaden the base so that everybody pays something, even if it's a dollar.

Yes, we need to broaden the base. Right now, our economy is balanced on such a tiny base, that every time Wall Street pours our money into an elaborate scheme based on the inability of poor people to pay their mortgages, it collapses! (Jenga-nomics)

Video and transcript below the fold.

Of course, there's one foreigner really robbing America, Barack Obama. Yesterday, Obama unveiled his deficit reduction plan with yet another fiery speech from the Rose Garden. I'm beginning to think he has locked himself out of the White House, and is afraid to admit he can't find his keys.

Now folks, you don't have to be a rocket scientist to understand that the U.S. needs money, which is good, because we have laid off all of our rocket scientists. But by taxing the rich, there is a name for what Obama is trying to do here.

SEN. LINDSEY GRAHAM, R-SC (9/18/2011): When you pick one area of the economy, and you say we're gonna tax those people, because most people are not those people, that's class warfare.

REP. PAUL RYAN, R-WI (9/18/2011): The president wants to move down the class warfare path.

JOHN BOEHNER (9/19/2011): I don't think I would describe class warfare as leadership.

Yes, it is class warfare. And that is unfair to rich people, who generally speaking, would prefer not to fight our wars. Meanwhile, President Obama denies his tax-the-wealthy plan is even war.

BARACK OBAMA (9/19/2011): This is not class warfare. It's math.

Since when does math settle anything? Like evolution, I believe math is just a theory. And demonizing the wealthy is not what our economy needs. Just ask GOP economist guru Paul Ryan.

REP. PAUL RYAN, R-WI (9/18/2011): If you tax something more, Chris, you get less of it. If you tax job creators more, you get less job creation.

Yes, job creators like me need low taxes so we can continue to create jobs. Just look at history. In 1995, the effective tax rate paid by millionaires was 30.4%. By 2009, it had dropped to 22.4%. And over that same period, unemployment plummeted from 5.6% all the way down to 9.3%.

But folks, I promise, there is more jobs coming. Just be patient. We job creators are like a slot machine. If you just keep pumping in tax cuts, eventually we're gonna pay off. You can't quit now, you've got us all warmed up.

But the most frightening aspect of Obama's plan is that it might be popular. A recent CNN poll shows that 63% of people think taxes should be raised on high-income Americans and corporations. That is ridiculous! If we raise taxes on corporations, what incentive will they have to make money, other than the fact that it's the sole reason they exist?

Now fortunately, there is a way to raise revenue without asking anything of our job creators. And it's the subject of tonight's Wørd. Death And Taxes

Folks, if we don't find someone to pay the government's tab soon, Congress may get desperate enough to do the unthinkable: what the majority wants. (Bacon On Everything!) Fortunately, the Republicans have another way.

JOHN BOEHNER (7/11/2011): ... let's grow the economy and create jobs, broaden the tax base ...

REP. PAUL RYAN, R-WI (4/3/2011): We need to lower tax rates for corporations and individuals, and broaden the tax base.

JON HUNTSMAN (9/8/2011): ... we've got to broaden the base ...

MICHELE BACHMANN (7/19/2011): We need to broaden the base so that everybody pays something, even if it's a dollar.

Yes, we need to broaden the base. Right now, our economy is balanced on such a tiny base, that every time Wall Street pours our money into an elaborate scheme based on the inability of poor people to pay their mortgages, it collapses! (Jenga-nomics)

So, the question is, folks, how do we broaden it? (Take It To The Cheesecake Factory) Well, luckily, America is sitting on vast fields of untapped revenue.

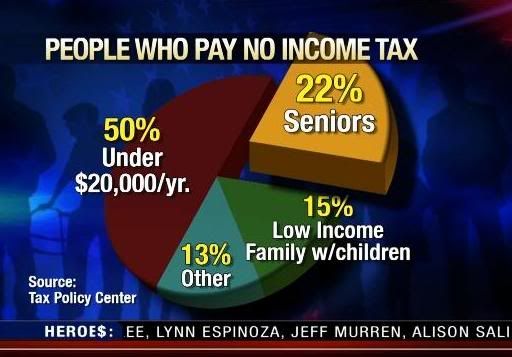

RICK PERRY (8/13/2011): We're dismayed at the injustice that nearly half of all Americans don't even pay any income tax.

MITT ROMNEY (8/11/2011): Half the people in this country pay no income tax

MICHELE BACHMANN (7/19/2011): 47% pay nothing ... Everyone should pay something because we all benefit.

Michele Bachmann is right. Everyone needs to contribute, because we all benefit from the government programs she has promised to eliminate on Day 1. (Day 2: Blink)

So, just how do these freeloaders dodge federal income taxes? Well, it turns out half of them don't pay simply because they make less than $20,000 a year. That's right. They are living the good life in their cushy jobs as fry cooks, Walmart greeters, and slaughterhouse floor grate de-brainers. "Oh look at me, I have my own apron!"

And before you cry for the poor, remember, 90% of soup kitchens reported increased demand over the last year. That's right. The so-called "poor" have special kitchens just for soup! So save your tears, folks. (Makes Excellent Soup Stock)

And it's not just low-income workers, because over 20% of these Mooch-Americans are elderly people enjoying tax-free Social Security benefits, money they use to fuel their decadent lifestyles sitting around the house taking drugs all day. (Getting Their Plavix On!)

And I believe that we cannot stop at the elderly and the working poor. We must also tax everyone who's found the ultimate loophole in our income tax code: having no income. Just because you're one of the 16.6 million unemployed Americans doesn't mean you can't pull your weight. That's why God gave you two kidneys. (Cry Me A Liver)

And those who say, oh you're going to tax the poor to death, I say death is no excuse for not paying their share. (Can't Worm Your Way Out Of It) I mean, just think of these lazy bones lying on their backs all day in their fancy satin boxes. Hey, I don't know about you, but my bed doesn't have a lid. (But Does Have Racecar Wheels)

So folks, let's not just broaden the tax base. I say, we need to deepen the tax base. And let's force these Cadaverican-Americans to pay, in the forms of rings, watches, and whatever else we can pry from their cold dead hands. (Leave The Guns!) That is not grave robbing. It's grave sharing. Because to solve the deficit, we have no choice but to tax the working poor, the non-working poor, and the non-living poor. Otherwise we might have to consider raising taxes on the wealthy. (Over Their Dead Bodies)

And that's the Wørd. We'll be right back.

Stephen also covered the final end of DADT.

Meanwhile, after basking in their

Emmy win, Jon also

covered the end of DADT and looked at the

history of America's military policy on gays as well.

Jon then had Ron Suskind on to discuss his controversial new book. The interview went long, of course, so here's the full unedited interview in two parts.

Part 1

Part 2