In 2009, there was a crazy, wild-eyed passion spreading among conservatives and the Teabagger. Here are some choice quotes from prominent conservatives and teabagger favorites.

Glenn Beck and Ron Paul

Ron Paul: [snip] So the bailout is a disease, it’s contagious, it’s ongoing, and the result of this will be the destruction of the dollar, which to me means runaway inflation, and political chaos. It’s very, very dangerous.

Glenn Beck: OK, hang on, because you are saying “runaway inflation”. You’re meaning Weimar Republic, wheelbarrow full of money type of stuff to buy a loaf of bread. Is that the kind of inflation you are talking about?

Eric Cantor

Finally, we must ensure that vast government spending doesn't lead to rampant inflation in the future. At $825 billion, this Democrat stimulus proposal causes us great concern. While the Fed remains rightfully concentrated on fighting deflation, uncontrolled spending and borrowing will most ultimately lead to inflation if the spigot is not turned off in time. That could trigger a flight of foreign capital and a steep drop in the purchasing power of the dollar for the American consumer. As interests rates rise to keep foreigners financing our debt, the pain dealt to businesses and families alike promises to be sharp.

Michele Bachman

Make no mistake. This stimulus bill has very little to do with stimulating the economy and helping the average American . This is a bailout for big government. And let's get ready. We are looking at massive tax increases and we are looking at massive inflation or both. In fact, we could be looking at hyperinflation.

Arthur Laffer (The "

Father of supply-side economics" or Reaganomics)

With the crisis, the ill-conceived government reactions, and the ensuing economic downturn, the unfunded liabilities of federal programs -- such as Social Security, civil-service and military pensions, the Pension Benefit Guarantee Corporation, Medicare and Medicaid -- are over the $100 trillion mark. With U.S. GDP and federal tax receipts at about $14 trillion and $2.4 trillion respectively, such a debt all but guarantees higher interest rates, massive tax increases, and partial default on government promises.

But as bad as the fiscal picture is, panic-driven monetary policies portend to have even more dire consequences. We can expect rapidly rising prices and much, much higher interest rates over the next four or five years, and a concomitant deleterious impact on output and employment not unlike the late 1970s.

We are a couple of months away from the close of the third year of the Obama Administration. Before that we will mark the 4 year anniversary of the start of the Great Recession(Dec 2007). And, most importantly we've just finished our third fiscal year in a row of having more than a trillion-dollar budget deficit.

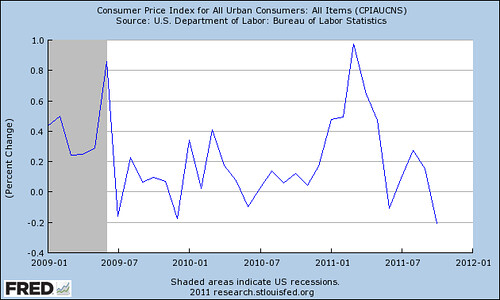

So based on all the hyperbole of conservatives, and the fact we've had such huge budget deficits, one might think we were facing huge bouts of inflation. So let's take a look at the inflation rate for the last three years.

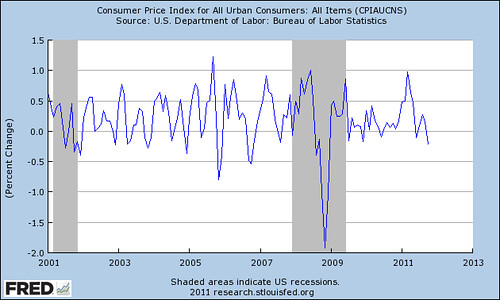

As you can see, since the stimulus and other government spending brought us out of a recession, month to month changes bounced around between .4 and negative .2 and only briefly went higher than .5 percent. However, is that a lot? Let's compare it to the previous years. Let's take at the data since January 2001.

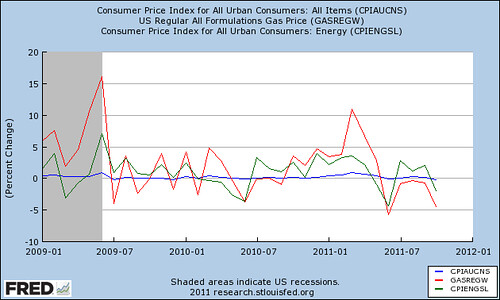

As you can see, after officially exiting the recession, inflation has actually been consistently lower than in the earlier, non-recession ,years. The only spike you see was from earlier this year and was almost entirely driven by energy costs. How do I know? Let's lay over the cost of energy in general and gasoline into the graphs.

Remember these are month-to-month changes. As you can see, the energy costs went up so much higher and faster that I had to adjust the scale of the graph to show the increase. General Prices(blue line) barely looks like a bump while Gas Prices(Red) and general energy costs(Green) went up about 10 times as fast. So those price increases weren't driven by general inflation, they were driven by an increase in energy costs.

So in spite of these billion and trillion-dollar budget deficits, how has there been such low inflation? Didn't Weimer Germany prove that always happens? The assumption that a large budget deficits will automatically lead to high inflation is deeply ingrained in our politics. Based on the last 3 years, you would think that this belief would be re-examined. And yet, republicans and conservative allies are still warning that the sky is falling inflation is coming. The whole theory of oncoming inflation is based on the flawed quantity theory of money. A theory rendered even less relevant since it was developed when we were still on a gold standard.

So what is an alternative explanation? Does this mean that government can spend and spend without consequence? MMT (which evolved from keynesian economics) provides an alternative economic framework for understanding why a government can have a trillion dollar deficit 3 years running and still have inflation that is lower than it was when deficits were less than 400 billion. First of all, inflation comes from spending money, not creating it.

As long as all spending is matched by an equal increase in the amount of goods and services produced by an economy, that spending won't be inflationary. Here's the macro economic implications: During a recession dollar savings tends to increase - i.e. people tend not to spend their money. People are afraid of losing their job, and businesses are afraid to expand, leading to reinforcing recessionary effects. One thing that doesn't change right away is the capacity in the economy. Therefore, when people save dollars, they open up room for the federal government to deficit spend money that won't be inflationary. In fact, if the government doesn't spend it'll cause deflation which is really bad for an economy.

To better understand the macro economics, let's take a look at a micro economic example: Presumably, even during a recession, a factory that produced 100 cars yesterday, can still produce 100 today. If all the people in the economy bought 100 cars yesterday, but only bought 99 today, then that means that the government can come in and buy an extra car and it won't be inflationary because the factory can produce it. Now, of course I'm not suggesting that the government start asking factories how much it can produce and directly buy what it doesn't sell. Instead, I'm just trying to give a micro example of what is happening across an entire economy. The economy has excess capacity that the people producing the items aren't buying because they are saving their dollars.

The take away is that the federal government has the ability to have deficits until the economy can no longer increase the amount of goods the economy is capable of producing, then inflation happens. The size the budget deficit can be depends on many things. One of the things as explained above is the rate of private savings which tends to be higher during recessions. That is why the federal government can run a trillion dollar plus deficit 3 years running and the economy can still have a lower inflation rate than when it was running sub 400 billion dollar deficit.

Cross Posted From Our Dime

Much of this analysis is based on Modern Monetary Theory (MMT). It's a (relatively) new "Post-Keynesian" economic school of thought. If you're interested in learning more, please follow our group, Money and Public Purpose. Also, there is a small, but growing MMT wiki that is worth checking out. I'm also starting a facebook page as another avenue to get people's attention.