Having made allegations profuse, in the previous Diary (here), stating, what amounts to opening remarks. That Bain and Goldman Sachs have committed federal fraud in the eToys case - with many cohorts - with more than 100 felony counts. It is now time to give the easy part of this organized criminal enterprise. How they planned to make a company worth alot of money, then steal that money, again and again and again. It is worth your time to read and learn - it will Free Your Mind and open your eyes.

Background".

In 1999, several major business dealings transpired. Mitt Romney and various Bain associated parties were involved in Stage Stores and The Learning Company. Also in 1999, an online internet retailer during the Clinton years, eToys, made the decision to go public. Goldman Sachs is the firm that took eToys thru its "IPO" (initial public offering). The contracts were written for an projected $18 to $20 per share price. When the stock soared to above $78 - a pump/n/dump scheme began. Goldman Sachs was limited to $1.50 per share commission.

Yet, inexplicably, eToys only received $16.50 and the balance of money Goldman Sachs was sued to explain. The case is in the New York Supreme Court (case 601805/2002). To make sure that they would not have to explain where the money went, Goldman Sachs arranged for a [solvent] eToys to file bankruptcy March 7, 2001. They then [illegally] destroyed the evidence and obstructed justice. Then the NY Supreme Court case of Goldman Sachs,(in essence suing Goldman Sachs), was put entirely under SEAL from public view.

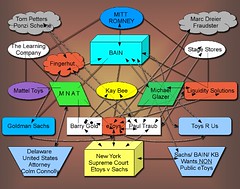

Goldman Sachs is represented [secretly] in Delaware by the Law firm Morris Nichols Arsht & Tunnell ("MNAT"). The Law firm that handled the merger of Romney's Bain "The Learning Company" with Mattel - was also the Delaware law firm of MNAT. Originally, eToys, located in California, hired the Californian firm of Irell & Manella. Corrupt federal employees within the Department of Justice in Delaware, substituted MNAT [illegally] - as eToys bankruptcy Debtor's counsel. To complete the conspiracy and collusion to defraud, MNAT, working hand in hand with the Creditors Committee attorney (Paul Traub); put in a new President and CEO of eToys - Mr. Barry Gold. Being that many crimes were already transpiring and Paul Traub has a secret relationship with Romney/ Bain and cohorts; it should not knock you off your chair to learn that secretly - Barry Gold and Paul Traub are also partners.

How they then engaged in Racketeering to monopolize the retail toy industry is below

Bain, Toys R Us, Monopoly, Goldman Sachs & Racketeering

.

They Broke the Law

If you are saying to yourself, that all the relationships that we mentioned above, sounds like a conflict of interest - You are Correct. Furthermore, unlike in the government or Wall Street; where conflicts can be resolved by negotiation or distancing. In federal estates, ANY undisclosed conflicts of interest are totally forbidden by law. As per Section 327(a) - the failure to disclose a relationship - MUST result in disqualification and, at the judge's discretion - disgorgement of fees and expenses.

To recap what was just presented above, the relationships are incestuous and systemic. Though they have been boasting and enjoying their brilliant, ruthless and successful business plan; it is also - Totally - Illegal. Attorneys who practice in bankruptcy cases, must have the court's approval per § 327(a) as a Professional Person. They must "disclose" any and all relationships to other parties and be a "Disinterested Person" (per Section 101(14)). They may self police themselves (a recipe for disaster in the eToys case). The check-n-balance is that they must submit a Rule 2014 Affidavit, testifying - "Under Penalty of Perjury" - that they have NO Conflict of Interest.

Conflict of Interest in eToys - the Players

.

Despite what you have heard by the press, Mitt Romney founded Bain Capital and did NOT give up all business pursuits in 1999. He needs you to believe that line of BS, because the crimes in eToys - if [when] investigated - makes the Chief Executive of Bain accountable. Mitt Romney still ran Bain Capital (

and hundreds of sub entities therefore) in 1999, 2000 and 2001.

Paul Traub and Barry Gold met with Romney's Bain at NeoStar, Jumbo Sports, TSS or earlier. Both Mr. Gold and Mr. Traub have admitted that they get employments thru Jack Bush of Dallas Texas. Jack Bush was a director at Stage Stores and also CEO of Bain's IdeaForest. He was also with Barry Gold and Paul Traub at Jumbo Sports in Florida. Also at Stage Stores as director was Michael Glazer, who was the CEO of Kay Bee Toys too. Don't forget, MNAT works for Goldman Sachs, Bain/ Mattel and partnered with Paul Traub to [secretly] put in Barry Gold as the [Illegal] President/ CEO of eToys

.

Mitt Romney was CEO of Bain in 2001 and still benefits from fraud

.

As "

transitive logic" goes - A=B B=C thus A=C. Thus Romney=Bain and Bain=Traub then Romney=Traub. Wherefore, we have MNAT equals Bain, Romney equals Bain, Traub equals Bain and Traub equals Barry Gold. Their relationships are incestuous beyond compare. As this chart shows, Romney is connected by the dots to everything. Including fraudsters Marc Dreier and Tom Petters. But more on that in future Chronicles.

Mitt Romney, not Bain, had been the controlling owner (800,00 shares) of Stage Stores in 2000/ 2001; which filed bankruptcy in 2000. Barry Gold worked for the Stage Store directors and "they" got caught because Barry Gold personally signed the letter at Stage Stores to hire Paul Traub (see Supplement Rule 2014/ 2016 Affidavit (here)). Then they all went to illegally seize and controll the entire federal bankruptcy estate of eToys. Except for 1 little wrench. The court approved Liquidation Consultant CLI was keeping eToys alive and was going to remain a public company due to CLI's sole owner = Laser Haas = (me).

Schemes + Plots + Ploys and More Schemes

.

Scheme 1 - A classic pump n dump

You have to be somewhat amazed at the Lottery these crooks won. You have a public company (eToys), where the stock soared to above $78, but Goldman Sachs only gave eToys around $16.50. Even though they had contract to earn no more than $1.50 per share; the amount of money and above the law mentality - was just too much of a temptation. So a classic pump-n-dump occurs.

Scheme 2 - Buy a Billion $ company for a few million

You now control all 3 parties necessary. That being Debtor (Barry Gold as President/ CEO), his partner (Paul Traub) as the Creditors attorney (they are required by law to NOT be connected). With the coup de grace of also having the Debtor's attorney MNAT (also forbidden by law, against having any beneficial connections with the creditors and/ or their attorney).

Scheme 3 - When you have to pay more millions to buy - also be the one to sell

There's a wrench in the works. Laser Haas. You have the perfect world, a way to own a company worth billions for $3 to $5.4 million. Along comes Haas and the next thing you know - the ambitious clown has driven up the price to $50 million. How in the hell are you going to get that money back?

Simple - sell it to yourself.

I know, right now you are saying "Huh" - how do you do that? Actually it is really simple when you think about it. Just answer this question. What happens when anyone or any company files bankruptcy? I mean in the sense of what "we" - the general public/ persons - think about a bankrupt person or company? You forget about them - right! You toss them out of your mind. Once anyone or any company goes belly up - it is Buried from our minds. This is how they have been stealing from us for decades.

When a company or person files for bankruptcy - they become an "alter ego" = sort of like a Corporation (did the light bulb just go on)? Bankruptcy is the realm of finality. Once someone files bankruptcy - anyone who is a creditor - is lucky to get 10 cents on a dollar. Romney/ Bain/ Traub and MNAT know this. So do all the creditors in the country. Like the Post Office, UPS, Fedex, Sony, General Mills --- HASBRO and Mattel. They have to pay their attorneys $500 to $1000 per hour (I know - it sucks how much they can get away with).

When your business is bankruptcy - Bankrupt Every Business

.

Now keep up. This is the place where they snow everyone. How Goldman Sachs, Bain, Bank of America Fleet Retail Finance and even GE - are making millions faster than a whole bunch of check cashing branches at once. They make money on both sides of the fence. You make fees for handling the bankruptcy case, stiff everyone you owe, re issue stock to yourself (do you hear me Mitt Romney and Ron Burkle)? Then, when you want to buy the bankrupt federal estate - Become the Seller.

Let me say that again, cause I know it is confusing - until you say "OH" I get it.

If you are Bain and you want to buy eToys for as little as possible, you have to bid against everyone else that wants eToys. This is a problem. If you have been watching the TV Shows "Auction or Storage Wars" - you see junk go for high prices. When we 1st watched, there were 4 or 5 groups bidding. Now there are 100 people. Same thing with Pawn Stars in Las Vegas. They are SO busy, that there's a coffee and hot dog wagon outside and a LINE at 5 a.m. in the morning. Sometimes people wait for hours in 110% heat or freezing cold. NUTs.

So, Mitt Romney and his Bain had a problem, Laser Haas was doing to their plan to buy eToys for pennies, the same thing TV did for Storage Wars. Being that I have been in the Liquidation business for 25 years, had handled over 1000 bankruptcies, liquidations, auctions etc. All I did was call everyone, tell them how great a deal they could get and that $3 million that MNAT, Traub and Barry Gold "thought" they were going to sell eToys to Bain/ Kay Bee for - jumped to tens of millions. There were two (2) problems, that the criminal cohorts needed to resolve.

1. Get rid of Laser Haas - he is a pain in our ass.

2. How do we get back the extra money he made us spend?

My power center was good faith creditors and honorable employees at eToys. Over 1000 people were losing their jobs. I told them I could save them. They asked for proof and I took them to my 150,000 sg ft warehouse and presented them with a bank letter to guarantee them $5.4 million. Thus, I had the room to move everyting and the money equal to the highest bid. So everyone believed.

Unfortunately, there were snakes in the grass. I was too naive, even with my 25 years of experience. I knew that Paul Traub was up to no good. So when the new, extremely funny and charming Barry Gold came to meet me and asked if he could help - I said yes.

Don't Laugh too loud - it cost me $3.7 million

Yep, you are laughing at me now, saying You Fool - You Fool. Sad to say - you are correct, I was foolish enough to believe in honorable United States Trustee's. I was foolish enough to believe that I had a Chief Federal Justice's signed contract. That I was getting back more than $50 million and saving the company when they were only getting $3 to $5.4 million. I was foolish enough to believe that Barry Gold had NO connections to Paul Traub - RIGHT. After all, it would be against the law. It gets worse, but you are gonna laugh your ass off.

I was also foolish enough to pull Barry Gold over and say

"Watch out for Paul Traub - I think he is a crook" "

Now that I know what was really going on - it must have taken everything in the world for Barry Gold not to choke on his own tongue and get away to his laughter. I had to be the joke of all the lawyers bars on Wall Street for months. Can you imagine being Eliot Ness and pulling over a Taxi driver named Frank Nitti and tell him - Look, go away, Al Capone is possibly a crook? Well, there's my SIGN.....(thanks Engvall)

Implementing Bain's plan to steal Everything

The Chairman of the Creditors Committee in eToys is an honest man. He had been working at Mattel for 22 years. But, both he and I did not know that MNAT and Mitt Romney were actually inside Mattel thru The Learning Company. There's also the fact that Mattel and Hasbro very Top - their CEO's and General Counsels, had to be in on the plan for Bain to take the monopoly of the toy industry. So they helped Romney/ Bain and Goldman Sachs - by giving the Creditors Chairman in eToys early retirement.

Then, they simply refused to pay Laser Haas and locked me out of my company. Making me lose career, life savings, money borrowed from others - etc. It has been a decade long battle, costing more money than I would be happy to have today - as my life savings. Because, like the fool that I am, believing in the federal judge's contract I had signed - I naively thought I would just settle one day. How can a court stiff me when I helped get back $50 million - after they were only going to get $5 million?

With me gone, they turned their focus to the final issue - How to get all that extra money back? Remember, as we discussed before, the best way not to lose as a buyer, is to also be the seller. What happens then will amaze you.

The Distressed Debt Business

In bankruptcy, there is a seldom discussed business, that is better than Credit Default Swaps. It is called "Distressed Debt". Sony, the Post Office, Fedex, the toilet paper suppliers, the Utility companies - they all know - it is going to take 3, 4 or maybe even 10 years to get paid. At $500 to $1000 per hour - that could end up costing you millions. But you can't simply throw away the debt; such would encourage everyone to file bankruptcy tomorrow. So what big companies do, is sell their claims to people to buy them. It is a win - win. You get money now, save money in legal fees and the people or companies that buy the claims will make a good profit. Correct?

But here is the $64,000 question.

If, let's say XYZ company has $10 million in cash after selling everything that was once worth $100 million and the lawyers are going to get paid $500 to $1000 per hour. With accountants like Price Waterhouse, Ernst & Young, Liquidators, Security, Rents and on and on. How does anyone know what to pay for a claim? How is there any guarantee that you will make money?

Again - Real Simple.

Bain and Goldman Sachs will NOT pay 1 cent for the claim and get 50% of the net proceeds - when the bankruptcy court settles it. Then, after awhile, Bain and Goldman Sachs (and several other lucky bastard companies) - realize they can do even better. if you could somehow - CONTROL - who gets paid and who doesn't. Then, also keep that item a Secret. You can do a 50/50 deal with who you have to. But, you can buy a few claims that will be given PRIORITY. When you know which is a Priority claim, instead of doing a 50/50 deal - you buy it for CASH. Typically, they pay less than 3%. (after all, the most anyone can expect is 10%).

BAIN actually gets PAID to buy eToys

Yes, I know, again you are saying "Huh" - how does that happen?

Well, continuing along the line of "When you are a buyer - also be the seller" - The plan is really simple. MNAT is eToys Debtor's counsel and Paul Traub is the Creditors attorney - they are partners. They put Barry Gold in and kick Laser Haas out. Now you have $50 million, your customers of Bain/ Kay Bee and Goldman Sachs. Bain wants to own eToys for as little as possible and Goldman Sachs wants all the paperwork that shows how much it stole in the case - GONE.

Barry Gold signed an Declaration to the Chief Federal Justice and said - I quote

"This Plan (contract) was drafted in "extensive good faith" and extensive arm's length between Debtor and Creditor. That is to say that Barry Gold just told the court that the Debtor (Barry Gold) was "extensively" acting in good faith and Totally 'arm's length" from the Creditors - His Partner Paul Traub.

Wait - it gets better.

In that contract, what the lawyers call a Confirmed PLAN. It actually states that the Administrator (Barry Gold) may settle all claims under $1 million - without asking the Court's permission. The only permission that the Administrator (Gold) needed - was that of the Creditors Post Effective Date Committee (PEDC) - that was being represented by - PAUL TRAUB.

That's how you are both buyer and seller. You buy up the claims - which is legal for ANYone - even the Debtor to do. HOWEVER, you MUST DISCLOSE all the relationships. If you are a "Connected" party - you are Forbidden to profit One (1) single penny. Because that would be a Conflict of Interest. If you paid $5 dollars - the most you can get back is $5 dollars. If you paid ZERO, the most you can get back is ZERO.

That's enough for today guys and gals. - More to come

MUCH MORE

including a Corrupt United States Attorney - PROOF

NEXT - Toys R Us is in Possession of $1 Billion in Stolen Property