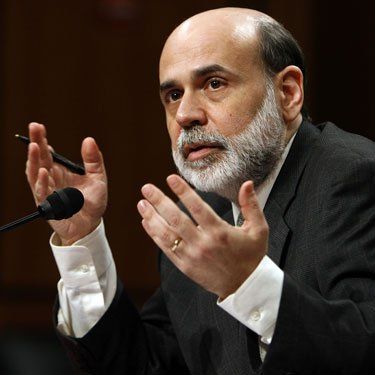

Ben Bernanke addressed Congress yesterday. While acknowledging that risks to the U.S. economy have grown, he proposed no new actions:

The situation in Europe poses significant risks to the U.S. financial system and economy and must be monitored closely. As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate.

Let me translate this from economic speak. What you just heard Ben Bernanke say was, we're not going to do anything until the situation gets worse.

This should make you angry.

Last Friday's jobs report found that employers added only 69,000 jobs in May, the fewest in a year, and analysts have reduced their estimates for economic growth in the U.S. to 2.0-2.2 percent (2.5 percent is the generally accepted rate required to keep unemployment from rising).

In the face of these jobs numbers, Ben Bernanke announced that he is going to do nothing unless things get worse.

The unemployment rate rose to 8.2 percent from 8.1 percent. And our growth fell, indicating that unemployment is likely to go up even more in the future.

Yet the Federal does nothing. This should make you angry.

Why? Because there are steps he could take. It's a political choice. When Ben Bernanke chooses to do nothing, he's saying that an unemployment rate of 8.2 percent is acceptable.

Let me explain and then show you how you can help.

The problem is that there are real people out there suffering right now from a high unemployment rate.

Ben Bernanke and the Federal Reserve have a dual mandate:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.

The dual mandate is: 1) promote the goal of maximum employment, and 2) stabilize prices (read "keep inflation low").

Got that? One of the Fed's goals is "to promote effectively the goals of maximum employment".

This is important because what you heard Bernanke say yesterday is that unemployment has ticked upwards, it is likely to continue to tick upwards because economic growth is below 2.5 percent, and his plan is to do nothing until things get worse.

This is why you should be angry with Ben Bernanke and the Federal Reserve.

Is There Anything We Can Do?

I happened to have the great fortune to hear Karl Smith, Lisa Donner, and Matthew Yglesias address this very issue on the same day Bernanke spoke in a panel session entitled "Why the Fed is the Most Important Economic Issue You Know Nothing About."

The panel talked about how Ben Bernanke and the Federal Reserve have fallen down on the job when it comes to their dual mandate.

Instead of focusing on both maximizing employment and stabilizing prices the Federal Reserve has focused only on the latter, setting an inflationary rate of 2 percent that they refuse to budge from under any circumstances.

Matthew Yglesias phrased this as:

We're crucifying the country on the cross of a 2% inflation target.

In other words, Ben Bernanke could take steps to increase the money supply (which is what the Federal Reserve does) which economists will tell you would decrease the unemployment rate. But they

fear that inflation might increase.

The key word here is "fear" because despite recent steps that the Fed has taken in the past to boost the monetary supply (quantitative easing), there has been no real evidence of inflation.

What this means is that Ben Bernanke and the Federal Reserve have decided that 8.2 percent unemployment is an acceptable number. They could take action on this number, but because of a "fear" of inflation, they are going to sit on their hands and do nothing.

If you listened to members of Congress quiz Bernanke, you'll notice that conservatives constantly harped on this "fear" of inflation. Liberals, on the other hand, while pressing Bernanke about regulations in the face of the recent JP Morgan debacle, remained silent on the issue of employment.

I asked the panel if there were any way that we might put pressure on Ben Bernanke and the Federal Reserve, if there were any levers progressives might be able to push and Karl Smith had a fantastic response which I will paraphase here.

He said we need to call out that these decisions Ben Bernanke is making are responsible for our high unemployment rate. People, by and large, don't understand that the Federal Reserve could be doing more about unemployment, but they aren't.

If you ask Ben Bernanke if the Federal Reserve's policies are responsible for the 8.2 percent unemployment rate, he won't deny this. Because it's largely accepted by economists that there are additional steps the Federal Reserve could take to reduce unemployment.

But they aren't.

This should make you angry.

Contact the Federal Reserve and let them know that you want them to do a better job with their dual mandate. Conservatives have done a good job of making their single-sided case on prices. But this is just one side of the coin.

Ask Ben Bernanke why he's not focusing on employment and let him know that this is a problem.

Here's My Letter to Ben

Dear Ben Bernanke,

After hearing you speak on the economy yesterday, I understand that unemployment has risen from 8.1 to 8.2 percent and that growth is slowing below the 2.5% rate required to keep it stable. This means unemployment is likely to rise further.

I further heard you say that the Federal Reserve intends no actions until the situation grows worse.

To me, this means that you have decided that higher unemployment is acceptable.

I know you could take steps to reduce the unemployment rate if you weren't solely focused on maintaining 2% inflation.

Based on past stimulus efforts, I believe this fear is unfounded.

Please remember the 2nd part of your dual mandate: promoting maximum employment.

Sincerely,

-David

Additional Links

Recording of yesterday's Federal Reserve meeting:

http://www.ustream.tv/...

Federal Reserve objectives under Ben Bernanke:

http://www.federalreserve.gov/...

Contact page for Federal Reserve

http://www.federalreserve.gov/...