Among the myriad Republican myths about taxes, the most pernicious and demonstrably false—that "tax cuts pay for themselves"—is the mostly deeply held by the GOP faithful. As President George W. Bush famously (and erroneously) put it, "You cut taxes and the tax revenues increase." Now, a survey of leading economists conducted by the University of Chicago Booth School of Business is just the latest shovelful of evidence to bury Arthur Laffer's zombie lie.

Earlier this year, as Congressional Republicans learned the hard way three weeks ago from CBO Director Douglas Elmendorf, another Chicago Booth poll revealed that "80 percent of economic experts agreed that, because of the stimulus, the U.S. unemployment rate was lower at the end of 2010 than it would have been otherwise." (As Elmendorf told the House Budget Committee, "Only 4 percent disagreed or strongly disagreed. That is a distinct minority.")

Now, the U of C is back with a new two-part survey on the Laffer Curve. In the first question, 35 percent agreed and another 35 percent were unsure that "a cut in federal income tax rates in the US right now would lead to higher GDP within five years than without the tax cut." (That response is unsurprising, given that one definition states that GDP equals consumption plus investment plus government plus net exports minus taxes.) But far more interesting are the results (see chart at top) on the question that gets to the heart of Arthur Laffer's supply-side snake oil that has been Republican orthodoxy ever since Jude Wanniski sketched Laffer's curve on a cocktail napkin. In a nutshell, not a single one of the economists surveyed agreed that "a cut in federal income tax rates in the US right now would raise taxable income enough so that the annual total tax revenue would be higher within five years than without the tax cut."

In his comments, David Autor of MIT pointed out, "Not aware of any evidence in recent history where tax cuts actually raise revenue. Sorry, Laffer." Former Obama administration economist and current University of Chicago professor Austan Goolsbee put it this way:

Moon landing was real. Evolution exists. Tax cuts lose revenue. The research has shown this a thousand times. Enough already.

Of course, you don't have to take Goolsbee's word for it. Your own eyes will suffice.

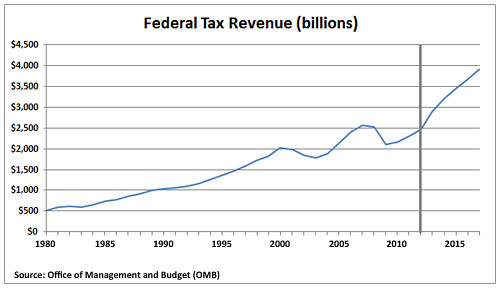

After Ronald Reagan tripled the national debt with his supply-side tax cuts, George W. Bush doubled it again with his own. (Reagan's performance would have been much worse had he not raised taxes 11 times to help make up the shocking shortfall.) This chart shows just how dire the tax revenue drought has become. For those Republicans who claim "tax cuts pay themselves," it's worth noting that federal revenue did not return to its pre-Bush tax cut level until 2006. (While this graph shows current dollars, the dynamic is unchanged measured in inflation-adjusted, constant 2005 dollars.)

But that picture tells only part of the story. Measuring taxes and spending as a percentage of the total U.S. economy reveals revenue at historical lows. As the nonpartisan Congressional Budget Office concluded last year, "Revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950."

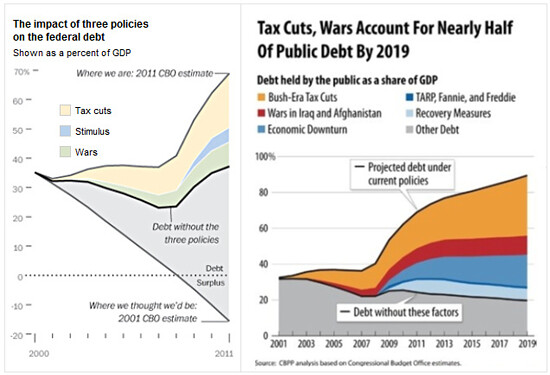

As the Center on Budget and Policy Priorities concluded, the Bush tax cuts of 2001 and 2003 accounted for half of the deficits during his tenure, and if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus—combined.

It's no wonder that, three decades after he concluded "the supply-siders have gone too far," former Arthur Laffer and Reagan OMB chief David Stockman lamented that "[The] debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

Nevertheless, two years ago future House Speaker John Boehner denied the obvious:

"It's not the marginal tax rates ... that's not what led to the budget deficit. The revenue problem we have today is a result of what happened in the economic collapse some 18 months ago."

"We've seen over the last 30 years that lower marginal tax rates have led to a growing economy, more employment and more people paying taxes."

And as the Republican Party waged its all-out attack in 2010 to

preserve the Bush tax cuts for the wealthy, the GOP's number two man in the Senate provided the talking point to help sell the $70 billion annual giveaway to America's rich. "You should never," Arizona's

Jon Kyl declared, "have to offset the cost of a deliberate decision to reduce tax rates on Americans." For his part, Senate Minority Leader

Mitch McConnell rushed to defend Kyl's fuzzy math:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

That tax cut increase revenue may be the view of virtually every Republican. It just happens to be, as the University of Chicago's panel of economists reminded Americans, laughably wrong.