In February 2009, President Obama delivered what Steve Benen rightly described as the largest two-year tax cut in American history. Nevertheless, the New York Times asked in the run-up to the 2010 midterms, "What if a president cut Americans' income taxes by $116 billion and nobody noticed?" What happened, of course, was the Democrats' drubbing that November.

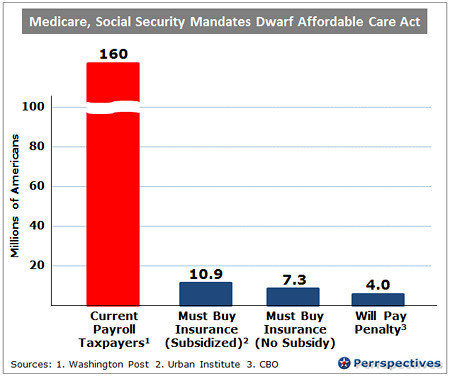

Now Republicans are hoping to repeat history this fall, this time by pretending that the Affordable Care Act upheld by the Supreme Court Thursday is a "massive tax increase" on American families. As it turns out, the penalty for failing to obtain health insurance beginning in 2014 will impact four million people, or less than two percent of the U.S. population. To put that figure in context, 40 times as many Americans pay the mandated taxes for the very popular Social Security and Medicare programs.

As we learned during the recent debate over the extension of the payroll tax cut, 160 million Americans pay taxes to fund the Medicare and Social Security trusts for today and tomorrow's retirees. Since 1935, workers and their employers have each paid into the Social Security trust fund, a figure which next year will return to its 6.2 percent rate on the first $106,000 of income. In addition, employer and employee alike are on the hook for another 1.45 percent for Medicare, the insurance program for the elderly established in 1965. (If you have any lingering doubts that you must purchase these mandated public products for your old-age health care and retirement income, these prosecutions will disabuse you of that notion.)

In comparison, the Affordable Care Act's individual mandate to obtain workplace, government-provided or privately purchased insurance impacts just a small fraction of Americans. For starters, over 80 percent already have health insurance, compared to roughly 17 percent who do not. The Economic Policy Institute estimates that 59 percent of those under age 65 receive employer-sponsored insurance, while another 22 percent are covered by public programs including Medicaid and SCHIP. Of the 50 million people who are currently uninsured, about 20 million (including undocumented immigrants and those with religious objections or claiming economic hardship) are not covered or are otherwise exempt from the health insurance mandate. As a recent Urban Institute analysis concluded:

What may be surprising, however, is that if the ACA were in effect today, 94 percent of the total population (93 percent of the nonelderly population) or 250.3 million people out of 268.8 million nonelderly people--would not face a requirement to newly purchase insurance or pay a fine.

As

Ryan Grim noted, that's because "98 percent of Americans would either be exempt from the mandate—because of employer coverage, public health insurance or low income—or given subsidies to comply." The Urban Institute estimated that 8.1 million Americans would have their insurance paid for by the expansion of Medicaid to 133 percent of the federal poverty level. Another 10.9 million people would receive subsidies to buy private insurance in the new state exchanges, while only 7.3 million (2 percent of the total U.S. population) would be required to purchase a health plan using their own resources alone. As for those Americans choosing to instead to

pay the penalty of $695 or up to 2.5 percent of household income for failing to obtain insurance at all,

the CBO estimated that number at 4 million. (That forecast is almost

double the rate in Massachusetts, where only 48,000 in a state of 6.6 million people opted to pay the penalty rather than acquire health insurance under Mitt Romney's version of the individual mandate.)

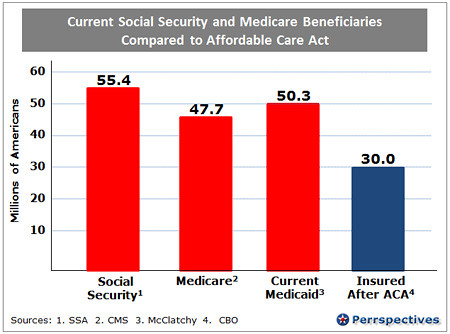

But if far more Americans pay the Social Security and Medicare mandates, the number of direct beneficiaries of "Obamacare" is much lower. In 2011, over 55 million people received Social Security benefits. Of those, 44.7 million got old age and survivors insurance, with another 10 million receiving disability benefits. Forty-seven million people are enrolled in Medicare, with 8 million of them non-elderly, disabled recipients. In comparison, the Congressional Budget Office now forecasts that 30 million Americans will gain health insurance under the Affordable Care Act. (That figure understates the program's benefits, as the closing of the Medicare donut hole, ending lifetime benefit caps, mandatory coverage for a range of preventive care services and barring discrimination for pre-existing conditions is already helping millions more.)

In Thursday's ruling, Chief Justice John Roberts concluded that its taxing power under the Constitution gives Congress the authority to issue penalties for non-compliance with the Affordable Care Act. But as the data above show, those penalties hardly constitute a "massive tax hike" that "hits everybody, not just rich people." While is certainly true that new taxes, fees and penalties will generate roughly $500 billion in new revenue over the next decade, much of it will come from businesses and households earning over $250,000 a year. Nevertheless, Mitt Romney's sidekick Sen. Marco Rubio (R-FL) was quick to resurrect "the jack-booted thugs" of the Republican Party's 1990s war on the IRS:

Romney "supported it on the state level. Which means if you didn't like it in Massachusetts, you could move to another state," Rubio said on Bloomberg Television. "What are people supposed to do? Leave the United States now because of Barack Obama's brilliant idea to stick the IRS on millions of people? More importantly, the state of Massachusetts doesn't have the IRS. The IRS will follow you. Do people understand what this means?"

What this means is that Marco Rubio is both melodramatic and factually challenged. (As

Bloomberg BNA noted, "Unlike most other types of tax debts, IRS cannot file a tax lien against individuals who do not comply with the health insurance mandate and can only collect the money by withholding it from tax refunds or Social Security checks.") Going off script, he's also suggesting that Mitt Romney raised taxes on and sent his department of revenue after Massachusetts residents to pay for his signature 2006 health care law.

In any event, Americans can and will argue about the distinction between a literal tax levied and a penalty imposed under Congress' power to tax. But Republican hysteria about "biggest tax increase ever in the history of our country" notwithstanding, there should no disagreement about the massive tax hike that isn't.