With the Bush tax cuts of 2001 and 2003 once again set to expire at the end of this year, President Obama on Monday once again proposed temporarily extending them only for families earning less than $250,000 annually. Predictably, his Republican rival Mitt Romney called the return of upper-income tax rates to their slightly higher Clinton-era levels a "massive tax increase" for "on families, job creators, and small businesses."

But while Romney's regurgitation of these tired Republican talking points comes as no surprise, it doesn't make them any more true. Here, then, are 10 things the GOP doesn't want you to know about taxes.

(Click a link to jump to the details for each below)

- President Obama Cut Taxes for Almost All Working Americans

- Tax Cuts Don't Pay for Themselves

- Almost All Working Americans Pay Taxes

- The GOP's "Job Creators" Don't Create Jobs

- Low Capital Gains Taxes Fuel Income Inequality...

- ... But Not Investment

- The Estate Tax Has Virtually No Impact on Family Farms and Businesses

- Income Inequality is at an 80 Year High...

- ... While the Federal Tax Burden is at a 60 Year Low

- Which of the $1 Trillion in Tax Breaks Will GOP End?

1. President Obama Cut Taxes for Almost All Working Americans

Back in April, Bloomberg News correctly reported that "Obama Delivers on Tax Cut Promises as Increases for Rich Blocked." Of course, you'd never know if you listened to Mitt Romney, who claimed that the president "has already raised taxes on millions of Americans, but he won't stop there."

During the campaign four years ago, then-Sen. Barack Obama called for families making over $250,000 a year to return to their Clinton-era of income tax rate of 39.6 percent, up from 35 percent under President Bush. With his stimulus program in February 2009, President Obama as promised delivered tax relief for 95 percent of working families. As Steve Benen noted at the time, it was the largest two-year tax cut in American history. But thanks to the jet-engine decibel level of right-wing rage, a cacophony willingly amplified by the media, that accomplishment was drown out. As the New York Times asked just before the 2010 midterm elections, "What if a president cut Americans' income taxes by $116 billion and nobody noticed?"

In a New York Times/CBS News Poll last month, fewer than one in 10 respondents knew that the Obama administration had lowered taxes for most Americans. Half of those polled said they thought that their taxes had stayed the same, a third thought that their taxes had gone up, and about a tenth said they did not know.

And that was before President Obama and Democrats in Congress secured a two-year reduction in Americans' payroll taxes.

What Americans may also not know if that both Mitt Romney and Paul Ryan plan on delivering another windfall for the wealthy even as they hike taxes for working Americans.

Continue reading below the fold.

2. Tax Cuts Don't Pay for Themselves

In his version of the Republican myth that "tax cuts pay for themselves," President Bush confidently proclaimed, "You cut taxes and the tax revenues increase." As it turned out, not so much.

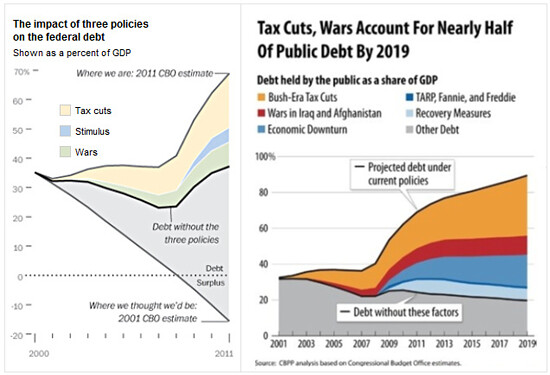

After Ronald Reagan tripled the national debt with his supply-side tax cuts, George W. Bush doubled it again with his own. (Reagan's performance would have been much worse, had he not raised taxes 11 times to help make up the shocking shortfall.)

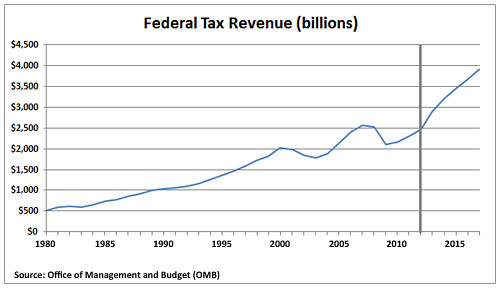

This chart shows just how dire the tax revenue drought has become. For those Republicans who claim "tax cuts pay themselves," it's worth noting that federal revenue did not return to its pre-Bush tax cut level until 2006. (While this graph shows current dollars, the dynamic is unchanged measured in inflation-adjusted, constant 2005 dollars.)

As a share of American GDP, tax revenues peaked in 2000; that is, before the Bush tax cuts of 2001 and 2003. As the Center on Budget and Policy Priorities concluded, the Bush tax cuts accounted for half of the deficits during his tenure, and if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus - combined.

Nevertheless, as the Republican Party waged its all-out attack in 2010 to preserve the Bush tax cuts for the wealthy, the GOP's number two man in the Senate provided the talking point to help sell the $70 billion annual giveaway to America's rich. "You should never," Arizona's Jon Kyl declared, "have to offset the cost of a deliberate decision to reduce tax rates on Americans." For his part, Senate Minority Leader Mitch McConnell rushed to defend Kyl's fuzzy math:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

That may have been a view universally shared by virtually every Republican, but it happens to be wrong.

3. Almost All Working Americans Pay Taxes

Going back to the 2008 campaign, Republicans have kept up a steady drumbeat that "half of Americans don't pay taxes." That claim is no more true now than it was then.

In 2010, New York Times columnist David Leonhardt urged Americans to "look closer":

With Tax Day coming on Thursday, 47 percent has become shorthand for the notion that the wealthy face a much higher tax burden than they once did while growing numbers of Americans are effectively on the dole.

Neither one of those ideas is true. They rely on a cleverly selective reading of the facts. So does the 47 percent number.

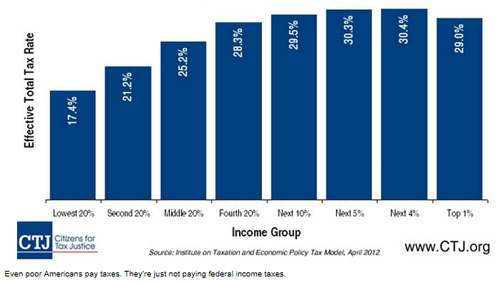

Labeling the 47 percent argument a "distraction" from "who really pays what in taxes," Leonhardt explained:

Even if the discussion is restricted to federal taxes (for which the statistics are better), a vast majority of households end up paying federal taxes. Congressional Budget Office data suggests that, at most, about 10 percent of all households pay no net federal taxes. The number 10 is obviously a lot smaller than 47.

The reason is that poor families generally pay more in payroll taxes than they receive through benefits like the Earned Income Tax Credit. It's not just poor families for whom the payroll tax is a big deal, either. About three-quarters of all American households pay more in payroll taxes, which go toward Medicare and Social Security, than in income taxes.

(Over the years, the Earned Income Tax Credit has enjoyed bipartisan support from the White House. Among its admirers was

Ronald Reagan, who praised the EITC as "the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress.")

As Ezra Klein explained Monday in the Washington Post:

But when we focus on the federal income tax, we miss all the taxes that low-income Americans do pay. The payroll tax, for instance. And state sales taxes. And lots of local taxes. Indeed, Citizens for Tax Justice, a left-leaning tax policy group, produces a study every year showing the total tax burden for different groups once federal, state and local taxes are taken into account. And when you include all the taxes people pay, then, as you can see in the graph atop this post, it turns out that most Americans do pay taxes, and they in fact pay about as much as the rich.

4. The GOP's "Job Creators" Don't Create Jobs

For years, Republicans have warned that President Obama's proposal to let the Bush tax cuts expire for the top two percent of taxpayers would crush "job creators." As Speaker Boehner protested:

"The top one percent of wage earners in the United States...pay forty percent of the income taxes...The people he's [President Obama] is talking about taxing are the very people that we expect to reinvest in our economy."

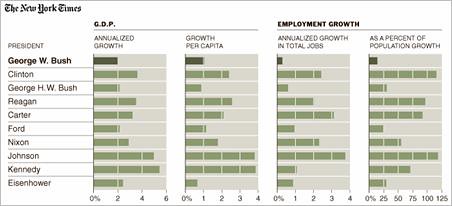

If so, those expectations were sadly unmet under George W. Bush. After all,

the last time the top tax rate was 39.6 percent during the Clinton administration, the United States enjoyed rising incomes, 23 million new jobs and budget surpluses. Under Bush? Not so much.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover.

That dismal performance prompted David Leonhardt of the New York Times to ask last fall, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

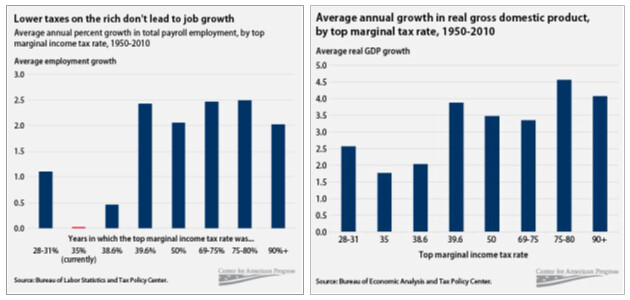

The data is clear: Lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

It's no wonder Leonhardt followed his first question with another. "I mean this as a serious question, not a rhetorical one," he asked, "Given this history, why should we believe that the Bush tax cuts were pro-growth?" Or as Mark Shields asked and answered in April:

"Do tax cuts help 'job creators' or 'robber barons'?"

Just days after the

Washington Post documented that George W. Bush presided over the

worst eight-year economic performance in the modern American presidency, the

New York Times in January 2009 featured an analysis comparing presidential performance going back to Eisenhower. As the

Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and even fueling stock market growth. Apparently, America's job creators can create a lot more jobs

when their taxes are higher—even much higher—than they are today.

(It's worth noting that the changing landscape of loopholes, deductions and credits, especially after the 1986 tax reform signed by President Reagan, makes apples-to-apples comparisons of effective tax rates over time very difficult. For more background, see the CBO data on effective tax rates by income quintile.)

5. Low Capital Gains Taxes Fuel Income Inequality...

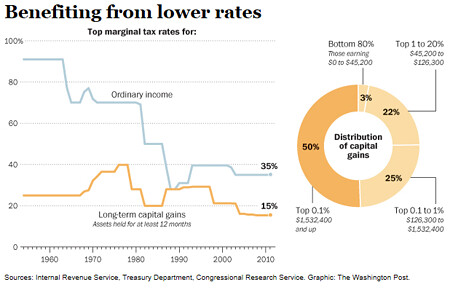

For years, Republicans have also wanted to slash capital gains taxes. (Newt Gingrich proposed eliminating them altogether.) Predictably, that would only serve to make the very rich much, much richer.

In September, an analysis by the Washington Post concluded that "capital gains tax rates benefiting wealthy feed [the] growing gap between rich and poor." As the Post explained, for the very richest Americans the successive capital gains tax cuts from Presidents Clinton (from 28 to 20 percent) and Bush (from 20 to 15 percent) have been "better than any Christmas gift":

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

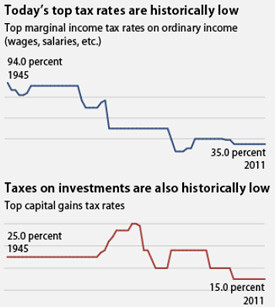

This convenient chart tells the tale:

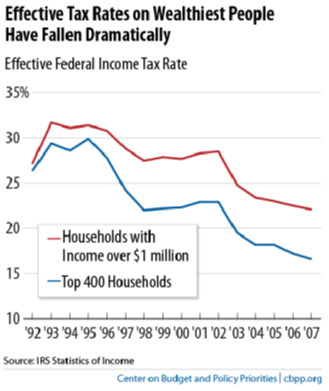

As the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained, "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income." It's no wonder that between 2001 and 2007—a period during which poverty was rising and average household income had fallen—the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

It's no wonder Mitt Romney, who thanks to the "carried interest exemption" pays the low capital gains rate for most of income, told Newt Gingrich during a GOP debate:

"Well, under [your] plan, I'd have paid no taxes in the last two years."

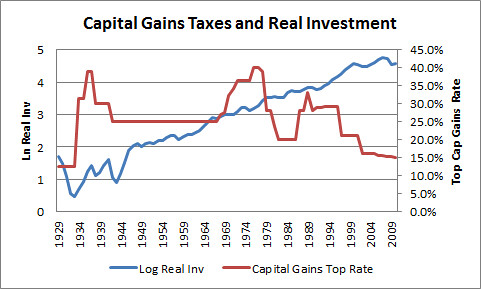

6. ...But Not Investment

Much lower tax rates for capital gains than income earned through labor, conservatives claim, spur investment, catalyze economic growth and fuel job creation. But if that Republican theology isn't true, then the United States has for decades done nothing more than deliver a massive windfall to the wealthiest Americans needing it least. Unfortunately, that's precisely what the data show. As it turns out, lower capital gains taxes increase income inequality—and not investment—in America.

As Paul Krugman recounted, the historically low capital gains rate enjoyed by the likes of Mitt Romney hasn't always been 15 percent. In the not-too-distant past, it reached 39.9 percent and before the Reagan tax reform of 1986 was the same as the top tax rate on income. But successive presidents of both parties lowered the capital gains rate on investment income because they believed, the Washington Post explained, "it spurs more investment in the U.S. economy, benefiting all Americans."

But as Jared Bernstein demonstrated with the chart below, there's no evidence to support that claim.

Bernstein found that that the business cycle, not acts of Congress, drive investment in the U.S.

Hard to see anything in the picture supporting the view that either the level or changes in cap gains taxes play a determinant role in investment decisions.

Remember, the ostensible reason for the favoritism in tax treatment here is to incentivize more investment and faster productivity growth. But that's not in the data and the reason it's not in the data is because investors aren't nearly as elastic to cap gains rates as their lobbyists say they are (more precisely, they'll carefully time their realizations to maximize their gains around rate changes, but that's not real economic activity-that's tax planning).

Reviewing other analyses,

Brad Plummer of the Washington Post concurred with that assessment that low capital gains taxes don't necessarily jump-start investment in the economy:

The top tax rate on investment income has bounced up and down over the past 80 years—from as high as 39.9 percent in 1977 to just 15 percent today—yet investment just appears to grow with the cycle, seemingly unaffected...

Meanwhile, Troy Kravitz and Len Burman of the Urban Institute have shown that, over the past 50 years, there's no correlation between the top capital gains tax rate and U.S. economic growth—even if you allow for a lag of up to five years.

Billionaire

Warren Buffett, the inspiration for the "Buffett Rule" advocated by President Obama and his Democratic allies, couldn't agree more. As he told the

New York Times last year:

"I have worked with investors for 60 years and I have yet to see anyone -- not even when capital gains rates were 39.9 percent in 1976-77 -- shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off."

But if lower capital gains tax rates have had little impact on investment, they have had an outsized impact on income inequality in the United States. As the

Congressional Research Service (CRS) explained in December:

Capital gains and dividends were a larger share of total income in 2006 than in 1996 (especially for high-income taxpayers) and were more unequally distributed in 2006 than in 1996. Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality. Taxes were less progressive in 2006 than in 1996, and consequently, tax policy also contributed to the increase in income inequality between 1996 and 2006.

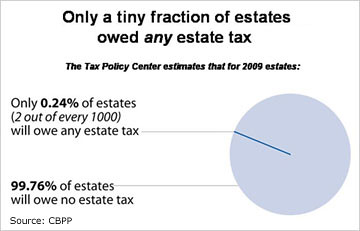

7. The Estate Tax Has Virtually No Impact on Family Farms and Businesses

The Republican scam over the so-called "death tax" is as bogus now as it was when President Bush first perpetrated it during the 2000 election. Both Paul Ryan and Mitt Romney want to eliminate the tax—and the billions in annual revenue it generates for the U.S. government—altogether.

As former Nevada Sen. John Ensign griped, "It destroys a lot of small businesses and a lot of family farms and ranches in America," House Minority Leader John Boehner (R-OH) groused:

"People who aren't wealthy, who may have built up value in land over generations and many family farms find themselves in situations where they've got to sell the farm in order the pay the taxes."

Sadly for conservative myth-makers, that claim, too, is completely false.

That tax is currently paid by less than a quarter of one percent of American estates each year. Despite Republican mythology to the contrary, the Tax Policy Center reported that in 2009 fewer than 2,700 family farms and businesses owed the tax to Uncle Sam. But thanks to successful Republican brinksmanship, the December 2010 tax cut compromise lowered the rate from 45 percent to 35 percent while boosting the estate tax exemption to $10 million per couple, dropping the number of families impacted to just 40 a year. Now, Mitt Romney wants to make sure those 40 richest estates estimated to now pay the tax each year could keep billions of dollars away from the federal government.

And among those 40 estates would be his own. With President Romney zeroing out the estate tax, his five sons and 18 grandchildren would get a golden shower when their grandparents Mitt and Ann leave the scene. Their payday courtesy of all other American taxpayers could reach $84,000,000, that is, 35 percent of $240 million. (The Romney clan's winnings courtesy of the U.S. Treasury pale in comparison to the billions to be saved by the billionaires who back Mitt Romney and his Super PAC.)

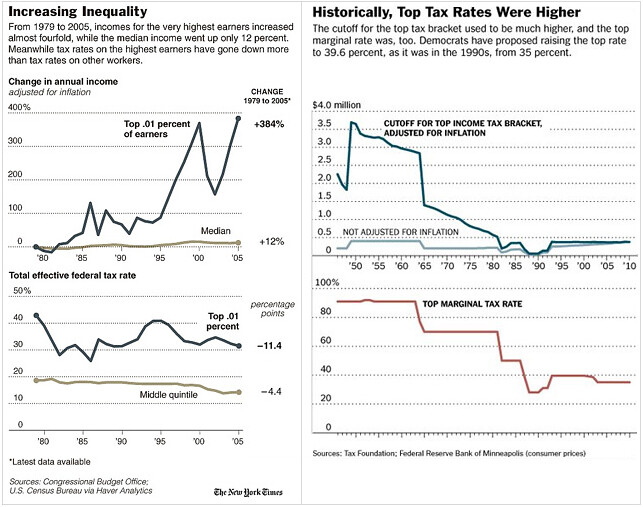

8. Income Inequality is at an 80 Year High ...

As Think Progress demonstrated (see charts above), historically lower tax rates for the richest Americans did not produce either more job creation or faster economic growth. (In fact, the Bush years produced what Leonhardt rightly labeled as "The decade with the slowest average annual growth since World War II.") But what the conservative cornucopia for the gilded-class does reliably produce is unprecedented income inequality.

A report from the Center on Budget and Policy Priorities (CBPP) found a financial Grand Canyon separating the very rich from everyone else. Over the three decades ending in 2007, the top 1 percent's share of the nation's total after-tax household income more than doubled, from 7.5 percent to 17.1 percent. During that time, the share of the middle 60 percent of Americans dropped from 51.1 percent to 43.5 percent; the bottom four-fifths declined from 58 percent to 48 percent. As for the poor, they fell further and further behind, with the lowest quintile's income share sliding to just 4.9 percent. Expressed in dollar terms, the income gap is staggering:

Between 1979 and 2007, average after-tax incomes for the top 1 percent rose by 281 percent after adjusting for inflation -- an increase in income of $973,100 per household -- compared to increases of 25 percent ($11,200 per household) for the middle fifth of households and 16 percent ($2,400 per household) for the bottom fifth.

As economists Emmanuel Saez and Thomas Piketty documented, income inequality isn't just as it highest level since the Great Depression. The rich, it turns out, have already more than recovered from the impact of the Bush recession which began in late 2007:

They have found that the trends have mostly continued. From 2000 to 2007, incomes for the bottom 90 percent of earners rose only about 4 percent, once adjusted for inflation. For the top 0.1 percent, incomes climbed about 94 percent.

The recession interrupted the trend, with the sharp decline in stock prices hitting the pocketbooks of the rich. But the income share of 1 percent has since rebounded. Data that the two economists released in March showed that the top 1 percent of earners got nearly every dollar of the income gains eked out in the first full year of the recovery. In 2010, the top 10 percent of earners took about half of overall income.

9. ... While the Federal Tax Burden is at a 60 Year Low

During the height of the Republicans' debt ceiling hostage-taking last summer, Speaker Boehner said the road to a compromise was my way or the highway:

"Medicare, Medicaid—everything should be on the table, except raising taxes."

Which purely by the numbers (if not ideology) is an odd position to take. After all, as a percentage of the U.S. economy, the total federal tax bite hasn't been this low in 60 years.

As the chart representing President Obama's 2012 budget proposal above reflects, the American tax burden hasn't been this low in generations. Thanks to the combination of the Bush Recession and the latest Obama tax cuts, the AP reported, "as a share of the nation's economy, Uncle Sam's take this year will be the lowest since 1950, when the Korean War was just getting under way." In January, the Congressional Budget Office (CBO) explained that "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." That finding echoed an earlier analysis from the Bureau of Economic Analysis. Last April, the Center on Budget and Policy Priorities concluded, "Middle-income Americans are now paying federal taxes at or near historically low levels, according to the latest available data." As USA Today reported in May 2010, the BEA data debunked yet another right-wing myth:

Federal, state and local taxes—including income, property, sales and other taxes—consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress.

Or as former Reagan Treasury official

Bruce Bartlett explained it in the

New York Times:

In short, by the broadest measure of the tax rate, the current level is unusually low and has been for some time. Revenues were 14.9 percent of G.D.P. in both 2009 and 2010. Yet if one listens to Republicans, one would think that taxes have never been higher, that an excessive tax burden is the most important constraint holding back economic growth and that a big tax cut is exactly what the economy needs to get growing again.

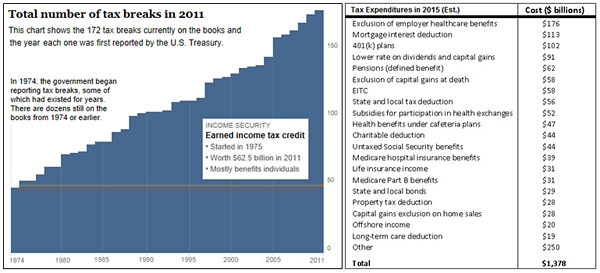

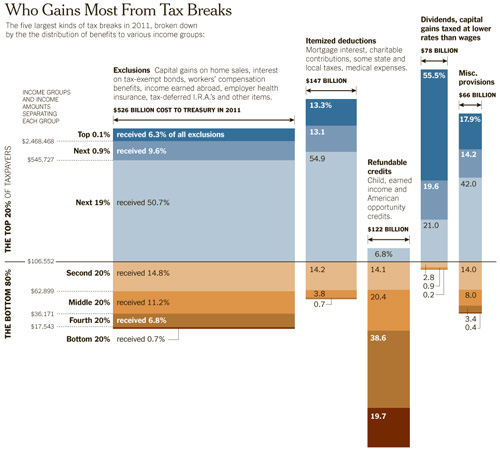

10. Which of the $1 Trillion in Tax Breaks Will GOP End?

Republicans Mitt Romney and Paul Ryan have promised to slash tax rates and yet still balance the budget by getting "rid of the special interest loopholes, special deductions, lower everybody's tax rates, bring in at least as much revenue to the government." But because neither Romney nor Ryan has had the courage to publicly state which loopholes and deductions they would end, the inevitable result would be trillions in new national debt.

But their cowardice is to be expected. As the New York Times recently revealed, that trillion dollars in annual tax expenditures is now larger than Uncle Sam's take from the income tax each year. And as the Washington Post highlighted last year, "ever-increasing tax breaks for U.S. families eclipse benefits for special interests"

It's important to understand that much of the estimated $1.3 trillion in annual tax expenditures in 2015 (a figure larger than the entire 2012 budget deficit and equivalent to about a third of the $3.8 trillion in federal spending next year) benefit working and middle income Americans. For example, the home mortgage tax deduction was worth $89 billion in 2011. Tax-deferred 401K accounts cost the Treasury $63 billion. The Earned Income Tax Credit had a similar $63 billion price tag last year.

Yet, as Paul Krugman pointed out in "Pink Slime Economics," the deductions and loopholes are the mystery meat in Paul Ryan's budgetary dog food:

We're talking about a lot of loophole-closing. As Howard Gleckman of the nonpartisan Tax Policy Center points out, to make his numbers work Mr. Ryan would, by 2022, have to close enough loopholes to yield an extra $700 billion in revenue every year. That's a lot of money, even in an economy as big as ours. So which specific loopholes has Mr. Ryan, who issued a 98-page manifesto on behalf of his budget, said he would close?

None. Not one. He has, however, categorically ruled out any move to close the major loophole that benefits the rich, namely the ultra-low tax rates on income from capital. (That's the loophole that lets Mitt Romney pay only 14 percent of his income in taxes, a lower tax rate than that faced by many middle-class families.)

In April, the

New York Times put Krugman's question into a handy chart of "

Who Gains Most from Tax Breaks":

NOTE: An earlier version of this article first appeared on April 17, 2012.