I was skimming through articles at Google News this afternoon and saw an article titled, NYTimes: Yes, Mitt Romney pays his income taxes, I clicked through to find myself at the conservative blog, The Blaze, reading this post:

What are the chances Harry Reid will apologize for his baseless claims to the contrary?

But even though he has not released his returns from earlier years, the 2010 return sheds some light on those years.

That’s because Mr. Romney paid income tax to foreign countries, and as result claimed in 2010 a $129,697 foreign tax credit, which he used to offset taxes he owed in the United States. American taxpayers who claim the foreign tax credit are required to report their total foreign taxes paid and tax credits used for the previous 10 years. So that return contains foreign tax data going back to 2000.

The good news for Mr. Romney is the forms suggest that he paid at least some federal income tax every year, as he has said he did. He used the foreign tax credit every year to offset his taxes in the United States, and American taxpayers can’t use a tax credit if they owe no federal income tax. This casts even more doubt on the claim by the Senate majority leader, Harry Reid, attributed to an unnamed Bain Capital source, that Mr. Romney paid no income taxes during that time.

I had written a

diary on Friday about the same article in

The New York Times, but I didn't realize it was the same article at first. So when I read that part I have placed in bold, my initial reaction was to laugh at that conservative blog. I thought they had just proved that Mitt Romney did pay ZERO income taxes using this logic:

If you paid more in Foreign Income Taxes than you owed in U.S. Federal Income Taxes, and you had so much credit that you had to carry some of it forward to future years because you can't take more in credits than you owe the U.S. Treasury, that must mean you wiped out what you owed in U.S. Federal Income Taxes in that year. Meaning that you essentially did pay ZERO U.S. Federal Income Taxes because all your income taxes went to foreign countries.

But the very next sentence in the NYT articles says, "This casts even more doubt on the claim by the Senate majority leader, Harry Reid, attributed to an unnamed Bain Capital source, that Mr. Romney paid no income taxes during that time." I had to be missing something. How could both my interpretation of the bolded part and the sentence after it be true? So I went to the IRS website and looked up

What Foreign Taxes Qualify For The Foreign Tax Credit?

Generally, the following four tests must be met for any foreign tax to qualify for the credit:

1. The tax must be imposed on you

2. You must have paid or accrued the tax

3. The tax must be the legal and actual foreign tax liability

4. The tax must be an income tax (or a tax in lieu of an income tax)

The

Foreign Tax Credit - How to Figure the Credit page indicates there is a limit on how much of the Foreign Tax Credit you can claim.

Foreign Tax Credit Limit

Your foreign tax credit cannot be more than your total U.S. tax liability multiplied by a fraction. The numerator of the fraction is your taxable income from sources outside the United States. The denominator is your total taxable income from U.S. and foreign sources.

If you have foreign taxes available for credit but you cannot use them because of the foreign tax credit limit, you may be able to carry them back to the previous tax year and forward to the next 10 tax years. Refer to Carryback and Carryover in Publication 514, Foreign Tax Credit for Individuals.

However, just below that the tax rules explain that there are exemptions from the limit.

Exemption from the Foreign Tax Credit Limit

You will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using Form 1116 if the following requirements are met.

- Your only foreign source gross income for the tax year is passive income, as defined in Publication 514 under Separate Limit Income. However, for purposes of this rule, high taxed income and export financing interest are also passive income. Passive income also includes income that would be passive except that it is also described in another income category.

- Your qualified foreign taxes for the tax year are not more than $300 ($600 if filing a joint return).

- All of your gross foreign income and the foreign taxes are reported to you on a payee statement (such as a Form 1099-DIV or 1099-INT).

- You elect this procedure for the tax year.

I went to

Publication 514 to find out the definition passive income for income tax purposes, which turns out to be what you would think it is; income from sources like dividends, interest, rents, royalties, etc. So, I went to Romney's Website and I downloaded his

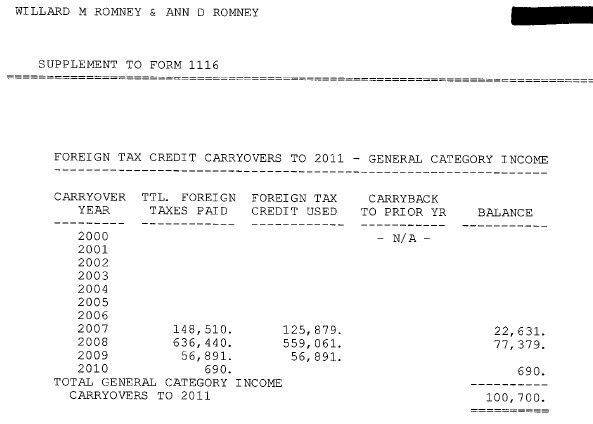

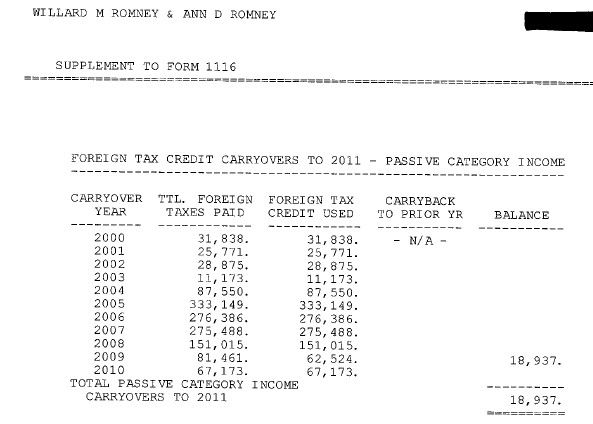

tax return for 2010. It turns out his foreign investments are so complicated that he filed four separate Form 1116s. He also attached schedules to the end of the return of his carryovers for 10 years. There were two. One for for

General Income and one for

Passive Income.

General Income Carryover Schedule

Passive Income Carryover Schedule

Update: Love this Tweet! DR added up the foreign taxes. Why didn't I think of that?

But wait, DR only added up the Passive taxes to get the $1,369,879. When you add the $842,531 taxes paid on general foreign income, the actual total is $2,212,410.

Look at the Passive Income Schedule. Every year he uses the entire amount as a credit because there is no limit on how much of the income taxes paid to foreign countries on passive income that you can use to off-set your U.S. Income Taxes. If this is the rule, and Romney is all about taking advantage of all the rules to save on taxes, why didn't he use all of the 2009 Foreign Income Taxes paid to off-set his U.S. Taxes owed? Why is there $18,937 carried forward?

Maybe I'm just over-simplifying this. I'm not a tax expert, but I sure would like a tax expert to explain to me why Romney carried forward $18,937 in 2009 because the only reason I can think of is that the $67,173 brought him to owing the U.S. Treasury ZERO dollars in 2009, and so he had to carry the remaining balance of $18,937 forward.

Here's a clip from the August 3rd The Rachel Maddow Show of how Romney responded to questions about what Harry Reid said:

Rachel Maddow: Mitt Romney really never takes questions from reporters. But today he did.

[Video of Mitt Romney] Question from female Reporter: Harry Reid has said that you didn't pay taxes for ten years, according to some sources that he hasn't named. I mean, could you silence these, these remarks if - by just disclosing more of your tax returns?

Mitt Romney: Well, Harry Reid has to put up, or shut up. All right.

This is the guy who won't release his tax returns, talking about his tax returns, saying somebody else needs to (laughing) put up or shut up.

[Video of Mitt Romney] Mitt Romney: Let me also say categorically, I have paid taxes every year, and a lot of taxes. A lot of taxes. So Harry is simply wrong.

Question from male Reporter: Instead of just going back and forth with Harry Reid, why not just release the tax returns? Just put the issue to bed.

Mitt Romney: Well actually, you can go on our website, and you can see my financial disclosure statements going back to 2002. You also can see the tax returns that I put out for 2010. [Splice in tape] Go on the website. You'll be surprised to see the amazing about of data that's associated with our campaign's disclosure. Thank you.

Rachel Maddow: Thank you.

Notice how Romney says, "I have paid taxes every year, and a lot of taxes. A lot of taxes." People have noticed before that Romney never says "income taxes," and deduced that Romney was generalizing on purpose to include property taxes, sales taxes, etc. I never saw anybody mention that Romney could have also been talking about foreign income taxes. Does anybody else find it hubris that the man who is campaigning on the slogan "

Believe in America" could have meant "I have paid foreign income taxes every year, and a lot of foreign income taxes. A lot of foreign income taxes?"

Yeah, Mitt, way to Believe in America! Look at all those dollars you paid in foreign income taxes that you were able to deduct from the amount you owed in U.S. Federal Income Taxes. That really shows us how much you believe in investing in America.