If for nothing else, you have to give Republican leaders and their conservative echo chamber credit for staying on message. After Paul Ryan famously declared the America was becoming a nation of "makers versus takers," Jeb Bush praised Ryan's defense of "the right to rise" supposedly now under assault. Last week, supply-side propagandist George Gilder, perhaps best known for his mantra that "the poor most of all need the spur of their own poverty," returned to warn that "people will abuse any free good." And campaigned this weekend in Ohio, the GOP ticket of Mitt Romney and Paul Ryan claimed theirs is the party of "success."

As it turns out, there is one problem with this Republican chest-thumping. Because when it comes to which political party is best for the American economy, it's not the GOP. It's not even close.

As the historical record shows, from economic growth and job creation to stock market performance and just about every other indicator of the health of American capitalism, the modern U.S. economy has almost always done better under Democratic presidents. Despite GOP mythology to the contrary, America generally gained more jobs and grew faster when taxes were higher (even much higher) and income inequality lower.

While the U.S. recovery from the crippling Bush recession has been painfully slow, most economists--including the nonpartisan CBO and some of John McCain's own 2008 advisers--believe President Obama saved the American free-enterprise system from the abyss. And many economists are increasingly worried that businessman-turned-President Romney would lead the United States back into recession.

Here's why the economic debate between Democrats and Republicans is no contest at all. (Click a link below for the details on each.)

Continue reading below the fold.

Job Creation and Economic Growth

When President Obama declared in December that decades of Republican trickle-down economics "never worked," conservatives were predictably apoplectic. Instead, they should have been ashamed.

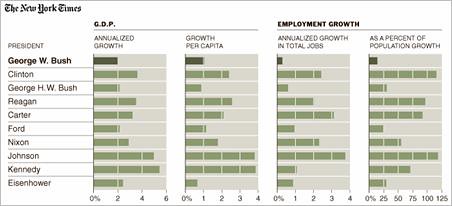

To be sure, George W. Bush provided the perfect bookend to era of modern Republican economic management ushered by Herbert Hoover. The verdict on President Bush's reign of ruin was pronounced even before Barack Obama took the oath of office. Just days after the Washington Post documented that George W. Bush presided over the worst eight-year economic performance in the modern American presidency, the New York Times on January 24, 2009 featured an analysis ("Economic Setbacks That Define the Bush Years") comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and fueling stock market growth.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

That dismal performance prompted David Leonhardt of the New York Times to ask last fall, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

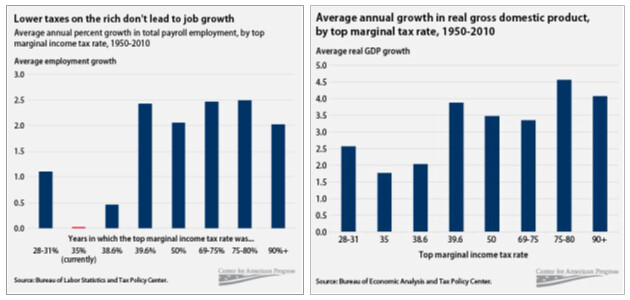

The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

It's no wonder Leonhardt followed his first question with another. "I mean this as a serious question, not a rhetorical one," he asked, "Given this history, why should we believe that the Bush tax cuts were pro-growth?" Or as Mark Shields asked and answered last April:

"Do tax cuts help 'job creators' or 'robber barons'?"

But as the

Washington Post and the

New York Times suggested, Bush's dismal performance was hardly the exception to the rule. In general, the American economy simply does better when a Democrat sits in the White House. Apparently, America's job creators can create a lot more jobs when their taxes are higher - even much higher - than they are today.

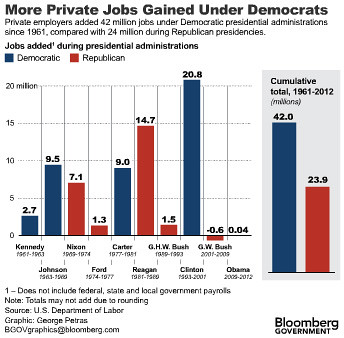

In May, Bloomberg News similarly confirmed that private sector jobs increase more with Democrats in the White House. (Ironically, this is the first recession in 40 years in which the total federal, state and local government workforce contracted.) As Bloomberg explained:

Since Democrat John F. Kennedy took office in January 1961, non-government payrolls in the U.S. swelled by almost 42 million jobs under Democrats, compared with 24 million for Republican presidents, according to Labor Department figures...Democrats hold the edge though they occupied the Oval Office for 23 years since Kennedy's inauguration, compared with 28 for the Republicans.

And as ThinkProgress highlighted, over the past 50 years, Republican administrations oversaw the largest declines in wages (measured as a percentage of U.S. Gross Domestic Product):

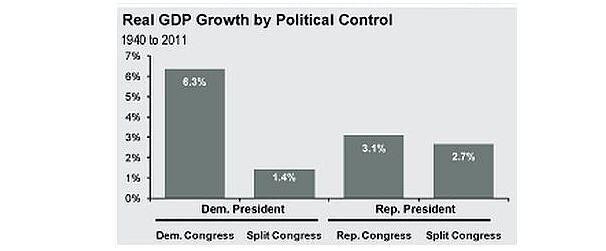

As it turns out, control of Congress matters as well. As the Washington Post reported earlier this month, a recent JP Morgan study found that the American economy grew fastest when Democrats in charge of both 1600 Pennsylvania Avenue and Capitol Hill:

The Stock Market

For the investor class so fond of perpetuating the myth of Republicans' superior economic stewardship, the collapse of the stock marketing during the Bush recession must be particularly galling. The Standard & Poor's 500 spiraled down at annual rate of 5.6% during Bush's time in the Oval Office, a disaster even worse than Richard Nixon's abysmal 4.0% yearly decline. (Only Herbert Hoover's cataclysmic 31% plunge makes Bush look good in comparison.)

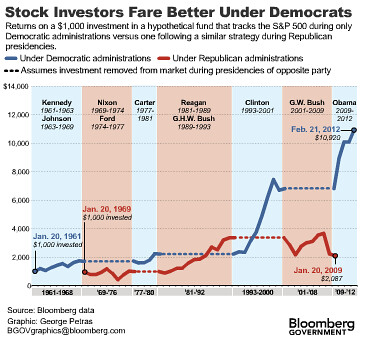

As it turns out, as the New York Times also showed in October 2008, the Democratic Party "has been better for American pocketbooks and capitalism as a whole." To make its case, the New York Times asked readers to imagine having put their money where its mouth is. Contrary to Republican mythology, Americans fare better - much, much better - under Democratic administrations:

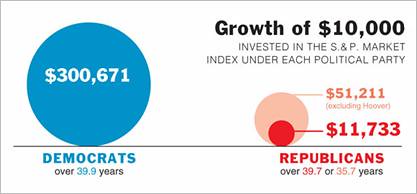

As of Friday, a $10,000 investment in the S.& P. stock market index would have grown to $11,733 if invested under Republican presidents only, although that would be $51,211 if we exclude Herbert Hoover's presidency during the Great Depression. Invested under Democratic presidents only, $10,000 would have grown to $300,671 at a compound rate of 8.9 percent over nearly 40 years.

(For the

eye-popping chart of the S&P's performance under each of the presidents from Hoover through Bush 43,

visit here.)

As the broader record shows, the best path to prosperity is to elect Democratic presidents.

There's no shortage of studies to show that stock market returns are higher under Democratic leadership. As Slate in 2002 and the New York Times in 2003 found, "It's not even close. The stock market does far better under Democrats." And asBloomberg News documented in February, Barack Obama has been no exception:

Income Inequality

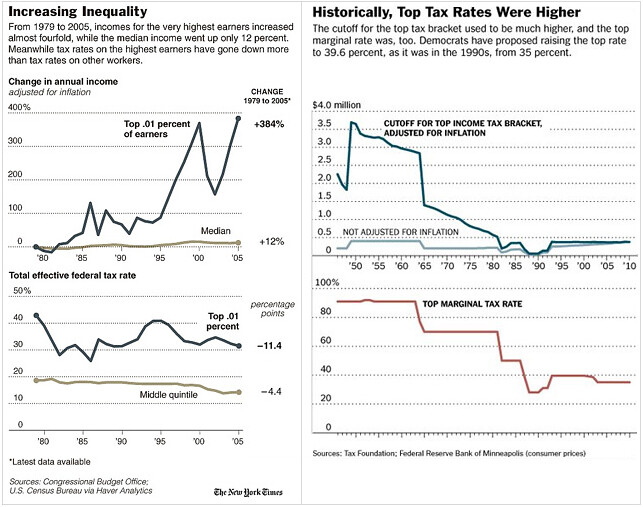

While the GOP's "job creators" didn't create any jobs after the top rate was trimmed to 35 percent and capital gains and dividends taxes were slashed under President Bush, they did enjoy an unprecedented windfall courtesy of the United States Treasury.

For Republicans, this predictable result of the Bush tax cuts was a feature, not a bug.

As the Center for American Progress noted in 2004, "for the majority of Americans, the tax cuts meant very little," adding, "By next year, for instance, 88% of all Americans will receive $100 or less from the Administration's latest tax cuts."

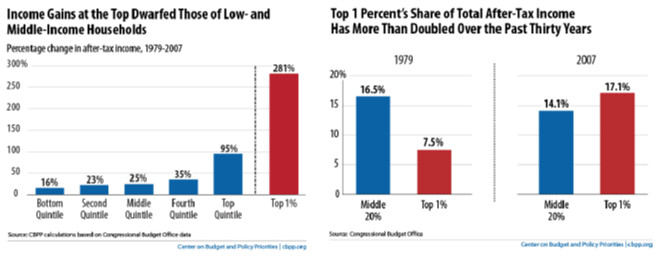

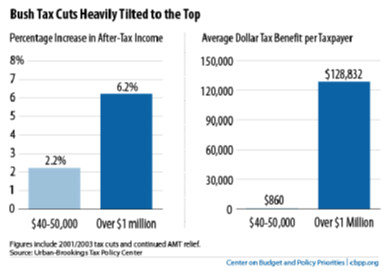

But that's just the beginning of the story. As the CAP also reported, the Bush tax cuts delivered a third of their total benefits to the wealthiest 1% of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities showed that millionaires on average pocketed almost $129,000 from the Bush tax cuts of 2001 and 2003. As a result, millionaires saw their after-tax incomes rise by 6.2%, while the gain for those earning between $40,000 and $50,000 was paltry 2.2%.

And as the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained in a shocking chart: "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income."

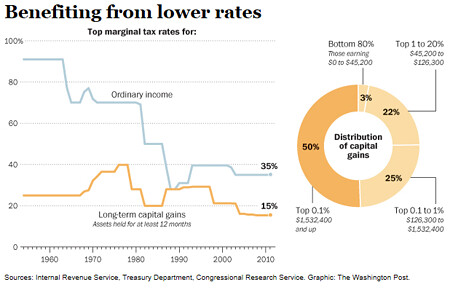

And as the Washington Post recently explained, for the very richest Americans the successive capital gains tax cuts from Presidents Clinton (to 20 percent) and Bush (to 15 percent) have been "better than any Christmas gift":

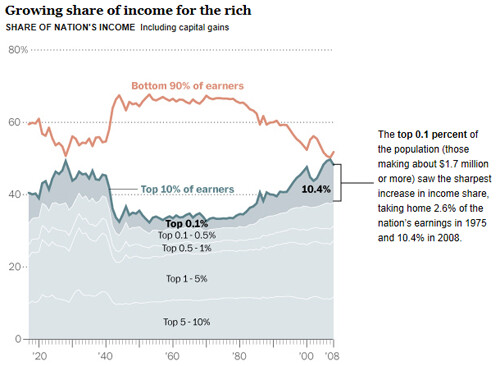

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

This convenient chart tells the tale:

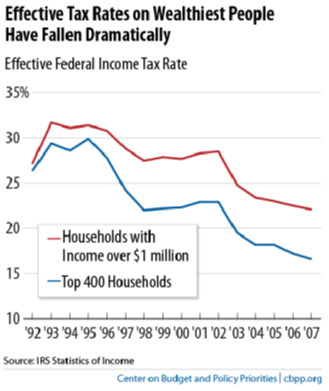

It's no wonder that between 2001 and 2007- a period during which poverty was rising and average household income had fallen - the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

(It's worth noting that the changing landscape of loopholes, deductions and credits, especially after the 1986 tax reform signed by President Reagan, makes apples-to-apples comparisons of marginal tax rates over time very difficult. For more background, see the CBO data on effective tax rates by income quintile.)

If you had any lingering doubts about Warren Buffett's admission that "it's my class, the rich class, that's making war, and we're winning," this pair of charts from the New York Times should put them to rest. As the upper-income tax burden fell, income inequality in the U.S. exploded.

As the Washington Post demonstrated in its jaw-dropping series "Breaking Away," plummeting tax rates overall and on capital gains in particular have been widening the chasm between the rich and everyone else in America:

National Debt

The Republican tax cut windfall for the wealthy didn't merely produce the lowest total federal burden in 60 years and the highest income inequality in 80. GOP trickle down policies also drained the United States Treasury.

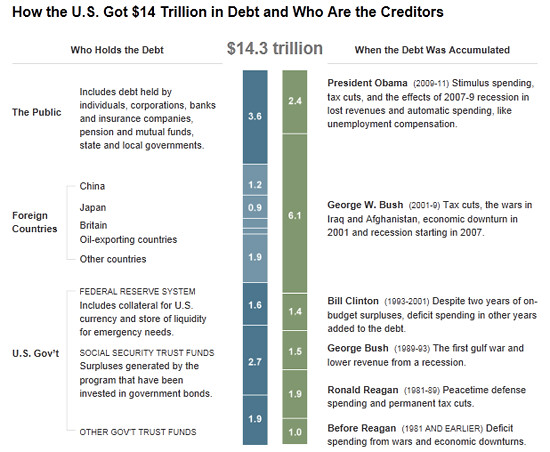

In case Americans had forgotten that Ronald Reagan tripled the national debt and George W. Bush doubled it, the New York Times presented this helpful reminder:

Leave aside for the moment that small government icon Ronald Reagan signed 17 debt ceiling increases into law. (That might explain why the Gipper repeatedly demanded Congress boost his borrowing authority and called the oceans of red ink he bequeathed to America his greatest regret.) As it turns out, Republican majorities voted seven times to raise the debt ceiling under President Bush and the current GOP leadership team voted a combined 19 times to bump the debt limit $4 trillion during his tenure. (That vote tally included a "clean" debt ceiling increase in 2004, backed by 98 current House Republicans and 31 sitting GOP Senators.)

Of course, they had to. After all, the two unfunded wars in Afghanistan and Iraq, the budget-busting Bush tax cuts of 2001 and 2003 (the first war-time tax cut in modern U.S. history) and the Medicare prescription drug program drained the U.S. Treasury. Mitch McConnell, John Boehner and Eric Cantor voted for all of it.

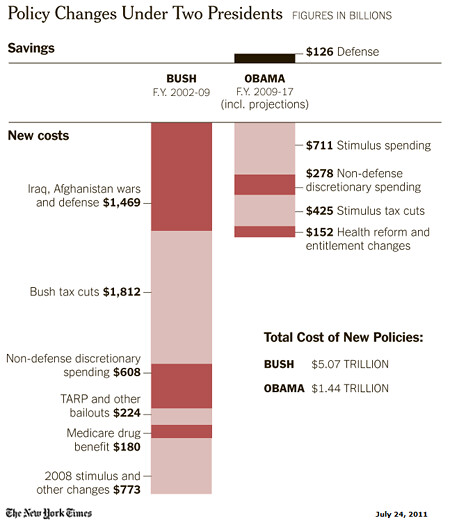

Again, in words and pictures, the New York Times tells the tale:

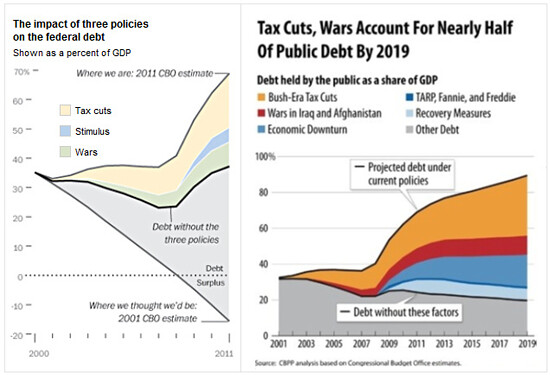

As the Washington Post summed up the CBO's conclusions regarding the causes of the nation's mounting debt earlier this year, "The biggest culprit, by far, has been an erosion of tax revenue triggered largely by two recessions and multiple rounds of tax cuts." The analysis by the Times echoed that finding:

With President Obama and Republican leaders calling for cutting the budget by trillions over the next 10 years, it is worth asking how we got here -- from healthy surpluses at the end of the Clinton era, and the promise of future surpluses, to nine straight years of deficits, including the $1.3 trillion shortfall in 2010. The answer is largely the Bush-era tax cuts, war spending in Iraq and Afghanistan, and recessions.

But as

Ezra Klein explained in the Washington Post, the revealing Times chart doesn't tell the full story of the impact of Bush-era policies on future debt facing Barack Obama:

What's also important, but not evident, on this chart is that Obama's major expenses were temporary -- the stimulus is over now -- while Bush's were, effectively, recurring. The Bush tax cuts didn't just lower revenue for 10 years. It's clear now that they lowered it indefinitely, which means this chart is understating their true cost. Similarly, the Medicare drug benefit is costing money on perpetuity, not just for two or three years. And Boehner, Ryan and others voted for these laws and, in some cases, helped to craft and pass them.

These two graphs from the

Washington Post and the

Center on Budget and Policy Priorities make that point crystal clear. Analyses by CBPP showed that the

Bush tax cuts accounted for half of the deficits during his tenure, and

if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus -

combined.

Utah Senator Orrin Hatch was telling the truth when he described Republican fiscal mismanagement during the Bush years by acknowledging, "It was standard practice not to pay for things."

As Paul Krugman documented, the jump in federal spending as a percentage of GDP under President Obama is almost completely explained by the contraction of the economy and the stimulus programs now ending. (Republicans always take great to care to avoid mentioning that the total federal tax burden as a percentage of the U.S. economy is at its lowest level in 60 years even as income inequality is at its highest in 80.) As Krugman summed it up:

Now, pointing out the Obama spending binge is a myth generally produces rage: people know that it happened, because Rush Limbaugh and the Wall Street Journal say so. But that doesn't make it true.

Put another way, when it comes to the American balance sheet, Republicans broke it. Now, they claim, Democrats own it.

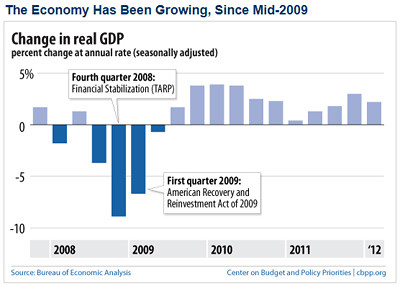

The Bush Disaster and the Obama Recovery

Despite Republican mythmaking that the American Recovery and Reinvestment Act (ARRA) "created zero jobs," the CBO reported in November that the stimulus added up to 2.4 million jobs and boosted GDP by as much as 1.9 points in the past quarter. As it turns out, that conclusion confirms the consensus of most economists - including John McCain's 2008 brain trust- that President Obama's recovery program is continuing to deliver benefits for the American people.

From the beginning, the nonpartisan CBO has testified to the success of the largely concluded 2009 stimulus package in driving employment and economic growth. In February, the New York Times assessed the impact of the Obama stimulus and rebutted its Republican critics:

By comparison, despite criticism of its size and composition by both the right and the left, the stimulus by the Obama administration did add to jobs and growth. The nonpartisan Congressional Budget Office estimates it will have contributed at least 1.6 million jobs and perhaps as many as 8.4 million by 2013.

This month, the Booth School of Business at the University of Chicago surveyed a panel of economic experts of different political persuasions about the impact of the president's stimulus package: eight out of 10 said it had contributed to lower unemployment by the end of 2010. There was less consensus on whether its benefits would exceed its long-term costs, including higher taxes to pay for the spending. Still, when asked if the policy was worth it, four times as many economists agreed as disagreed.

But to really gauge the success of the stimulus, it's worth taking a second look at just how dire the U.S. economic situation was when the Obama administration made its fateful prediction that unemployment would peak at 8 percent. As The Economist and the Washington Post's Ezra Klein detailed, in early 2009 the American economy was not only in much worse shape than anyone imagined; it was literally on the brink of collapse. As The Economist explained the run-up to the passage of the $787 billion recovery program:

The White House looked at the economic situation, sized up Congress, and took its shot. Unfortunately, the situation was far more dire than anyone in the administration or in Congress supposed.

Output in the third and fourth quarters fell by 3.7% and 8.9%, respectively, not at 0.5% and 3.8% as believed at the time. Employment was also falling much faster than estimated. Some 820,000 jobs were lost in January, rather than the 598,000 then reported. In the three months prior to the passage of stimulus, the economy cut loose 2.2m workers, not 1.8m. In January, total employment was already 1m workers below the level shown in the official data.

Klein points out that "wasn't until this year that the actual number was revealed" for Q4 2008 by the Bureau of Labor Statistics. As The Economist lamented, the Obama administration was "flying blind."

Whether the White House should have known the unemployment picture was going to be much, much worse (as Joseph Stiglitz and Jared Bernstein argued) or that the stimulus package itself was too small and too laden with tax breaks (as Paul Krugman warned at the time), there is little question that the American Recovery and Reinvestment Act worked largely as designed. And you don't have to take the CBO's word for it. You can just ask some of John McCain's advisers.

Douglas Holtz-Eakin, former head of the CBO and chief economic adviser to John McCain during the 2008 election, acknowledged the impact of the stimulus. Certainly no fan of either Barack Obama or the design of the ARRA, Holtz-Eakin told Ezra Klein that:

"The argument that the stimulus had zero impact and we shouldn't have done it is intellectually dishonest or wrong. If you throw a trillion dollars at the economy it has an impact, and we needed to do something."

Mark Zandi, another adviser to McCain, was much more adamant. Federal intervention, he and Princeton economist Alan Blinder argued in August 2010, literally saved the United States from a second Great Depression. In "

How the Great Recession Was Brought to an End," Blinder and Zandi's models confirmed the impact of the Obama recovery program and concluded that "laissez faire was not an option":

The effects of the fiscal stimulus alone appear very substantial, raising 2010 real GDP by about 3.4%, holding the unemployment rate about 1½ percentage points lower, and adding almost 2.7 million jobs to U.S. payrolls. These estimates of the fiscal impact are broadly consistent with those made by the CBO and the Obama administration.

But their modeling also suggests that the totality of federal efforts to rescue the banking system dating back to the fall of 2008 prevented a catastrophic collapse:

We find that its effects on real GDP, jobs, and inflation are huge, and probably averted what could have been called Great Depression 2.0. For example, we estimate that, without the government's response, GDP in 2010 would be about 11.5% lower, payroll employment would be less by some 8½ million jobs, and the nation would now be experiencing deflation.

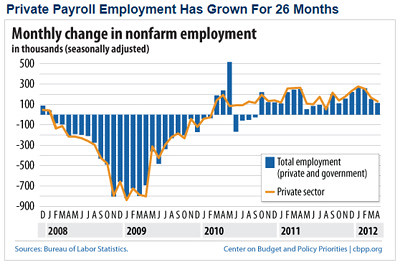

While the U.S. economy is now experiencing slow growth and disappointing job gains, the effects of the stimulus have wound down. Worse still, the

draconian budget-cutting by state and local governments which have already cost 600,000 workers their jobs could rightly be deemed the "anti-stimulus." (Ironically, the public sector grew dramatically under Obama's Republican predecessor, with

900,000 government jobs added during Bush's tenure.) In April, the

Economic Policy Institute reported that "the current recovery is the only one that has seen public-sector losses over its first 31 months." The impact of contracting government is clear. "In fact, if it weren't for this destructive fiscal austerity,"

Paul Krugman explained in March, "Our unemployment rate would almost certainly be lower now than it was at a comparable stage of the 'Morning in America' recovery during the Reagan era."

We're talking big numbers here. If government employment under Mr. Obama had grown at Reagan-era rates, 1.3 million more Americans would be working as schoolteachers, firefighters, police officers, etc., than are currently employed in such jobs.

And once you take the effects of public spending on private employment into account, a rough estimate is that the unemployment rate would be 1.5 percentage points lower than it is, or below 7 percent -- significantly better than the Reagan economy at this stage.

As Krugman asked in November, "And you wonder why the economy isn't recovering strongly?"

Looking Ahead to the Romney-Ryan Recession

Last fall, columnist George Will exulted that the public sector "happily shrank" and cheered "that's good." For his part, Senate Minority Leader Mitch McConnell (R-KY) called those layoffs a "local problem." And to ensure that local problem didn't become Washington's problem, McConnell's Republican friends in Congress didn't merely vote against the February 2009 stimulus bill. During his admitted debt ceiling hostage-taking last summer, McConnell explained, "I refuse to help Barack Obama get re-elected by marching Republicans into a position where we have co-ownership of a bad economy." And last fall when President Obama rolled out his $447 billion American Jobs Act which included new assistance to state and local governments, the GOP filibustered the bill in the Senate. Republicans made it clear why they opposed a bill former McCain economic adviser Mark Zandi forecast that could create up to 1.9 million jobs and add two points to U.S. GDP:

"Obama is on the ropes; why do we appear ready to hand him a win?"

But if the Republicans win in November, the American people will likely be the big losers.

That's because in spite of the GOP's bogus claims that "President Obama made the economy worse," the Romney and Ryan budget blueprints would actually bring economic growth to a screeching halt and with it cast hundreds of thousands of Americans into the ranks of the unemployed.

The Economic Policy Institute summed up the carnage the Ryan budget is forecast to produce:

Paul Ryan's latest budget doesn't just fail to address job creation, it aggressively slows job growth. Against a current policy baseline, the budget cuts discretionary programs by about $120 billion over the next two years and mandatory programs by $284 billion, sucking demand out of the economy when it most needs it and leading to job loss. Using a standard macroeconomic model that is consistent with that used by private- and public-sector forecasters, the shock to aggregate demand from near-term spending cuts would result in roughly 1.3 million jobs lost in 2013 and 2.8 million jobs lost in 2014, or 4.1 million jobs through 2014.

Despite his promise to produce 12 million new jobs in his first term, Mitt Romney's vision isn't much better.

Many leading economists predict that far from rescuing the middle class, Mitt Romney will only batter it further. Joel Prakken, chairman of economic forecasting firm Macroeconomic Advisers, rejected the notion that Mitt's 159-point plan would "reduce the unemployment rate from eight to five in two years." James Galbraith worried that" if applied, these fiscal measures would be utterly draconian" and "the attacks on Medicare and Social Security would throw large portions of the population into poverty." Mark Hopkins of Moody's Analytics stated that "on net, all of [Romney's] policies would do more harm in the short term," adding, "If we implemented all of his policies, it would push us deeper into recession and make the recovery slower." Nobel Prize-winning economist Joseph Stiglitz cautioned, "The Romney plan is going to slow down the economy, worsen the jobs deficit, and significantly increase the likelihood of a recession." And his fellow Nobel winner

Paul Krugman was doubtless saying what those foreign business leaders were thinking when he lamented:

"Ireland is Romney economics in practice. I think Ireland is America's future if Romney is president."

The

Center for American Progress put a number what could result from Mitt Romney looking to the capitals of Europe for guidance:

By a conservative tally, Gov. Romney's 59-point plan would actually cost the economy about 360,000 jobs in 2013 alone.

-----------------------------

Writing in the New York Times, Ross Douthat on Saturday suggested Mitt Romney could be a modern-day FDR because he could be "a president who tries, and tries, and ultimately gets things right." (Given that the Romney-Ryan program ignores almost every lesson learned during the Great Depression, that seems unlikely.) But while Douthat was rewriting history, Steve Pearlstein of the Washington Post asked a simple question: "Can We Save American Capitalism?"

We can, but only if we turn to the party--the Democratic Party--that has done it before.