No doubt we will hear a lot about the "precious fragility" of the super-rich "Job Creators" once again, as we head into another "grand bargaining" season -- otherwise known as "paying our national bills."

Those super-rich "Job Creators" so filled with Uncertainty -- about whether they will rake in 10 or 12 million this year corporeally -- that they couldn't possible hire another American, even if their own "future business growth" and their "nation's well-being" depended on it.

So go the Trickle-Down theories. The super-rich need super-pampering -- in order to even consider their country's economic challenges. Don't test their generosity IRS -- because as Candidate Romney has shown: The super-rich have options -- on where and how and if they invest their millions. It's the American-Cayman way.

Wouldn't it be nice, that instead of "being held hostage" once again to the "precious fragility" of the super-rich "Job Creators" -- that we could instead apply logic and history and maybe some actual Math -- to discover what raising Taxes on the Rich actually does -- in real life, in practice, in the light of previous economic growth periods?

Well a nonpartisan agency has done just that -- combed through the historical archive to "find the linkage" between Tax Rates and concurrent Job Growth.

Thing is the party of the super-rich -- the Republicans -- have preemptively decided that conclusions of that study are somewhat inconvenient to their their storyline. So they have stamped it as "null and void" ... (much like their own political and economic rhetoric).

Here are some of the key findings of that Report -- the facts the Republicans don't want you to see. The Report that puts the "angst-ridden" Job Creators on notice -- that their jig is up. That wherever they put those lower Tax Rate gains -- it certainly isn't back into Creating Jobs, historically speaking.

Multiple CRS Reports Show Tax Cuts for Rich Will Not Harm Economic Growth

On OMBwatch.org -- November 9, 2012

[...]

The New York Times recently reported that a Congressional Research Service (CRS) report was "withdrawn from circulation" at the behest of Senate Republicans. The CRS report finds no relationship between upper-income tax rates and economic growth, undercutting Republican claims that an extension of the Bush tax cuts for the wealthy is necessary for economic growth.

[...]

CRS is a part of the Library of Congress and provides Congress with unbiased analyses of legislative topics to help members craft public policy.

That is what they

used to do -- at least before the current crop GOP Pact-takers,

took our Congress hostage to their

unproven pamper-the-rich ideology, that is.

Here are some of the key findings of that unbiased Library of Congress Report:

Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945 (pdf)

Thomas L. Hungerford, Specialist in Public Finance

September 14, 2012

Congressional Research Service -- 7-5700

www.crs.gov -- R42729

[...]

Summary

Income tax rates have been at the center of recent policy debates over taxes. Some policymakers have argued that raising tax rates, especially on higher income taxpayers, to increase tax revenues is part of the solution for long-term debt reduction.

[...]

Advocates of lower tax rates argue that reduced rates would increase economic growth, increase saving and investment, and boost productivity (increase the economic pie). Proponents of higher tax rates argue that higher tax revenues are necessary for debt reduction, that tax rates on the rich are too low (i.e., they violate the Buffett rule), and that higher tax rates on the rich would moderate increasing income inequality (change how the economic pie is distributed). This report attempts to clarify whether or not there is an association between the tax rates of the highest income taxpayers and economic growth.

[...]

Concluding Remarks

[...]

The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. [...]

In brief, the main "objective" association found, is when top marginal tax rates

go down,

the Rich get Richer. Giving lower Tax Rates to the richest among us, has very little to do with whether the Economy will grow or not.

That does NOT spur them to "create jobs."

No wonder the Republicans don't want this report to get out. They'll need some radically new talking points, if it ever does.

Here's a serious business man breaking down the finer points of the report into plain English. A numbers guy who knows his way around a Linear Regression chart.

BOMBSHELL: New Study Destroys Theory That Tax Cuts Spur Growth

by Henry Blodget, CEO and Editor-in-Chief of Business Insider -- Sep. 21, 2012

One economic theory has been repeated so often for so long in this country that it has become an accepted fact:

Tax cuts spur growth.

Most Americans have gotten so used to hearing this theory that they don't even question it anymore.

[...]

According to a new study by the Congressional Research Service (non-partisan), there's no evidence that tax cuts spur growth.

[...]

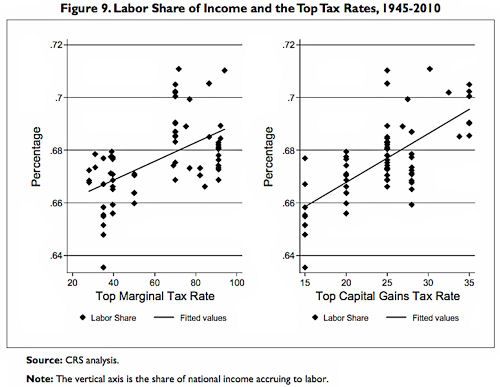

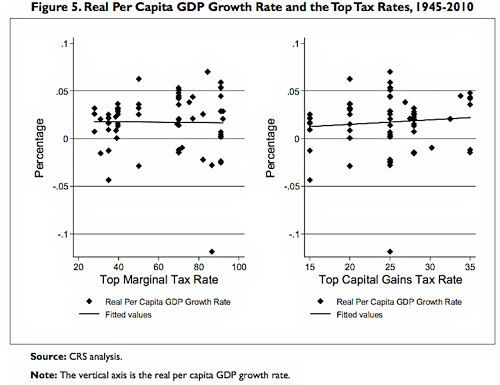

The following charts show the correlation between tax rates and economic growth over the periods above. The slope of the solid line in each chart is the key.

larger image

[Correlation: As Top Tax Rate goes up, the share of Workers Income goes up.]

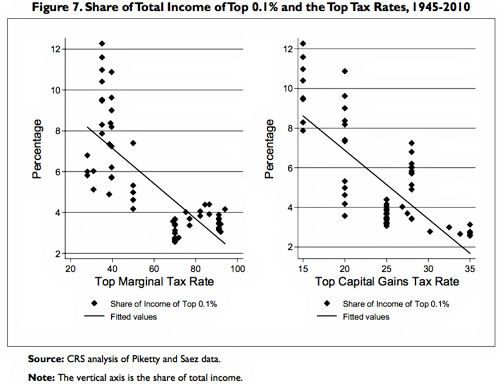

larger image

[Correlation: As Top Tax Rate goes down, the Income of the super-wealthy goes up.]

The lefthand chart shows that there is no correlation between GDP growth and the top marginal tax rates.

larger image

[Correlation: None. The Growth of GNP is independent of Top Tax Rate.]

Thanks for highlighting those nuts and bolts of those CRS charts, CEO Blodget. So what do all those X-Y dots and average correlation lines mean?

Well basically, the closer the line is to a 45 degree angle, the stronger "the relationship" is between variable X and variable Y. ie. a change in Variable X seems to be related to, likely even "causing," the associated change in Variable Y.

And conversely, the the closer the regression line is to a 0 degree angle (flat-line), the more likely it is that variable X and variably Y are not linked, not related. ie. they are "random variables," oblivious to each other in the real world.

In other words, the link between Lower Top Tax Rates (X) and the concurrent Job Growth (Y) is Flat-lined. It does not exist. That's what the historically data shows.

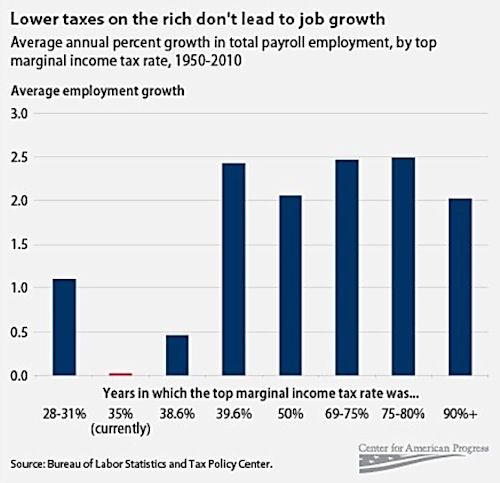

Here is another data chart, posted by Erza Klein, that shows much the same thing -- the Lack of causal correlation between pampering the "Job Creators" and the actual Creation of Jobs.

Tax rates and job creation in one graph

Posted by Ezra Klein, washingtonpost.com -- 06/28/2011

Tax Rates vs Job Growth

larger image

[Correlation: As Top Tax Rate goes up, the level of Employment Growth usually goes up too. Note: that red bar. It's our current situation -- the era of the Bush Tax Cuts.]

It's truly tragic we have let Republicans -- hold hostage unbiased Fact like these.

Let them get away with the unproven, hollow, worn-out Trickle-Down claims.

It's truly tragic, especially considering Republicans, don't much believe in Science, believe in Math, nor much in Facts.

Truly tragic, because what they have been selling us -- DOES NOT WORK.

This has been proven, time and time again. Just check their track record. Just check the data-point history. ... The history of where the "spoils of productivity," really go. In this "uncertain" economy.

Trickle-Down does not work. We need growth driven by consumer demand -- from the Middle Class outward. That is what grows our economy. Money in our pockets, to spend.

Tax Cuts to the super-rich, not so much. That just makes them Super-Richer.

If the Facts, be told.