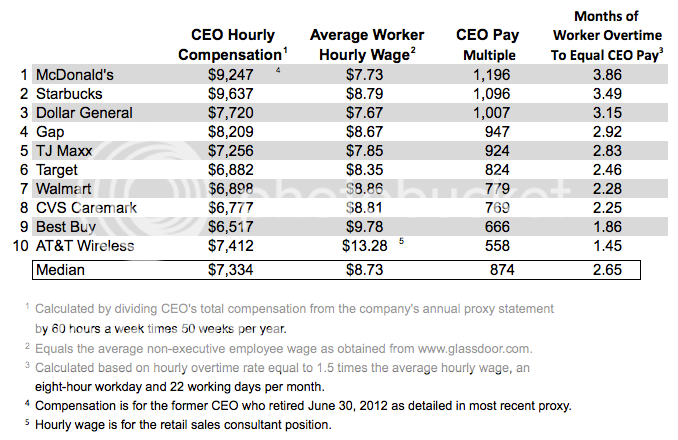

A few weeks ago, the folks at the site NerdWallet decided to analyze just how stark the inequality at major fast food and retail chains is. They calculated the ratio of CEO hourly compensation to the average hourly worker wage as well the number of months of overtime that average worker would have to work in order to earn money equivalent to that hourly CEO pay. Their results are below:

The CEOs at McDonald's, Starbucks, and Dollar General make over 1,000 times as much per hour as the average non-executive employee in their company. Their employees would have to work over three months just to make as much as those CEOs make in one hour.

According to data from the Social Security Administration, the median wage in 2012 was $27,519.10. If we assume 40 hours a week and 52 weeks per year, then that comes out to $13.23 per hour. The CEO at McDonald's makes 699 times that per hour.

The CEO with the lowest hourly compensation in NerdWallet's sample was that of Best Buy, at $6,517 per hour. That CEO makes 666 times the average non-executive Best Buy employee and 493 times the median worker in the country.

According to a 2010 report from the Institute for Policy Studies, CEOs back in the 70s rarely made more than 30 times what their workers made. IPS calculated that the CEOS major corporations recently averaged 263 times the compensation of average workers. Unsurprisingly, the rapid growth of executive compensation began in the 1980s---and it's continued since.

Socialists and Greens in Switzerland recently championed a referendum to limit executive compensation to 12 times the compensation of the lowest-paid worker, often called the "1:12 referendum" for short. The referendum did not pass (65.3% against to 34.7% in favor), which should come as no surprise since market liberalism is stronger in Switzerland than in other European countries. Consider, for instance, the results of the most recent Swiss federal election. The Socialists, the Greens, and the minor parties of the left won only 28.3% of the popular vote. The parties of the center-right and right had a combined 49.6%, and the parties of the center (the Christian democrats and the Green liberals) had 19.7% of the vote. The 65-35 split in the vote on the referendum looks about right, given this ideological split.

The political will for such an initiative appears even weaker in the U.S. Here is the response I received from Elizabeth Warren, one of the most progressive Democratic senators, in response to a petition calling for similar action in the US:

Thank you for contacting me in support of limitations on corporate executive compensation, such as the recent Swiss proposal that would have capped the salary of certain corporate executives at 12 times the salary of the lowest-paid employee at the executive's company.

I believe that companies should be able to pay top dollar to attract and retain key executives but that the public deserves to know more about these disparities so that investors can assess whether they benefit from such stark differences in compensation. That is why I joined several fellow Senators in urging the Securities and Exchange Commission to promptly finalize a rule that requires companies to report, in the form of a ratio, the CEO's total annual compensation compared to the median total annual compensation of all other company employees. When executive compensation packages are misaligned with shareholder interests, it is bad for workers, bad for investors, and bad for the economy. We learned that the hard way during the financial crisis, when the structure of inflated executive compensation packages on Wall Street led to short-term recklessness and staggering economic cost to our country. We still have not fully recovered from that crisis, and this is an area that I care deeply about.

Disclosure is a positive step, even if it could end up

inadvertently exacerbating the problem. However, transparency does not inherently create political will or inspire action. The logic for disclosure in the email above is very technocratic. Its value apparently lies in how it promotes efficiency and sound management and how it helps to manage risk. Morality and justice are largely absent.

This emphasis on productivity and economic efficiency dominates much of Democratic argumentation/rhetoric these days (but, thankfully, not all of Warren's--she often manages to be a very effective moral communicator). Consider the effort to increase the minimum wage. Because the increase in the minimum wage boosts economic productivity of workers and buying power of consumers, say Democrats, it won't conflict with the continuation of profit. Perhaps it could even increase profits! We see similar arguments as well in the debate over immigration, where Democrats often would prefer to talk about the economic benefits of immigration than to address questions of human rights, justice, and family reunification. Action on climate change, too--insofar as it even gets discussed--is often presented more as an economic opportunity than a moral imperative.

One gets the impression that Democrats are talking to their donors, not their constituents, when they make such arguments.

In their recent book How Much is Enough? Money and the Good Life, Robert and Edward Skidelsky highlight the weakness of the technocratic defense for reform:

The historian Peter Clarke has usefully distinguished between “moral” and “mechanical” reformism. Moral reformism saw improvements in material conditions as ways of elevating the moral condition of the people; mechanical reformism simply aimed to increase their prosperity. Deprived of the ethical language by the collapse of religion and the strongly individualist fashion in economics and political philosophy, ‘moral’ liberals were forced back on purely ‘mechanical’ arguments. They stressed the positive effect on productivity of a better fed, better housed, better clothed, healthier and better educated workforce. This was almost certainly true. However, once the commonly accepted language became one of efficiency, the moral reformers were vulnerable to the charge that their reforms had created inefficiency by lessening the incentives to work and save, and by stealing resources from the productive sector. The social liberalism of the 1950s and 1960s had nothing left to put in place of the profit motive, only qualifications that applied to particular examples of ‘market failure.’ So when the social liberal states ran into fiscal crisis in the 1970s, they had no intellectually cogent defenses to offer against the restatement of the philosophy of untrammeled self-interest. Tax rates tumbled, the welfare state was reined in, state industries were privatized, the financial sector was set free.

[Note: The book by Peter Clarke cited is

Liberals and Social Democrats. If you are interested in the intellectual history of the early 20th century British left, then definitely take a look.]

With a reduced willingness to make the moral case for egalitarian policies, liberals have embraced "growth" as their favored economic tool. Economic growth, to the (technocratic) liberal, can resolve the contradictions between classes within capitalism. If you are growing the size of the pie, then you can avoid the question of the disparity in the sizes of the slices.

The rising tide may "lift all boats," but the yacht will go further than the rowboat--and might even crush it.

Economic growth, in other words, is how liberals avoid talking about power.

Liberalism, by its nature, is an ideology of compromise. Liberalism celebrates the power of the market to increase prosperity but asserts the need to tame the market for its own good. Liberalism does not veer into the territory of system change or redesign. Consequently, liberal reformism often amounts to little more than opportunism: steps forward but no path.

Liberal reformism is constrained by its refusal to challenge the centrality of the profit motive—that is, to ask how much (if any) profit is justified and, as Skidelsky and Skidelsky ask, how much (money) is enough. Because of the inherent aversion to structural or systemic change, liberalism often depends on weak appeals to sympathy or enlightened self-interest. Sympathy is often narrow and intermittent, and at best, can support a pity-charity liberalism. Relying on enlightened self-interest is difficult because self-interest is rarely enlightened.

"Get as much as you can--but leave some for others" is not a particularly inspiring credo.

Eschewing the need to change society at the root and to change culture and values in order to broaden the sphere of the possible, liberal reformist opportunism prevents itself from offering enduring solutions to the problems that it is often capable of identifying. Organizing will be only ad hoc, piecemeal, provisional. In a lecture series published as The Reconstruction of the Spiritual Ideal (1923), Felix Adler explained this dynamic well:

Sentiment, self-interest, can be appealed to, and the factors that make for unfairness can be made to yield to a certain extent. Wages can be raised so long as their increase is consistent with the accumulation of profit. When, however, the cessation of profit itself is threatened, there is an end of concession. The motive, the principle that operates in the competitive system then stands forth as an insurmountable obstacle. Better housing can be supplied here and there by benevolent employers--a complete change in the housing system is resisted tooth and nail. Certain forms of the piratical instinct in business are prohibited; big business declares with self-complacency, we have seen a new light; but the same ruthless instinct, like a flood which is dyked at one point, breaks out in new quarters, under new modes or disguises. There is no help for it. Man is actuated by motives, and unless the motives can be changed, there will be no steadfast, no large, lasting improvement, even in material conditions. Unless a new respect for human nature as such can be won, the power will be lacking to support the efforts that are demanded, even toward material betterment. Unless the poorest of the poor are seen as beings having worth, the value to which they may justly claim will never be accorded to them. There will be a little lightening of their heavy burden, the scanty requirements of what is called a “decent” way of living may be provided, so far as is compatible with the continued living in palaces of the rich; but social reconstruction in any thoroughgoing sense will not take place.

Going back to my earlier point, ratios of CEO to average worker pay in the 100s, even 1,000s, is not just a problem because it might hinder productivity or increase risk for shareholders. It is a problem because it poses a threat to the foundations and functioning of democracy.

The central affirmation of democracy is that of moral equality--that individuals may differ in empirical abilities but that they are equally worth of dignity and respect. Formal or legal equality stems from this principle: we are all equal in the eyes of the law.

If all human beings are equally worthy of dignity and respect, then we must work to create the conditions fitting of such equal dignity and respect. Poverty, hunger, disease, ignorance, and war must be abolished. Creating conditions that acknowledge equal dignity and respect must also take into account the democratic ethos of citizenship. When those of small means cannot engage fully as citizens, the promise of democracy remains unfulfilled. Political equality is a sham in conditions of extreme economic inequality.

When those of great wealth can buy themselves justice, then no justice exists. When laws are applied unequally, as we see quite flagrantly in the drug war, then the spirit of the law rings hollow. When politicians place more emphasis on the views of their most affluent constituents, then democracy suffers.

Such inequality also increases social distance, which when, too large, can undermine the spirit that underlies the belief in democratic and moral equality. If those at the top are so far removed from those at the bottom (hundreds of times removed per hour, let's say), they will not even realize that such individuals exist and will more easily equate their own private good with the good of society at large. If corporate profits are up, the Dow reaching new heights, then the economy must be fine, they think, because the economic echo chamber in which they live says so, too. Social distance between representatives and the represented likewise threatens the health of democracy.

As Louis Brandeis once said, "We must make our choice. We may have democracy, or we may have wealth concentrated in the hands of a few, but we can't have both."