Loan modifications rise; many don't pare payments

By ALAN ZIBEL – AP April 4, 2009

Though lenders are boosting their attempts to curb record-high home foreclosures, fewer than half of loan modifications made at the end of last year actually reduced borrowers' payments by more than 10 percent, data released Friday show.

The report, based on an analysis of nearly 35 million loans worth more than $6 Trillion, was published by the federal Office of the Comptroller of the Currency and the Office of Thrift Supervision. It provides the most detailed and broad analysis to date of efforts to stem the foreclosure crisis, which President Barack Obama is trying to combat with a $75 Billion plan to promote loan modifications.

Since Home-ownership is so pivotal to the success of the Middle Class, shouldn't the Plan to "promote loan modifications", actually promote Home-ownership?

FAQ: Who Qualifies for Housing Bailout?

Nick Timiraos - WSJ Blogs - Feb 19, 2009

The housing plan outlined Wednesday has two main components — a $75 billion loan modification plan, and a separate program to allow borrowers who aren’t in danger of default to refinance.

...

Who is eligible for a loan modification?

The program is open only to primary residences and homeowners who are paying more than 31% of their monthly gross income on mortgage payments.

...

Can I refinance my loan if I owe more than my property is worth?

Borrowers with little or no equity can refinance into a 30-year or 15-year fixed-rate mortgage at current rates as long as the amount owed on a first mortgage does not exceed 105% of their home’s current value. The refinance program is only open to borrowers with conforming loans that are owned or guaranteed by Fannie Mae or Freddie Mac. Borrowers must be able to demonstrate that they are current on mortgage payments and that they will be able to meet the new payment terms on the first mortgage.

Those are some pretty tough "restrictions" (aka "fine print") -- especially if you're one of the millions of people who has lost your job, due to the latest "Economic Tsunami".

Those who are "underwater" or "behind on your payments" -- need NOT Apply! (only Mortgages in good standing please!)

We all know Mortgage Bankers will do their best to Protect their ASS-ets! (Won't they? ... Foreclosure is such a hassle -- they'll do the Right Thing, right?)

April 3, 2009

OTS 09-018 - OCC and OTS Release Mortgage Metrics Report for Fourth Quarter 2008

Office of the Comptroller of the Currency

Office of Thrift Supervision

WASHINGTON — The Office of the Comptroller of the Currency and the Office of Thrift Supervision today jointly released their quarterly report on first lien mortgage performance for the fourth quarter of 2008.

...

The reasons for high re-default rates are not clear. As noted in the previous quarter’s report, high re-defaults could be the result of a worsening economy, excessive borrower leverage, or poor initial underwriting.

...

This decline in credit quality was evident in all loan risk categories, with subprime mortgages showing the highest level of serious delinquencies.

...

Overall for 2008, about 42 percent of modified loans resulted in reduced payments, 27 percent in unchanged payments, and 32 percent in increased payments.

...

OTS Acting Director John E. Bowman noted ... These modifications, which reduced homeowners’ monthly payments the most and resulted in fewer re-defaults, rose to more than 37 percent of all modifications, from 26 percent in the previous quarter.

"The trend toward lowering payments to make home mortgages more affordable is moving in the right direction," Bowman said. "The continuing decline in credit quality underscores the need for mortgage servicers to increase their efforts to modify home mortgages. Sustainable and affordable mortgages is a goal we all share for keeping more Americans in their homes."

Is that goal the reason why those Out-of-Work, or those Underwater on their Mortgage -- need not apply for refinancing, Director Bowman?

News events, seem to be thwarting that worthy "goal" of "Sustainable and affordable mortgages" ...

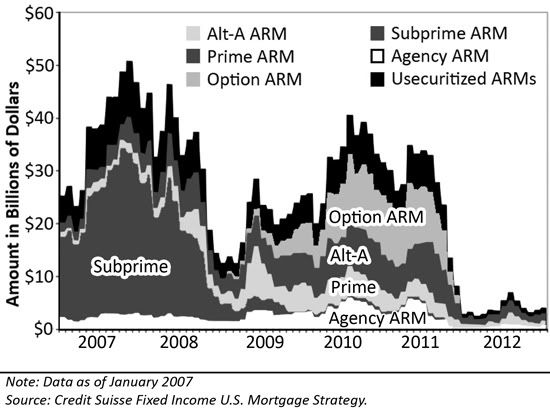

If Trends of flaky Mortgage Resets continue, as those in-the-know are predicting, that Middle Class "fabric" will only continue to fray ...

It's complicated I know, but why do those with "White Collars" get all the attention, while the rest of us, get all the Grief?

Here's MY "simple solution" to the SubPrime mess:

America should create a "FDIC for Mortgages" --

ie. The Govt would be the Insurer of Last Resort

for ALL those vulnerable "Mortgage assets",

with the power to lower those interest rates,

NO MATTER the depth of the Water.

We do the same thing for Savings & Checking Accounts, so why not our Mortgages -- which have been the "piggy bank" of the last Decade?

I'm just sayin' ... If the Govt can step up to prevent "a run on Banks", Why can WE prevent "a run on Mortgage Foreclosures"?

This "simple commonsense solution" would be ultimately "cheaper" than the bottomless pit of CDO/CDS Bailouts (about 7 times cheaper):

http://i158.photobucket.com/...

AND a "FDIC Agency for Mortgages"

would likely "reverse" the current queuing priority system, which favors Wall Street elites over Main Street workers:

What ever happened to "women and children first" (and fathers)

into that Lifeboat?

Shouldn't "OUR HOMES" be the ultimate Asset that is being protected, in the latest efforts of to "Plug the Leaks" in that National, Economic Lifeboat?

White Collar Wizards turned our Homes into "Commodities" like,

gold, silver, and coffee,

and THAT is the root cause of the CDO Toxicity --

And this "secret asset siphoning" mechanism, is THE THING must be plugged and ultimately reversed -- IF the Middle Class is EVER to be salvaged, from Wall Street's negligence.

Of course there are other "possible" Bailout Plans -- that are MUCH CHEAPER in the long run. I hear, that On the Spot Commodity Markets for "canvas and cardboard" you can get always get a Great Price, when you buy in bulk, or wait long enough ...

.... I wonder if "Tent Cities" will ever be, "too big to fail", in our Leaders' eyes?