Really. Sort of.

Rep. Anthony Weiner (D-NY) will introduce, in the House Energy and Commerce Committee, an amendment to the Tri-Committee health care bill. The amendment would replace the private health insurance industry with a single-payer national health insurance program.

In effect, the Weiner amendment would substitute Rep. John Conyers' (D-MI) single-payer bill, HR-676, for the Tri-Committee legislation.

The vote will take place the same day it is offered; last I heard on Monday.

My take:

- It is a good thing, even though it will not pass.

- It will make more clear what reform we are getting and what we are not getting, that whatever the details of whatever eventually passes in 2009 is NOT single payer, is not Canada/French/Taiwan style single payer like. That it is not DOD/VAMC/UK/Spainish style socialized medicine.

- It gives us single payer advocates a little bit of satisfaction.

- It gives the Democratic leadership, including Obama, the added ability to point out that they are NOT supporting single payer. Hurrah for them.

If your representative is a member of the Energy and Commerce Committee, please call your congressperson today and ask that he or she support Rep. Weiner's single-payer amendment. A list of Committee members can be found here.

The Congressional Switchboard can be reached toll-free at 800-473-6711.

If your representative is not a member of the Committee, please call Committee Chair Henry Waxman at 202-225-3976 and ask him to support Weiner's single-payer amendment.

This initiative was inspired in part by Rep. Weiner's meeting with Dr. Quentin Young of PNHP at the time of Dr. Young's testimony in support of single payer before the House Ways and Means Committee in June. It is also a reflection of the grassroots demand that single payer be on the table in Congress.

Other potential supporters on the committee besides Weiner, the following members are co-sponsors of HR-676: Tammy Baldwin (WI), Donna Christensen (VI), Eliot Engel (NY), Edward Markey (MA), Bobby Rush (IL), Jan Schakowsky (IL) and Peter Welch (VT). How they will vote on the amendment is not certain, of course.

Let there be a vote.

Let the distinction between the health reform we are getting and single payer be made.

Update:

There was a bit of a distraction/ side-bar debates over the term "scoring" versus what we really need which is an analytic study; below should shed some clarity and honesty on this:

"zcoring" is a narrow and limited process that deals only with bills that are moving through the congressional process and only looks at Federal cost, which would show tax increase for single payer... but ignores savings for total U.S. and all other stakeholders.

CBO study we desire should have been requested back in January before the congressional process became locked in on particular legislative approaches.

VERY VERY important to use the correct language, we want "analytic study" and we do NOT want just "scoring.' Do NOT use the word scoring. Scoring only looks at the federal budget pice, which of course goes up under single payer. Only "analytic study" can look at the total costs, and costs to different sectors (federal, state, local, individual tax, individual premium, individual out-pocket, employer, etc.).

The ask should be:

"There ought to be a complete, honest, side-by-side comparison of all proposals, including single payer, as a complete analytic study by the Congressional Budget Office &/or the Geneal Accounting Office. Per the table attached, the side-by-side comparison should include not only the Federal government costs, but also the projected total U.S. cost and the costs to other stakeholders including state and local governments, employers and to individual, families and households of different income levels."

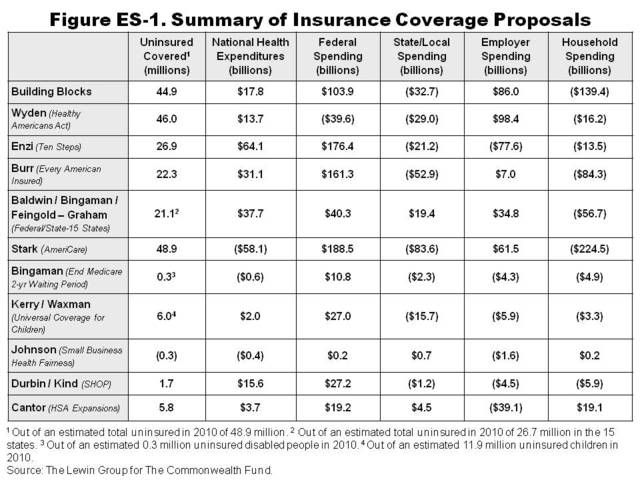

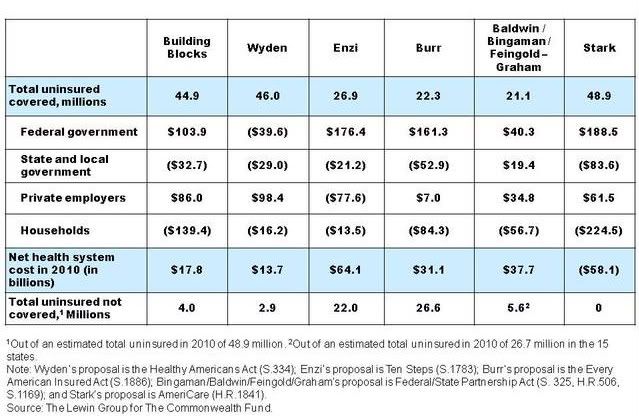

A model example, in addition to analyses done in the 1990s by CBO & GAO, is the Commonwealth Fund/Lewin Report table from earlier this year, where:

"Building Blocks" = Hacker/Obama/Democratic mainstream

"Stark" = an expanded and improved Medicare for All (Staks not single payer version)

The closest we have is the analysis and report done by the liberal leaning pro-reform Commonwealth Fund think tank, which supports the Obama "Building Blocks" approach, with both individual and employer mandates and a moderately strong public option (essentially the same as Jacob Hacker, HCAN, Campaign for America, Edwards and Clinton from the campaign, etc). Their partner in analysis is the industry gold-standard Lewin Group (which is actually owned by United Health and so if biased, certainly is biased against single payer as well as strong public option.

Key to the tables and charts below:

- Building Blocks = the mainstream Democratic Party Consensus

- Stark = Single Payer

- Wyden = Wyden-Bennett plan emphasizing eliminating employer health tax deduction.

- The others can be pretty much ignored, as you will see.

Here is overall summary.

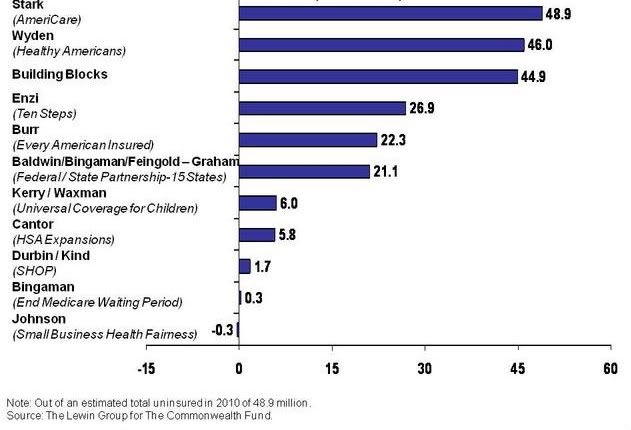

Number of the Uninsured Who Would Become Newly Covered:

Looking first at how many of the currently uninsured will become covered?

Out of the estimated total number of 48.9 million, only the Stark Plan, like the Conyers HR-676 plan, would automatically assure that everybody is covered.

Commonwealth/Lewin finds that the Wyden and Building Blocks (including Obama and Baucus to lesser extents) come relatively close but don't actually acheive universal coverage.

The other plans, including all the ones from Republicans do not come close and mostly don't really even try.

So, what about costs?

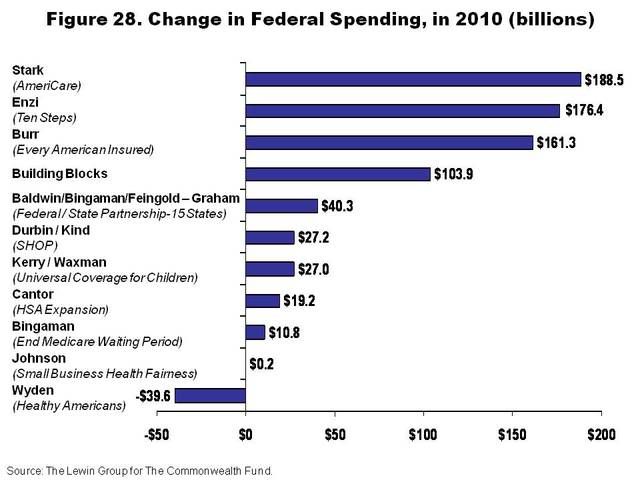

Change in Spending Just of the Federal Government:

The graph below shows just the direct costs to the Federal government, not the total cost.

In other words, not the additional costs by individual and families such as premiums, deductibles co-pays, out-of-pocket due to refusals of insurance company to pay. It does not include additional costs by employers. It does not include the additional costs by state or local government.

The above is what those inside the beltway will mostly try to report on!

Not surprisingly, the Wyden Plan, which like the McCain plan from the campaign, takes away the tax corporate deduction for providing insurance and does little to offer pay directly for coverage, saves the Federal Government the most. While the proposals from Stark, Enzi, Burr and the Building Blocks plan cost the Federal Government the most.

When the Congressional Budget Office comes out with favorable analyses of the Wyden plan, this is what they mean. But as we shall see, this is a very incomplete and essentially dishonest view.

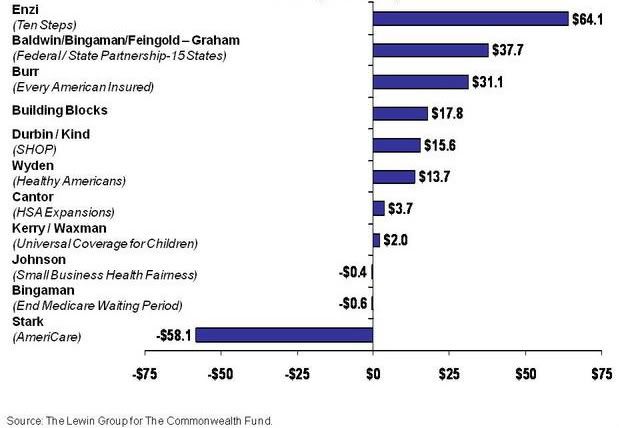

Total Change in National Expenditures on Health Care:

This table shows the change in total costs, the total national expenditure on health care. This is the one that corresponds with Percent of GNP spent on health care, that infamous statistic that shows that U.S. spends twice as much as other developed industrialized nations, but is the only one not covering everybody and the only one bankrupting families if they get sick... and the only one dependent on for-profit private insurance companies.

Notice the complete turn-around compared to the JUST federal government view in the prior table. While the Wyden plan saves the Federal Government money, it actually increases total costs and dumps those cost onto others.

Indeed most of the other plans... Enzi, Baldwin, Burr and alas even Building Blocks (including Obama and Baucus) amount to huge giveaways and supports for the private for-profit insurance companies.

Only the Stark Plan (like Conyers HR-676) actually saves money for the overall system, the country as a whole. Only Single-Payer like plans can actually control overall total costs. And this from an organization that does not support single payer, and supports Obama/Baucus/Building Blocks.

Who Pays by Stakeholder Under the Different Plans:

This is the real story, typically ignored by proponents of the other plans including the Wyden plan, the various variations of mandate plans (Obama, Baucus, Clinton, Edwards, Building Blocks, etc.) and the Republican proposals.

The Building Blocks plan, like the Obama and Baucus plan, would increase costs overall, and to the federal government and for employers. The Wyden plan dumps even heavier on employers.

Regardless of what the CBO or GAO or beltway mainstream may say, being "revenue neutral" and saving the Federal government money is not the most important goal of health care reform.

We do need to control costs, but it is overall total costs that are what really count.

And, we also need to provide coverage that is truly Universal for all people, Comprehensive in covering all health needs, and does not bankrupt you if you get sick.

What that table is showing is that all those other proposals -- not only those of Republicans Enzi, Baldwin and Burr, but alas even Building Blocks (aka: Obama and Baucus) and Wyden's -- amount to huge giveaways and bailouts for the private insurance companies. The mainstream Democrat "Building Blocks" plan increases costs overall, and to the federal government and for employers. So when they talk about cost control they know they are lying. Indeed, while the bipartisan Wyden plan saves the Federal Government money, it actually increases total costs even more and dumps those cost onto everybody else: states, employers, families and individuals. So when somebody talks about the CBO analysis showing a plan is somehow good (revenue neutral or saving the Federal government money), ask them if they know how it effects total costs and who pays more instead. They are all being at best completely disingenuous. Or just lying.

In the context of the ongoing health care debate, its chief responsibility is to prepare cost estimates for inclusion in the committee reports for the bills that are approved by various congressional committees. CBO has specific statutory functions - preparing analytical reports falls low on the pecking order, especially if the report is requested by someone like Bernie Sanders, who is not a committee chair or Conyers who is chair of the "wrong" committee. CBO can do them (and obviously has done many in the past) but is not required to do them by law (as it is required to do the federal costing "scores" for committee approved bills) and probably will not do them while it is dealing with an active legislative process in the health care area that requires that it prepare multiple "scores." That is what Barney Frank was alluding to when he said there was no time anymore.

Here's how CBO describes its responsibilities on its website:

CBO's Statutory Responsibilities

Under the Congressional Budget Control and Impoundment Act of 1974, which created CBO, the agency's primary job is to provide budget-related information to all committees of both Houses, with priority given to the needs of the Committees on the Budget and of the Committees on Appropriations, Ways and Means, and Finance. The law also requires CBO to prepare several budget projections each year and to perform studies of budgetary issues. In addition, CBO must prepare estimates of new budget authority, outlays, or revenues that would result from bills or joint resolutions reported from committees of either House, and of the costs that the government would incur in carrying out the provisions of the proposed legislation. Those cost estimates are usually included in the committee reports accompanying bills or resolutions before action by the House or Senate.

* * * * *

How Work on CBO's Estimates and Studies Is Initiated

Cost Estimates. The Congressional Budget Office is responsible for providing federal budget and mandate cost estimates for bills (other than appropriation bills) when they are reported by a full committee of either House. Committee staff should notify CBO when bills are about to be ordered reported and when cost estimates are needed.

CBO sometimes prepares cost estimates for proposals at other stages of the legislative process at the request of a committee of jurisdiction, a budget committee, or the Congressional leadership. For example, CBO may prepare cost estimates for alternative proposals to be considered by a committee or subcommittee, including draft bills not yet introduced, or for amendments to be considered during committee markups. In many cases, cost estimates provided at early stages in the legislative process are informal, conveying preliminary budgetary effects. Similarly, CBO may prepare cost estimates for floor amendments and for bills that pass one or both Houses.

* * * * *

When undertaking a cost estimate, CBO analysts contact the staff of the committee of jurisdiction and, when applicable, the staffs of the Member sponsoring the proposal and the Member requesting the estimate to gather background information and discuss the schedule for completing the estimate. Budget and mandate cost estimates are based on the text of the proposed legislation. CBO analysts consult with the staff of the committee of jurisdiction (for a reported bill) or the sponsoring Member (for an introduced bill or amendment) when questions of interpretation arise, but they draw their own conclusions on an impartial and objective basis.

* * * * *

Analytic Studies. In addition to statutory reports, or studies done to support CBO's statutory work, each year the office also undertakes a number of analytic studies at the request of the Chairman or Ranking Minority Member of the relevant committee or subcommittee; the Congressional leadership; or, as time permits, individual Members.

By the way, such analyses were done back in the early 1990s, including for single payer even though it too was off the table back then. And they have also been done for various State reforms proposals through recent years. You can find them here (click and scroll down).