This is a reworking and a reprint of an article I wrote in 2006, during our last round of battles regarding Social Security. It seems like a good time for some review. Here is exactly how the other side tries to scam us regarding Social Security.

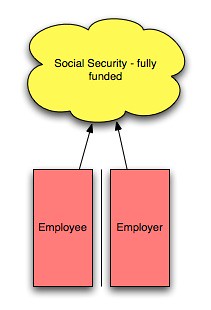

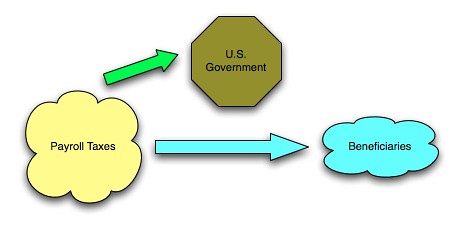

We pay into Social Security with a portion of our paychecks. You can see it on any paystub - a sum of money that is labeled "Social Security". All this money is intended to go towards Social Security.

Our employer matches our contribution and pays in an equal amount.

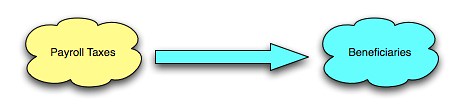

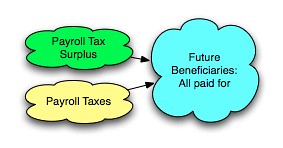

Social Security is designed so that the money we pay into the system goes to seniors, and other people who receive Social Security checks. Since we will always have workers earning paychecks, the system is designed to continue indefinitely.

In a perfect year, the government gathers exactly the amount of payroll taxes that the beneficiaries need for that year. But in truth, society is more complicated than that. Some years, we will have extra payroll tax income, and other years we will have extra expenses. The system is designed to even out in the long run.

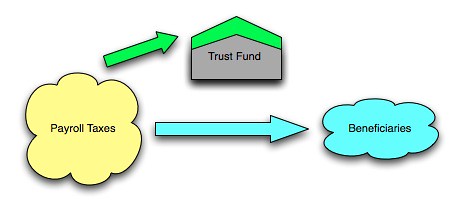

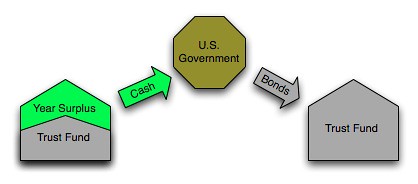

In order to smooth things out and keep payroll taxes consistent from year to year, the designers created a Trust Fund.

The idea is that in years where we have more payroll tax income, that money gets added into the trust fund, a kind of rainy day fund.

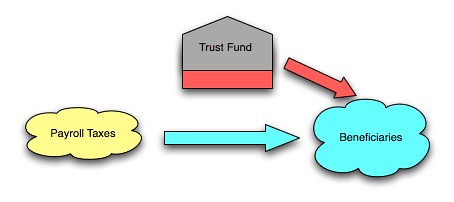

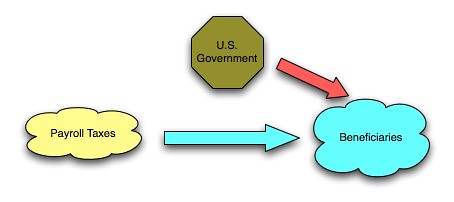

And then in years where we have more expenses, we pull money from the Trust Fund to make up the shortfall.

It is not a big deal to have a year where we have more expenses - this is what the Trust Fund is designed for. It has happened plenty of times in the past.

In fact, it can even work in reverse - the Trust Fund can be entirely emptied out and go negative for a few years, if future years are projected to start filling it up again. This has happened in the past as well.

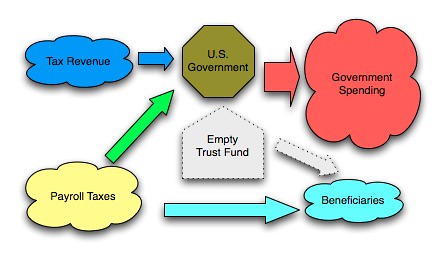

The government does not have a big bank account where the money in this Trust Fund just sits. Instead, Social Security buys Treasury Bonds from the U.S. Government. These are considered the safest investments in the world, and the U.S. Government has never defaulted on them. The Government gets the cash.

But this is where people start to confuse things.

The government takes this cash and spends it on whatever it spends it on. Grants, the military, income tax cuts, etc.

Remember that when we pay into Social Security, that money is supposed to go into Social Security only. That's what it says on our paystubs. It is 100% accurate to say that by doing this, the U.S. Government is borrowing from Social Security.

And by doing so, it means that in years that Social Security has more expenses, they need to dip into the trust fund. This means cashing in the Treasury Bonds, and receiving money from the U.S. Government. This is when the U.S. Government pays back the loan.

But this is where Social Security opponents start to confuse matters. They want you to look at it as if it's the Government paying for the social security benefits. They say that this is Social Security contributing to increased government spending, when it isn't. Social Security is paid for. The U.S. Government has borrowed money from it and spent the proceeds, and needs to pay it back - as they have plenty of times in the past, more than ten times since 1970.

We should again note that the U.S. Government has never defaulted on Treasury Bonds.

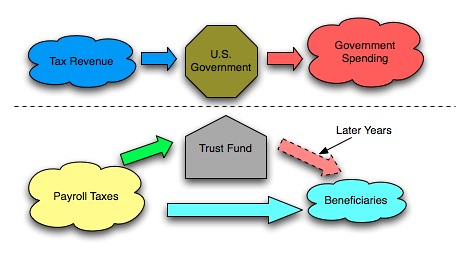

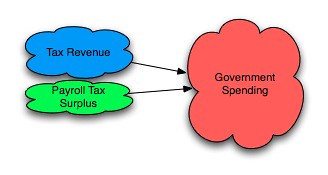

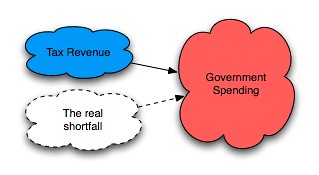

Here's the full picture. Generally speaking and in the long run, Income Tax revenue is supposed to balance government spending, and Payroll Tax revenue is supposed to balance beneficiary spending. At the time of this writing, payroll tax revenue does balance beneficiary spending, projected through the year 2037 using conservative assumptions. Our Income Tax and Government Spending picture is far worse.

Here is how Social Security opponents would like us to look at it. They see our excess Payroll Taxes - the money that is labeled "Social Security" on our paystubs - as going towards normal government spending. They claim there is no Trust Fund, or that it is empty. On top of that, government spending is still too large, and so they claim that it is reason to cut Social Security benefits.

This is important to understand thoroughly. This advocates borrowing from Social Security and refusing to pay it back.

This also is taking money that is designed to go chiefly towards our least advantaged members of society, and spending it on other government expenses including income tax cuts, which benefit richer members of society.

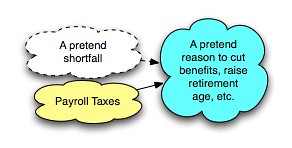

Another way of looking at it: Social Security opponents take income tax revenue, and payroll tax surplus, and use it on government spending, even though payroll taxes are supposed to go towards Social Security...

... and then when Social Security expenses exceed Payroll Tax income, they pretend there is a shortfall in Social Security, and use this as a reason to discuss things like cutting benefits and raising the retirement age...

...when in reality, Social Security is healthy, projected through 2037 using conservative assumptions...

.. and the real shortfall is here.

Contact your congressperson and tell them to leave Social Security alone. The money was taken out of our own paychecks, and we deserve to be paid back in full.