It's real money, especially since "Bank of America Deathwatch" financial pundits have multiplied on the web and it has become a bit of a geek guessing game. When will BoA finally tank? And when it tanks, the question becomes, who will walk away with all their money, and who will be left holding the bag? The deal just snuck through with the Federal Reserve's, and implicitly, Congress's approval insures Wall Street casino gambler's debts by moving them into accounts meant for penny-pinching grandmas.

Citing Bloomberg, financial commentator Avery Goodman tells us:

Even if we net out the notional value of the derivatives involved, down to the net potential obligation, the amount is so large that the United States could not hope to pay it off without a major dollar devaluation, if a major contingency actually occurred and a large part of the derivatives were triggered.

A bailout for one company's most irresponsible investors triggering a major dollar devaluation? This is the kind of thing that starts revolutions.

Goodman reports:

Bank of America (BAC) has shifted about $22 trillion worth of derivative obligations from Merrill Lynch and the BAC holding company to the FDIC insured retail deposit division. Along with this information came the revelation that the FDIC insured unit was already stuffed with $53 trillion worth of these potentially toxic obligations, making a total of $75 trillion.

Without going too far into bewildering financial jargon, it's like this: Your wildest son is asking you to co-sign for a debt. If he can't make his payments, you are on the hook. How much is the debt? He doesn't know. Just sign on the dotted line.

Meanwhile the "super committee" is looking for a trillion or so dollars in hits to everything, including Social Security and Medicare/Medicaid, to keep the budget from going any more out of whack. It's urgent, they say, for us to stop spending like drunken sailors. But at the same time they just whipped out a pen and signed for junior, crossing their fingers that something won't happen which is almost inevitable.

Where did I stumble across this news item? Sure as heck not on MSM, which is focused on the smoke grenade of BoAs recent $400 million fee case settlement. $400 million fits into $72 trillion almost 2 million times. Now which is the bigger story?

I stumbled across it posted by an outraged Occupy Wall Street-type on one of their Facebooks. You don't need to read Karl Marx to become an Occupy Wall Streeter. The American financial pages will do it.

It is unlikely the taxpayer's hit will be as much as $72 trillion. Again, no one knows. But it will be a chunk of money.

BusinessWeek writers Phil Mattingly and Bob Ivry point out that Dodd-Frank is not strong enough to prevent the BoA move:

Separating complex transactions from FDIC-insured savings has been a cornerstone of U.S. regulation for decades, including Dodd-Frank, the regulatory overhaul enacted last year. Bank of America’s transfer prompted some lawmakers to push for stronger rules than were included in that sweeping law. Senator Bernie Sanders, a Vermont Independent who supported legislation to separate trading operations from commercial banking, said the transaction is a “perfect example why we should break up too-big-to-fail financial behemoths.”

Representative Maurice Hinchey, a New York Democrat who pushed to require splitting commercial and investment banking, said “What Bank of America is doing is perfectly legal -- and that’s the problem.”

Hinchey is among more than 40 House lawmakers who have signed on to a bill that would reinstate the Glass-Steagall Act, the Depression-era law that enforced separation of depository institutions from investment operations. Most are Democrats, but that leaves roughly 180 House Democrats who have not signed onto the bill, and at the moment have no intention to. Not to mention the "super committee" eyeing your Social Security. Nor Obama.

A commenter in a Columbia Journalism Review piece on the Bloomberg reportage says:

The government should not be on the hook for the bets of an investment bank which is impossible when you allow a deposit and investment bank to merge.

The re-instatement of Glass_Steagall, which prevents bankers from going to Vegas with grandma's money, is consistently on lists of reforms being being debated by OWS. (Also please see "Demand to Get the Money Out of Politics: A "One Demand" for Occupy Wall Street?," Truthout)

Glass-Steagall began to be dismantled under Ronald Reagan, with Bill Clinton finishing the job for Wall Street in 1999. When Bill Clinton signed the law, Progressive Historian notes:

it symbolized the ending of the twentieth century Democratic Party that had created the New Deal. Although the 1999 law did not repeal all of the banking Act of 1933, retaining the FDIC, it did once again allow banks to enter the securities business...

The repeal of one of the most important pieces of legislation in this nation's history came about as a result of another Clinton "triangulation,"...

The transaction is against the Federal Reserve's own regulations, but as Avery Goodman points out, Congress has given ultimate power to the Federal Reserve to ignore its own enabling Act legislation. The pertinent passage of the enabling legislation reads:

The Board may, at its discretion, by regulation or order exempt transactions or relationships from the requirements of this section if it finds such exemptions to be in the public interest

Dave Johnson writing for Truthout.org summarizes the absurdity well:

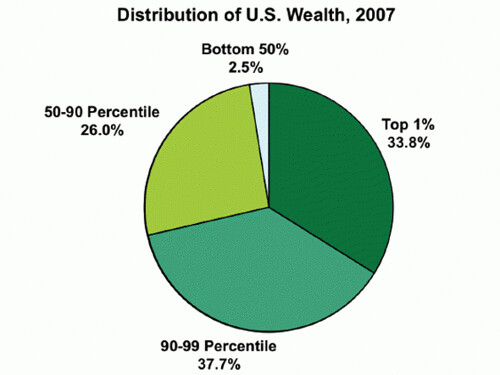

This situation of crony government protecting the connected rich while people are in the streets demanding change is more and more reminiscent of Egypt under Mubarak.... Currently in Washington Congress' elite "super committee" represents the 1%, looking at ways to take more money out of the economy, discussing cutting Social Security at a time when many people have lost their pensions and savings. They are discussing cutting Medicare and other health services at a time when more and more people are in need. They are discussing cuts and cuts and cuts, when working people are falling behind and behind and behind.

But the actual causes of the deficits that have Congress so concerned are ignored. Reagan and the Bushes cut taxes on the rich and increased military spending, and the deficits and resulting debt soared. It is right there in front of our faces. But even with such "concern" about deficits the tax cuts for the rich continue and the huge increases in military spending are left alone. Instead Congress discusses austerity - making the 99% pay for the benefits and bailouts for the 1%.

Now why are those protesters out there again? Simple. The ones whose interviews the MSM does not air read the financial pages. At the same time many politicians, including Obama, give plenty of lip service about busting up banks which are "too big to fail." But unless someone does something soon, BoA is a done deal. As always, never listen to what politicians say. Watch what they do. A couple of currency devaluations, and we're in Greece.

It is something when financial geeks in conservative business pages are calling for the government to seize Bank of America now, before it brings just America down with it. That's when you know we are all in this together.

White House contact page

Congress contact page (including the "super committee")

Distribution of wealth in America: one percent own one-third of all assets:

From "21 Mind-Blowing Facts About Inequality in America"

Related article:

Demand to Get the Money Out of Politics: A "One Demand" for Occupy Wall Street? (Truthout)