Here is what this Diary will prove by using historical documented facts, empirical data, and beyond any doubt, for Major Garrett:

Between April 2002 through June 2002, Mitt Romney, knowingly, willingly and with forethought intentionally lied to the People of Massachusetts regarding his 1999-2001 Tax Returns when he falsely claimed to the MA People that he had listed Massachusetts as his residency on his 1999-2001 Federal and State Tax Returns.

Major Garrett was on NPR's Diane Rehm show today. The host was not Diane Rehm but was Tom Gjelten.

A caller called in and asked the panel why we should believe Romney is telling the truth about anything he says about his Tax Returns when he was caught lying on and about his 1999-2001 Tax Returns.

After the caller outlined that in June 2002 Romney got caught lying on and about his Federal and State 1999-2001 and explained that for months Romney and his campaigned had been telling the people of Massachusetts to "trust me" regarding Romney's Tax Returns only to find out in June 2002 that Romney had not only lied to the people of Massachusetts for months on end, but actually had lied on his 1999-2001 Federal and State Tax Returns so he had to Amend them retroactively.

The host, Tom Gjelten, was in disbelief and said, "lying on tax returns is a serious issue." Yes, Gjelten is correct, lying on Tax Returns is a serious issue which explains why Mitt Romney Amended his 1999-2001 Federal and State Tax Returns retroactively - before he got in trouble for lying on them.

Major Garrett said he had never heard that story and then he went on to talk about Harry Reid.

I like Major Garrett, I think, now that he is off Fox, he is fair minded and has a lot of journalistic integrity. Therefore, I think it is time to educate Major Garrett with the fact that yes, in 2002 Mitt Romney was factually caught lying on and about 3 years worth of Federal and State Tax Returns.

Facts

1) In order to be qualified to run for Governor of Massachusetts you have to prove your Primary Residency was Massachusetts for 7 consecutive years.

2) For months and month, between April 2002 - June 2002, Romney and his campaign said, "trust me when I tell you that my 1999-2001 Tax Returns listed Massachusetts as my Residency."

3) That chant Romney and his campaign spouted about in 2), above, to the People of Massachusetts turned out to be a blatant bold-faced lie when the facts came out on June 7, 2002.

4) In April 2002, Mitt Romney secretly Amended 1999-2001 Tax Returns to finally include Massachusetts as his residency.

5) On June 7, 2002, Mitt Romney had to publicly admit that he had been lying to the MA people and that he had not listed Massachusetts as any form of Residency on his 1999-2001 Tax Returns.

6) On June 7, 2002, Romney had to tell the MA People that on April 2002 he Amended his 1999-2002 Tax Returns to finally include Massachusetts as a residence retroactively.

7) Between April 2002 and June 2002 he, Mitt Romney, knowingly, willingly and with forethought intentionally lied to the People of Massachusetts when he falsely claimed he had listed Massachusetts as his residency on his 1999-2001 Tax Returns.

8) Mitt Romney finally had to admit he only Amended his 1999-2001 Returns in April 2002 after he decided to run for Governor of Massachusetts -- 'for Pete's sake.'

9) Mitt Romney testified, under oath, that he habitually and routinely perjures himself to the Federal and State Governments about the accuracy and completeness of his personal Tax Returns as he, a licensed lawyer, testified that he willfully ignored the fact that he was legally compelled to examine Form 1040 and all attached Schedules under the pains of Penalty of Perjury as he testified he had not even bothered to even so much as read if the State of his Permanent Residence, domicile, was even filled out.

Evidence That Backs Up Facts:

Below is a partial transcript of Mitt Romney, under oath, with the Massachusetts Board of Election plus a series of 2002 articles that support the items I listed as "Fact" above.

June 19, 2002, from 2002 New York Times:

Until early June, Mr. Romney had said that he had paid his taxes as a Massachusetts resident while in Utah. He later acknowledged [June 7, 2002] that in 1999 and 2000 he paid state taxes as a Utah resident and listed himself as either a part-time resident or a non-resident of Massachusetts. He said that in April, after deciding to run for governor, he had amended his 1999 and 2000 tax returns to say that he was a Massachusetts resident.

~June 19, 2002 GOP Candidate Seeks to Clarify Massachusetts Residency Issue New York Times (page 2)

June 7, 2002 Boston Globe:

Boston Globe reported Mitt had been lying to the MA People and Mitt finally admitted he listed Utah as his primary residence so he Amended his 1999-2002 Federal & State Tax Returns

retroactively in April 2002 when he decided to run for Governor of MA.

ROMNEY: “I am Amending them because it is the right thing to do. I was not thinking of running for office. I was trying to fill our -- my tax forms as accurately as possible.”

~ Romney quote in Romney says he didn’t file as Mass. resident in ’99-’00 Boston Globe 6/7/2002

There it is again,

I didn't know I would run for office for Pete's sake.

June 13, 2002:

Boston Globe

[...] Romney had told a "baldfaced lie" when he originally told reporters he filed income tax returns as a resident of Massachusetts when living in Utah. Romney later acknowledged he had not filed as a resident, but Amended those Returns to claim resident status after he decided to run for governor.

Also yesterday, Romney spokesman Eric Fehrnstrom, after denying it earlier in the week, confirmed that a lawyer for the Romney campaign had contacted Harvard Law School constitutional scholar Laurence Tribe.

~Boston Globe "Romney Offers Documents On Utah Tax Break Payment Record Called A Mistake"

June 18, 2002:

Romney, under Oath, told the Massachusetts State Ballot Commission that he signed the IRS Form 1040 but, gee whiz, he had no idea his signature meant he was signing under

Penalty of Perjury that he had examined his 1040 and schedules in their entirety.

2002 New York Times reported:

Mitt Romney said in a hearing before the Massachusetts Ballot Law Commission.

ROMNEY: ''I do not read those [IRS 1040] or review those before I sign them nor the attached Schedules,''

~June 19, 2002 GOP Candidate Seeks to Clarify Massachusetts Residency Issue New York Times (page 2)

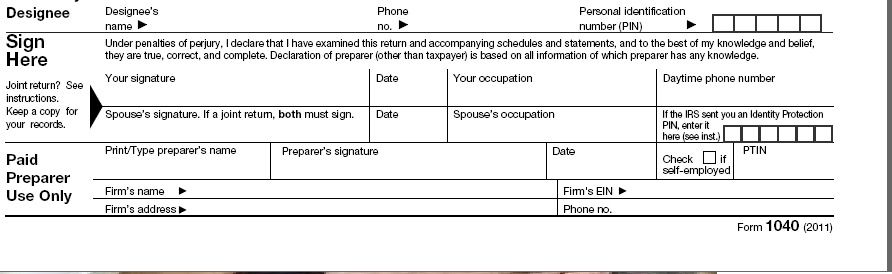

See the picture below? That's a picture of the Signature Line on IRS Form 1040. See the part above where you sign your name that says:

"Under penalty of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge they are true, correct and complete.

~IRS Form 1040 "

Romney does not claim he 'didn't see' the sentence saying he was signing under Penalty of Perjury, Romney was saying he didn't give a damn that he was signing under Penalty of Perjury because, as you will see in the below Transcript when Mitt was under Oath, Mitt does not examine any document he signs under Penalty of Perjury, thus,

Romney admitted he habitually, routinely, willingly perjures himself.

June 18, 2002:

Here is the MS Ballot Commission exchange after Romney said he didn't bother to examine his Tax Returns.

LAWYER: "...if I were to hand you an affidavit, Mr. Romney, and at the end of it, typed in your signature, and above your signature, I put "signed under the pains and penalties of perjury," and I said, "Mr. Romney, sign this document," you'd read it first; wouldn't you?"

ROMNEY: "If you were to put it in front of me, yes."

LAWYER: "So, you'd sign documents under the pains and penalties of perjury without necessarily reading them; is that your testimony?"

ROMNEY: "I have not read the entire Massachusetts tax form, nor the Federal tax form, nor the Utah tax form, and all of them have me sign under pains and penalty to the best of my knowledge and belief, and I do not read the entire form."

[-June 18, 2002 testimony before MA State Ballot Commission]

I find it very troubling that Mitt Romney admits he signs his signature to documents, under the pains of Penalty of Perjury,

without examining the document to determine if the document is accurate --- something very troubling about that.

June 8, 2002:

Boston Globe reports Mitt profited by listing Utah, not Massachusetts, as his Primary Residence.

By declaring himself a Utah resident rather than a Massachusetts resident in 1999 and 2000, gubernatorial candidate Mitt Romney might have saved on his taxes if he had substantial short-term capital gains, analysts said yesterday; otherwise, Utah residency would have provided him no obvious tax benefits.

Utah doesn't differentiate between capital gains and regular income, which means Romney would have paid the top 7 percent tax rate on all of the earnings as a resident there. Massachusetts, on the other hand, taxes gains from investments held less than a year at 12 percent and hits longer-term capital gains at a sliding scale that falls to zero for investments held six years or more.

~ Boston Globe, June 8, 2002 "Tax Benefit Unclear and Candidate Mum"

(Boston Globe requires subscription for complete article, sorry)

The same article reports

When it came to light that [Romney] had gained a $54,000 tax break by claiming his Utah home as his primary residence, [Romney] said that that filing was the result of a clerical error. When reporters questioned whether he'd also profited on his income taxes by declaring Utah residency, Romney first said that he would respond to questions posed in writing. When those questions were submitted.

~ Boston Globe, 6/8/02, "Tax Benefit Unclear and Candidate Mum"

June 8, 2002 same Boston Globe article

But after a reporter submitted written questions to a campaign aide, Romney's spokesman, Eric Fehrnstrom, said that Romney would not be responding because "he values his privacy and his wife's privacy."

A few minutes later, pressed on whether he benefited financially in Utah by filing as a resident there and a nonresident in Massachusetts, he said: "That's as far as I'm telling you, that's it. That's the answer I'm going to give you, and that's all I got."

That sounds like what Romney camp says now, "

we won't release any more taxes period, you people got all you're going to get -- oh and did mention, my secret Tax Returns show I never paid less than 13% tax rate -- trust me"

June 8, 2002

New York Times reports Romney intentionally lied to the People of Massachusetts about his Tax Returns.

Mr. Romney insisted until Thursday that he had paid his taxes as a Massachusetts resident during his three years in Utah. Then he acknowledged that in 1999 and 2000 he paid his state taxes as a Utah resident and listed himself as nonresident of Massachusetts.

~ New York Times "Republican's Candidacy Is Challenged By Democrats"

June 19, 2002:

Boston Globe reports

Romney acknowledged under oath yesterday that he filed income taxes as a part-time resident of Massachusetts in 1999 and a nonresident in 2000.

In April, after he announced he would run for governor, he amended the returns to claim Massachusetts residency, he confirmed under oath. When the Globe first raised the issue, Romney initially said he had filed as a resident of both states. He later revised that position [retroactively]

Also yesterday introduced an affidavit from a Utah reporter who wrote in 2000 that Romney had told her he had declared his Utah house "his primary residence for tax purposes." Deseret News reporter Lisa Riley Roche provided an affidavit stating that the article was, to her knowledge, a "fair and accurate representation" of what Romney told her in an interview. Romney spokesman Eric Fehrnstrom said Romney had been talking about his status as a Utah resident for income tax purposes, not property taxes.

~ The Boston Globe June 19, 2002 "Romney Taxes Show No 'Domicile'"

(Globe requires paid subscription for complete article, sorry)

Since Mitt Romney signed his 1999-2001 Tax Returns under Penalty of Perjury indicating Utah was his residency, then he lied

on his Tax Returns and had to Amend them 3 years later so he would not be

accused of defrauding the Federal Government and the State of Utah. Additionally, he would have had to Amend them 3 years later so he would not be accused of being a tax evader by the State of Massachusetts. Because, like NPR host Tom Gjelten said,

"lying on tax returns is a serious issue."

I believe I have provided enough evidence, that is documented in history, to conclude:

Mitt Romney, knowingly, willingly and with forethought intentionally lied to the People of Massachusetts when he falsely claimed he had listed Massachusetts as his residency on his 1999-2001 Tax Returns.

Clearly Mitt Romney is willing to lie to the People about what is in his Tax Returns.

What I find disturbing, is Mitt Romney lied to the People of Massachusetts about the "Residency" listed on his Tax Returns. What else, what other big ticket items on Mitt's Tax Returns is Mitt Romney willing to lie to the People about?

Maybe now Major Garrett can answer the caller's questions:

why we should believe Romney is telling the truth about anything he says about his Tax Returns when Mitt was caught lying on and about his 1999-2001 Tax Returns?