This diary is Part II of GETTING TO ZERO: Our non-fossil energy future.

Human civilization depends on food, food depends on weather, and weather depends on climate. Every grain and every mammal on the face of the earth – almost everything we eat – evolved under a different climate than the one we're heading toward. We are running toward a cliff, and merely walking toward that cliff isn't a viable strategy. We need to stop. Right now.

If civilization is to survive, we need to get to zero emission of fossil carbon, and we need to get there rapidly. Every ton of carbon we emit stays in the air for centuries, and will continue to warm the planet for centuries.

In this series GETTING TO ZERO we will take a very hard-headed look at current energy policy and energy strategies. We will ask hard questions: does this really get us to zero? How much would it cost? How rapidly can it be deployed? We may find some answers along the way, but don't expect them to be easy.

Part 2: Is renewable energy economically viable?

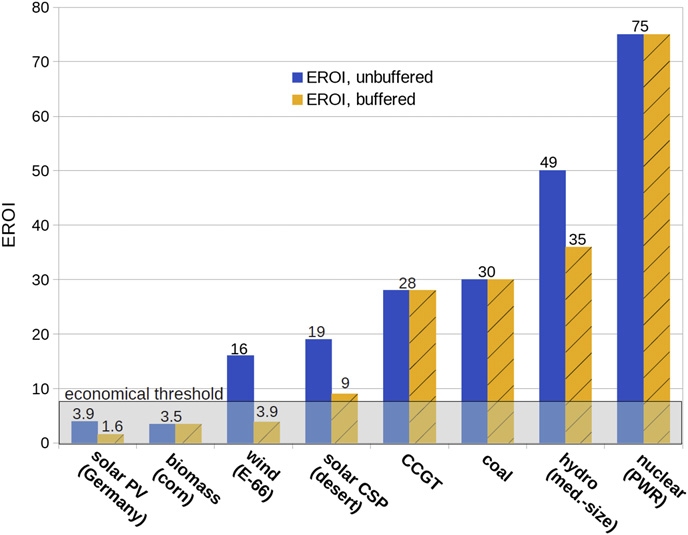

An important new study in the journal Energy (Weißbach et. al. 2013, paywalled) focuses on energy return on investment (EROI, or sometimes ERoEI), which is the ratio of electrical energy produced by a given power source to the amount of energy needed to build, fuel, maintain and decomission that power plant. Here is one of the main results from the paper (higher numbers are economically better):

PV=photovoltaic; E-66 is the Enercon 1.5 MW wind turbine model studied; CSP=Concentrated Solar Power (Sahara site assumed); CCGT=Combined cycle gas turbine; PWR=pressurized water reactor.

In this study, "unbuffered" is the raw generation without storage, while "buffered" includes the cost of pumped hydro storage where it is needed to buffer the difference in peaks between production and consumption (assuming, rather optimistically, that the geography is available for any amount of such storage facilities). Fueled energy sources already store energy in the fuel, so no additional buffering is needed there. The hydropower system analyzed is a run-of-river type (i.e., no dam or reservoir), which has a very favorable EROI, but would require buffering at some times of the year if deployed en masse.

A couple of important points: first, these are energy costs and outputs, not monetary costs, which can be entirely different. These numbers represent technological ability only. Second, every source shown here has an EROI greater than 1, which is break-even. In other words, each of these generates more energy during its lifetime that the energy used to make and maintain it. That's good. But note the gray area at the bottom labeled as the economic threshold. To understand how this is arrived at, we need to take a major digression.

First we need to understand that not all energy is created equal. Electrical energy is very useful, because it can immediately do work. Heat and chemical energy are less useful because it's harder to get work out of them. This introduces an important concept: exergy, which is available energy, or energy usable for work. In general a large heat-type power plant (coal, gas, or nuclear) will require 3 joules of heat energy to create 1 joule of electrical energy. Therefore it is common to weight electricity by a factor of 3 when computing the exergy of a system. (Note also that unlike energy, exergy can be created and destroyed.)

So instead of computing the raw EROI, as in the graph above, it can be more useful to consider the exergy equivalent, by weighting both the energy inputs and energy output by a factor of 3 when the energy type is electrical. Weißbach (pronounced "vise-bach") calls this EMROI, and the results are shown below.

Since all these sources produce high-weight electricity as output, but not all energy inputs are electric, the EMROI of all sources is higher than their EROI. What we've done here is taken one step toward monetizing the EROI, by allowing for the greater monetary value of electricity compared to other energy types. (This gives us Energy Money Return On Investment, EMROI). A fully monetized ROI would include non-energy inputs like labor and capital, which can be very large. That means a fully monetized ROI will always be smaller than EMROI. In effect, EMROI is a theoretical "best case" scenario for monetary ROI.

But note that the economic threshold has increased in EMROI too. Here's how those thresholds are computed:

... an EROI threshold can be roughly estimated by the ratio of the GDP to the unweighted final energy consumption while an EMROI threshold can be estimated by the weighted final energy consumption (which is not the primary energy consumption). For the U.S., for instance, the GDP was $15 trillion in 2011 while the unweighted end energy consumption was about 20 trillion kWh, resulting in an “energy value” of some 70 cent/kWh (Germany ~135 cent/kWh). The average electricity price, however, is 10 cent/kWh [10], (Germany ~18 cent/kWh) so there is a factor of 7 higher money to energy ratio on the input side. The same calculation for the weighted final energy consumption (the electricity demand was multiplied by a factor of about 3) results in a ratio of about 16 for both countries, assuming average primary energy costs of 5 cent/kWh and 3.5 cent/kWh for Germany and the USA, respectively. A similar ratio can be seen for other countries which leads to the conclusion that the thresholds are 7 and 16 for the EROI and the EMROI, respectively, assuming OECD-like energy consuming technology. For lower developed countries thresholds might be smaller, thus making also “simple” energies like biomass economic.

Here's the idea in a nutshell: in the US, a kWh of energy (unweighted) costs about 10 cents but it produces about 70 cents worth of GDP, a ratio of 7 to 1. (Note the switch: we're talking

money now, not joules.) If we do the same computation in exergy terms, the ratio is 16 to 1. That means the

fully monetary ROI of exergy, for the economy as a whole, is 16. But remember that if we have an exergy source whose EMROI is less than 16, its fully monetary ROI

must be less than that -- which means that deploying such a source on a large scale will reduce GDP. The economy becomes less efficient as we deploy less efficient energy sources to run it. As we spend more of our time and effort making exergy, we will spend less making all the other stuff we need and GDP goes down. The flip side of this is that as the price of electricity goes up and GDP goes down, the economic threshold decreases: more marginal energy sources will become profitable.

Solar PV and

biomass both fall below the current threshold, and wind would too, if we deploy it widely enough to require storage buffering.

Concentrated solar thermal beats the threshold (at least in the Sahara desert case, and presumably the southwestern US would be comparable.) There are limited areas in which it could be deployed, but it makes sense to do so.

Wind is a tricky case. If you ask most people, they will tell you that we don't currently have energy storage for wind. In fact we do, but the buffering for wind comes from natural gas powerplants, which are typically built at the same time wind is deployed. When the wind dies, the backup gas plants are turned on, to keep the grid power reliable. Thus the energy storage for wind is embodied in the natural gas that isn't burned when the wind turbine is producing peak output.

This means that wind, as it's used now in the US, isn't really zero-fossil. It's a hybrid system that's part wind, part natural gas. And considering the availability of wind (30% is typical for a wind turbine), most of the energy actually comes from the fossil side of the equation. We're using the wind to offset some of the CO2 emissions from the gas plant (which is good), but instead of getting to zero, we're just walking toward the cliff instead of running toward it.

Denmark currently is one of the most wind-energy-intensive countries in the world, which works because they buffer their wind energy against hydroelectric power from Norway and Sweden. When the wind is blowing in Denmark, they export electricity to Sweden, which then can turn down its hydro plants (thus keeping more water stored in the reservoirs behind the dam). When the wind dies, Sweden turns up the taps on the hydroelectric production, and exports that stored energy back to Denmark. It's a great zero-fossil system, but it's only possible because of the unique geography that places a flat windy country right next to a couple of wet mountainous countries.

Finally, it's important to note that the grid-buffering sources for wind (hydro in Denmark, gas in the US) both have a higher EROI than wind itself. Thus these hybrid systems do make economic sense, but that's partly because the buffering portion makes economic sense on its own. Essentially, these hybrid systems dilute the EROI of hydro or gas, in order to subsidize the EROI of the wind portion of system. For the hybrid gas system that makes sense, because the reduction in CO2 is worth it. For the hydro-buffered system, the question is more problematic. In any case, it's clear that if wind had to be buffered with a non-generating storage-only system, the economics would be difficult to justify.

But the big winners in non-fossil energy are run-of-river

hydro (Weißbach allows a 100 year plant lifetime, which may be generous) and

nuclear (at a 60 year plant lifetime, in line with other studies). And by the way, this is one reason Weißbach's study is better than some earlier works: he includes plant lifetime in his computations, which can make a big difference. Wind turbines, for example, are subjected to large physical stresses which limits their lifetime to about 20 years, both in this study and according to the

National Renewable Energy Laboratory. In effect, you have to build a windfarm two or three times over during the lifetime of a nuclear plant, and that adds up.

Two cases were analyzed for coal, one hard coal (EROI 29, EMROI 49) and one brown coal (EROI 31, EMROI 49). These were averaged to an EROI of 30 as shown. In the US we have plenty of hard coal reserves and don't use brown coal. Also, the authors omitted from this study the energy cost needed to transport coal, apparently because that varies by country. Using EIA data, this amounts to 244 KJ per tonne-km for rail transport. So in the US, where a lot of coal is moved from mines in Wyoming to end users far away, a typical 1000 mile trip would lower the EROI of coal from 29 to 28, while EMROI remains unchanged at 49.

It's interesting to note that other studies have put the unweighted EROI of Canadian tar sands between 4 and 6, below the economic threshold. But since the output of tar sands is non-electrical energy, its EMROI decreases compared to EROI, which would put tar sands even farther below the economic threshold in exergy terms. So instead of building Keystone XL, Canada's economy would benefit far more by putting a lot of hydro in the Rockies and building a powerline instead of a pipeline. If Obama nixes the pipeline (as he seems poised to do), perhaps someone in Canada will take a harder look at the dismal economics of it. Or we might have to wait until Harper is out of office.

EROI isn't a new concept, and there are a lot of similar studies out there already. Weißbach has taken a good look at the previous literature and identified and corrected inconsistencies in many previous works. Most especially, the EROI of nuclear power in previous studies has been notoriously all-over-the-map, and Weißbach has pointed out a raft of errors, omissions, and uneven-handedness in earlier works, both those that come out above and below his result. Also, Weißbach has used the most up-to-date databases available on the energy embodiments of materials, which are required to compute energy inputs.

One reason previous studies on nuclear have been all over the map is that it's a moving target: the EROI of nuclear has been rising rapidly during the past 20 years (and will continue to rise) as the industry switches from gas-diffusion enrichment of uranium, to centrifuge enrichment (which is 35 times more energy efficient). Since uranium enrichment is a major part of energy input, this makes a huge difference. A nuclear plant using 100% gas diffusion would have and EROI of 31, EMROI of 34, comparable to coal. Weißbach's numbers above are based on 83% centrifuge, 17% diffusion. The World Nuclear Association projection is that there will be no more diffusion enrichment anywhere in the world by 2017. With 100% centrifuge, nuclear will have an EROI of 106, EMROI of 166 according to Weißbach's analysis. In other words, the switch from diffusion to centrifuge roughly quadruples the overall energy efficiency of nuclear power.

Beyond that, there is a new laser enrichment process being developed called SILEX which promises to be 10 times more energy efficient than centrifuge. And even beyond that, some Gen IV reactor designs (the fast neutron reactor, and the liquid-fuel thorium reactor, or LFTR) don't use enrichment at all, and could therefore come in at EROI of about 114, EMROI of 187. The LFTR in particular can't melt down and produces almost no long-term waste, which is why the Chinese are working on one right now. They've got 300 engineers doing the design, based on US research into liquid fuel reactors from the 1960's and 70's. (Your tax dollars at work -- in China.) The fast neutron reactor can use our existing long-term nuclear "waste" as its fuel, which is why the Russians have them, China and India are building them, and the British are considering it.

So if you ever wondered why climate scientists like James Hansen are pro-nuclear, this is one reason. Yes, wind is fine if it can be grid-buffered against a non-fossil generating source. And absolutely we need more hydro, especially run-of-river hydro where it's feasible. But there are limits to the amount of river where it is feasible. So if we want to eliminate fossil fuels from electricity production (and we do), and if we want to manage that transition so that it doesn't hurt the economy (and we do), nuclear has to be part of the mix. And in fact, it has to be a much bigger part of the mix than it has been in the past. In the next part of GETTING TO ZERO, I will address the safety issues of nuclear power in detail, but for right now what you need to know is that even after accounting for latent deaths from Chernobyl (and non-deaths from Fukushima), nuclear is still one of the safest forms of energy.

Finally, if you'd like to take a detailed look at the calculations, Weißbach's spreadsheet can be found on Google Docs. I used the spreadsheet to compute some of the numbers above.

Citation:

Weißbach, D., G. Ruprecht, A. Huke, K. Czerski, S. Gottlieb, and A. Hussein. "Energy intensities, EROIs (energy returned on invested), and energy payback times of electricity generating power plants." Energy 52 (2013) 210-221.

ISSN 0360-5442, http://dx.doi.org/....

Further reading:

Thorium: Energy cheaper than coal, by Dr. Robert Hargraves, available on Amazon.